Canon Marketing Japan (TSE:8060) has just rolled out a sizable share repurchase program, aiming to buy back up to 200,000 shares, or about 2% of its total share capital, for as much as ¥10 billion. This move signals management’s positive outlook and may influence investor sentiment.

See our latest analysis for Canon Marketing Japan.

Canon Marketing Japan’s latest buyback announcement comes right after a strong run for shareholders, with the company’s 1-year total return reaching 45% and its stock posting a 9% share price gain in just the past month. Momentum has been building, supported by upbeat earnings and the board’s decision to revisit its dividend outlook.

If buybacks and dividends have you curious about other fast-moving opportunities, now is a great time to expand your horizons and discover fast growing stocks with high insider ownership

With shares still trading at a modest discount to analyst price targets and recent gains fueled by improving fundamentals, investors have to ask: Is there more upside ahead, or has future growth already been factored in?

Price-to-Earnings of 17.6x: Is it justified?

Canon Marketing Japan currently trades at a price-to-earnings (P/E) ratio of 17.6x, placing it above key sector benchmarks and signaling an expensive valuation compared to peers.

The price-to-earnings ratio is a commonly used metric that expresses how much investors are willing to pay today for each yen of earnings. For Canon Marketing Japan, this higher P/E might reflect optimism about its profit consistency or future growth. It can also suggest the market’s expectations are already factored into the share price.

Compared to the JP Electronic industry average P/E of 15.6x and the peer group P/E average of 13.4x, Canon Marketing Japan’s valuation stands out as relatively steep. Even against the estimated fair P/E ratio of 16.8x, the stock remains on the pricier side and highlights a premium being paid for perceived quality or stability.

Explore the SWS fair ratio for Canon Marketing Japan

Result: Price-to-Earnings of 17.6x (OVERVALUED)

However, slower revenue growth or an unexpected drop in net income could quickly weigh on sentiment and challenge the outlook for further gains.

Find out about the key risks to this Canon Marketing Japan narrative.

Another View: Discounted Cash Flow Model Signals Opportunity

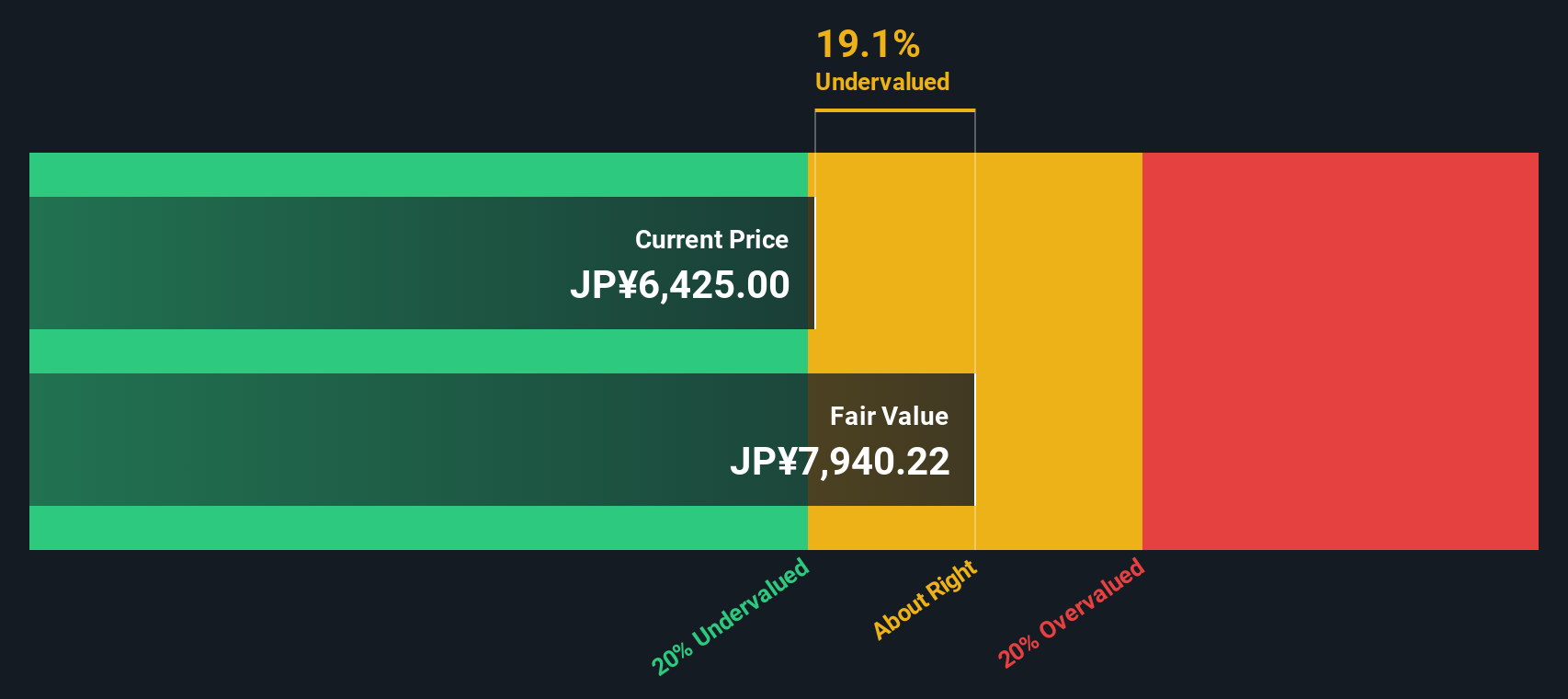

While the price-to-earnings ratio paints Canon Marketing Japan as overvalued, the SWS DCF model offers a different perspective. According to this method, the stock is trading at a 19% discount below its estimated fair value, which may suggest possible undervaluation. Could the market be underestimating future cash flows?

Look into how the SWS DCF model arrives at its fair value.

8060 Discounted Cash Flow as at Nov 2025

8060 Discounted Cash Flow as at Nov 2025

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Canon Marketing Japan for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 840 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match – so you never miss a potential opportunity.

Build Your Own Canon Marketing Japan Narrative

If you see things differently or want to dive into the details yourself, you can quickly build your own view in just a few minutes, Do it your way

A great starting point for your Canon Marketing Japan research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t let new opportunities pass you by. The Simply Wall Street Screener gives you the inside track on fresh stocks making moves, right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Explore Now for Free

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

AloJapan.com