Japan’s economy is sending mixed signals. Its travel market is not.

After years of deflationary drag, Japan entered a new chapter in 2024. Economic growth was modest, but the signals were unmistakable: the first interest-rate hike in 17 years, record equity markets and the strongest wage growth in more than three decades. A weak yen amplified the impact, supercharging inbound travel and delivering real gains to regional economies even as household demand remained cautious into 2025.

For travel, this marked a clean pivot from recovery to revival.

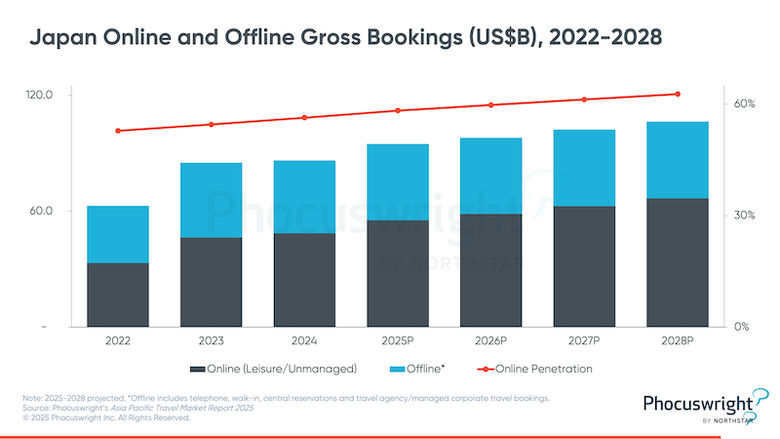

According to Phocuswright’s Japan Travel Market Essentials 2025 report, gross bookings moved past 2019 levels in 2023 and accelerated again in 2024, rising 9% to ¥13.1 trillion. In local currency terms, momentum is strong. In U.S. dollars, it’s a different story—growth remains muted, and the market is unlikely to reclaim its 2019 USD size even by 2028. The takeaway is clear: Inbound demand is booming, but the economics of the market are changing.

Against that backdrop, Japan is now focused less on whether tourism grows—and more on how.

From growth to guardrails

Japan is no longer just attracting visitors. It’s managing them.

Crowding in cultural districts, pressure on natural sites and strain on transport systems have pushed sustainability from principle to policy. National tourism plans now place dispersal and visitor experience alongside headline growth targets—with clear metrics to back them up.

What was once encouragement is becoming execution.

Policy with consequences

Some of Japan’s most iconic destinations are setting the tone.

New access rules, visitor caps, fees and taxes are being used to protect residents, preserve heritage and influence traveler behavior. Upcoming changes to visas, departure taxes, tax-free shopping and digital travel authorization signal a more structured, data-led approach to tourism management—one designed to sustain growth without eroding quality.

These measures won’t slow demand. They will reshape it.

The regions step into the spotlight

Relieving pressure on major cities means redirecting demand—and investment.

Rail extensions, airline incentives and coordinated regional promotion are quietly expanding what “Japan travel” looks like beyond the Golden Route. The goal is to flatten peaks, spread economic benefits and bring secondary destinations into the mainstream without sacrificing experience.

Japan as a global aviation connector

Inbound growth is reinforcing something bigger: Japan’s role as a global hub.

Rising visitor volumes are supporting higher frequencies and broader long-haul reach, strengthening Tokyo’s position as a transfer point between Asia, North America and beyond. Network carriers and challengers alike are expanding, adding density that benefits both inbound tourism and global connectivity.

Why this matters

Japan’s travel market isn’t just larger. It’s more complex.

Currency dynamics, policy shifts, sustainability pressures and aviation strategy are converging at once.

Phocuswright’s Japan Travel Market Essentials 2025

This report explains how these forces connect—and what they mean for companies making decisions in, or about, Japan.

AloJapan.com