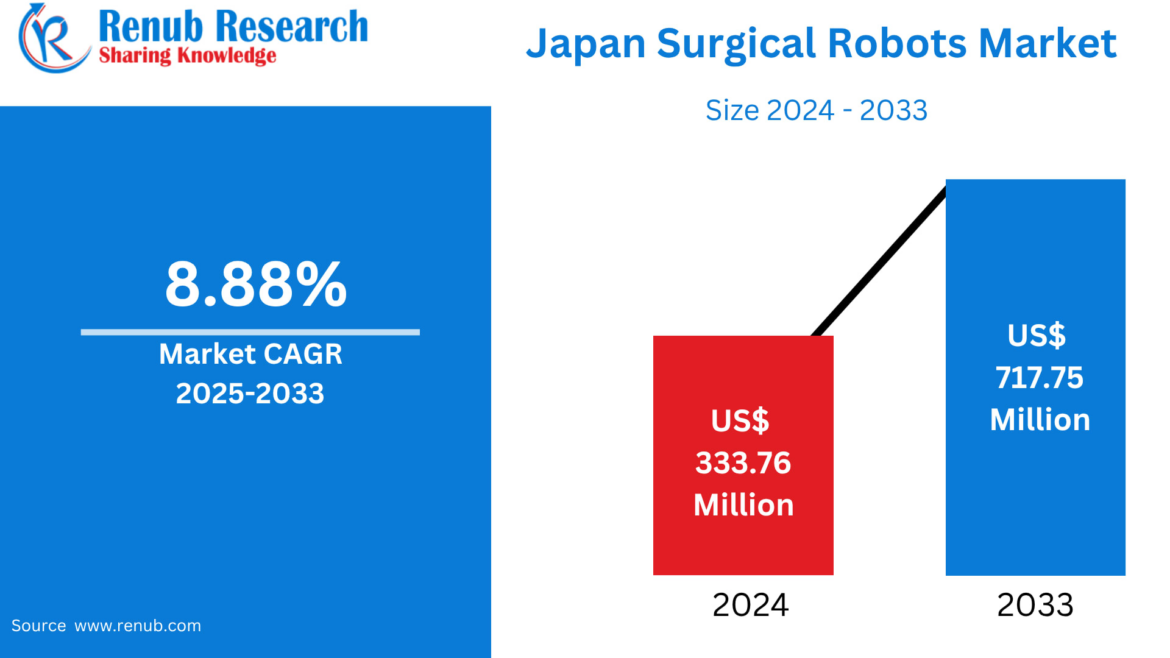

The Japan Surgical Robots Market is entering a new era of rapid transformation, supported by technological breakthroughs, government momentum, and a sharply aging population that increasingly depends on advanced medical interventions. According to Renub Research, the market is projected to grow from US$ 333.76 million in 2024 to US$ 717.75 million by 2033, expanding at a robust CAGR of 8.88% between 2025 and 2033. The rising preference for minimally invasive (MI) surgeries, coupled with Japan’s strategic focus on medical robotics, is turbocharging demand across hospitals nationwide.

As Japan repositions itself as a global leader in next-generation healthcare technology, surgical robots are rapidly becoming the backbone of precision surgery in fields such as orthopedics, neurosurgery, urology, gynecology, and cardiology. From Tokyo’s high-tech medical hubs to emerging centers across Kansai, Aichi, and Kyushu, robotic systems are rewriting the rules of patient care—delivering shorter recovery times, fewer complications, and unrivaled procedural accuracy.

Download Sample Report

Japan Surgical Robots Industry Overview

Surgical robots are computer-guided systems engineered to assist surgeons in performing highly precise minimally invasive procedures. Using tiny instruments mounted on robotic arms and guided by high-definition 3D imaging, these systems allow surgeons to operate with increased dexterity, stability, and visualization.

Equipped with tools such as motion sensors, robotic catheters, advanced optical systems, and data recorders, these robots replicate the delicate hand movements of surgeons—but with greater precision and stability. This makes them especially valuable for operations requiring extreme accuracy, such as neurosurgery, deep-tissue procedures, and microsurgery.

In Japan, demand for robotic-assisted surgeries is rising due to:

High neurological disease prevalence

A rapidly aging population

Strong government funding for medical technology

Growing trust among patients seeking MI surgical options

Hospitals’ push for faster recovery and reduced complications

Neurosurgical robots, in particular, are gaining popularity, helping surgeons navigate deep brain lesions, preserve neuronal structures, and minimize tissue damage—significantly improving patient outcomes.

At the same time, the integration of AI, IoT, VR/AR, and real-time data analytics is amplifying what surgical robots can do. Complex procedures that were once limited to a few specialized centers are gradually becoming mainstream in Japan’s evolving digital healthcare ecosystem.

Key Factors Driving Japan’s Surgical Robots Market Growth

1. An Aging Population Demanding More Surgeries

Japan is home to one of the world’s largest elderly populations, with nearly one-third of citizens aged 65 and above. This demographic shift is directly increasing the demand for surgeries, especially for conditions linked to aging:

Osteoporosis & joint degeneration (orthopedics)

Cardiovascular disorders

Prostate enlargement & urinary tract issues (urology)

Cancer surgeries

Neurological decline

Elderly patients often face higher risks from conventional surgery due to blood loss, trauma, longer healing times, and infection rates. Robotic surgery—being minimally invasive, controlled, and highly precise—significantly reduces these risks.

The result? Hospitals are increasingly adopting robotic systems as the preferred option for elderly patient care.

Robotic surgery helps older adults experience:

Shorter hospital stays

Faster procedure times

Reduced scarring and postoperative pain

Lower complication rates

As Japan’s aging continues to accelerate, robotic-assisted surgery will become indispensable across healthcare institutions.

2. Breakthroughs in Medical Robotics and Imaging

Technological advancements are dramatically reshaping Japan’s surgical capabilities. Newer robotics systems offer:

High-definition, real-time 3D imaging

Greater instrument dexterity and joint articulation

AI-driven decision support

Automated motion stabilization

Surgical navigation and mapping tools

These improvements not only reduce surgical errors but also enable complex procedures to be performed through tiny incisions.

Additionally, machine learning algorithms now help surgical robots:

Predict tissue behavior

Analyze surgical risks

Enhance preoperative planning

Support intraoperative adjustments

Such enhancements significantly improve patient outcomes while reducing recovery time—making robotic systems attractive for both surgeons and hospitals.

3. Government Support and Funding Initiatives

Japan’s government plays a pivotal strategic role in accelerating the adoption of surgical robots. Through policies such as the Future Medical Technology Strategy, the nation is doubling down on robotics, automation, and AI to modernize hospitals and develop more homegrown robotic systems.

Key government initiatives include:

Grants and subsidies for robotic system adoption

Incentives for R&D in medical robotics

Training programs to develop surgeon proficiency

Programs to expand robotic surgery access beyond major urban centers

Support for public–private partnerships in robotics innovation

Japan’s proactive stance is not only supporting the healthcare industry but also positioning the country as a global exporter and technological leader in surgical robotics.

Challenges Slowing Market Expansion in Japan

While Japan’s surgical robotics outlook is highly promising, some challenges remain.

1. High Costs and Affordability Gaps

Surgical robots represent a major financial burden for smaller and rural hospitals. Costs include:

Initial system purchase

Infrastructure upgrades

Annual maintenance contracts

Consumables and accessories

Ongoing software and hardware updates

Surgeon and staff training

While large urban hospitals can absorb these investments, many regional institutions struggle to justify the expenditure—leading to disparities in access to advanced procedures.

2. Limited Training and Surgeon Familiarity

Although robotic surgery demand is rising, many surgeons still have limited exposure to these systems. Barriers include:

Insufficient hands-on training

Heavy workloads hindering skill development

Limited simulation or mentoring programs

Hesitancy in transitioning from traditional surgery

Expanding collaborations between manufacturers, academic institutions, and hospitals is critical to building a strong talent pipeline capable of fully utilizing these technologies.

Japan Surgical Robots Market: Regional Breakdown

Japan’s surgical robot adoption varies significantly across regions. Urban hospitals lead adoption due to better funding, higher patient volumes, and early access to advanced systems.

Below is a regional snapshot:

Tokyo: The Epicenter of Robotic Surgery

Tokyo remains Japan’s strongest and fastest-growing market for surgical robotics. As the nation’s primary medical cluster, Tokyo has:

A dense network of advanced hospitals

Access to government-funded pilot programs

Strong medical research institutions

High patient demand for MI surgeries

More robust surgeon training ecosystems

Tokyo’s leadership role makes it the trendsetter for nationwide adoption.

Kansai: Home to Japan’s First Domestic Surgical Robot

The Kansai region (Osaka, Kyoto, Kobe) is another crucial hub. It is known for:

World-class medical universities

High-tech surgical facilities

Strong academic–industry partnerships

Kobe is particularly notable as the birthplace of “hinotori”, Japan’s first domestically developed surgical robot, created by Medicaroid, a collaboration between Sysmex Corporation and Kawasaki Heavy Industries. Kansai’s innovation-driven environment accelerates robotic adoption across multiple hospitals.

Aichi: Advanced Manufacturing Meets Medical Robotics

Aichi Prefecture—anchored by Nagoya—leverages its world-leading industrial ecosystem to support medical technology. This region benefits from:

Strong engineering and manufacturing talent

Widespread adoption of robotic technologies in hospitals

Collaboration between healthcare and industrial giants

Several hospitals in Aichi have already installed the “hinotori” robot, providing a more affordable alternative to foreign systems.

Additional Regions: Expanding but Uneven Growth

Other prefectures—Kanagawa, Saitama, Hyogo, Chiba, Hokkaido, Fukuoka, and Shizuoka—show steady but unequal growth. Cost barriers and training gaps restrict adoption in rural zones, but government initiatives aim to gradually close this gap.

Market Segmentation

By Component

Surgical Systems

Accessories

Services

By Area of Surgery

Gynecological Surgery

Cardiovascular

Neurosurgery

Orthopedic Surgery

Laparoscopy

Urology

Other Surgeries

By Cities

Tokyo, Kansai, Aichi, Kanagawa, Saitama, Hyogo, Chiba, Hokkaido, Fukuoka, Shizuoka

Key Companies Covered

Each company includes an overview, key persons, recent developments, SWOT analysis, and revenue analysis:

Intuitive Surgical Inc.

Stryker Corporation

Johnson & Johnson

Renishaw PLC

Accuray Incorporated

Titan Medical Inc.

Medtronic PLC

Smith & Nephew PLC

Zimmer Biomet

These players are advancing robotics globally through innovation in surgical systems, training, imaging, precision tools, and automation.

Final Thoughts

Japan stands on the brink of a surgical revolution. With its rapidly aging society, accelerating technological capabilities, and significant government backing, the nation is fast becoming a global hub for next-generation surgical robots. From homegrown innovations like the hinotori system to widespread deployment of advanced robotic platforms in Tokyo, Kansai, and Aichi, Japan’s healthcare system is evolving toward precision, efficiency, and patient-centered outcomes.

Between 2025 and 2033, the market’s upward trajectory—reaching US$ 717.75 million by 2033—signals more than just economic growth. It reflects a future where minimally invasive, AI-assisted, robotics-powered surgeries become the norm, reshaping patient care for generations.

If current trends continue, Japan’s surgical robotics ecosystem will not only strengthen its domestic healthcare system but also export technologies and expertise worldwide—solidifying its role as a pioneer in the global medical robotics arena.

AloJapan.com