Traders are ramping up bets on two BOJ hikes by October next year as inflation and wage signals strengthen. Could this shift spell trouble for bulls?

Tokyo inflation tops forecasts

BOJ hike odds sit at 56% for December

USD/JPY breaks mid-October uptrend

Momentum signals show fading bullish strength

Summary

Tokyo’s hotter-than-expected inflation has traders bracing for a as early as December, with odds climbing sharply for further tightening in 2026. While USD/JPY has held firm for weeks, the break of its recent uptrend and fading momentum suggest the bullish run may be losing steam. With Governor Ueda’s speech looming and carry trade dynamics in play, the next move could redefine the yen’s outlook.

Tokyo Inflation Remains Hot

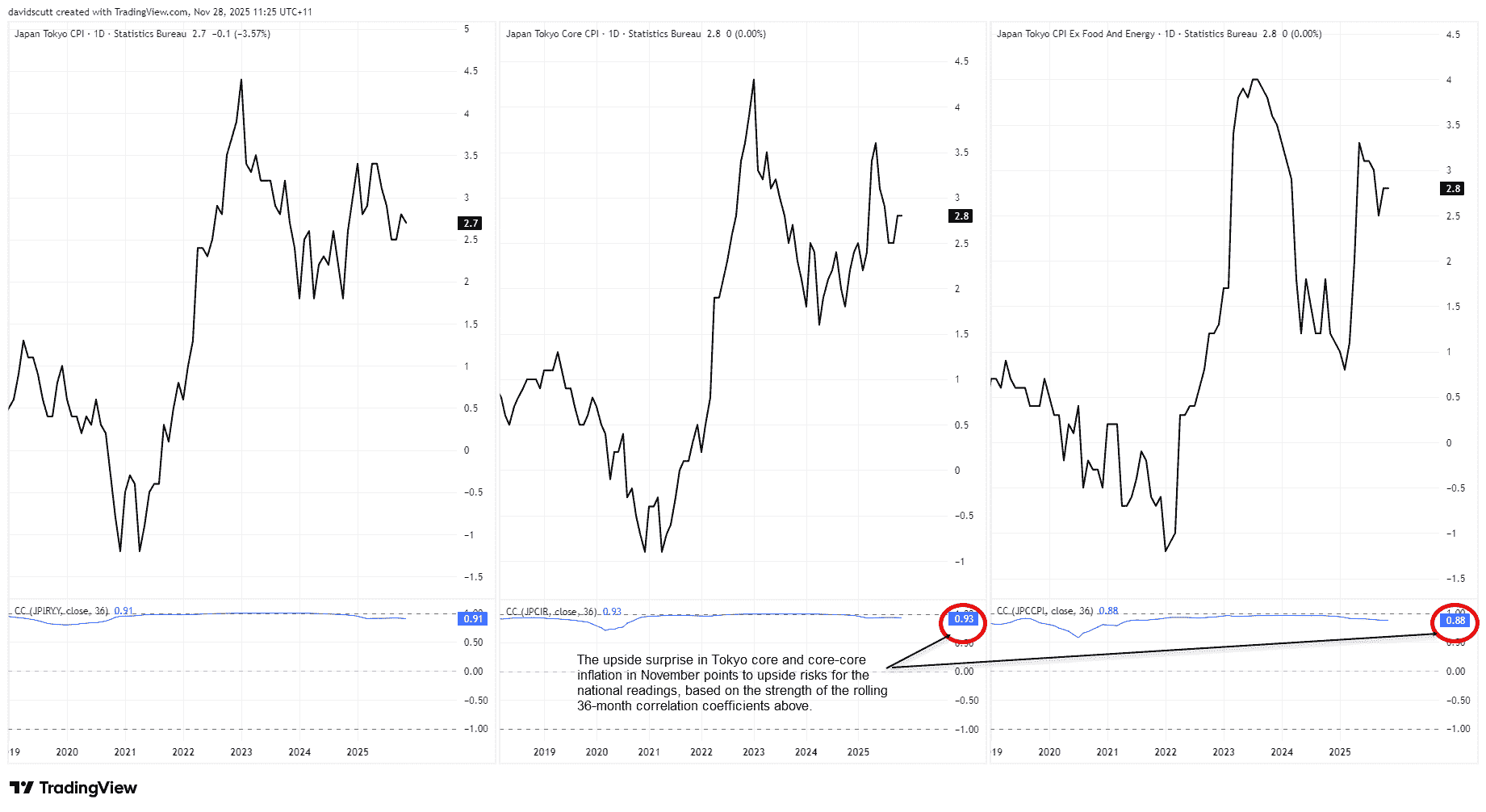

Inflationary pressures in Japan’s capital, , remained elevated in November, pointing to the risk of similar trends nationwide and keeping the prospects of a Bank of Japan (BOJ) rate hike next month very much alive.

rose 0.3% in November, leaving the fractionally lower at 2.7%. Stripping out fresh food prices, rose 2.8% from a year earlier—one-tenth above expectations and well above the BOJ’s 2% target. Excluding fresh food and energy, inflation also topped forecasts, rising 2.8% over the year versus the 2.7% pace expected.

Source: TradingView

As shown in the graphic tracking all three series, inflation has not only exceeded the BOJ’s 2% target for an extended period, but the rolling three-year monthly correlation with subsequent national readings points to similar trends when that data is released in three weeks.

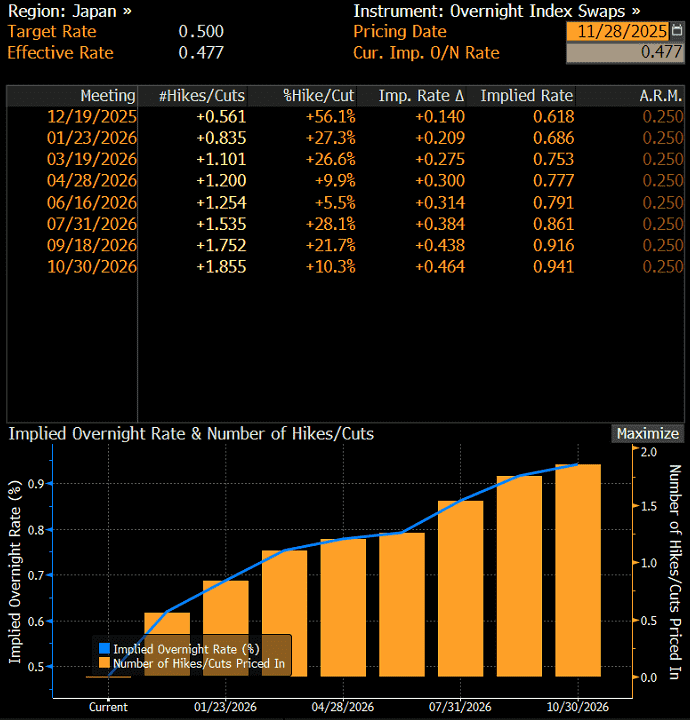

BOJ December Hike Favoured

Following the Tokyo inflation data, swaps pricing puts the implied probability of a 25-basis-point BOJ rate hike next month at 56%, rising to 84% by the bank’s first meeting of 2026 in late January. With early signals from annual wage negotiations pointing to strong union demands for similar large increases to those seen in the past two years, it’s no surprise traders are now pricing in the risk of two full 25-point hikes by October next year.

Source: Bloomberg

Attention now turns to a speech by BOJ Governor Ueda next Monday, with the strength of the latest inflation data making this a key event should he choose to prime markets for a move on December 19.

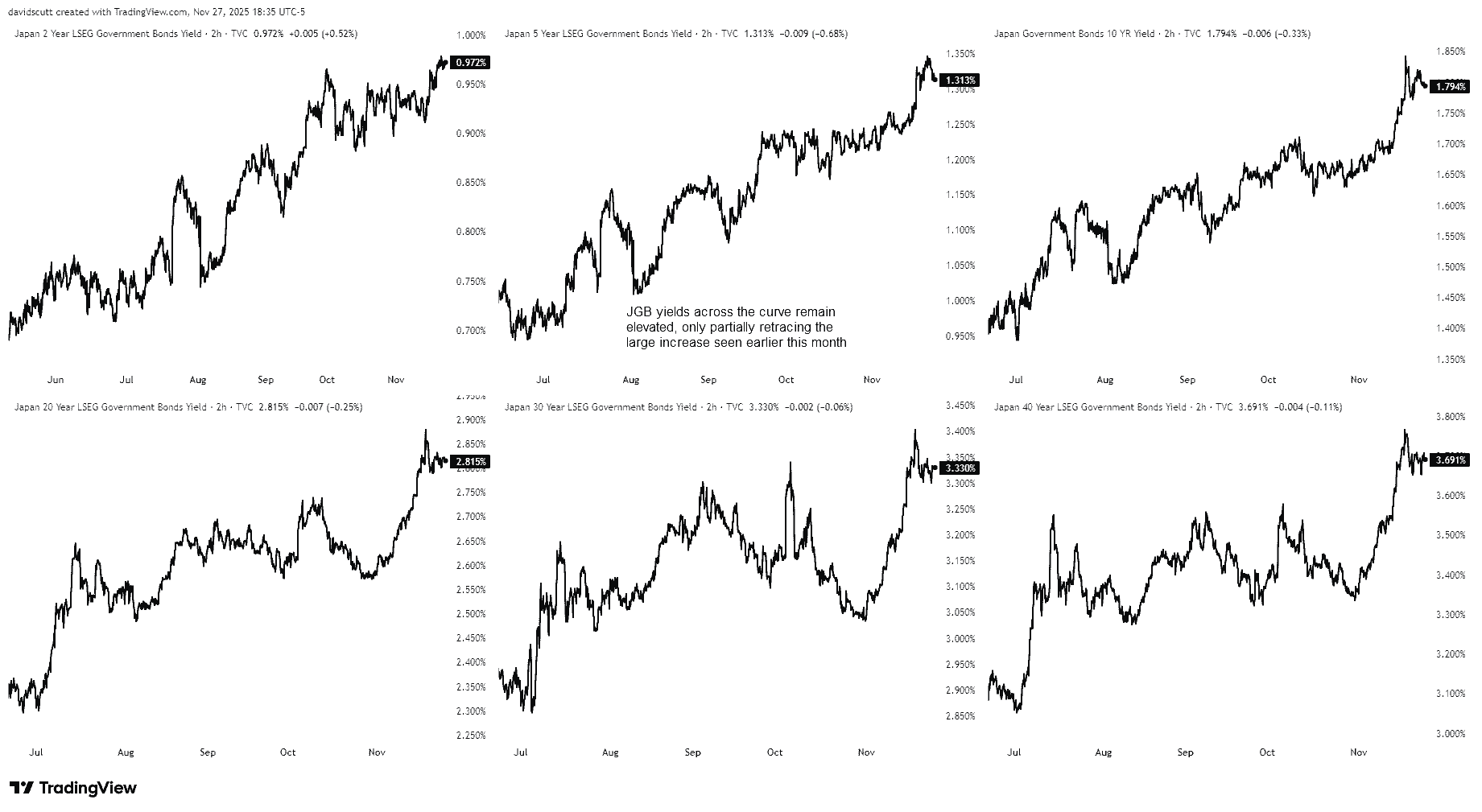

Yield Compression Risks Carry Trade Unwind

Source: TradingView

While USD/JPY has not shown a particularly strong relationship with yield differentials between the United States and Japan in recent weeks—with U.S. yields pressured by mounting expectations for up to 100 basis points of next year while Japanese yields remain elevated—directional risks for USD/JPY appear skewed lower, especially if carry trades come under pressure from higher borrowing costs and/or weaker asset prices.

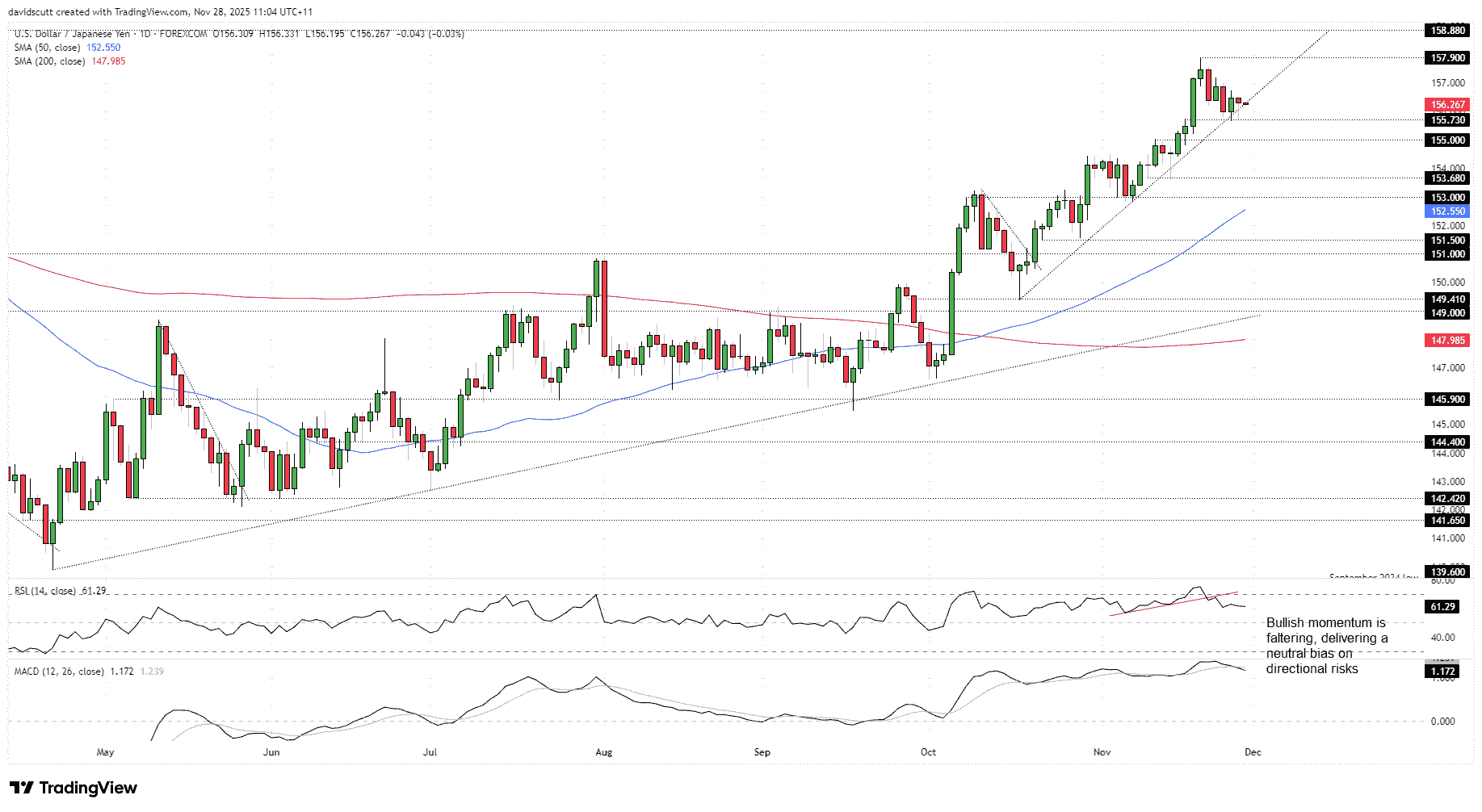

USD/JPY Trend Change?

Source: TradingView

On the daily chart, USD/JPY is now trading through the uptrend in place since mid-October, pointing to the risk the pair may be embarking on a new trend. For now, price continues to attract bids on moves toward 155.73 support, suggesting that if we see a sustained break of the uptrend, the near-term path may be sideways. Beneath 155.73, minor support sits at 155.00 and again at 153.68, where price bounced twice earlier this month, with 153.00 a more pronounced support zone below.

If the uptrend is reclaimed, resistance may emerge around 157.00, with the November swing high of 157.90 the next topside level of note.

Momentum signals point to diminishing bullish strength. RSI (14) is trending lower but remains above the neutral 50 level, offering at least a cautionary message to dip buyers. MACD reinforces that caution, crossing the signal line from above while holding in positive territory. It’s not an outright bearish message from the oscillators, but the strength of the bullish thrust seen in recent months is clearly waning.

Original Post

AloJapan.com