Demand for Bronchiectasis Therapeutic in Japan Forecast and Outlook 2025 to 2035

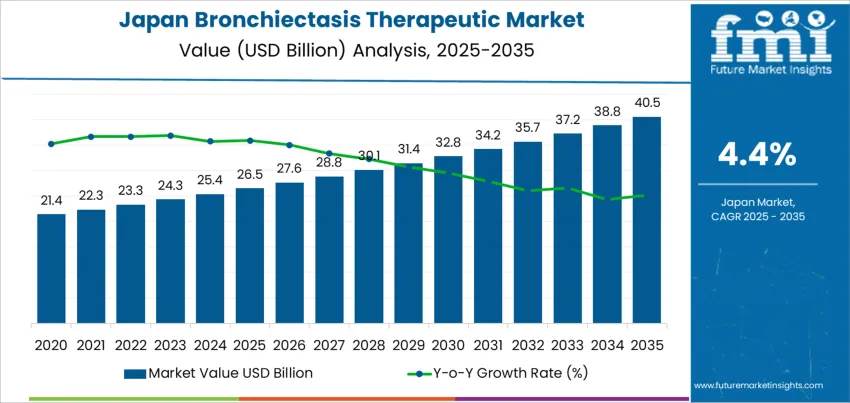

Demand for bronchiectasis therapeutics in Japan is recorded at USD 26.5 billion in 2025 and is projected to reach USD 40.5 billion by 2035, reflecting a CAGR of 4.4%. Early growth is shaped by steady increases in diagnosis among elderly patients and those with chronic respiratory infections. Long-term antibiotic therapies, bronchodilators, and mucolytic agents account for a major share of current treatment spending. Hospital respiratory departments and specialist pulmonary clinics form the core treatment centers due to the complex nature of disease management. Japan’s structured reimbursement system supports consistent therapy access, which stabilizes baseline demand. Screening linked to post-infectious lung conditions and chronic inflammation continues to expand the treated patient pool across urban health networks.

From 2030 onward, value growth reflects longer treatment duration rather than sharp increases in patient numbers. Demand advances from about USD 32.8 billion in 2030 toward USD 40.5 billion by 2035 as maintenance therapies, inhaled antibiotics, and combination regimens gain wider use in recurrent and severe cases. Home-based respiratory care expands under outpatient management models, raising sustained drug utilization. Clinical focus shifts toward slowing disease progression and reducing hospitalization frequency. Domestic pharmaceutical manufacturers and select global respiratory drug suppliers compete through portfolio depth, dosing convenience, and supply reliability. Spending trends in later years are shaped more by adherence, treatment persistence, and relapse prevention strategies than by one-time acute interventions.

Quick Stats of the Demand for Bronchiectasis Therapeutics in Japan

Demand for Bronchiectasis Therapeutics in Japan Value (2025): USD 26.5 billion

Demand for Bronchiectasis Therapeutics in Japan Forecast Value (2035): USD 40.5 billion

Demand for Bronchiectasis Therapeutics in Japan Forecast CAGR (2025–2035): 4.4%

Demand for Bronchiectasis Therapeutics in Japan Leading Product Type: Antibiotics (68%)

Demand for Bronchiectasis Therapeutics in Japan Key Growth Regions: Kyushu & Okinawa, Kanto, Kansai, Chubu, Tohoku, Rest of Japan

Demand for Bronchiectasis Therapeutics in Japan Top Players: Insmed Incorporated, Aradigm Corporation, AstraZeneca plc, GlaxoSmithKline plc (GSK), Bayer AG

What is the Demand Forecast for Bronchiectasis Therapeutic in Japan through 2035?

Bronchiectasis treatment demand in Japan reflects chronic respiratory disease burden rather than episodic acute care cycles, giving the category a persistence-driven growth profile. Demand increases from USD 26.5 billion in 2025 to USD 27.6 billion by 2026 and USD 28.8 billion by 2027, reaching USD 31.4 billion by 2030 and adding USD 4.9 billion from the 2025 base. This phase is shaped by rising diagnosis rates in aging populations, long-term antibiotic regimens, bronchodilator use, and mucolytic therapies for disease control rather than cure. Growth is reinforced by hospital respiratory clinics, expanded pulmonary rehabilitation access, and stable reimbursement coverage for chronic airway disease management.

From 2030 to 2035, the market expands from USD 31.4 billion to USD 40.5 billion, adding USD 9.1 billion in the second half of the decade. This back weighted acceleration reflects wider deployment of advanced inhaled antibiotics, anti-inflammatory biologics, and infection-targeted maintenance therapies that raise per-patient treatment value. Demand also strengthens as comorbid COPD and post-infectious lung conditions increase treatment complexity and duration. As Japan continues to manage a structurally aging population with rising chronic respiratory care needs, bronchiectasis therapeutics shift from maintenance-focused medication spending toward higher-intensity, long-duration treatment protocols, driving sustained demand growth through 2035.

Bronchiectasis Therapeutic Industry in Japan Key Takeaways

Metric

Value

Industry Value (2025)

USD 26.5 billion

Forecast Value (2035)

USD 40.5 billion

Forecast CAGR (2025–2035)

4.4%

What Is Driving the Demand for Bronchiectasis Therapeutics in Japan?

The demand for bronchiectasis therapeutics in Japan has expanded as chronic respiratory disease has become more visible within an aging population. Historically, many bronchiectasis cases were underdiagnosed or managed as recurring infections rather than a defined long term condition. Improved imaging access, routine CT use, and greater clinical awareness have shifted diagnosis toward earlier and more accurate identification. Japan high prevalence of post infectious lung damage, earlier tuberculosis burden in older cohorts, and long life expectancy have created a persistent patient base requiring continuous airway management. Hospital pulmonology departments gradually shifted from episodic antibiotic care toward long term inhaled therapies, mucus clearance regimens, and infection control strategies, which increased sustained therapeutic demand.

Future demand for bronchiectasis therapeutics in Japan will be shaped by disease chronicity, treatment adherence, and comorbidity burden rather than patient count alone. Patients increasingly require rotating antibiotic therapies, anti-inflammatory inhaled agents, and airway clearance support over long durations. Growth will be driven by outpatient disease management models that reduce hospitalization and focus on stability rather than cure. Barriers include limited disease modifying options, treatment fatigue among elderly patients, and overlap with other chronic lung diseases that complicates therapy selection. Reimbursement sensitivity, antibiotic resistance, and uneven specialist access outside major cities will also influence uptake. Market evolution will depend on how effectively long term symptom control, infection prevention, and patient adherence are addressed within Japans respiratory care framework.

How Are Product Type and Distribution Channel Structuring the Demand for Bronchiectasis Therapeutics in Japan?

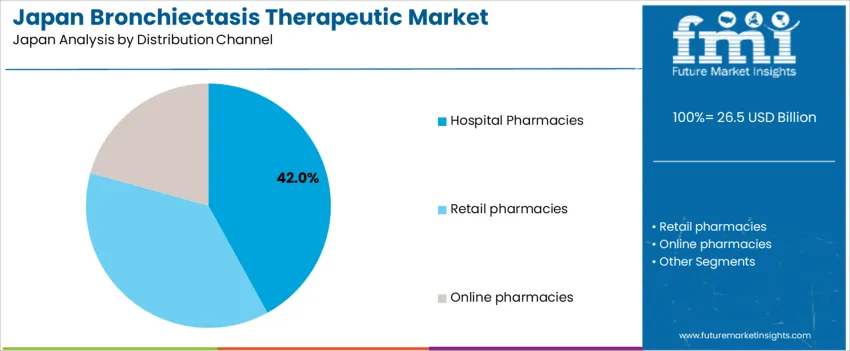

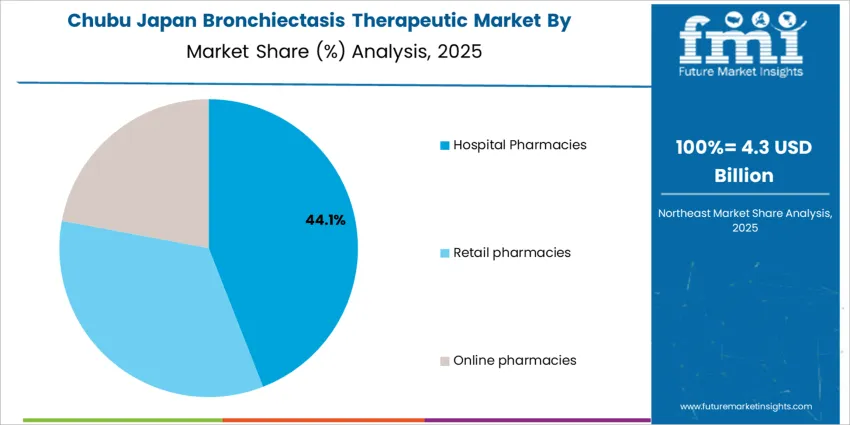

The demand for bronchiectasis therapeutics in Japan is structured by product type and distribution channel. Antibiotics account for 68% of total demand, followed by expectorants and other supportive drug classes used in long term disease management. By distribution channel, hospital pharmacies represent 42.0% of total dispensing, followed by retail pharmacies and online pharmacies. Demand behavior is shaped by chronic infection management needs, hospitalization rates, treatment adherence requirements, and physician supervised therapy initiation. These segments reflect how clinical severity, diagnostic confirmation, and continuity of care influence prescribing and drug distribution patterns across tertiary hospitals, outpatient respiratory clinics, and community pharmacy networks in Japan.

Why Do Antibiotics Lead the Bronchiectasis Therapeutic Product Demand in Japan?

Antibiotics account for 68% of total bronchiectasis therapeutic demand in Japan due to the central role of bacterial infection control in disease management. Patients with bronchiectasis experience recurrent lower respiratory infections caused by pathogens such as Pseudomonas aeruginosa and Haemophilus influenzae. Antibiotics are prescribed for both acute exacerbations and long term suppressive therapy to reduce sputum load, control inflammation, and prevent lung function deterioration. These regimens often require prolonged or repeated courses, which sustains continuous drug utilization across hospital and outpatient care settings.

Antibiotic use is also reinforced by Japan’s aging population, which shows higher susceptibility to chronic respiratory infections and slower immune response. Clinical guidelines emphasize early and targeted antimicrobial intervention to reduce hospitalization rates and complications. Culture guided antibiotic selection further increases treatment precision. These infection burden, guideline driven care pathways, and repeated dosing requirements position antibiotics as the dominant product type in the Japan bronchiectasis therapeutic demand structure.

Why Do Hospital Pharmacies Dominate the Bronchiectasis Therapeutic Distribution Demand in Japan?

Hospital pharmacies account for 42.0% of total bronchiectasis therapeutic distribution in Japan due to the high rate of specialist led diagnosis and initiation of therapy in inpatient and tertiary care settings. Bronchiectasis patients often present with severe respiratory distress, hemoptysis, or recurrent acute exacerbations that require hospitalization for diagnostic imaging, sputum culture testing, and intravenous antibiotic administration. Hospital pharmacies serve as the primary dispensing point for these initial intensive therapies under physician supervision.

Hospital based dispensing also supports dose adjustments, drug interaction monitoring, and transition from intravenous to oral therapy during discharge planning. Many long term patients maintain follow up with pulmonology departments within large hospitals, which sustains repeat hospital pharmacy utilization. Strict handling requirements for certain antimicrobial agents further reinforce centralized hospital distribution. These clinical supervision needs, severity linked admissions, and controlled dispensing protocols position hospital pharmacies as the leading distribution channel for bronchiectasis therapeutics in Japan.

Why Is Bronchiectasis Treatment in Japan Closely Tied to Chronic Respiratory Aging Rather Than Acute Infection Burden?

Demand for bronchiectasis therapeutics in Japan is driven by long-term respiratory degeneration rather than episodic infection outbreaks. A large elderly population lives with cumulative airway damage from past infections, chronic inflammation, and smoking-related lung injury. Many patients shift into lifelong disease management rather than short-course treatment. This sustains continuous demand for mucus control agents, inhaled antibiotics, and anti-inflammatory therapies. Recurrent hospital visits for airway clearance support further reinforce treatment continuity. The condition behaves as a chronic aging-associated respiratory disorder in Japan, rather than a transient infectious disease category.

How Do Pulmonary Clinics, Home Oxygen Use, and Long-Term Monitoring Shape Therapy Utilization?

Bronchiectasis care in Japan is structured around pulmonary specialty clinics and long-term outpatient monitoring rather than emergency-driven admission. Regular airway imaging, sputum culture tracking, and lung function testing guide therapy adjustment over time. Many patients manage oxygen therapy and nebulized drugs at home under physician supervision. Visiting nurse services support device use, inhalation routines, and infection surveillance. This care model encourages sustained pharmaceutical consumption with stable refill behavior rather than episodic prescription cycles linked only to acute flare-ups.

What Treatment Complexity, Drug Tolerance, and Adherence Issues Constrain Outcomes?

Bronchiectasis therapy in Japan is constrained by drug tolerance limits, antibiotic resistance risk, and patient adherence burden. Long-term inhaled antibiotics increase airway irritation and microbial adaptation. Elderly patients often struggle with complex inhalation schedules and airway clearance routines. Polypharmacy across cardiac, metabolic, and neurological conditions complicates respiratory drug management. Corticosteroid exposure raises infection vulnerability. These interacting risks force physicians to balance symptom control against long-term safety, which limits aggressive escalation of therapy even in patients with frequent exacerbations.

How Are Targeted Antibiotics, Airway Clearance Devices, and Precision Monitoring Redefining Future Demand?

Future demand for bronchiectasis therapeutics in Japan is shifting toward targeted inhaled antibiotics matched to individual microbial profiles. Mechanical airway clearance devices and oscillation systems are gaining broader outpatient use to reduce drug dependence. Digital lung monitoring tools now track symptom fluctuation and sputum characteristics remotely. Precision imaging supports earlier intervention before severe airway remodeling occurs. These shifts show bronchiectasis treatment moving toward personalized maintenance regimes rather than uniform long-term antibiotic exposure across all patient types.

What is the Demand for Bronchiectasis Therapeutic in Japan by Region?

Region

CAGR (%)

Kyushu & Okinawa

5.4%

Kanto

5.0%

Kansai

4.4%

Chubu

3.9%

Tohoku

3.4%

Rest of Japan

3.2%

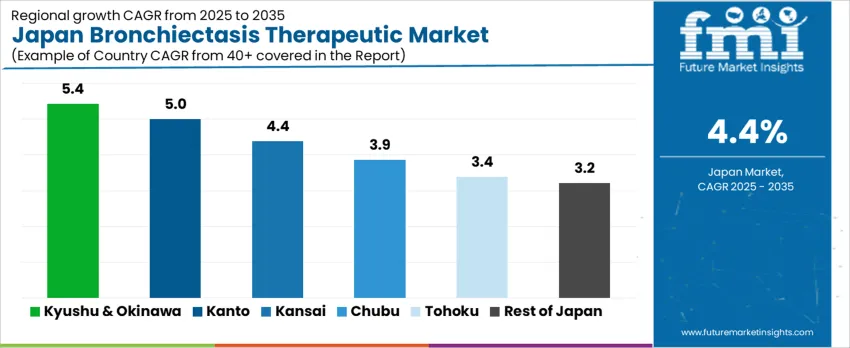

The demand for bronchiectasis therapeutics in Japan is expanding steadily across all regions, with Kyushu & Okinawa leading at a 5.4% CAGR. Growth in this region is supported by rising diagnosis rates, improved access to respiratory care, and growing use of long-term management therapies in regional hospitals. Kanto follows at 5.0%, driven by a high concentration of pulmonology centers, specialist clinics, and strong prescription volumes. Kansai records 4.4% growth, supported by ageing demographics and steady outpatient respiratory care demand. Chubu at 3.9% reflects moderate uptake linked to regional hospital infrastructure. Tohoku and Rest of Japan, at 3.4% and 3.2%, show slower expansion shaped by lower population density and fewer specialist respiratory treatment facilities.

How Is Respiratory Care Expansion Supporting Growth in Kyushu And Okinawa?

Clinical demand in Kyushu and Okinawa is advancing at a CAGR of 5.4% through 2035 for bronchiectasis therapeutic use, supported by rising diagnosis rates, expanding pulmonary clinics, and improved access to long term respiratory care. Coastal humidity and aging demographics contribute to steady chronic respiratory case volumes. Hospitals strengthen antibiotic therapy, bronchodilator access, and airway clearance treatment programs. Inter regional patient movement also adds to outpatient load. Demand remains treatment driven, with consistent growth linked to follow up therapy adherence, expanded respiratory diagnostics, and steady hospital pulmonology staffing across major urban centers.

Pulmonary clinics expand outpatient therapy access

Chronic case follow ups sustain recurring drug usage

Aging population drives long term respiratory treatment need

Inter regional patient movement adds outpatient volume

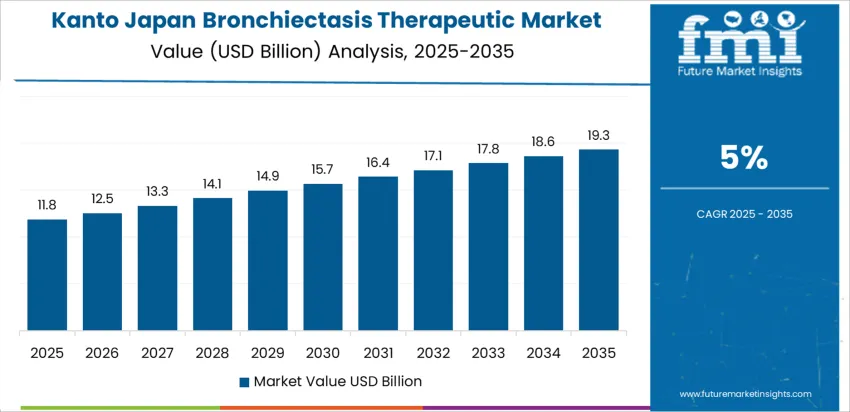

What Is Sustaining Strong Bronchiectasis Therapeutic Demand Across Kanto?

Metropolitan healthcare concentration in Kanto supports a CAGR of 5.0% through 2035 for bronchiectasis therapeutic demand, driven by high diagnostic screening, dense specialist networks, and strong hospital referral activity. Advanced imaging improves early detection of airway damage. Tertiary hospitals manage complex infectious cases and long term antibiotic regimens. Home based respiratory therapy programs also expand treatment continuity. Demand remains diagnosis led and referral driven, with growth tied to clinical pathway standardization, patient education programs, and steady expansion of respiratory disease management across urban hospital systems.

Advanced imaging improves early disease detection

Specialist density supports high therapy initiation rates

Home based care strengthens treatment continuity

Urban referrals drive complex case management

Why Is Kansai Developing as a Consistent Mid Tier Market?

Regional respiratory services in Kansai support a CAGR of 4.4% through 2035 for bronchiectasis therapeutic demand, shaped by balanced hospital distribution, steady COPD overlap cases, and expanding long term care support. Rehabilitation hospitals manage airway clearance therapy for chronic patients. Day care pulmonary programs increase adherence to maintenance regimens. Regional prescribing remains protocol driven and standardized. Demand remains volume stable and follow up focused, with steady growth supported by structured respiratory monitoring, hospital discharge continuity programs, and controlled expansion of outpatient pulmonology services.

Rehabilitation facilities manage airway clearance therapy

COPD overlap cases sustain maintenance drug usage

Day care pulmonary programs improve patient adherence

Protocol based prescribing supports stable demand

How Is Workforce Demography Influencing Demand in Chubu?

Industrial population coverage in Chubu supports a CAGR of 3.9% through 2035 for bronchiectasis therapeutic demand, influenced by employer health programs, urban air exposure, and steady chronic respiratory diagnosis. Manufacturing workers access early screening through occupational health services. Mid sized hospitals manage recurring infection control and inhaled therapy distribution. Employer insurance maintains treatment continuity for long term patients. Demand remains treatment focused rather than innovation driven, with utilization aligned to predictable diagnosis flow, standard antibiotic therapy cycles, and stable outpatient respiratory service capacity.

Occupational health programs support early diagnosis

Inhaled therapies dominate maintenance treatment volume

Employer insurance sustains long term treatment access

Recurring infection management drives repeat prescribing

What Is Guiding Moderate Bronchiectasis Therapeutic Growth in Tohoku?

Public healthcare consolidation in Tohoku supports a CAGR of 3.4% through 2035 for bronchiectasis therapeutic demand, shaped by aging rural populations, limited specialist density, and gradual improvement in pulmonary diagnostics. Chronic cough and recurrent infection cases dominate therapy volume. Local hospitals rely on standardized antibiotic protocols and supportive respiratory care. Referral to major metros remains common for complex cases. Demand stays necessity driven and clinically steady, with gradual growth tied to routine outpatient follow ups, infection control management, and stable public hospital pulmonology staffing.

Aging rural population sustains baseline treatment demand

Standard antibiotic protocols dominate prescribing patterns

Referral systems guide complex case management

Public hospitals anchor routine respiratory care

Why Does the Rest of Japan Show Stable but Slower Therapeutic Expansion?

Community healthcare networks across the rest of Japan reflect a CAGR of 3.2% through 2035 for bronchiectasis therapeutic demand, supported by municipal hospitals, stable outpatient respiratory services, and national insurance reimbursement continuity. Treatment focuses on maintenance antibiotics, bronchodilators, and airway clearance support. Advanced biologic or device based therapies remain concentrated in large metros. Patient adherence programs stabilize refill patterns. Demand remains steady and necessity oriented, with predictable therapy usage linked to routine diagnosis cycles, seasonal infection control, and essential community level respiratory care coverage.

Municipal hospitals sustain routine therapy distribution

Maintenance antibiotics dominate treatment regimens

Advanced therapies remain metro centered

Insurance stability supports predictable refill cycles

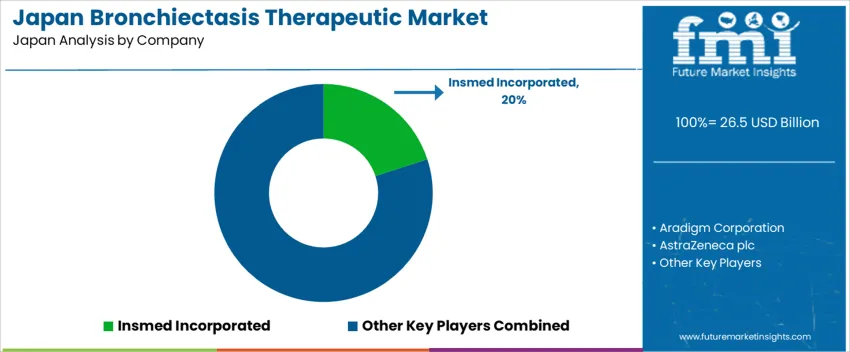

What Is Driving the Demand for Bronchiectasis Therapeutics in Japan and Who Are the Key Players Shaping the Market?

Demand for bronchiectasis therapeutics in Japan is rising as awareness grows of the chronic lung condition, particularly non-cystic forms, and as an ageing population increases the number of diagnosed cases. Improved diagnostic capabilities mean more patients are entering care pathways, creating demand for therapies beyond symptomatic treatment. Clinicians seek drugs that address airway inflammation, mucus clearance issues, and the risk of recurrent infections. Focus on improving quality of life, reducing exacerbation rates, and managing long-term disease progression drives interest in advanced therapeutic options. Rising patient awareness and physician adoption of novel treatments support continued growth in the bronchiectasis therapeutic segment across Japan.

Key companies shaping the Japanese bronchiectasis treatment market include Insmed Incorporated, Aradigm Corporation, AstraZeneca plc, GlaxoSmithKline plc (GSK), and Bayer AG. Insmed offers innovative therapies that target underlying disease mechanisms. AstraZeneca, GSK, and Bayer bring expertise in respiratory and inflammatory diseases, with established R&D and regulatory capabilities that support introduction and distribution in Japan. Aradigm and other specialist firms focus on inhaled or localized therapies that improve mucus clearance and infection management. Together, these companies provide a range of treatment options for clinicians addressing bronchiectasis patients, covering anti-inflammatory, immunomodulatory, and supportive therapeutic approaches.

Key Players in Bronchiectasis Therapeutics Industry in Japan

Stranco

Brady Worldwide Inc.

Avantar

Shenzhen Mibils Precision Co.

GA International Labtag

Scope of the Report

Items

Values

Quantitative Units (2025)

USD billion

Product Type

Antibiotics, Expectorants, Others

Distribution Channel

Hospital Pharmacies, Retail Pharmacies, Online Pharmacies

Region

Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan

Key Companies Profiled

Insmed Incorporated, Aradigm Corporation, AstraZeneca plc, GlaxoSmithKline plc, Bayer AG

Additional Attributes

Dollar by sales by product type, distribution channel, and region. Includes chronic therapy adherence, long-term treatment persistence, infection recurrence management, inhaled drug utilization, bronchodilator and mucolytic therapy consumption, outpatient monitoring, hospital follow-up frequency, comorbidity management impact, physician-supervised dosing, precision therapy allocation, regulatory and reimbursement compliance, patient education programs, integration with pulmonary rehabilitation, and alignment with Japan’s structured respiratory care system for elderly and chronic patients.

Bronchiectasis Therapeutics Industry in Japan Segmentation Product Type:

Antibiotics

Expectorants

Others

Distribution Channel:

Hospital Pharmacies

Retail Pharmacies

Online Pharmacies

Region:

Kyushu & Okinawa

Kanto

Kansai

Chubu

Tohoku

Rest of Japan

Frequently Asked Questions

How big is the demand for bronchiectasis therapeutic in Japan in 2025?

The demand for bronchiectasis therapeutic in Japan is estimated to be valued at USD 26.5 billion in 2025.

What will be the size of bronchiectasis therapeutic in Japan in 2035?

The market size for the bronchiectasis therapeutic in Japan is projected to reach USD 40.5 billion by 2035.

How much will be the demand for bronchiectasis therapeutic in Japan growth between 2025 and 2035?

The demand for bronchiectasis therapeutic in Japan is expected to grow at a 4.4% CAGR between 2025 and 2035.

What are the key product types in the bronchiectasis therapeutic in Japan?

The key product types in bronchiectasis therapeutic in Japan are antibiotics, expectorants and others.

Which distribution channel segment is expected to contribute significant share in the bronchiectasis therapeutic in Japan in 2025?

In terms of distribution channel, hospital pharmacies segment is expected to command 42.0% share in the bronchiectasis therapeutic in Japan in 2025.

AloJapan.com