Kyoto Financial Group (TSE:5844) just revealed a fresh share buyback program, approving the repurchase of up to 1,000,000 shares. This step underscores management’s focus on boosting shareholder returns and capital efficiency, shortly after completing their earlier buyback.

See our latest analysis for Kyoto Financial GroupInc.

Kyoto Financial GroupInc’s new buyback announcement comes as momentum builds, with the stock posting a 12.2% gain over the past month and a stellar year-to-date share price return of 46.2%. The company’s 1-year total shareholder return of 51.7% underscores robust long-term gains as well. Management’s decision to launch another repurchase not only highlights their confidence but could further support upside, especially after such a strong run.

If this recent buyback piqued your interest, now is the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

But with shares already soaring over 46% year-to-date and trading above analyst price targets, investors may wonder whether Kyoto Financial Group is still undervalued or if the market has already factored in all its promising growth.

Price-to-Earnings of 29.4x: Is it justified?

With Kyoto Financial GroupInc trading at a price-to-earnings (P/E) ratio of 29.4x, the valuation stands well above its banking peers. This raises the question of whether the stock’s premium is sustainable after such a rapid run-up. The last close price sits at ¥3365, while industry and peer averages remain far lower, hinting that market enthusiasm is pushing expectations higher than fundamentals alone might justify.

The P/E ratio captures how much investors are willing to pay today for a yen of the company’s earnings. In the context of banks, this can reveal if the market is optimistic about future income streams, margin expansion, or has priced in especially high growth expectations.

Kyoto Financial GroupInc’s earnings multiple is steep. It nearly triples the Japanese Banks industry average of 11.2x, and it also more than doubles the peer average of 12.9x. Compared to the estimated Fair Price-To-Earnings Ratio of 15x, the valuation appears even more stretched. This suggests any misstep in future profit growth could trigger a sharp rerating.

Explore the SWS fair ratio for Kyoto Financial GroupInc

Result: Price-to-Earnings of 29.4x (OVERVALUED)

However, with growth slowing and shares trading at a premium to analyst targets, any earnings miss or sector weakness could quickly reverse recent gains.

Find out about the key risks to this Kyoto Financial GroupInc narrative.

Another View: What Does the DCF Model Say?

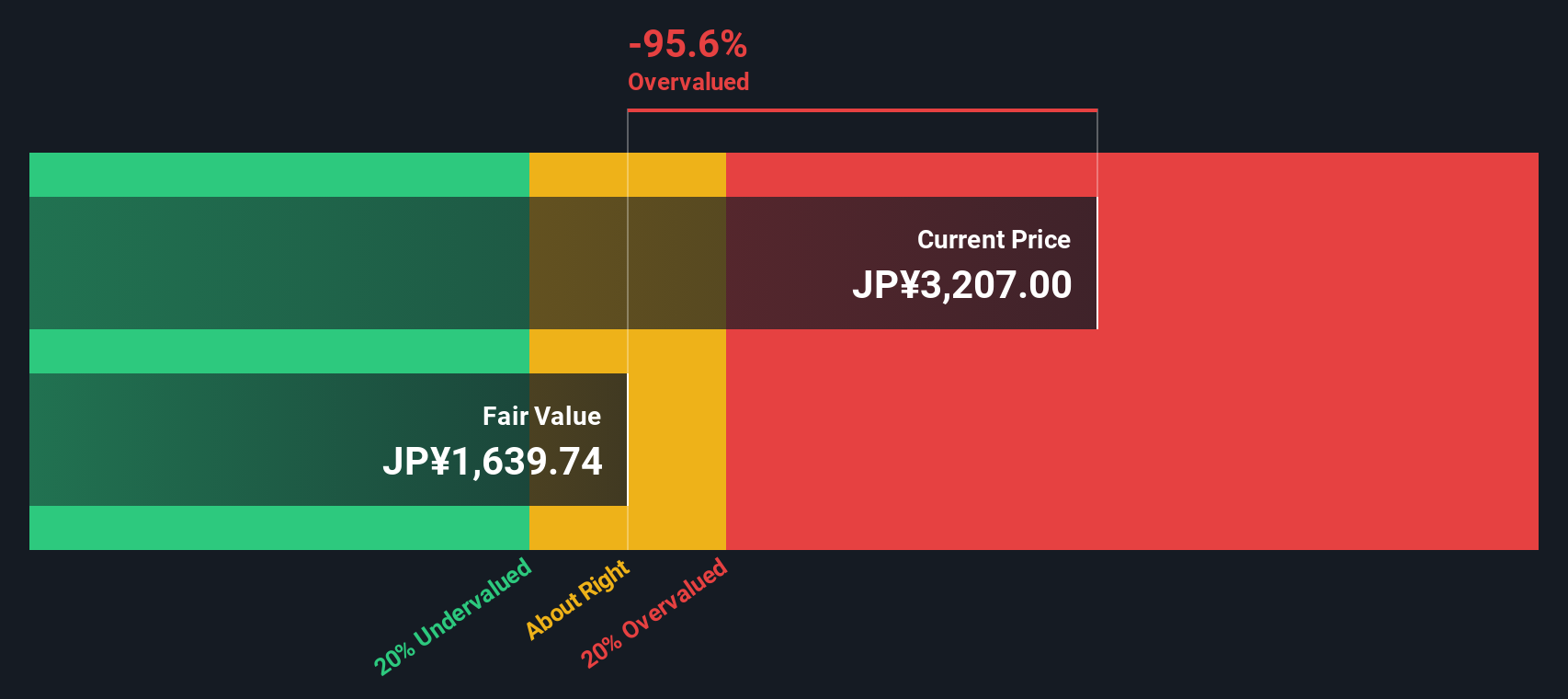

While the earnings ratio shows Kyoto Financial GroupInc trading at a steep premium, the SWS DCF model offers a different perspective. The DCF estimate puts fair value at ¥1607.45, much lower than the market price of ¥3365, which suggests the stock could be overvalued. But do models tell the full story, or does market optimism have the edge in this case?

Look into how the SWS DCF model arrives at its fair value.

5844 Discounted Cash Flow as at Nov 2025

5844 Discounted Cash Flow as at Nov 2025

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Kyoto Financial GroupInc for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 899 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match – so you never miss a potential opportunity.

Build Your Own Kyoto Financial GroupInc Narrative

If you see the story unfolding differently, or want to dig into the numbers on your own terms, it’s quick and easy to craft your perspective: Do it your way

A great starting point for your Kyoto Financial GroupInc research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors stay ahead by broadening their search for standout opportunities. Don’t let great companies slip past you. See what else is ready to make waves:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we’re here to simplify it.

Discover if Kyoto Financial GroupInc might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free Analysis

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

AloJapan.com