Long-term government bond yields have risen very sharply in Japan this year. Indeed, the 30-year yield is at its highest level EVER, which is causing consternation because – at the same time – the Yen has fallen to all-time lows in trade-weighted terms against its G10 peers. There are many people who see this decoupling as a sign that the Yen is now “irrationally” weak, including Japan’s government, which recently put markets on notice that it might intervene to strengthen the Yen.

I don’t think this is right. The key point to recognize is that Japanese long-term yields – while they have risen a lot – are still way below where they would be if markets were able to freely set them. At the current juncture, the Bank of Japan (BoJ) remains a very large buyer of government bonds in gross terms, which means that longer-term yields are capped in practice. Rising risk of a debt crisis, which would ordinarily drive yields higher, can’t get priced in the bond market and thus gets priced into the Yen instead. This is what’s weighing on the Yen and means that the currency – not yields – is what to watch when it comes to gauging Japan’s fiscal risk.

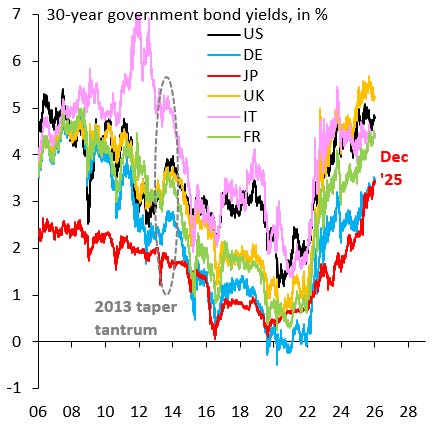

The chart above shows 30-year government bond yields for key advanced economies around the world. The red line shows Japan’s 30-year yield has risen to all-time highs, which makes it natural to think that Japanese yields should be supportive for the Yen. That’s not the case as the chart below shows. The scatter plot has gross government debt in 2024 on the horizontal axis and yesterday’s 30-year government bond yield on the vertical axis. Even through gross debt in Japan is substantially above Germany, its yield is the same. This is the best illustration of how distorted Japan’s bond yields are. They’re nowhere near high enough given Japan’s towering debt burden.

The key question is what market price is a better reflection of reality: long-term yields or the Yen? As the scatter plot above shows pretty clearly, Japanese government bond yields are far below where they should be. BoJ bond buying prevents markets from pricing a proper risk premium, which instead gets expressed in a beaten down Yen. This means that the unprecedented decoupling between long-term rate differentials and the Yen – shown in the chart below – is meaningless. The weak Yen is the signal to watch and it’s signaling mounting risk of a debt crisis in Japan.

AloJapan.com