Dublin, Nov. 17, 2025 (GLOBE NEWSWIRE) — The “Japan Shrimp Market Overview: Consumption Trends and Export Opportunities” has been added to ResearchAndMarkets.com’s offering.

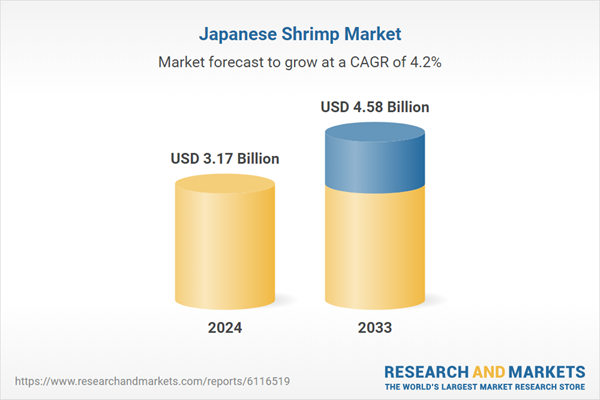

Japan’s Shrimp Market is expected to reach US$ 4.58 billion by 2033 from US$ 3.17 billion in 2024, with a CAGR of 4.17% from 2025 to 2033. Some of the main drivers propelling the market are the related health benefits of eating shrimp, the growing use of contemporary technology to increase production efficiency, and the growing government measures to encourage food supplied ethically.

The major companies profiled in this Japan Shrimp market report include:

Avanti Feeds Ltd.High Liner Foods Inc.Surapon FoodsThai Union GroupThe Waterbase Ltd.Royal GreenlandMaruha Nichiro CorporationMowi ASACharoen Pokphand Foods PCL

Key Factors Driving the Japan Shrimp Market Growth

Preferences for Sustainability and Traceability

The shrimp business is undergoing considerable change as a result of growing customer demand in Japan for seafood obtained sustainably. Customers are increasingly choosing shrimp with eco-labels like MSC (Marine Stewardship Council) and ASC (Aquaculture Stewardship Council), which ensure ecologically friendly growing and harvesting practices. Concerns about food safety, increased environmental awareness, and demands for openness all have an impact on this change. Consequently, there is pressure on imports and domestic producers to enhance traceability along the whole supply chain, from hatchery to sale. These days, suppliers that provide wild-caught or responsibly farmed shrimp with verified provenance and sustainability credentials are preferred by retailers and foodservice companies. In addition to influencing purchasing choices, this preference is promoting spending on certification and ethical aquaculture methods.

Innovations in Aquaculture and Technology

The shrimp business in Japan is adopting new technologies to increase output and lessen its impact on the environment. To increase water efficiency and reduce waste, innovative aquaculture techniques including biofloc technology and Recirculating Aquaculture Systems (RAS) are being used. Real-time shrimp health, feeding regimens, and water quality optimization are all made possible by AI-enabled monitoring systems. Increased yields, less risk of disease, and improved resource management are all facilitated by these tools. In addition to lowering expenses, improved shrimp feed formulas are boosting sustainability and growth rates. When taken as a whole, these developments are reviving domestic manufacturing, which has long suffered from lower-priced imports. Japan’s larger objectives of food security, environmental stewardship, and lowering dependency on imported shrimp sources are all in line with the emphasis on high-tech aquaculture.

Strong Import Connections & Supply Chain Enhancements

The bulk of the shrimp that Japan imports come from Southeast Asian countries including Vietnam, Thailand, and Indonesia. These solid business ties guarantee a regular supply of goods to satisfy stable consumer demand. The nation has made investments to update its port facilities, logistics systems, and cold storage infrastructure in order to facilitate this. Both frozen and chilled shrimp may now be handled, transported, and distributed more effectively thanks to these advancements, maintaining quality from dock to shelf. Furthermore, improvements in digital inventory and tracking systems increase transparency and lower spoilage. When taken as a whole, these supply chain improvements improve Japan’s standing as a significant importer of shrimp, giving merchants and eateries access to a wide range of shrimp kinds while upholding strict requirements for traceability, safety, and freshness.

Challenges in the Japan Shrimp Market

Labor Shortage and an Aging Workforce

The shortage of new entrants and the aging workforce are two of the most urgent problems facing Japan’s shrimp business. Few young people are interested in taking over these physically difficult, rural jobs, and the average age of workers in fishing and aquaculture is over 60. For labor-intensive shrimp farming and wild capture enterprises that need continuous supervision and manual work, this demographic imbalance is particularly troublesome. Many small farms are closing as production capacity decreases due to the retirement of elderly personnel. Farm automation and modernization initiatives are in progress, but the lack of competent workers is slowing the adoption of new technologies. In the end, the lack of workers restricts creativity, efficiency, and the potential to sustainably increase domestic shrimp output.

Price Sensitivity of Consumers

Even though shrimp are a common and important part of Japanese culture, many buyers are nevertheless quite price conscious. Households are becoming frugal with their expenditure, particularly when it comes to premium or sustainably certified shrimp products, as a result of inflation, growing living expenses, and stagnant pay growth. The market is tense as a result of providers having to pay more for imports and inputs yet having little power to boost prices without alienating clients. Many consumers still place a higher value on pricing than eco-labels or quality differences, despite increased knowledge of sustainability and food safety. Retailers and foodservice suppliers have to strike a compromise between maintaining slim profit margins and providing shrimp at competitive prices. The expansion of value-added and environmentally friendly shrimp segments in the Japanese market is hampered by this price sensitivity.

Key Attributes

Report AttributeDetailsNo. of Pages200Forecast Period2024-2033Estimated Market Value (USD) in 2024$3.17 BillionForecasted Market Value (USD) by 2033$4.58 BillionCompound Annual Growth Rate4.1%Regions CoveredJapan

Key Topics Covered

1. Introduction

2. Research & Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Japan Shrimp Market

5.1 Historical Market Trends

5.2 Market Forecast

6. Market Share Analysis

6.1 By Species

6.2 By Size

6.3 By Product Form

6.4 By City

7. Species

7.1 L. vannamei

7.2 P. monodon

7.3 M.rosenbergii

7.4 Others

8. Size Category

8.1 < 15

8.2 15-20

8.3 21-25

8.4 26-30

8.5 31-40

8.6 41-50

8.7 51-60

8.8 61-70

8.9 >70

9. Product Form

9.1 Breaded

9.2 Cooked

9.3 Peeled

9.4 Green/Head-off

9.5 Green/Head-on

9.6 Other Forms

10. Top 10 Cities

10.1 Tokyo

10.2 Kansai

10.3 Aichi

10.4 Kanagawa

10.5 Saitama

10.6 Hyogo

10.7 Chiba

10.8 Hokkaido

10.9 Fukuoka

10.10 Shizuoka

11. Value Chain Analysis

12. Porter’s Five Forces Analysis

12.1 Bargaining Power of Buyers

12.2 Bargaining Power of Suppliers

12.3 Degree of Competition

12.4 Threat of New Entrants

12.5 Threat of Substitutes

13. SWOT Analysis

13.1 Strength

13.2 Weakness

13.3 Opportunity

13.4 Threats

14. Pricing Benchmark Analysis

15. Key Players Analysis

For more information about this report visit https://www.researchandmarkets.com/r/781in8

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world’s leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

AloJapan.com