In recent months, several major Japanese utilities have escalated support for natural gas and other fossil fuel technologies overseas, while downplaying clean energy targets at home.

Tokyo Gas, the country’s largest gas distribution utility, announced it would abandon its renewable energy targets entirely, while investing more heavily in liquefied natural gas (LNG) and other fossil fuel-based technologies. Meanwhile, JERA, Japan’s largest power generation company, is expanding its presence in overseas LNG markets and doubling down on efforts to develop gas infrastructure in Southeast Asia.

Backsliding on clean energy has coincided with a greater public push for unproven, fossil-based technologies. Not only do these strategies jeopardize Japan’s international commitments to triple renewable energy capacity by 2030 and reach net-zero emissions by 2050, but they could also incur unintended financial consequences resulting from increased exposure to global fossil fuel price volatility.

Tokyo Gas replaces renewables with false solutions

In October, Tokyo Gas announced that it would invest USD2.3 billion over three years in United States (US) shale gas production and liquefied natural gas (LNG) trading, while scrapping its medium-term renewable energy plans entirely.

One month later, the company announced a 20-year contract to buy LNG from Virginia-based Venture Global. Tokyo Gas has also been in negotiations for LNG supplies beyond 2050, the year when both the company and the country aim to achieve net-zero greenhouse gas (GHG) emissions.

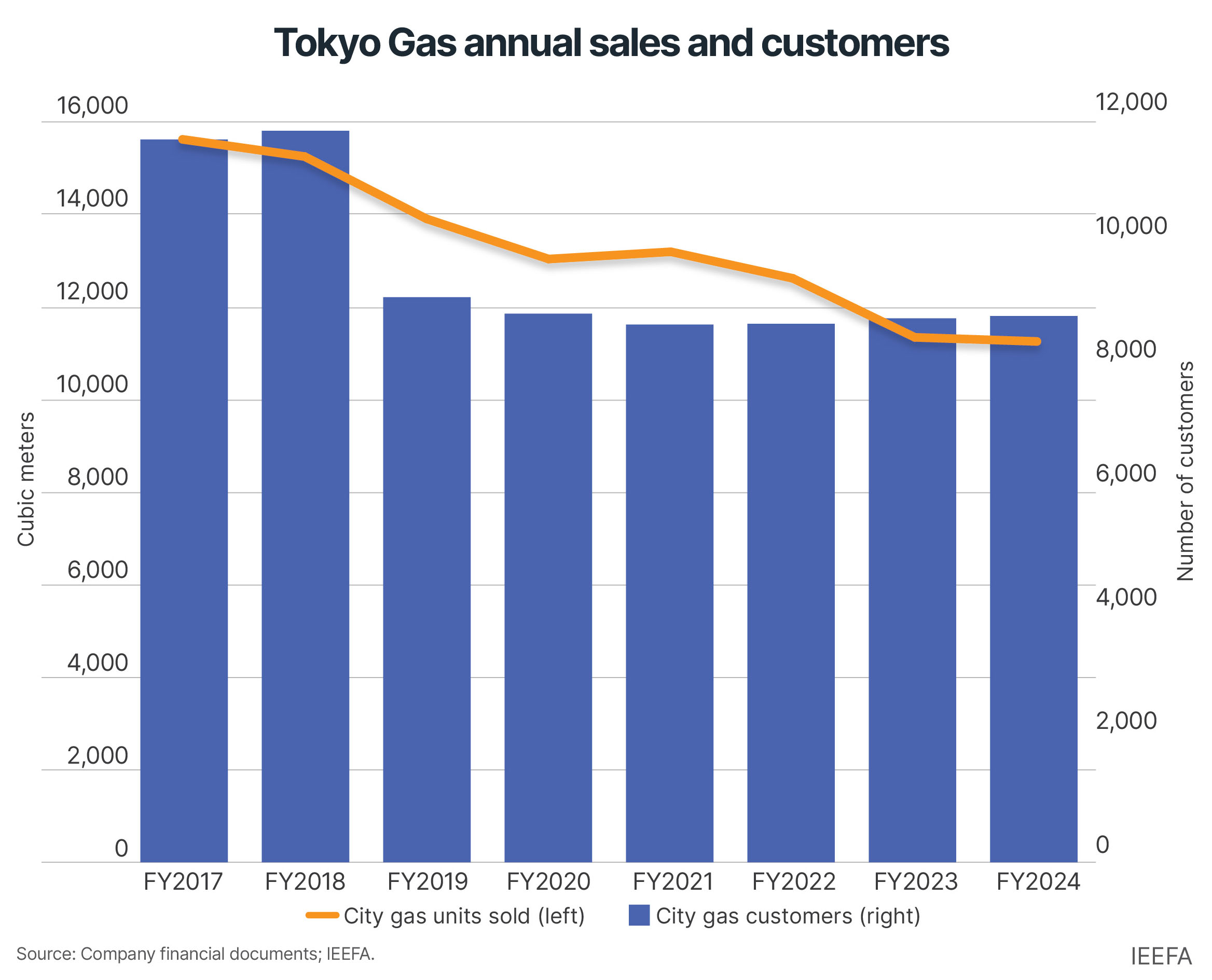

Tokyo Gas representatives often frame this strategy as one designed to bolster Japan’s energy security. However, the company’s own domestic gas sales in fiscal year (FY) 2024 fell to their lowest level in at least two decades, down 28% since 2018.

In reality, the strategy prioritizes overseas business opportunities while putting Japan’s energy transition on the back burner.

A backsliding on renewables has coincided with a greater public push for unproven, costly fossil-based technologies to reach 2050 climate targets. For example, Tokyo Gas and many other Japanese utilities are heavily promoting e-methane, a “renewable gas” made by combining hydrogen with carbon dioxide from carbon capture and storage (CCS) facilities.

Experts have described e-methane as “wonderful,” but only “as long as you don’t worry about thermodynamics, engineering or economics.” As a result of the highly inefficient process, e-methane costs are currently estimated at up to USD200 per million British thermal units (MMBtu), or roughly 20 times the current LNG prices. Yet, Tokyo Gas claims e-methane will anchor Asia’s energy transition.

Relying entirely on unproven technologies to reach climate targets increases the likelihood of backsliding when proposed solutions don’t pan out. Already, the Japan Gas Association (JGA) — chaired by the Chief Executive Officer (CEO) of Tokyo Gas, Takashi Uchida — has revised its e-methane targets downward, from 90% of Japan’s gas supply by 2050 to as low as 50%.

JERA’s search for growth

Meanwhile, JERA has amplified its commitments to LNG investments across Southeast Asia, allocating more capital toward LNG upstream and trading assets.

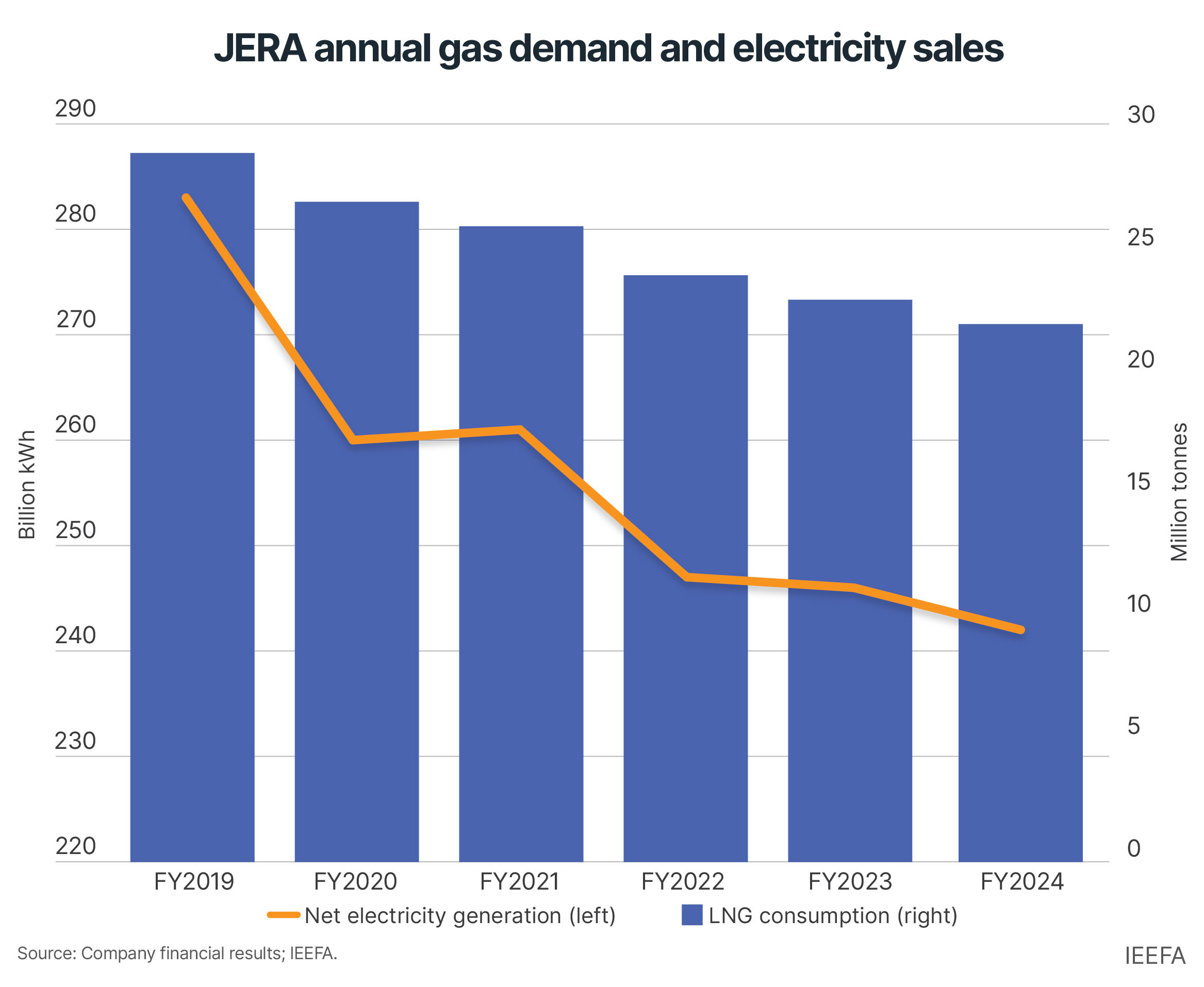

The company is expanding its LNG footprint more aggressively than at any point in the past decade. It plans to boost its long-term LNG contracts by 20% by 2030 — from roughly 25 million tonnes per annum (MTPA) to 30 MTPA. This is despite the fact that JERA’s domestic gas consumption and electricity generation have fallen 24% and 14%, respectively, since FY2019.

JERA’s gas needs within Japan are likely to decrease further with the ongoing reboot of the country’s nuclear fleet. Prime Minister Sanae Takaichi has strongly emphasized nuclear’s role in the national energy mix, and the world’s largest reactor, Tokyo Electric’s Kashiwazaki Kariwa plant, recently received approval to restart from the prefectural governor.

Instead, the company aims to “become a portfolio player like BP and Total” by acquiring flexible LNG supplies and reselling the fuel to customers outside Japan. In 2025 alone, JERA signed 5.5 MTPA of new long-term contracts with US Gulf Coast LNG projects and has even considered procurement from the long-delayed, high-cost Alaska LNG project as it diversifies its supply portfolio.

This strategy may soon encounter unintended financial consequences. As the world enters its largest growth phase for LNG supply ever, global prices are widely expected to fall, squeezing profits for LNG traders. Already, JERA’s earnings from its fuel business, which includes upstream and trading activities, have declined 24% from 2022, when LNG prices were at their highest.

JERA’s LNG trading results during the looming global oversupply will depend on its ability to lock in new customers, hence the importance of Southeast Asia. This is a highly risky approach considering the substantial cost and infrastructure barriers to LNG demand growth in emerging markets, compounded by a global gas turbine shortage that is delaying new LNG-to-power investments throughout the region.

Lackluster policy and corporate indifference for clean energy

Persistent policy ambiguity underpins the trajectories of Tokyo Gas and JERA. Japan’s Green Transformation (GX) strategy places LNG, hydrogen, and ammonia co-firing on equal footing with renewables, offering limited incentives for renewable deployment. The 7th Strategic Energy Plan further reinforces this ambiguity by including a scenario in which renewable energy stagnates — implying higher LNG imports to close the supply gap.

By codifying this possibility, the government signals to utilities that increased LNG dependence is acceptable, and even expected. A recent Institute for Energy Economics and Financial Analysis (IEEFA) report found that the major utilities have added less than 2 gigawatts (GW) of renewable capacity between 2021 and 2023, compared to more than 10GW of solar capacity added during years when a favorable feed-in tariff was in place. Japan’s 12 largest electric utilities account for roughly 1% of the country’s electricity produced from wind and solar, while 99% is generated by non-major power suppliers.

Conclusion

Of course, not all utilities are moving in the same direction. J-POWER, one of Japan’s largest wholesale power producers, aims to expand its renewable capacity by 1.5GW above its 2017 level (0.9GW) by FY2025. The company also plans to retire 2.7GW — around 31% — of its coal capacity by 2030. It has already begun closing several aging coal plants, while continuing to develop an offshore wind project awarded during the country’s second auction round.

Although J-POWER still plans to rely heavily on unproven technologies to transition its fossil fuel assets, it has notably scaled back its US power generation investments and reinvested the proceeds in large-scale renewable energy plants in Japan, the US, Australia, and elsewhere.

This is a stark contrast to Tokyo Gas and JERA, who appear to be downplaying national climate efforts, while also ceding domestic market share in favor of increased exposure to volatile global fossil fuel markets. Whether or not it pays off, this gamble would lock in Japan’s fossil fuel dependence and widen the gap with global energy transition leaders.

AloJapan.com