Demand for Endoluminal Suturing Device in Japan Forecast and Outlook 2025 to 2035

The demand for endoluminal suturing devices in Japan is expected to grow from USD 4.2 million in 2025 to USD 6.4 million by 2035, reflecting a CAGR of 4.3%. These devices are used primarily in minimally invasive surgeries, particularly for gastrointestinal and bariatric procedures. As Japan’s healthcare system emphasizes minimally invasive surgeries to improve patient outcomes, reduce recovery time, and minimize complications, the demand for advanced surgical tools like endoluminal suturing devices is expected to rise steadily. Furthermore, as robot-assisted surgery and laparoscopic procedures continue to evolve, the integration of these suturing devices into modern surgical practices will drive their adoption.

The increasing prevalence of obesity, gastrointestinal diseases, and age-related health conditions will also play a role in the growing demand for these devices. Japan’s aging population, in particular, will contribute to a higher demand for bariatric surgery and other procedures that require precise and efficient suturing, driving the market expansion for endoluminal suturing devices. Innovations in device design, efficiency, and patient safety will further support this growth, making these devices a key component of surgical practices in Japan.

Quick Stats of the Demand for Endoluminal Suturing Device in Japan

Demand for Endoluminal Suturing Device in Japan Value (2025): USD 4.2 million

Demand for Endoluminal Suturing Device in Japan Forecast Value (2035): USD 6.4 million

Demand for Endoluminal Suturing Device in Japan Forecast CAGR (2025-2035): 4.3%

Demand for Endoluminal Suturing Device in Japan Leading Product Type: Needle-based Suturing Devices (65%)

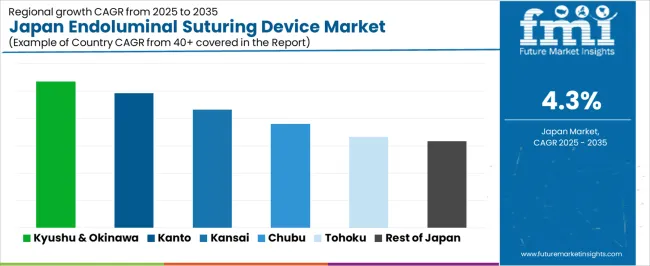

Demand for Endoluminal Suturing Device in Japan Key Growth Regions: Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan

Demand for Endoluminal Suturing Device in Japan Top Players: Olympus Corporation, Fujifilm Holdings Corporation, HOYA Corporation / PENTAX Medical, Boston Scientific Corporation, Medtronic plc, Ovesco Endoscopy AG, EndoRobotics Co., Ltd.

What is the Growth Forecast for the Endoluminal Suturing Device Industry in Japan through 2035?

The early vs late growth curve comparison for endoluminal suturing devices in Japan highlights key differences in growth dynamics as the market matures over the forecast period.

From 2025 to 2030, the market will grow from USD 4.2 million to USD 5.2 million, contributing USD 1 million in value. This early phase of growth is driven by increased adoption of minimally invasive and robot-assisted surgeries, where the need for advanced suturing devices is critical. As hospitals and surgical centers in Japan increasingly adopt these technologies, the demand for precise suturing tools will rise, leading to strong growth. This phase will be characterized by rapid technology integration and early-stage adoption as medical professionals adopt endoluminal suturing devices for their safety benefits and improved surgical outcomes.

From 2030 to 2035, the market will grow from USD 5.2 million to USD 6.4 million, adding USD 1.2 million in value. The late phase of growth will see slower acceleration, as the market reaches saturation in terms of adoption across major hospitals and surgical centers. While demand will continue to rise, it will be driven by replacement cycles, upgrades to newer devices, and continued advancements in surgical practices. The late growth phase will see more incremental adoption driven by technological improvements, but the overall growth rate will be slower compared to the earlier phase, reflecting the maturity of the market. Despite this, the market will continue to benefit from consistent demand from Japan’s aging population and the increasing prevalence of bariatric and gastrointestinal surgeries.

Key Takeaways of Endoluminal Suturing Device Industry in Japan

Metric

Value

Industry Sales Value (2025)

USD 4.2 million

Industry Forecast Value (2035)

USD 6.4 million

Industry Forecast CAGR (2025-2035)

4.3%

What Is Driving the Demand for Endoluminal Suturing Devices in Japan?

Demand for endoluminal suturing devices in Japan is rising as the country’s healthcare system increasingly favours minimally invasive surgical solutions for gastrointestinal and bariatric applications. In 2024 the Japanese market was valued at approximately USD 2.5 million and is projected to reach about USD 5.4 million by 2030, representing a compound annual growth rate (CAGR) of around 13.4%. The growing incidence of gastroesophageal reflux disease (GERD), gastrointestinal cancers and obesity drives procedure volumes where endoluminal suturing devices offer a less invasive alternative to open surgery, contributing to adoption in hospitals and specialty clinics.

Another factor supporting demand is Japan’s advanced endoscopy infrastructure and clinician acceptance of high precision procedural tools. Japanese medical institutions are more actively deploying technologies that reduce recovery time, hospital stay and post operative complications, making endoluminal suturing more attractive. At the same time, limitations such as high device cost, need for specialist training in endoscopic suturing techniques and slower reimbursement pathways may restrict faster uptake. Despite these constraints, the convergence of procedural demand, infrastructure readiness and clinical preference for less invasive interventions suggests that demand for endoluminal suturing devices in Japan will continue to grow.

What Is the Current State of the Demand for Endoluminal Suturing Devices in Japan in Terms of Product Type and Application?

The demand for endoluminal suturing devices in Japan is primarily driven by product type and application. The leading product type is needle-based suturing devices, capturing 65% of the market share, while gastrointestinal repairs is the dominant application, accounting for 50% of the demand. Endoluminal suturing devices are used in minimally invasive surgeries for suturing tissues within the body, particularly in gastrointestinal and bariatric procedures. As minimally invasive techniques continue to gain popularity in surgical practices, the demand for advanced suturing devices in Japan remains robust.

How Are Needle-based Suturing Devices Leading the Demand for Endoluminal Suturing Devices in Japan?

Needle-based suturing devices are the leading product type for endoluminal suturing in Japan, capturing 65% of the demand. These devices are designed to facilitate precise suturing in minimally invasive surgeries by enabling surgeons to suture tissues through a needle. They offer the advantage of versatility and precision, making them ideal for a wide range of surgical applications, including gastrointestinal surgeries and bariatric procedures.

The demand for needle-based devices is driven by their ability to provide strong, reliable sutures while minimizing the invasiveness of procedures. These devices are also favored for their ease of use, precision, and effectiveness in securing tissue without the need for large incisions. As Japan continues to invest in advanced medical technologies and emphasizes minimally invasive surgery, needle-based suturing devices are expected to maintain their leadership in the endoluminal suturing device market.

How Are Gastrointestinal Repairs Leading the Application Demand for Endoluminal Suturing Devices in Japan?

Gastrointestinal repairs are the leading application for endoluminal suturing devices in Japan, accounting for 50% of the demand. Endoluminal suturing devices are widely used in gastrointestinal surgeries to repair tissues, such as those affected by ulcers, perforations, or post-surgical complications. These devices help secure sutures in delicate, hard-to-reach areas within the gastrointestinal tract, enabling surgeons to perform minimally invasive procedures with greater accuracy and reduced patient recovery times.

The demand for endoluminal suturing devices in gastrointestinal repairs is driven by the growing number of gastrointestinal disorders, such as cancer, inflammatory bowel disease, and other chronic conditions requiring surgical intervention. Additionally, the increasing preference for minimally invasive surgeries in Japan, which offer quicker recovery and fewer complications, further boosts the demand for these devices. As the need for advanced, efficient, and patient-friendly surgical techniques continues to grow, gastrointestinal repairs will remain a key driver of endoluminal suturing device demand in Japan.

What Are the Key Dynamics Influencing Demand for Endoluminal Suturing Devices in Japan?

Demand for endoluminal suturing devices in Japan is being driven by an increasing preference for minimally invasive gastrointestinal and bariatric procedures, alongside rising incidence of gastrointestinal disorders among the ageing population. Japanese hospitals and specialised surgical centres are gradually adopting advanced suturing tools that enable endoscopic tissue repair and reduce surgical trauma. At the same time, relatively low baseline usage, high device cost and tight reimbursement frameworks moderate growth. These combined forces define the emerging demand environment for these devices in Japan.

What Are the Primary Growth Drivers for Endoluminal Suturing Device Demand in Japan?

Several factors support growth in Japan. First, the increasing number of gastrointestinal surgeries, including for cancer, reflux disease and bariatric indications, creates more cases where suturing devices can be used. Second, the shift toward minimally invasive endoscopic procedures encourages adoption of specialised suturing instruments that extend therapeutic capabilities beyond traditional methods. Third, the Japanese healthcare system’s investment in advanced surgical infrastructure and endoscopy suites supports uptake of new technologies. Fourth, global device manufacturers and local distributors are focusing on product introductions and educational programs in Japan, which raises awareness and surgeon usage potential.

What Are the Key Restraints Affecting Endoluminal Suturing Device Demand in Japan?

Despite opportunities, the market faces constraints. The small size of the current market estimated at only a few million USD in Japan limits scale advantages and may constrain supplier investment. Reimbursement and regulatory pathways for novel endoscopic suturing devices can be complex and slow, reducing uptake. Surgeon training and case volume constraints in Japan may limit how quickly endoluminal suturing procedures become routine. Finally, competing technologies and conventional devices (e.g., staplers, clips) remain entrenched, which can slow displacement by newer suturing systems.

What Are the Key Trends Shaping Endoluminal Suturing Device Demand in Japan?

Key trends include rising interest in device formats tailored for lesions and defects in the gastrointestinal tract, such as leak or fistula closure, which leverage suturing beyond standard resections. There is also increasing collaboration between device manufacturers and Japanese surgical societies to deliver training and adoption support in endoscopic suturing procedures. Hybrid approaches combining endoluminal suturing with other minimally invasive techniques are gaining traction. Moreover, localisation of device features, including compatibility with Japanese endoscopy systems and language appropriate training materials, enhances adoption prospects in Japan.

What Are the Key Drivers Behind the Demand for Endoluminal Suturing Devices in Japan?

The demand for endoluminal suturing devices in Japan is driven by the country’s advanced healthcare system, high adoption of minimally invasive surgical techniques, and increasing prevalence of gastrointestinal disorders, including cancer, obesity, and other chronic conditions that require surgical interventions. Endoluminal suturing devices are essential for performing suturing inside the body through small incisions, making them crucial for laparoscopic and other minimally invasive procedures.

The growing emphasis on reducing recovery times, improving patient outcomes, and minimizing surgical trauma is pushing the demand for these advanced devices. Additionally, Japan’s aging population, the high incidence of digestive diseases, and increasing technological advancements in the healthcare sector are all contributing to the adoption of endoluminal suturing devices. Regional variations in demand are influenced by healthcare infrastructure, the concentration of specialized medical centers, and the awareness of advanced surgical technologies across different regions. Below is an analysis of the demand for endoluminal suturing devices across Japan.

Region

CAGR (%)

Kyushu & Okinawa

5.3

Kanto

4.9

Kinki

4.3

Chubu

3.8

Tohoku

3.3

Rest of Japan

3.2

Why Is the Demand for Endoluminal Suturing Devices Highest in Kyushu & Okinawa?

Kyushu & Okinawa leads the demand for endoluminal suturing devices in Japan with a CAGR of 5.3%. The region’s healthcare infrastructure, including a high concentration of hospitals and medical centers specializing in gastrointestinal and minimally invasive surgeries, contributes to the high demand for these devices. Kyushu, in particular, has a strong focus on advanced medical technologies and surgical innovations, which is driving the adoption of minimally invasive procedures that require suturing devices.

Furthermore, Kyushu & Okinawa’s aging population, which is more susceptible to gastrointestinal disorders and other chronic conditions, is increasing the demand for advanced surgical solutions. As the region continues to invest in improving its healthcare facilities and surgical capabilities, the demand for endoluminal suturing devices is expected to remain high.

What Factors Are Supporting the Growth of Endoluminal Suturing Device Demand in Kanto?

Kanto shows strong demand for endoluminal suturing devices with a CAGR of 4.9%. Kanto, including Tokyo, is the economic and healthcare hub of Japan, with many top-tier medical institutions and hospitals offering advanced surgical treatments. The region’s demand for endoluminal suturing devices is primarily driven by the high number of surgeries performed in large medical centers and the growing trend of minimally invasive procedures, which are gaining popularity for their shorter recovery times and reduced risks of complications.

As Kanto continues to lead in healthcare innovation, particularly in the field of laparoscopic and endoscopic surgery, the demand for advanced surgical tools like endoluminal suturing devices is expected to grow steadily. The region’s high level of healthcare expenditure, along with its concentration of cutting-edge research and development in medical technologies, ensures a strong market for these devices.

Why Is the Demand for Endoluminal Suturing Devices Steady in Kinki?

Kinki, with a CAGR of 4.3%, shows steady demand for endoluminal suturing devices. The region, which includes major cities like Osaka and Kyoto, has a strong healthcare system and a significant number of hospitals performing gastrointestinal and laparoscopic surgeries. Kinki’s focus on healthcare advancements, combined with its strong manufacturing base in medical devices, contributes to the region’s stable growth in the demand for endoluminal suturing devices.

The demand in Kinki is driven by the region’s ongoing efforts to improve surgical outcomes and reduce recovery times for patients undergoing procedures like gastrointestinal surgeries. As awareness of minimally invasive surgical techniques continues to rise, the adoption of endoluminal suturing devices in Kinki is expected to remain steady, with gradual growth in the market over time.

What Is Driving the Demand for Endoluminal Suturing Devices in Chubu?

Chubu demonstrates moderate growth in the demand for endoluminal suturing devices with a CAGR of 3.8%. The region, home to the city of Nagoya, has a growing healthcare infrastructure, particularly in advanced surgical specialties like gastrointestinal surgery and oncology. While the demand for endoluminal suturing devices is not as high as in Kyushu & Okinawa or Kanto, Chubu’s healthcare sector is increasingly adopting minimally invasive surgical techniques to improve patient outcomes.

Chubu’s moderate growth in this market is also driven by the region’s efforts to expand medical technology offerings and its focus on improving the quality of healthcare. As hospitals in Chubu continue to upgrade their surgical equipment and embrace the benefits of minimally invasive procedures, the demand for endoluminal suturing devices is expected to grow steadily in this region.

Why Is the Demand for Endoluminal Suturing Devices Slower in Tohoku and Rest of Japan?

Tohoku, with a CAGR of 3.3%, and the Rest of Japan, with a CAGR of 3.2%, show slower growth in the demand for endoluminal suturing devices. These regions are more rural compared to urban centers like Kanto and Kinki, and they have fewer specialized medical centers and hospitals performing high volumes of advanced surgeries that require suturing devices. The relatively slower adoption of minimally invasive techniques in these regions, along with fewer healthcare facilities equipped with the latest surgical technologies, contributes to the slower demand growth.

However, as healthcare access and awareness about minimally invasive surgical techniques improve across Japan, these regions are likely to experience steady growth in the adoption of endoluminal suturing devices. Increasing medical infrastructure investment and the gradual shift towards advanced surgical methods in Tohoku and the Rest of Japan will support the growth of this market in the coming years.

How Are Companies Competing in the Endoluminal Suturing Device Industry in Japan

The demand for endoluminal suturing devices in Japan is rising, driven by advancements in minimally invasive surgical techniques and the increasing prevalence of gastrointestinal diseases. Companies like Boston Scientific Corporation, Medtronic, Olympus, Ovesco Endoscopy AG, and EndoRobotics Co., LTD. are key players in this market. Endoluminal suturing devices are essential in endoscopic procedures where suturing or tissue closure inside the body is required, such as in bariatric surgery, colorectal procedures, and treatment of gastrointestinal leaks.

Competition in the endoluminal suturing device industry is driven by product innovation, precision, and ease of use. Companies are focusing on developing devices that offer better control, reliability, and ease of insertion during endoscopic procedures, enhancing surgical outcomes while reducing recovery times. There is also an emphasis on miniaturization and the development of more flexible and ergonomic devices that improve the efficiency of surgeries and reduce the need for large incisions.

Another area of competition is the integration of advanced technology such as robotics or smart feedback systems to assist surgeons in performing suturing more precisely. Marketing materials typically highlight features such as suturing speed, device versatility, ease of use, and patient safety benefits. By aligning their products with the growing demand for minimally invasive procedures, reduced patient recovery times, and surgical efficiency, these companies aim to strengthen their position in Japan’s endoluminal suturing device market.

Key Players of the Endoluminal Suturing Device Industry in Japan

Olympus Corporation

Fujifilm Holdings Corporation

HOYA Corporation / PENTAX Medical

Boston Scientific Corporation

Medtronic plc

Ovesco Endoscopy AG

EndoRobotics Co., Ltd.

Scope of the Report

Items

Details

Quantitative Units

USD Million

Regions Covered

Japan

Product Type

Needle-based Suturing Devices, Clip-based Suturing Devices

Application

Bariatric, Gastrointestinal Repairs, Others

End User

Hospitals, Ambulatory Surgery Centers (ASCs), Specialty Clinics, Specialty Surgical Centers, Cancer Treatment Centers

Key Companies Profiled

Olympus Corporation, Fujifilm Holdings Corporation, HOYA Corporation / PENTAX Medical, Boston Scientific Corporation, Medtronic plc, Ovesco Endoscopy AG, EndoRobotics Co., Ltd.

Additional Attributes

The market analysis includes dollar sales by product type, application, and end-user categories. It also covers regional demand trends in Japan, particularly driven by the growing adoption of endoluminal suturing devices in bariatric and gastrointestinal surgeries. The competitive landscape highlights key manufacturers focusing on innovations in minimally invasive surgical tools and suturing technologies. Trends in the increasing demand for advanced suturing solutions in cancer treatment centers and specialized surgical facilities are explored, along with advancements in device design and functionality.

Key Segments of the Demand for Endoluminal Suturing Device in Japan Product Type

Needle-based Suturing Devices

Clip-based Suturing Devices

Application

Bariatric

Gastrointestinal Repairs

Others

End User

Hospitals

Ambulatory Surgery Centers (ASCs)

Specialty Clinics

Specialty Surgical Centers

Cancer Treatment Centers

Region

Kyushu & Okinawa

Kanto

Kinki

Chubu

Tohoku

Rest of Japan

Frequently Asked Questions

How big is the demand for endoluminal suturing device in Japan in 2025?

The global demand for endoluminal suturing devices in Japan is estimated to be valued at USD 4.2 million in 2025.

What will be the size of demand for endoluminal suturing device in Japan in 2035?

The demand for endoluminal suturing devices in Japan is projected to reach USD 6.4 million by 2035.

How much will be the demand for endoluminal suturing device in Japan between 2025 and 2035?

The demand for endoluminal suturing devices in Japan is expected to grow at a 4.3% CAGR between 2025 and 2035.

What are the key product types in Japan?

The key product types are needle-based suturing devices and clip-based suturing devices.

Which application segment is expected to contribute significant share in Japan in 2025?

In terms of application, the gastrointestinal repairs segment is expected to command a 50.0% share in Japan in 2025.

AloJapan.com