Demand for Decaffeinated Coffee in Japan Forecast and Outlook 2025 to 2035

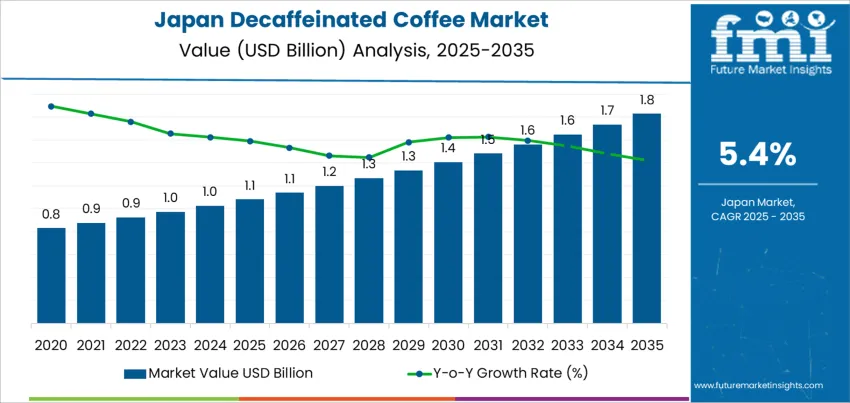

The demand for decaffeinated coffee in Japan is expected to grow from USD 1.1 billion in 2025 to USD 1.8 billion by 2035, reflecting a compound annual growth rate (CAGR) of 5.4%. Decaffeinated coffee is becoming increasingly popular among health-conscious consumers who want to enjoy the taste of coffee without the stimulating effects of caffeine. This trend is particularly evident in urban areas, where busy lifestyles are driving demand for alternatives that provide the familiar flavors of coffee without compromising on health. With the growing focus on wellness and dietary preferences, decaffeinated coffee offers a suitable option for consumers seeking to reduce their caffeine intake due to health concerns such as insomnia, anxiety, and high blood pressure.

The overall growth of the decaffeinated coffee sector will also be supported by the growing trend of premium coffee consumption in Japan. As consumers seek higher-quality coffee experiences, they will demand decaffeinated options that offer the same rich taste and robust flavor as regular coffee. The availability of decaffeinated coffee beans in various roasts and blends, alongside innovations in preparation methods like single-serve pods and ready-to-drink beverages, will further drive industry expansion. As the awareness of the health benefits of reduced caffeine consumption increases, decaffeinated coffee will continue to become a mainstream beverage choice, ensuring steady growth throughout the forecast period.

Quick Stats of the Demand for Decaffeinated Coffee in Japan

Demand for Decaffeinated Coffee in Japan Value (2025): USD 1.1 billion

Demand for Decaffeinated Coffee in Japan Forecast Value (2035): USD 1.8 billion

Demand for Decaffeinated Coffee in Japan Forecast CAGR (2025-2035): 5.4%

Demand for Decaffeinated Coffee in Japan Leading Product Type: Regular

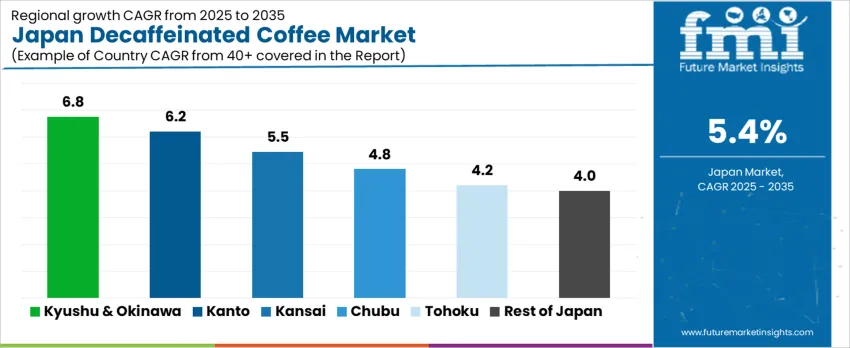

Demand for Decaffeinated Coffee in Japan Key Growth Regions: Kyushu & Okinawa, Kanto, Kansai, Chubu, Tohoku, Rest of Japan

Demand for Decaffeinated Coffee in Japan Top Players: Swiss Water Decaffeinated Coffee Inc., Don Pablo Coffee, Lifeboost Coffee LLC, Jo Coffee, Volcanica Coffee Company

What is the Growth Forecast for the Demand for Decaffeinated Coffee in Japan through 2035?

From 2025 to 2030, the demand for decaffeinated coffee in Japan is expected to grow from USD 1.1 billion to USD 1.4 billion, adding USD 0.3 billion in value. This period will see a steady rise in consumer interest in decaffeinated coffee due to increased awareness of its health benefits and its versatility in various beverage forms, including hot brews, iced coffee, and coffee-based beverages like lattes and cappuccinos. As coffee culture continues to grow in Japan, more consumers will seek out decaffeinated options at cafes, restaurants, and in packaged formats for home consumption. The introduction of new and improved decaffeination processes that preserve the flavor and aroma of coffee will also enhance the appeal of decaffeinated coffee.

From 2030 to 2035, demand will continue to rise from USD 1.4 billion to USD 1.8 billion, contributing USD 0.4 billion in value. During this phase, demand for decaffeinated coffee will be increasingly driven by the ongoing trend of healthier living and the growing preference for functional beverages. As more consumers adopt balanced lifestyles, decaffeinated coffee will find greater acceptance across diverse demographic groups. Advancements in decaffeination technology and the expansion of decaffeinated coffee product offerings, such as organic and fair-trade options, will make these products more appealing. The increasing availability of decaffeinated coffee in specialty coffee shops and superindustrys will also contribute to this growth.

Demand for Decaffeinated Coffee in Japan Key Takeaways

Metric

Value

Demand for Decaffeinated Coffee in Japan Value (2025)

USD 1.1 billion

Demand for Decaffeinated Coffee in Japan Forecast Value (2035)

USD 1.8 billion

Demand for Decaffeinated Coffee in Japan Forecast CAGR (2025-2035)

5.4%

Why is the Demand for Decaffeinated Coffee in Japan Growing?

The demand for decaffeinated coffee in Japan is increasing due to a growing consumer focus on health and wellness, as well as a desire for alternatives to regular coffee. Decaffeinated coffee, which offers the taste and experience of traditional coffee without the stimulating effects of caffeine, is gaining popularity among health-conscious individuals, those sensitive to caffeine, and those seeking to reduce their caffeine intake. This trend is particularly strong in urban areas, where busy lifestyles demand a broader range of beverage options that support overall well-being.

A major driver behind the growth of decaffeinated coffee is the increasing awareness of health benefits associated with reduced caffeine consumption. As consumers become more conscious of their health, many are turning to decaffeinated coffee to avoid the negative effects of excess caffeine, such as insomnia, anxiety, and jitteriness. The demand for beverages that provide relaxation and stress reduction is boosting the appeal of decaffeinated coffee, especially in the growing wellness and lifestyle sectors.

Innovations in the decaffeination process and product offerings are contributing to the growth of the sector. Manufacturers are focusing on improving the flavor profiles and quality of decaffeinated coffee to better compete with regular coffee. The availability of new brewing methods and a wider range of decaffeinated coffee products, such as capsules and ready-to-drink options, is making it easier for consumers to enjoy their favorite beverage without caffeine. With these developments, the demand for decaffeinated coffee in Japan is expected to grow steadily through 2035.

What is the Segment-Wise Analysis of Demand for Decaffeinated Coffee in Japan?

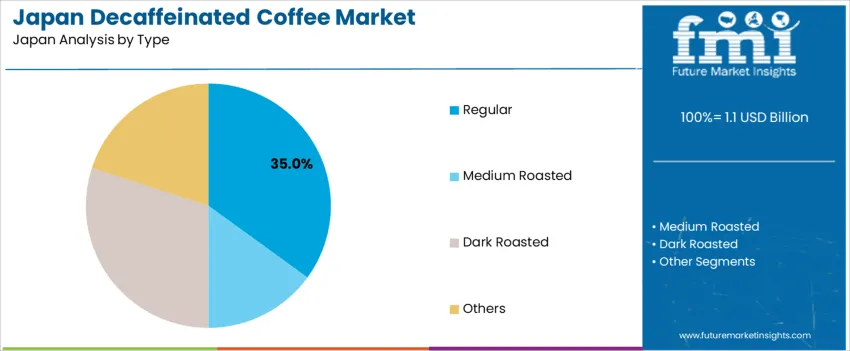

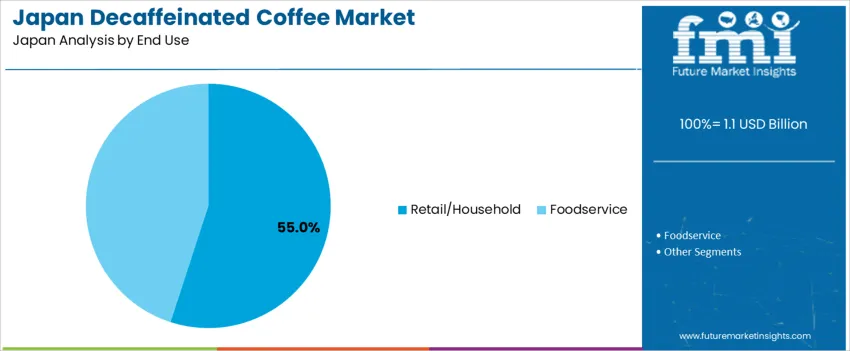

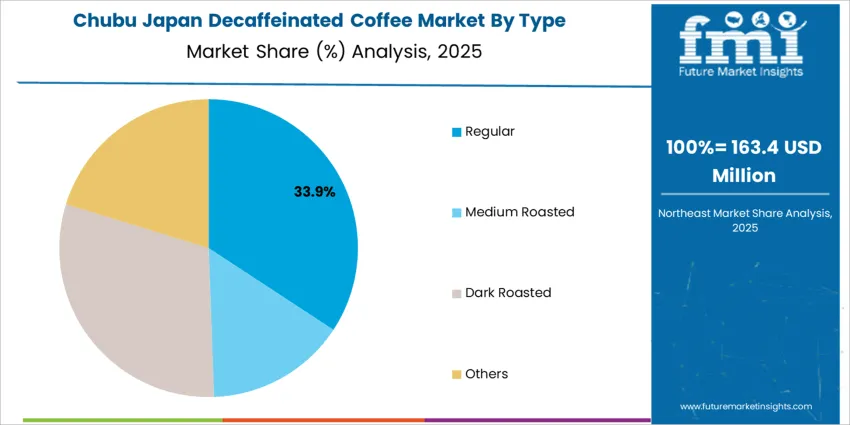

Demand for decaffeinated coffee in Japan is segmented by type, end-use, distribution channel, nature, and region. By type, demand is divided into regular, medium roasted, dark roasted, and others, with regular decaffeinated coffee leading at 35%. The demand is also segmented by end-use, including retail/household and foodservice, with retail/household leading at 55%. Distribution channels are split into business-to-business (B2B) and business-to-consumer (B2C), with B2C being the dominant channel. In terms of nature, decaffeinated coffee is available in both organic and conventional forms. Regionally, demand is spread across Kyushu & Okinawa, Kanto, Kansai, Chubu, Tohoku, and the rest of Japan.

Why Does Regular Decaffeinated Coffee Lead the Demand in Japan?

Regular decaffeinated coffee accounts for 35% of the demand in Japan, driven by its widespread appeal as a classic and versatile choice for coffee drinkers who prefer a caffeine-free option. Regular decaffeinated coffee is often favored for its smooth flavor and ease of preparation, making it suitable for various coffee drinks, such as espresso, lattes, and cappuccinos. In Japan, where coffee culture is deeply embedded in daily life, many consumers prefer regular decaffeinated coffee as a healthier alternative to caffeinated varieties, especially in the evening or for those sensitive to caffeine. As health-conscious trends grow and consumers seek out lower-caffeine beverages without sacrificing flavor, regular decaffeinated coffee remains a dominant product in the industry. Its consistent demand across both households and foodservice establishments helps maintain its leadership in the decaffeinated coffee segment.

Why Does Retail/Household Lead the Demand for Decaffeinated Coffee in Japan?

Retail/household accounts for 55% of the demand for decaffeinated coffee in Japan, driven by the preference for convenient, ready-to-brew options at home. With Japan’s growing focus on health and wellness, many consumers are seeking out decaffeinated options for personal use, as they can enjoy coffee without the stimulating effects of caffeine. Retail packaging for decaffeinated coffee allows consumers to purchase the product in various forms, including ground coffee, beans, and single-serve pods, which is ideal for home brewing. The rise of coffee culture in Japan, along with the increasing popularity of at-home coffee brewing, has made retail outlets the primary distribution channel for decaffeinated coffee. As more consumers embrace healthier and more mindful choices, the retail/household sector will continue to lead the demand for decaffeinated coffee in Japan.

What are the Key Trends, Drivers, and Restraints in Demand for Decaffeinated Coffee in Japan?

Decaf coffee offers a way to enjoy the ritual and taste of coffee while reducing caffeine intake, appealing to those concerned about wellness and moderated consumption. The expanding café culture, with more coffee chains and specialty shops offering decaf options, has brought it into the mainstream. The wider retail availability in superindustrys, convenience stores, and online shops further supports access. Decaf still faces challenges. High production and import costs raise retail prices, making it less affordable for some. Some consumers perceive decaf coffee as inferior in flavor compared to regular coffee, which may limit how quickly this segment can grow.

Why is Demand for Decaffeinated Coffee Growing in Japan?

The demand for decaffeinated coffee in Japan is growing as more consumers embrace mindful consumption. With rising awareness of the potential negative health impacts of excessive caffeine, especially among older adults or individuals sensitive to caffeine, decaf offers a practical alternative. As coffee becomes a regular part of daily routines, decaf provides a way to enjoy coffee more frequently without the negative side effects of regular coffee. Coffee culture in Japan is maturing, with cafés and retailers expanding their decaf offerings to meet consumer demand. The overall shift toward wellness, a balanced lifestyle, and a preference for clean-label or low-impact foods and beverages further fuels the interest in decaf coffee. As the demand for healthier alternatives grows, decaf coffee provides a versatile and appealing option for a broader consumer base.

How are Technological & Industry Innovations Driving Decaffeinated Coffee Demand in Japan?

Technological improvements in decaffeination methods and coffee processing are making decaf coffee more accessible and appealing in Japan. Newer decaffeination techniques preserve the flavor and aroma of the coffee, which helps address previous concerns about taste quality. These innovations allow producers to offer premium decaf beans, ground coffee, and ready-to-drink options, expanding the variety of products available. Specialty coffee shops and roasters are increasingly offering high-quality decaf blends to cater to a growing consumer base. The convenience of decaf coffee is enhanced by the expansion of distribution channels, including superindustrys, convenience stores, and online platforms. Advances in packaging and freshness retention also help make decaf coffee more accessible to consumers. These technological and industry advancements are improving the overall quality and availability of decaf coffee, driving demand in the Japanese industry.

What are the Key Challenges and Risks That Could Limit Decaffeinated Coffee Demand in Japan?

Despite growing interest, decaf coffee faces several challenges in Japan. One major issue is cost: decaffeination processes are more expensive than regular coffee, which raises the retail price of decaf products, potentially making them less accessible to price-sensitive consumers. Some consumers also perceive decaf coffee as lacking the full flavor richness of regular coffee, which can affect their preference. Furthermore, Japan’s long-standing tea culture continues to dominate, making it difficult for coffee to replace tea in many households. The competition from ready-to-drink caffeinated coffees and other beverages, such as tea, may limit the demand for decaf coffee. The traditional coffee-drinking culture in Japan has not fully embraced decaf, which can restrict the broader adoption of decaffeinated coffee.

What is the Regional Demand Outlook for Decaffeinated Coffee in Japan?

Region

CAGR (%)

Kyushu & Okinawa

6.8%

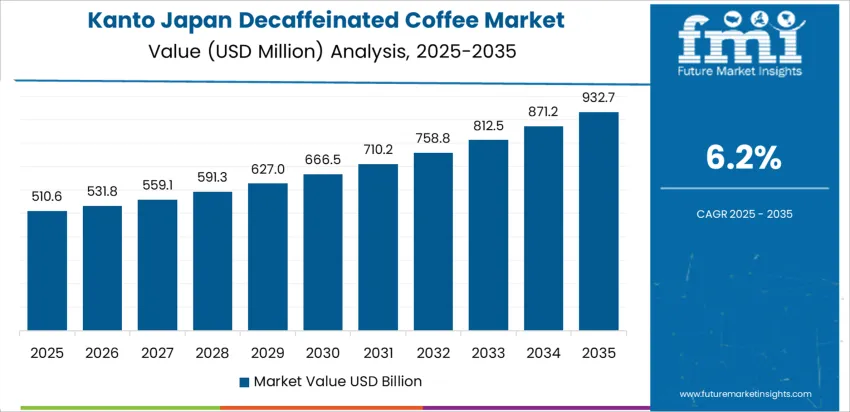

Kanto

6.2%

Kansai

5.5%

Chubu

4.8%

Tohoku

4.2%

Rest of Japan

4.0%

Demand for decaffeinated coffee in Japan is growing steadily across all regions, with Kyushu & Okinawa leading at a 6.8% CAGR, supported by health-conscious consumers in the region. Kanto follows with a 6.2% CAGR, driven by the large urban population and rising awareness of the benefits of decaffeinated options. Kansai shows a 5.5% CAGR, fueled by increasing demand for healthier beverages in the foodservice sector. Chubu experiences a 4.8% CAGR, driven by consumer preferences for low-caffeine alternatives in the coffee industry. Tohoku and the Rest of Japan see moderate growth at 4.2% and 4.0%, respectively, reflecting a steady rise in the adoption of decaffeinated coffee as a healthier beverage choice in both urban and rural areas.

How is Demand for Decaffeinated Coffee Growing in Kyushu & Okinawa?

Kyushu & Okinawa leads the demand for decaffeinated coffee, growing at a 6.8% CAGR. The region’s increasing health-conscious population, particularly in Okinawa, is contributing to this growth, as more consumers turn to decaffeinated coffee as a healthier alternative to regular coffee. Okinawa’s popularity as a tourist destination also drives demand, as many visitors seek caffeine-free options during their stay. The growing focus on wellness and balanced lifestyles in Kyushu & Okinawa has led to greater awareness of the benefits of reducing caffeine intake. Local cafés and restaurants are responding to this demand by offering decaffeinated coffee as part of their menus, ensuring that the region continues to lead in the adoption of this beverage trend. As health-conscious behaviors continue to rise, the demand for decaffeinated coffee in Kyushu & Okinawa is expected to grow steadily.

Why is Demand for Decaffeinated Coffee Rising in Kanto?

Kanto is experiencing strong demand for decaffeinated coffee, with a 6.2% CAGR. The region’s large urban population, particularly in Tokyo, is a key driver of this growth. As consumers become more health-conscious and increasingly aware of the negative effects of excessive caffeine consumption, many in Kanto are turning to decaffeinated coffee as a suitable alternative. Busy lifestyles in Kanto have also contributed to the popularity of decaffeinated options, as individuals seek beverages that are both enjoyable and less stimulating. The region’s coffee culture, with an ever-expanding café scene, continues to embrace decaffeinated options to meet consumer demand for healthier choices. Kanto’s increasing focus on wellness, including reducing caffeine intake for better sleep and health, further accelerates the adoption of decaffeinated coffee. With this growing trend, demand is expected to continue rising steadily across the region.

How is Demand for Decaffeinated Coffee Expanding in Kansai?

Kansai shows steady demand for decaffeinated coffee, with a 5.5% CAGR. The region’s health-conscious consumers, particularly in cities like Osaka and Kyoto, are increasingly turning to decaffeinated coffee as part of their broader focus on wellness. With growing awareness of the health benefits of reducing caffeine consumption, many consumers in Kansai are seeking decaffeinated options to enjoy their favorite beverage without the associated jitters or sleep disturbances. As the demand for healthier food and drink options continues to rise, more restaurants and coffee shops in Kansai are offering decaffeinated coffee on their menus. The growing interest in functional beverages and sustainable lifestyles in the region further supports this trend. As the coffee culture in Kansai evolves and consumer preferences shift towards health-conscious choices, decaffeinated coffee is expected to see continued growth.

Why is Demand for Decaffeinated Coffee Growing in Chubu?

Chubu is experiencing steady demand for decaffeinated coffee, growing at a 4.8% CAGR. The region’s increasing focus on health and wellness is contributing to the growth of decaffeinated coffee consumption. As consumers in Chubu seek healthier beverage options, decaffeinated coffee is becoming a popular choice for those looking to reduce their caffeine intake. Chubu’s food and beverage industry, including its growing café culture, is adapting to these trends by offering decaffeinated coffee options to meet the evolving needs of consumers. As health and lifestyle choices continue to influence the foodservice industry, demand for decaffeinated coffee is rising. With the region’s emphasis on well-being, and the growing interest in alternative beverages, decaffeinated coffee is becoming an increasingly popular choice among consumers, especially in urban areas. As this trend continues, demand in Chubu is expected to maintain steady growth.

How is Demand for Decaffeinated Coffee Expanding in Tohoku?

Tohoku is seeing moderate demand for decaffeinated coffee, with a 4.2% CAGR. While the demand for decaffeinated coffee in Tohoku is smaller compared to urban regions, there is steady growth as health-conscious behaviors continue to rise. Local consumers are increasingly seeking alternatives to regular coffee due to concerns over caffeine consumption and its effects on sleep and overall well-being. The rise in wellness trends and the growing focus on healthier lifestyles in the region are contributing to this shift. Small cafés and restaurants in Tohoku are introducing decaffeinated options to meet consumer demand, particularly in tourist areas where visitors seek lower-caffeine alternatives. As more consumers become aware of the benefits of decaffeinated coffee and as regional food and beverage businesses modernize, the demand for decaffeinated coffee in Tohoku is expected to grow steadily, reflecting broader national trends.

Why is Demand for Decaffeinated Coffee Steady in the Rest of Japan?

The Rest of Japan is experiencing steady demand for decaffeinated coffee, with a 4.0% CAGR. While the demand in rural areas and smaller cities is lower compared to urban regions, the growing awareness of health and wellness is gradually shifting consumer preferences toward decaffeinated options. As consumers in these regions become more health-conscious, there is a rising demand for beverages that reduce caffeine intake while still offering the experience of traditional coffee. Local foodservice establishments, including smaller cafes and restaurants, are starting to offer decaffeinated coffee as part of their menu to cater to this growing need. The increasing focus on health, along with changing consumer behaviors, is driving demand for decaffeinated coffee across rural and less urbanized areas. As this trend continues, the Rest of Japan is expected to see steady growth in the adoption of decaffeinated coffee options, particularly as local foodservice sectors expand.

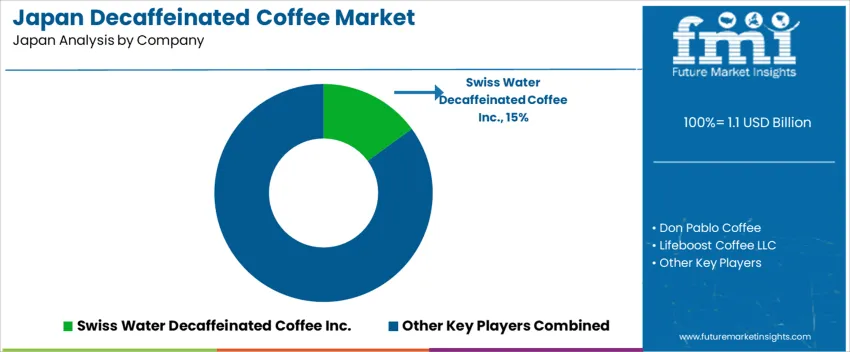

What is Driving the Demand for Decaffeinated Coffee in Japan and Who Are the Key Players Shaping the Industry?

The demand for decaffeinated coffee in Japan is rising as consumers seek healthier alternatives to traditional coffee, driven by a growing awareness of the health impacts of caffeine. Many consumers in Japan are looking for ways to enjoy the rich flavors of coffee without the stimulating effects of caffeine, particularly in the evening or for those with caffeine sensitivity. The increasing focus on wellness, coupled with a rise in the popularity of specialty coffee, is fueling the growth of decaffeinated coffee. Japan’s coffee culture, known for its quality and precision, has led to a higher demand for premium decaffeinated options that maintain the authentic coffee experience while catering to health-conscious preferences.

Key players shaping the decaffeinated coffee industry in Japan include Swiss Water Decaffeinated Coffee Inc., Don Pablo Coffee, Lifeboost Coffee LLC, Jo Coffee, and Volcanica Coffee Company. Swiss Water Decaffeinated Coffee Inc. leads the industry with a notable share of 15.0%, offering high-quality decaffeinated coffee produced using a chemical-free process. These companies focus on providing decaffeinated coffee options that meet the growing demand for clean-label, high-quality, and flavorful coffee alternatives. By emphasizing the preservation of coffee’s natural flavors and offering environmentally friendly decaffeination methods, they continue to attract Japanese consumers who are increasingly discerning about the products they consume.

The growth of the decaffeinated coffee industry in Japan is also supported by the increasing awareness of the health benefits of reducing caffeine intake, particularly for individuals with specific health concerns. As demand for premium and health-conscious beverages continues to rise, decaffeinated coffee is expected to gain further popularity in Japan, offering a wider range of choices for coffee lovers who seek the taste of coffee without the caffeine-related side effects.

Key Players in Japan Decaffeinated Coffee Demand

Swiss Water Decaffeinated Coffee Inc.

Don Pablo Coffee

Lifeboost Coffee LLC

Jo Coffee

Volcanica Coffee Company

Scope of Report

Items

Values

Quantitative Units (2025)

USD million

Nature

Organic, Conventional

Type

Regular, Medium Roasted, Dark Roasted, Others

End Use

Retail/Household, Foodservice

Distribution Channel

Business to Business, Business to Consumers

Regions Covered

Kyushu & Okinawa, Kanto, Kansai, Chubu, Tohoku, Rest of Japan

Countries Covered

Japan

Key Companies Profiled

Swiss Water Decaffeinated Coffee Inc., Don Pablo Coffee, Lifeboost Coffee LLC, Jo Coffee, Volcanica Coffee Company

Additional Attributes

Dollar sales by nature and type; regional CAGR and growth trends; increasing demand for organic decaffeinated coffee; rise in popularity of decaffeinated coffee in foodservice.

Japan Decaffeinated Coffee Demand by Key Segments Nature

Type

Regular

Medium Roasted

Dark Roasted

Others

End Use

Retail/Household

Foodservice

Distribution Channel

Business to Business

Business to Consumers

Region

Kyushu & Okinawa

Kanto

Kansai

Chubu

Tohoku

Rest of Japan

Frequently Asked Questions

How big is the demand for decaffeinated coffee in Japan in 2025?

The demand for decaffeinated coffee in Japan is estimated to be valued at USD 1.1 billion in 2025.

What will be the size of decaffeinated coffee in Japan in 2035?

The market size for the decaffeinated coffee in Japan is projected to reach USD 1.8 billion by 2035.

How much will be the demand for decaffeinated coffee in Japan growth between 2025 and 2035?

The demand for decaffeinated coffee in Japan is expected to grow at a 5.4% CAGR between 2025 and 2035.

What are the key product types in the decaffeinated coffee in Japan?

The key product types in decaffeinated coffee in Japan are organic and conventional.

Which type segment is expected to contribute significant share in the decaffeinated coffee in Japan in 2025?

In terms of type, regular segment is expected to command 35.0% share in the decaffeinated coffee in Japan in 2025.

AloJapan.com