Demand for Travel Agency Services in Japan Forecast and Outlook 2025 to 2035

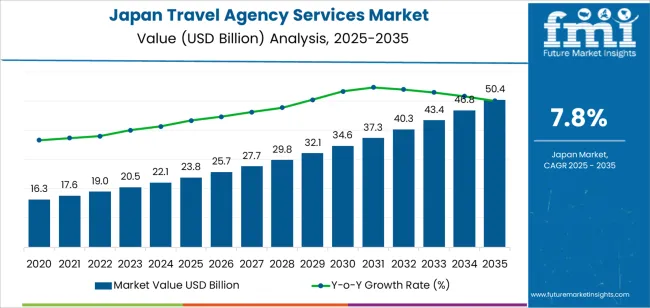

The demand for travel agency services in Japan is expected to grow from USD 23.8 billion in 2025 to USD 50.4 billion by 2035, reflecting a CAGR of 7.8%. Demand growth is driven by the recovery of global travel after the pandemic and by rising discretionary spending among consumers seeking personalized travel experiences. Travel agencies in Japan are increasingly offering tailored vacation packages, luxury travel experiences, and unique tours to cater to the diverse needs of both domestic and international travelers. Furthermore, Japan’s appeal as a tourism destination and the country’s strong cultural heritage continue to attract foreign visitors, driving demand for professional travel planning and logistical services.

Technological advancements, including online booking platforms, mobile apps, and AI-driven travel recommendations, will also drive the expansion of the travel agency services market. Additionally, as consumers become more accustomed to digital solutions for booking and trip planning, travel agencies are evolving to offer hybrid services that blend offline expertise with online convenience, further driving their market presence. Japan’s focus on sustainable tourism and eco-friendly travel will likely open new growth avenues for the sector, particularly in luxury travel and experiential tours.

Quick Stats of the Demand for Travel Agency Services in Japan

Demand for Travel Agency Services in Japan Value (2025): USD 23.8 billion

Demand for Travel Agency Services in Japan Forecast Value (2035): USD 50.4 billion

Demand for Travel Agency Services in Japan Forecast CAGR (2025-2035): 7.8%

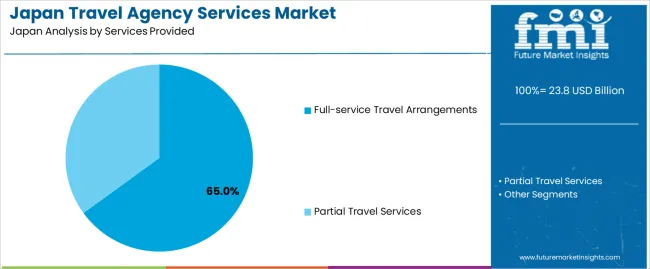

Demand for Travel Agency Services in Japan Leading Service Provided: Full-service Travel Arrangements (65%)

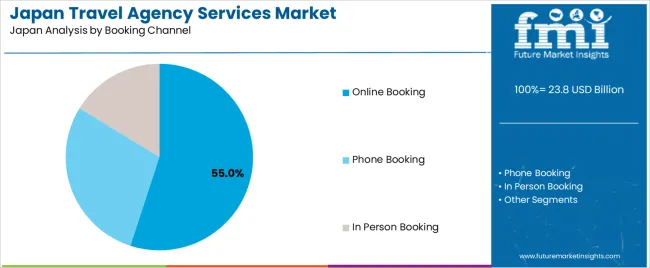

Demand for Travel Agency Services in Japan Leading Booking Channel: Online Booking (55.0%)

Demand for Travel Agency Services in Japan Key Growth Regions: Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan

Demand for Travel Agency Services in Japan Top Players: Expedia Group, Booking Holdings, TUI Group, American Express Global Business Travel, Viator

What is the Growth Forecast for the Travel Agency Services Industry in Japan through 2035?

The Growth Contribution Index (GCI) for the demand for travel agency services in Japan breaks down the contribution of different growth phases to the overall market expansion from 2025 to 2035.

From 2025 to 2030, the market will grow from USD 23.8 billion to USD 34.6 billion, contributing USD 10.8 billion in value. This phase accounts for approximately 48.7% of the total market growth during the forecast period. The early stage of growth will be primarily driven by post-pandemic recovery in both domestic and international tourism, as consumer confidence in travel and discretionary spending rebounds. The return of global travel and the increasing demand for personalized, high-quality travel experiences will play a major role in this phase, with a rise in luxury and bespoke travel services offered by agencies.

From 2030 to 2035, the market will expand from USD 34.6 billion to USD 50.4 billion, adding USD 15.8 billion in value. This phase represents the remaining 51.3% of the total growth. The growth during this period will be driven by technological advancements, the widespread adoption of online booking platforms, and AI-powered travel suggestions. Additionally, increasing focus on sustainable travel, eco-friendly options, and the growing demand for unique travel experiences will continue to drive demand. As younger generations prioritize experiential tourism and customized travel packages, the travel agency services sector will benefit from continued growth in this phase. The GCI suggests that the market will see a steady expansion throughout the forecast period, with both early and later stages contributing to overall growth, fueled by a combination of rebound effects and long-term trends.

Key Takeaways of Travel Agency Services Industry in Japan

Metric

Value

Industry Sales Value (2025)

USD 23.8 billion

Industry Forecast Value (2035)

USD 50.4 billion

Industry Forecast CAGR (2025-2035)

7.8%

What Is Driving the Demand for Travel Agency Services in Japan?

Demand for travel agency services in Japan is increasing as both domestic and international tourism rebound and diversify. The Japanese market for travel agency services was valued at around USD 12.91 billion in 2024 and is projected to reach approximately USD 27.41 billion by 2033, reflecting a compound annual growth rate (CAGR) of about 8.68%. One key driver is Japan’s rising inbound tourism and the recovery of outbound travel, with consumers and corporates showing renewed interest in package tours, tailored itineraries and managed booking services.

Another important factor is the digital transformation of travel services. Online booking platforms, mobile apps, and advanced travel-technology integration are enabling agencies to offer personalised experiences, real-time itinerary adjustments, and bundled travel-service solutions that appeal to Japanese consumers. The corporate travel segment is also noted for faster growth, providing agencies opportunities in business trip management, meetings-incentives-conferences-events (MICE) services and bespoke corporate arrangements. At the same time, the demand is somewhat constrained by factors such as labour shortages in the tourism service sector, intense competition from online-direct booking channels and variable consumer spending in times of economic uncertainty. Despite these challenges, the outlook for travel agency services in Japan remains positive.

What Is the Current State of the Demand for Travel Agency Services in Japan in Terms of Services Provided and Booking Channel?

The demand for travel agency services in Japan is largely driven by services provided and booking channel. The leading service is full-service travel arrangements, capturing 65% of the market share, while online booking is the dominant booking channel, accounting for 55% of the demand. As travel continues to be a popular activity in Japan, both domestic and international, consumers are increasingly relying on travel agencies for comprehensive, hassle-free services that cater to their specific travel needs, from transportation and accommodations to itineraries and tours.

How Are Full-Service Travel Arrangements Leading the Demand for Travel Agency Services in Japan?

Full-service travel arrangements are the dominant service offered by travel agencies in Japan, holding 65% of the market share. These arrangements typically include transportation, accommodations, tours, and sometimes additional services like travel insurance or visa assistance. Full-service travel offerings are particularly popular among travelers who prefer convenience and want a one-stop solution for their travel needs.

The demand for full-service travel arrangements is driven by their ability to offer convenience, expertise, and a seamless experience, especially for those planning complex trips, such as international travel, multi-destination tours, or family vacations. As more consumers prioritize convenience and personalized services, full-service travel agencies remain essential for planning and booking all aspects of a trip, ensuring that all travel needs are met efficiently. With the continued desire for stress-free, tailored travel experiences, full-service travel arrangements are expected to maintain their leadership in the travel agency market in Japan.

How Is Online Booking Leading the Demand for Travel Agency Services in Japan?

Online booking is the leading booking channel for travel agency services in Japan, accounting for 55% of the demand. Online booking platforms provide convenience, speed, and flexibility, allowing consumers to easily browse options, compare prices, and make reservations from the comfort of their homes or on the go. As the internet has become a dominant platform for booking travel services, online booking continues to gain traction due to its accessibility and the growing trend of tech-savvy travelers.

The dominance of online booking is driven by the rise of digital platforms and mobile applications that offer user-friendly interfaces and round-the-clock availability. Consumers appreciate the ability to independently search for and book flights, hotels, and activities at their convenience. Furthermore, the COVID-19 pandemic accelerated the shift toward online travel planning and booking, as travelers sought contactless solutions. As digitalization continues to reshape the travel industry, online booking will likely remain the leading method for booking travel services in Japan.

What Are The Key Market Dynamics Influencing Demand for Travel Agency Services in Japan?

Demand for travel agency services in Japan is shaped by a rebound in domestic and international travel, increasing interest in specialised and premium travel experiences, and growth in corporate and MICE (meetings, incentives, conferences and exhibitions) travel. Japanese providers are adapting to digital booking platforms and global service integration. At the same time, labour shortages in the hospitality and tourism sector, fluctuations in consumer confidence and rapidly evolving travel behaviours moderate demand growth. These factors combine to define the current environment for travelagency services in Japan.

What Are the Primary Growth Drivers for Travel Agency Service Demand in Japan?

Growth is supported by rising outbound travel among Japanese consumers eager for overseas experiences, and revival of inbound tourism which increases demand for fullservice and concierge travel agency offerings. Expansion of business travel and event tourism adds volume and complexity, requiring agency support for logistics and tailored itineraries. Consumer demand is shifting toward curated, personalised tours rather than standard packages, favouring agencies with niche expertise. Digitalisation and mobile booking adoption also streamline access to agency services, making them more appealing and accessible.

What Are the Key Restraints Affecting Travel Agency Service Demand in Japan?

Despite positive prospects, the market faces constraints. A shortage of service personnel and multilingual staff in tourism and agency sectors limits capacity to handle increased travel volumes and highend service demands. Economic uncertainty or weaker consumer spending may reduce travel frequency or premium travel bookings. Some travel agency services struggle to compete with online direct booking platforms and lowcost models, which can dilute traditional agency margins. Inbound tourism remains sensitive to global health and travel restrictions, which adds volatility to agency operations.

What Are the Key Trends Shaping Travel Agency Service Demand in Japan?

Important trends include a growing emphasis on experiential and themed travel—such as gastronomic, cultural immersion or adventure trips—which requires specialist agency design and coordination. Agencies are increasingly providing hybrid services combining digital and human support, such as AIdriven itinerary creation plus local guides. Rise of corporate and MICE travel demands integrated solutions covering meetings, venues, travel logistics and remote support. There is also a shift toward sustainable tourism, with agencies offering ecofriendly packages, lowimpact itineraries and localcommunity based experiences to meet changing traveller values.

What Are the Key Drivers Behind the Demand for Travel Agency Services in Japan?

The demand for travel agency services in Japan is influenced by several factors, including the country’s strong tourism sector, the growing interest in domestic and international travel, and the increasing availability of online booking platforms. Travel agencies play a crucial role in providing customized travel packages, offering convenience, expert recommendations, and support for travelers. The demand for travel services has seen significant growth due to Japan’s robust economy, government support for tourism, and an increasing number of both inbound and outbound travelers. The regional differences in demand reflect variations in local tourism trends, urbanization, and economic factors. Below is an analysis of the demand for travel agency services across different regions in Japan.

Region

CAGR (2025-2035)

Kyushu & Okinawa

9.8%

Kanto

9%

Kinki

7.9%

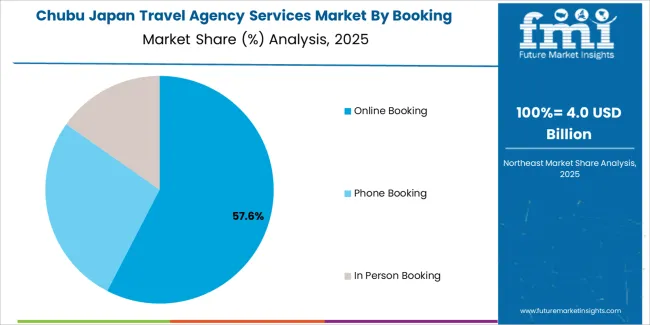

Chubu

6.9%

Tohoku

6.1%

Rest of Japan

5.8%

Why Is the Demand for Travel Agency Services Highest in Kyushu & Okinawa?

Kyushu & Okinawa leads the demand for travel agency services in Japan with a CAGR of 9.8%. The region is a popular destination for both domestic and international tourists due to its rich cultural heritage, natural beauty, and favorable climate. Okinawa, in particular, attracts a significant number of visitors from overseas and other parts of Japan, making it a key market for travel agencies offering customized packages for leisure travel.

Kyushu & Okinawa’s focus on promoting tourism, along with government initiatives to boost regional travel, supports the growing demand for travel agency services. Additionally, the region’s emphasis on unique local experiences, such as traditional festivals, scenic beaches, and historical sites, contributes to an increase in tourism activities. Travel agencies in this region are capitalizing on the increasing interest in both leisure and adventure travel, driving strong market growth.

What Factors Are Supporting the Growth of Travel Agency Services Demand in Kanto?

Kanto shows strong demand for travel agency services with a CAGR of 9.0%. As Japan’s economic and cultural center, Kanto, which includes Tokyo and its surrounding areas, is home to a large number of residents and tourists. Tokyo, being one of the most visited cities globally, significantly contributes to the demand for both inbound and outbound travel services. Travel agencies in Kanto cater to a wide range of needs, including corporate travel, luxury tourism, and cultural experiences.

The demand for travel agency services in Kanto is also driven by the region’s high levels of business and economic activity, with many individuals and companies requiring travel services for meetings, conferences, and leisure trips. Additionally, Kanto’s vast transportation network and proximity to international airports support the region’s travel sector, making it a key market for travel agencies.

Why Is the Demand for Travel Agency Services Steady in Kinki?

Kinki, with a CAGR of 7.9%, shows steady demand for travel agency services. The region includes cities like Osaka, Kyoto, and Kobe, which are major tourist destinations in Japan. Kinki attracts both domestic and international tourists interested in its historical landmarks, cultural heritage, and culinary offerings. The demand for travel services is driven by both inbound tourists visiting historical sites like Kyoto’s temples and outbound travelers seeking leisure trips to other parts of Asia and beyond.

While the growth rate is slightly lower than in Kyushu & Okinawa and Kanto, the steady demand for travel services in Kinki is supported by the region’s strong focus on tourism, well-established infrastructure, and growing interest in cultural experiences. As more people in Kinki seek organized travel experiences and local tours, the market for travel agency services continues to grow.

What Is Driving the Demand for Travel Agency Services in Chubu?

Chubu demonstrates moderate growth in the demand for travel agency services with a CAGR of 6.9%. The region, including Nagoya and its surrounding areas, has a strong manufacturing and industrial base but is also seeing increasing interest in tourism, particularly in rural and natural areas. Chubu’s scenic locations, such as the Japanese Alps and Mount Fuji, attract tourists who are looking for outdoor and adventure-based travel experiences.

Although Chubu’s travel market growth is not as rapid as in other regions, its diverse offerings, ranging from traditional experiences to modern urban attractions, are contributing to the steady rise in demand for travel agency services. As more travelers seek customized itineraries that combine cultural, outdoor, and urban experiences, the demand for travel services in Chubu is expected to continue growing at a moderate pace.

Why Is the Demand for Travel Agency Services Slower in Tohoku and Rest of Japan?

Tohoku, with a CAGR of 6.1%, and the Rest of Japan, with a CAGR of 5.8%, show slower growth in the demand for travel agency services compared to other regions. These areas are more rural and have fewer major tourist hubs compared to the more urbanized regions like Kanto and Kinki. While there is a demand for travel services, particularly for nature and cultural tourism, the overall growth in these regions is slower due to less extensive tourism infrastructure and lower levels of international tourism.

Despite this, the demand for travel services in Tohoku and the Rest of Japan is supported by niche markets such as eco-tourism, wellness tourism, and regional cultural experiences. As Japan continues to promote tourism in less-visited areas, travel agencies in these regions are seeing gradual growth in demand, although it remains slower than in more urbanized areas.

How Are Companies Competing in the Travel Agency Services Industry in Japan

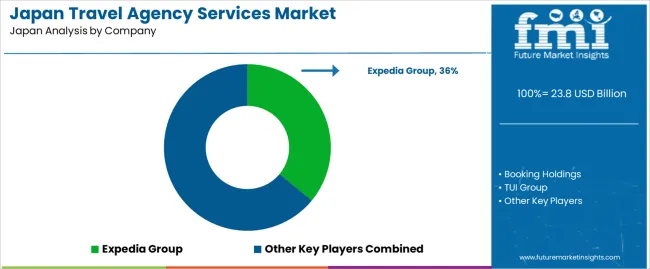

The demand for travel agency services in Japan is experiencing steady growth, driven by the recovery of the tourism industry and increasing consumer interest in both domestic and international travel. Companies like Expedia Group (holding approximately 36% market share), Booking Holdings, TUI Group, American Express Global Business Travel, and Viator are key players in this market. The demand is fueled by Japan’s strong tourism sector, business travel needs, and the country’s growing interest in both experiential travel and personalized vacation experiences.

Competition in the travel agency services industry is primarily focused on service offerings, pricing, customer experience, and digital platforms. Companies are investing heavily in user-friendly websites and mobile apps to enhance the booking experience, making it easier for customers to plan trips, book flights, accommodations, and activities. Another key area of competition is personalization, with companies offering tailored travel packages, exclusive deals, and specialized services for corporate travel, luxury vacations, and guided tours.

The rise of online travel agencies (OTAs) is also pushing traditional agencies to improve their digital capabilities and broaden their service offerings, such as seamless integration of travel insurance and local experiences. Marketing materials often highlight features such as competitive pricing, exclusive promotions, flexible booking options, and customer support services. By aligning their offerings with the growing demand for convenience, personalization, and competitive pricing, these companies aim to strengthen their position in the U.S. and Japan’s evolving travel agency services industry.

Key Players of the Travel Agency Services Industry in Japan

Expedia Group

Booking Holdings

TUI Group

American Express Global Business Travel

Viator

Scope of the Report

Items

Details

Quantitative Units

USD Billion

Regions Covered

Japan

Services Provided

Full-service Travel Arrangements, Partial Travel Services

Booking Channel

Online Booking, Phone Booking, In Person Booking

Tourist Type

Domestic, International

Tour Type

Independent Traveller, Package Traveller, Tour Group

Demography

Men, Women, Children

Key Companies Profiled

Expedia Group, Booking Holdings, TUI Group, American Express Global Business Travel, Viator

Additional Attributes

The market analysis includes dollar sales by services provided, booking channel, tourist type, tour type, and demography categories. It also covers regional demand trends in Japan, driven by the growth of both domestic and international travel. The competitive landscape highlights major players in the travel agency sector, focusing on innovations in booking technologies and personalized travel services. Trends in the increasing demand for online booking platforms, package tours, and customized travel experiences are explored, along with the role of demographic factors such as age and gender in travel preferences.

Key Segments of the Demand for Travel Agency Services in Japan Services Provided:

Full-service Travel Arrangements

Partial Travel Services

Booking Channel

Online Booking

Phone Booking

In Person Booking

Tourist Type

Tour Type

Independent Traveller

Package Traveller

Tour Group

Demography

Region

Kyushu & Okinawa

Kanto

Kinki

Chubu

Tohoku

Rest of Japan

Frequently Asked Questions

How big is the demand for travel agency services in Japan in 2025?

The global demand for travel agency services in Japan is estimated to be valued at USD 23.8 billion in 2025.

What will be the size of demand for travel agency services in Japan in 2035?

The demand for travel agency services in Japan is projected to reach USD 50.4 billion by 2035.

How much will be the demand for travel agency services in Japan between 2025 and 2035?

The demand for travel agency services in Japan is expected to grow at a 7.8% CAGR between 2025 and 2035.

What are the key product types in Japan?

The key product types in Japan are full-service travel arrangements and partial travel services.

Which booking channel segment is expected to contribute significant share in 2025?

In terms of booking channel, online booking segment is expected to command 55.0% share in 2025.

AloJapan.com