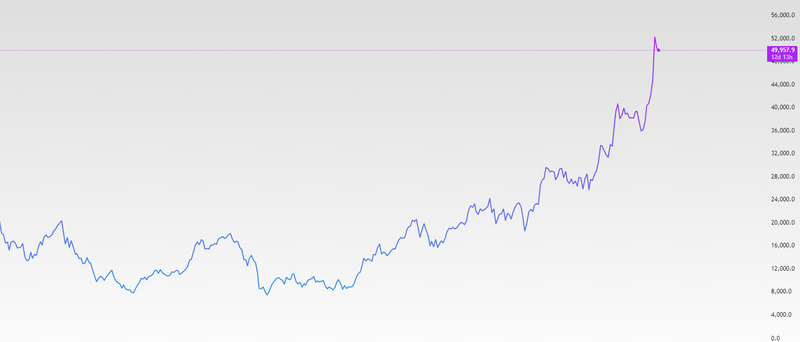

Nikkei Reaches Fresh Record Highs

Japan’s Nikkei index has surged to new record highs, marking a powerful comeback for a market that spent decades underperforming global peers. The rally reflects a broad improvement in investor confidence toward Japan’s economic direction and corporate landscape. Strong corporate earnings have played a central role, supported by improving profit margins, cost discipline, and stronger overseas demand. Many Japanese companies are benefiting from a weaker yen, which boosts export competitiveness and inflates foreign earnings when converted back into yen, particularly in sectors such as automobiles, industrial machinery, and technology hardware. Beyond earnings, structural changes have made Japanese equities more attractive to global investors. Corporate governance reforms have pushed companies to improve capital efficiency, raise returns on equity, and focus more on shareholder value through higher dividends and share buybacks. These reforms are gradually changing how Japanese firms allocate capital and communicate with investors, helping to narrow the valuation gap with global peers. Financial stocks have gained as rising interest rates improve profit outlooks for banks and insurers, while industrial and technological shares have benefited from global investment cycles and supply-chain realignment. Foreign investors, who long avoided Japan due to persistent deflation, weak growth, and policy uncertainty, are now returning in force. Many see Japan as a rare combination of economic stability, improving fundamentals, and still-reasonable valuations compared with U.S. markets. The market is also drawing support from Japan’s slow and careful move away from ultra-loose monetary policy.

Source: Trading View

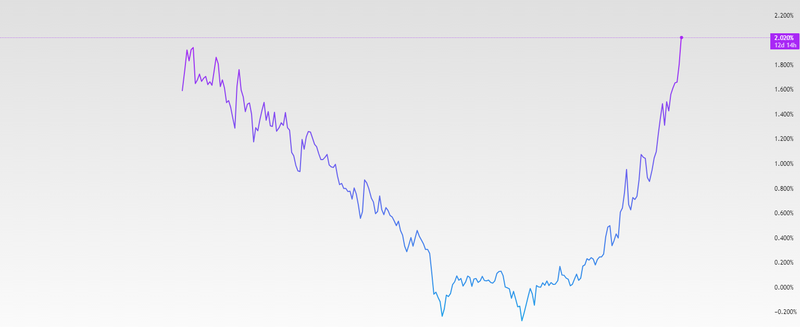

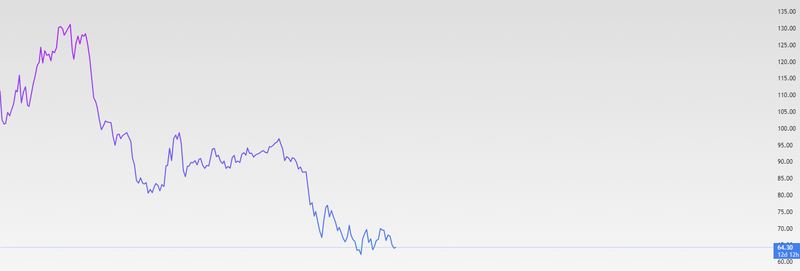

Why Bond Yields Are Rising While the Yen Is Falling

One of the most noticeable trends in Japan’s markets right now is that government bond yields are rising, while the yen continues to weaken. In the bond market, investors are becoming more confident that the Bank of Japan will keep moving away from ultra-low interest rates. Inflation has stayed above the 2% target for a long time, and wages are slowly rising, which makes investors believe interest rates will go higher over time. Because of this, bond yields are climbing as investors demand better returns for holding Japanese debt. The currency market sees the situation differently.

Source: Trading View

Even though Japan has started raising interest rates, rates in the United States and Europe are still much higher. This big gap means investors can earn more by keeping their money in other currencies instead of the yen. On top of that, the Bank of Japan has made it clear that any future rate increases will be slow and careful. This limits expectations for quick or aggressive tightening, which keeps pressure on the yen. So while bond investors are looking ahead and pricing in higher rates in the future, currency traders are focused on the here and now. They see Japan’s rates rising only gradually, while other countries still offer much higher yields. That difference explains why bond yields can go up at the same time as the yen goes down, even though both are reacting to the same economic data and policy signals.

Source: Trading View

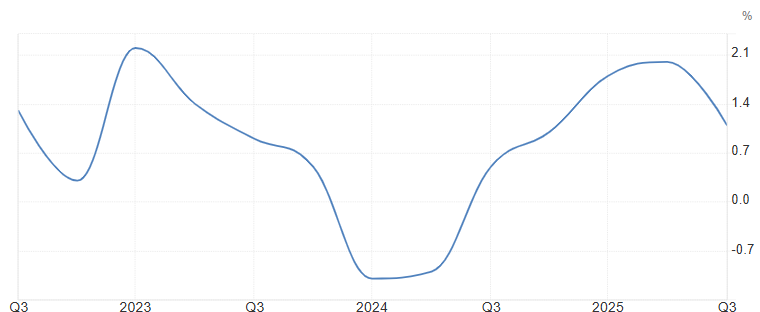

Can Japan’s economy support more rate hikes in 2026

Looking ahead, the key question is whether Japan’s economic data can justify further interest rate hikes in 2026. Much depends on three main indicators: GDP growth, inflation, and industrial production. Japan’s economy has shown modest but stable growth, supported by improving domestic demand and stronger corporate investment. While growth is not rapid, it appears resilient enough to withstand slightly higher borrowing costs. Inflation remains the most important factor. The Bank of Japan does not need inflation to accelerate further, but it does need it to stay stable and broad-based. If wage growth continues to expand beyond large corporations and into small and mid-sized firms, inflation is more likely to remain sustainable. Industrial production will also play a critical role, as it reflects the health of Japan’s manufacturing sector and global demand conditions. If GDP growth holds steady, inflation remains above target, and production avoids sharp contractions, the Bank of Japan may have room for additional rate hikes in 2026. However, policymakers are likely to proceed cautiously, especially given global risks such as slowing growth abroad and changes in trade policy. Rather than aggressive tightening, Japan’s path appears focused on slow normalization, ensuring that higher rates do not derail the recovery that has taken years to build.

Source: Cabinet Office, Japan

AloJapan.com