The Bank of Japan hiked its policy rate this week and yet the Yen tumbled. At first glance, that might seem puzzling, but really there is no puzzle. Japan’s longer-term interest rates – which are what drive the Yen – are much too low given massive public debt. As long as that remains true, the Yen will continue its debasement cycle.

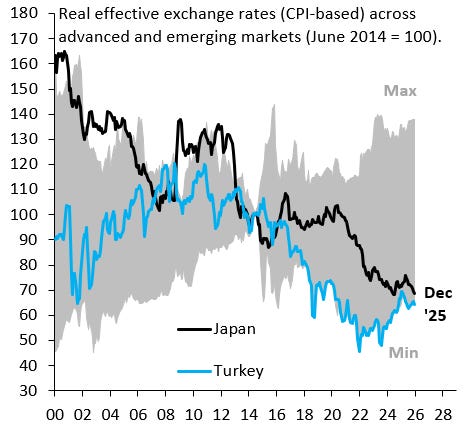

The chart above shows real effective exchange rates across all major countries around the world. These exchange rates measure the true strength of a currency vis-à-vis its trading partners, factoring in also what inflation is doing across countries. The gray area shows the range between the strongest and weakest real effective exchange rates. The blue line is the Turkish Lira, which for many years has been the weakest currency globally. The black line is the Japanese Yen, which is now almost as weak as the Lira.

How can the Japanese Yen be falling when the Bank of Japan (BoJ) just hiked rates? The reason is that the Yen depends on longer-term interest rates and those are much too low. Easiest way to see this is the chart above, which shows 30-year government bond yields across advanced economies on the vertical axis and gross public debt on the horizontal axis. Germany’s 30-year yield is slightly above Japan, even though its public debt is MUCH lower. The hard truth is that Japan’s yields are still being kept artificially low and – while that’s true – the Yen will continue its debasement cycle.

As the chart above shows, the BoJ remains a substantial buyer of government debt on a gross basis, which is how yields are being prevented from rising to their true market level. Without this buying, Japan’s longer-term yields would be MUCH higher, which would push the country into a debt crisis. So, unfortunately, given how huge Japan’s debt overhang is, the choice is between a debt crisis and currency debasement.

There is of course a third option, which is fiscal consolidation to bring down Japan’s debt. Indeed, Japan’s government is asset-rich, which is why net debt is 130 percent of GDP and far below gross debt of 240 percent. The government could sell some of its financial assets and privatize state-owned companies. But the political consensus for this does not yet exist. Yen debasement will have to get worse before that happens.

AloJapan.com