Demand for VRF Systems in Japan Forecast and Outlook 2025 to 2035

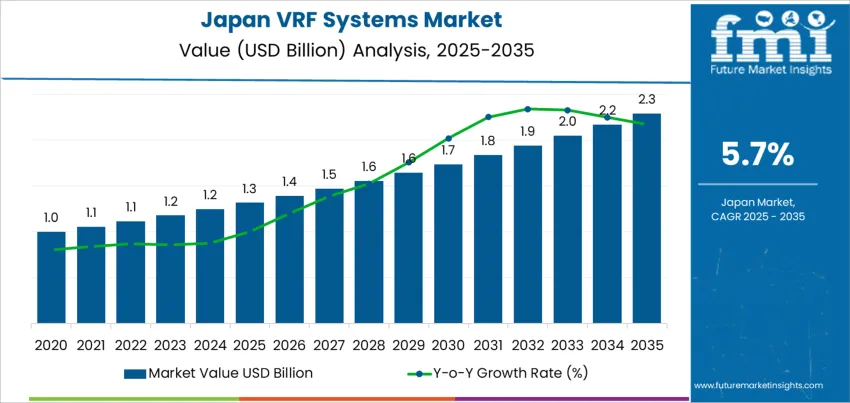

The demand for VRF systems in Japan reaches USD 1.3 billion in 2025, climbing toward USD 2.5 billion by 2035 with a compound annual growth rate of 5.7%. This expansion emerges from Japan’s building modernization initiatives, energy efficiency mandates, and commercial facility retrofitting programs. Construction companies across metropolitan areas implement VRF technologies in office towers, retail complexes, and hospitality projects where individual zone control delivers operational cost reductions. Property developers select VRF installations for mixed-use developments requiring flexible climate management across diverse occupancy patterns. These implementation trends drive consistent growth throughout the forecast timeline.

The trajectory shows progressive advancement from baseline values of USD 0.9 billion in 2020, rising through USD 1.0 billion in 2022 and USD 1.2 billion in 2024 before reaching USD 1.3 billion in 2025. Subsequent years demonstrate continued momentum with USD 1.4 billion expected in 2026, USD 1.5 billion in 2027, advancing through USD 2.0 billion in 2030 and USD 2.3 billion in 2032. This upward pattern reflects systematic adoption cycles, technological refinement, and expanded deployment across Japan’s commercial construction sectors. The progression highlights steady growth supported by building code requirements and energy performance standards governing Japanese construction practices.

Quick Stats of the Demand for VRF Systems in Japan

Demand for VRF Systems in Japan Value (2025): USD 1.3 billion

Demand for VRF Systems in Japan Forecast Value (2035): USD 2.5 billion

Demand for VRF Systems in Japan Forecast CAGR (2025–2035): 5.7%

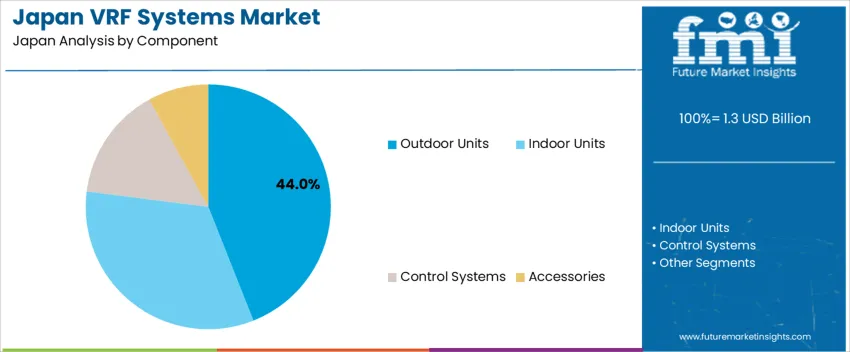

Demand for VRF Systems in Japan Leading Component: Outdoor Unit (44%)

Demand for VRF Systems in Japan Key Growth Regions: Kyushu & Okinawa, Kanto, Kinki, Chubu

Demand for VRF Systems in Japan Top Players: Daikin Industries, Ltd., Mitsubishi Electric Corporation, Panasonic Corporation, Toshiba Carrier Corporation, Johnson Controls-Hitachi Air Conditioning

What is the Growth Forecast for Demand for VRF Systems in Japan through 2035?

Demand in Japan for VRF systems is projected to increase from USD 1.3 billion in 2025 to USD 2.5 billion by 2035, reflecting a compound annual growth rate (CAGR) of approximately 5.7%. Starting at USD 0.9 billion in 2020, values progress through USD 1.1 billion in 2023, USD 1.2 billion in 2024, reaching USD 1.3 billion in 2025. From 2025 to 2030, demand advances toward USD 2.0 billion, concluding at USD 2.5 billion by 2035. Growth stems from Japan’s commercial building renovation cycles, hospitality sector expansion, healthcare facility modernization, and manufacturing plant climate control upgrades across regional construction networks.

During the forecast period, the value progression from USD 1.3 billion to USD 2.5 billion creates an incremental opportunity of USD 1.2 billion. Early growth (2025–2030) depends primarily on installation volume increases as building owners replace aging HVAC infrastructure with VRF solutions offering superior zone control. Later years (2030–2035) emphasize value appreciation through intelligent VRF systems, IoT integration, predictive maintenance capabilities, and premium efficiency models commanding elevated pricing. Suppliers developing inverter-driven compressors, refrigerant recovery systems, and building automation interfaces position themselves to capture expanding demand across Japan’s energy-conscious building sector.

VRF Systems Industry in Japan Key Takeaways

Metric

Value

Industry Value (2025)

USD 1.3 billion

Forecast Value (2035)

USD 2.5 billion

Forecast CAGR (2025–2035)

5.7%

What Is Driving the Demand for VRF Systems in Japan?

The demand for VRF systems in Japan has developed through Japan’s commercial real estate transformation, where office building owners pursued energy-efficient HVAC solutions capable of individual tenant zone management. Japanese property developers emphasized VRF installations in high-rise construction projects requiring simultaneous heating and cooling across different building orientations. Hotel chains adopted VRF technology for guest room climate control that reduces energy consumption while providing personalized comfort settings. Manufacturing facilities integrated VRF systems into production environments where precise temperature control supports quality manufacturing processes. These operational requirements created consistent, predictable demand tied to Japan’s building construction cycles and facility upgrade schedules.

Future growth reflects Japan’s movement toward intelligent building systems, net-zero energy construction standards, and integration of renewable energy sources with HVAC infrastructure. Commercial developers increasingly specify VRF systems with heat recovery capabilities that capture waste heat for building heating applications. Retail chains require VRF solutions that accommodate variable occupancy patterns while minimizing operating costs across multiple store locations. Healthcare facilities demand VRF installations with advanced filtration and humidity control for patient care environments. Japan’s seismic building standards create ongoing retrofit opportunities where VRF systems replace traditional HVAC during structural upgrades, maintaining demand growth across established building stock.

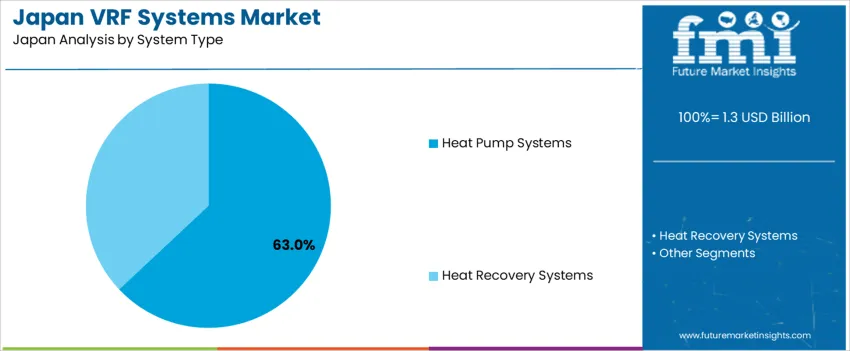

What Factors Are Affecting the Demand for VRF Systems in Japan in Terms of Component and System Type?

The demand for VRF systems in Japan depends on component configurations that determine system functionality and system types that define operational capabilities. Component categories include outdoor units, indoor units, control systems, and accessories that provide comprehensive climate control solutions for diverse building applications. System types encompass heat pump systems and heat recovery systems, each delivering specific performance characteristics for heating, cooling, and energy management requirements. As Japanese building owners emphasize operational efficiency and occupant comfort across commercial, residential, and industrial facilities, the combination of component reliability and system performance influences procurement decisions throughout Japan’s building construction and renovation sectors.

What Drives the Leading Demand for Outdoor Unit Components in Japan?

Outdoor units account for 44% of total demand across component categories in Japan. This leading position reflects the unit’s critical role in VRF system performance, energy efficiency, and operational reliability. Japanese commercial building owners value outdoor units for their inverter-driven compressor technology that adjusts cooling capacity based on actual demand rather than fixed-speed operation. Hotel operators rely on outdoor units with variable refrigerant flow control that serves multiple indoor zones simultaneously while optimizing energy consumption. The component’s compact design supports installation in space-constrained urban environments typical of Japanese commercial construction.

Demand for outdoor unit components grows as Japanese facilities pursue energy management systems that integrate HVAC controls with building automation platforms. The component enables remote monitoring and diagnostic capabilities that reduce maintenance costs and prevent system failures. Manufacturing facilities appreciate outdoor units with heat recovery functions that capture waste heat for process heating applications. Property managers favor units with quiet operation characteristics that comply with Japan’s noise pollution regulations in densely populated areas. As building efficiency standards become more stringent, outdoor units with advanced refrigerant management and leak detection maintain strong adoption across Japan’s commercial building sector.

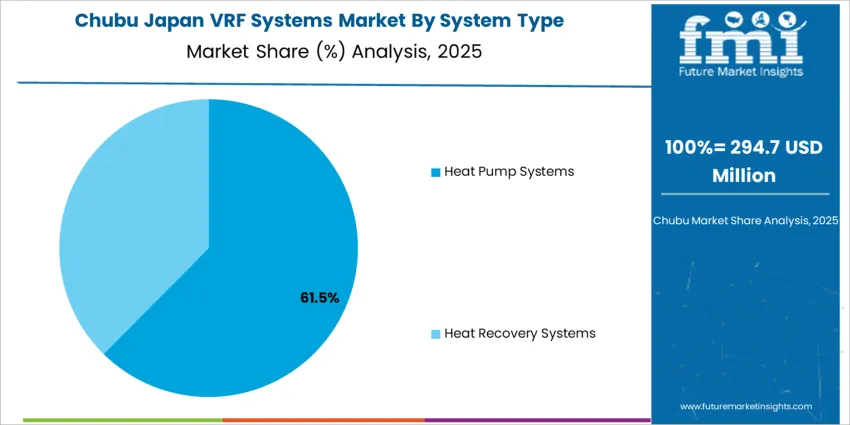

What Drives the Leading Demand for Heat Pump System Types in Japan?

Heat pump systems account for 63% of total demand across system type categories in Japan. Their dominant share stems from operational versatility, energy efficiency advantages, and compatibility with Japan’s moderate climate conditions. Japanese office building owners specify heat pump systems for their ability to provide both heating and cooling through a single installation, reducing equipment complexity and maintenance requirements. Retail facilities value heat pump technology for consistent temperature control across varying occupancy levels throughout daily and seasonal cycles. The system type supports zone-level climate management that accommodates diverse usage patterns within mixed-use developments.

Demand for heat pump systems expands as Japanese building operators pursue cost-effective climate control solutions that minimize operational expenses. The system type delivers superior energy efficiency compared to traditional HVAC alternatives, supporting corporate energy reduction targets and utility cost management. Healthcare facilities appreciate heat pump systems for reliable temperature control that maintains patient comfort while supporting medical equipment operation. Educational institutions favor the system type for classroom climate management that adapts to varying occupancy throughout academic schedules. As Japan implements energy efficiency regulations and building performance standards, heat pump systems provide proven technology that meets compliance requirements across diverse building applications.

What Is Shaping the Current Demand for VRF Systems in Japan?

Demand for VRF systems in Japan responds to commercial building modernization requirements, stringent energy efficiency regulations, and occupant comfort expectations across diverse facility types. Japan’s commercial property sector emphasizes HVAC solutions that provide individual zone control while minimizing energy consumption and operational complexity. Building owners require systems capable of simultaneous heating and cooling to accommodate varying thermal loads across different building orientations and usage patterns. Regulatory frameworks mandate energy performance standards and environmental impact assessments that position advanced VRF technology as necessary infrastructure for compliance rather than optional enhancement. These conditions establish sustained demand patterns based on building performance optimization and regulatory adherence.

How Are Japan’s Construction Standards and Climate Requirements Encouraging New Applications?

VRF systems gain traction because Japan’s building codes prioritize seismic resilience, energy conservation, and occupant safety over traditional HVAC cost considerations. Commercial developers integrate VRF installations into earthquake-resistant building designs where flexible refrigerant piping accommodates structural movement without system failure. Japanese hospitality operators leverage VRF technology for guest room climate control that provides individual temperature settings while centralizing maintenance and monitoring functions. Healthcare facilities require VRF systems with advanced air filtration and humidity management for infection control and patient care environments. These applications demonstrate Japan’s focus on building performance and operational reliability across critical infrastructure projects.

Where Are Strategic Growth Opportunities for VRF Systems in Japan?

Opportunities develop within mixed-use development projects, healthcare facility expansions, manufacturing plant upgrades, and retrofit applications across aging commercial building stock. Japan’s urban redevelopment initiatives create demand for VRF systems that serve combined residential, retail, and office spaces requiring diverse climate control capabilities. Hospital construction and renovation projects require VRF installations with medical-grade air quality management and redundant operation capabilities. Industrial facilities pursuing energy efficiency improvements adopt VRF technology for office areas, control rooms, and production spaces where precise temperature control supports operational requirements. Manufacturers offering VRF solutions with building automation integration, predictive maintenance capabilities, and renewable energy compatibility align with Japan’s intelligent building development trends.

What Technical Factors Are Constraining Wider Adoption of Advanced VRF Systems in Japan?

Constraints emerge from complex installation requirements, extensive commissioning processes, and specialized maintenance expertise needed for optimal system operation. Japanese building projects require detailed engineering coordination between VRF systems and existing building infrastructure, extending project timelines and increasing installation costs. Technical commissioning demands specialized knowledge of refrigerant management, control programming, and performance optimization that limits qualified installation contractors. Integration challenges with legacy building management systems create compatibility issues that delay system deployment. Furthermore, refrigerant regulations and environmental compliance requirements mandate specialized handling procedures and documentation that increase operational complexity for building maintenance teams.

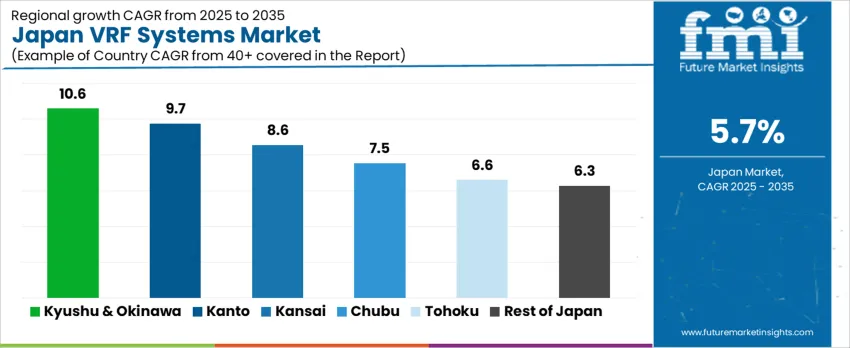

What is the Demand for VRF Systems in Japan by Region?

Region

CAGR (%)

Kyushu & Okinawa

10.6%

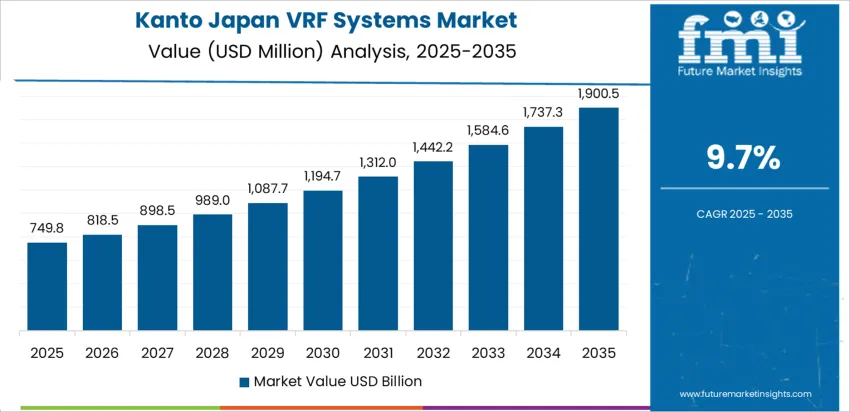

Kanto

9.7%

Kinki

8.6%

Chubu

7.5%

Tohoku

6.6%

Rest of Japan

6.3%

Demand for VRF systems in Japan accelerates across regions, with Kyushu & Okinawa leading at 10.6%. Growth in this region reflects intensive commercial development, hospitality sector expansion, and industrial facility modernization requiring advanced climate control solutions. Kanto follows at 9.7%, supported by dense urban construction, office building renovations, and mixed-use development projects demanding sophisticated HVAC technologies. Kinki records 8.6%, driven by manufacturing facility upgrades, commercial building retrofits, and healthcare infrastructure requiring precise temperature management. Chubu advances at 7.5%, influenced by automotive industry facilities and industrial complexes integrating VRF systems into production environments. Tohoku achieves 6.6%, showing consistent adoption across commercial and institutional building projects. The rest of Japan posts 6.3%, reflecting broader construction activity and building modernization across smaller urban centers.

How Is Kyushu & Okinawa Driving Demand for VRF Systems?

Kyushu & Okinawa is projected to advance at a CAGR of 10.6% through 2035 in demand for VRF systems. Fukuoka and Okinawa commercial development increasingly adopts VRF technology for hotel construction, office building projects, and retail facility climate control systems. Rising focus on tourism infrastructure, commercial building efficiency, and manufacturing facility modernization drives adoption. Manufacturers provide heat recovery VRF systems, high-efficiency outdoor units, and intelligent control platforms suitable for tropical climate applications and commercial building requirements. Distributors ensure availability across construction contractors, mechanical contractors, and facility management companies. Growth in commercial construction, tourism facility development, and industrial building projects supports steady adoption of VRF systems in Kyushu & Okinawa.

Fukuoka commercial projects adopt VRF systems for office buildings and retail facilities.

Tourism infrastructure and manufacturing facility modernization drive regional adoption trends.

Heat recovery systems and high-efficiency units suit tropical climate applications.

Distributors ensure access across construction, mechanical contracting, and facility management sectors.

How Is Kanto Supporting Demand for VRF Systems?

Kanto is projected to advance at a CAGR of 9.7% through 2035 in demand for VRF systems. Tokyo and surrounding metropolitan areas increasingly implement VRF technology in high-rise office construction, mixed-use development, and commercial building renovation projects. Rising focus on building energy efficiency, urban construction density, and advanced building automation drives adoption. Manufacturers provide variable refrigerant flow systems, zone control technologies, and building integration platforms suitable for urban construction and commercial applications. Distributors ensure accessibility across general contractors, mechanical systems integrators, and building management firms. Expansion in urban construction, commercial building renovation, and mixed-use development supports steady adoption of VRF systems across Kanto.

Tokyo high-rise construction implements VRF systems for office buildings and mixed-use projects.

Building energy efficiency and urban construction density drive regional growth patterns.

Variable refrigerant flow systems and zone controls support urban construction applications.

Distributors ensure access across contracting, mechanical integration, and building management sectors.

How Is Kinki Contributing to Demand for VRF Systems?

Kinki is projected to advance at a CAGR of 8.6% through 2035 in demand for VRF systems. Osaka, Kyoto, and surrounding manufacturing regions increasingly integrate VRF technology into industrial facility construction, commercial building projects, and healthcare facility development. Rising demand for manufacturing facility climate control, commercial building efficiency, and healthcare infrastructure modernization drives adoption. Manufacturers provide industrial-grade VRF systems, medical facility climate solutions, and precision control technologies suitable for manufacturing and healthcare applications. Distributors ensure accessibility across industrial contractors, healthcare facility specialists, and commercial construction firms. Growth in manufacturing facility construction, healthcare infrastructure, and commercial building development supports steady adoption of VRF systems across Kinki.

Osaka manufacturing facilities integrate VRF systems for industrial and commercial applications.

Manufacturing climate control and healthcare infrastructure modernization drive regional adoption.

Industrial-grade systems and medical facility solutions support manufacturing and healthcare applications.

Distributors ensure access across industrial, healthcare, and commercial construction sectors.

How Is Chubu Contributing to Demand for VRF Systems?

Chubu is projected to advance at a CAGR of 7.5% through 2035 in demand for VRF systems. Nagoya and surrounding automotive industry centers increasingly adopt VRF technology for manufacturing plant office areas, automotive facility climate control, and industrial building HVAC systems. Rising focus on automotive industry facility modernization, manufacturing building efficiency, and industrial climate management drives adoption. Manufacturers provide heavy-duty VRF systems, automotive facility solutions, and industrial climate control platforms suitable for manufacturing and automotive applications. Distributors ensure availability across automotive contractors, industrial mechanical systems providers, and manufacturing facility specialists. Expansion in automotive facility construction, manufacturing plant modernization, and industrial building development supports steady adoption of VRF systems across Chubu.

Nagoya automotive facilities adopt VRF systems for manufacturing plants and office areas.

Automotive facility modernization and manufacturing efficiency drive regional growth.

Heavy-duty systems and automotive facility solutions support manufacturing applications.

Distributors ensure availability across automotive, industrial, and manufacturing facility sectors.

How Is Tohoku Contributing to Demand for VRF Systems?

Tohoku is projected to advance at a CAGR of 6.6% through 2035 in demand for VRF systems. Sendai and surrounding regions gradually adopt VRF technology for commercial building construction, institutional facility projects, and industrial building climate control systems. Rising focus on institutional building modernization, commercial facility development, and industrial building efficiency drives adoption. Manufacturers provide cold-climate VRF systems, institutional building solutions, and energy-efficient platforms suitable for northern climate applications. Distributors ensure accessibility across institutional contractors, commercial building specialists, and regional mechanical system providers. Expansion in institutional facility construction, commercial building development, and industrial facility modernization supports steady adoption of VRF systems across Tohoku.

Sendai institutional facilities adopt VRF systems for commercial and institutional buildings.

Institutional modernization and commercial facility development drive regional adoption.

Cold-climate systems and institutional solutions support northern climate applications.

Distributors ensure access across institutional, commercial, and regional mechanical contracting sectors.

How Is Rest of Japan Supporting Demand for VRF Systems?

The Rest of Japan is projected to advance at a CAGR of 6.3% through 2035 in demand for VRF systems. Smaller urban centers and regional construction projects gradually adopt VRF technology for commercial building construction, institutional facility development, and regional industrial applications. Rising demand for regional building modernization, commercial facility efficiency, and institutional building climate control drives adoption. Manufacturers provide standard VRF systems, regional building solutions, and cost-effective climate control platforms suitable for regional construction and institutional applications. Distributors ensure accessibility across regional contractors, local mechanical system providers, and institutional facility specialists. Expansion in regional construction, institutional facility development, and commercial building modernization supports steady adoption of VRF systems across the Rest of Japan.

Regional construction projects adopt VRF systems for commercial and institutional facilities.

Regional modernization and institutional facility development drive adoption patterns.

Standard systems and regional solutions support regional construction applications.

Distributors ensure access across regional contracting and institutional facility sectors.

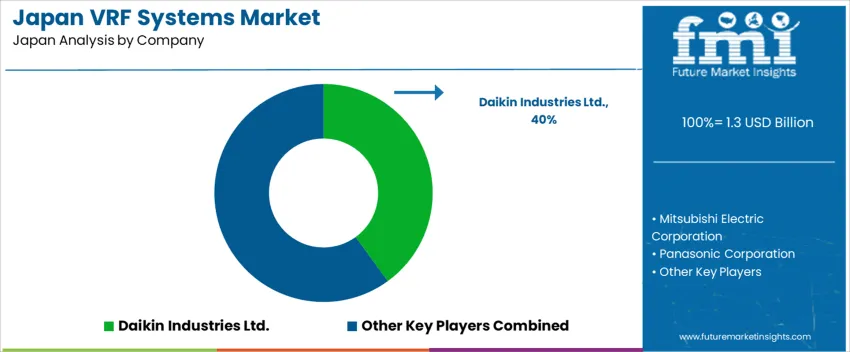

What Is Driving the Demand for VRF Systems in Japan and Who Are the Key Players Shaping the Industry?

The demand for VRF systems in Japan is driven by commercial building construction acceleration, stringent energy efficiency mandates, and occupant comfort requirements across diverse facility types requiring precise climate control. Property developers seek HVAC solutions that provide individual zone management, reduce operational costs, and support building automation integration. Hospitality operators require VRF installations capable of guest room climate control while minimizing energy consumption across varying occupancy patterns. Manufacturing facilities demand climate systems that maintain production environment stability while supporting office area comfort requirements. Technological improvements including inverter-driven compressors, heat recovery capabilities, and intelligent control systems enhance VRF suitability across Japan’s commercial, institutional, and industrial building sectors requiring advanced climate management.

Key companies active in Japan’s VRF systems sector include domestic leader Daikin Industries, Ltd., electrical giant Mitsubishi Electric Corporation, diversified manufacturer Panasonic Corporation, infrastructure specialist Toshiba Carrier Corporation, and international provider Johnson Controls-Hitachi Air Conditioning. Daikin Industries offers comprehensive VRF product lines with advanced inverter technology and heat recovery systems serving commercial and residential applications throughout Japan. Mitsubishi Electric provides high-efficiency VRF solutions with intelligent controls and building automation integration capabilities. Panasonic delivers VRF systems combining climate control with air quality management for healthcare and commercial applications. Toshiba Carrier supplies VRF technology with advanced refrigerant management and energy optimization features. Johnson Controls-Hitachi Air Conditioning contributes international HVAC expertise combined with Japanese manufacturing quality standards. This blend of domestic innovation and international technology ensures Japan’s VRF systems advancement through local engineering capabilities and global industry best practices.

Key Players in VRF Systems Industry in Japan

Daikin Industries, Ltd.

Mitsubishi Electric Corporation

Panasonic Corporation

Toshiba Carrier Corporation

Johnson Controls-Hitachi Air Conditioning

Report Scope for VRF Systems Industry in Japan

Items

Values

Quantitative Units (2025)

USD billion

Component

Outdoor Unit, Indoor Unit, Control System, Accessories

System Type

Heat Pump, Heat Recovery

End-User

Commercial, Residential, Industrial

Region

Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan

Countries Covered

Japan

Key Companies Profiled

Daikin Industries, Ltd., Mitsubishi Electric Corporation, Panasonic Corporation, Toshiba Carrier Corporation, Johnson Controls-Hitachi Air Conditioning

Additional Attributes

Dollar sales by component type and system configuration, regional CAGR and deployment patterns, and volume value shares are analyzed with commercial vs. residential uptake, heat pump vs. heat recovery penetration, automation integration, efficiency validation, installation complexity, and domestic–international HVAC technology competition in Japan.

VRF Systems Industry in Japan Segmentation Component:

Outdoor Unit

Indoor Unit

Control System

Accessories

System Type:

End-User:

Commercial

Residential

Industrial

Region:

Kyushu & Okinawa

Kanto

Kinki

Chubu

Tohoku

Rest of Japan

Frequently Asked Questions

How big is the demand for VRF systems in Japan in 2025?

The demand for VRF systems in Japan is estimated to be valued at USD 1.3 billion in 2025.

What will be the size of VRF systems in Japan in 2035?

The market size for the VRF systems in Japan is projected to reach USD 2.3 billion by 2035.

How much will be the demand for VRF systems in Japan growth between 2025 and 2035?

The demand for VRF systems in Japan is expected to grow at a 5.7% CAGR between 2025 and 2035.

What are the key product types in the VRF systems in Japan?

The key product types in VRF systems in Japan are outdoor units, indoor units, control systems and accessories.

Which system type segment is expected to contribute significant share in the VRF systems in Japan in 2025?

In terms of system type, heat pump systems segment is expected to command 63.0% share in the VRF systems in Japan in 2025.

AloJapan.com