Tokyo Tekko (TSE:5445) delivered a notable earnings performance, with profit margins climbing to 13.4% from 11.5% last year and earnings rising 7.4% over the past twelve months. Over a five-year period, the company has posted impressive average annual earnings growth of 33.5%. Investors will note the current share price of ¥5,640 is well below an estimated fair value of ¥9,129.2, placing the stock in distinctly discounted territory.

See our full analysis for Tokyo Tekko.

The next section will put these headline numbers in context by comparing them with the latest market narratives, highlighting where Tokyo Tekko’s story might surprise or confirm investor expectations.

Curious how numbers become stories that shape markets? Explore Community Narratives

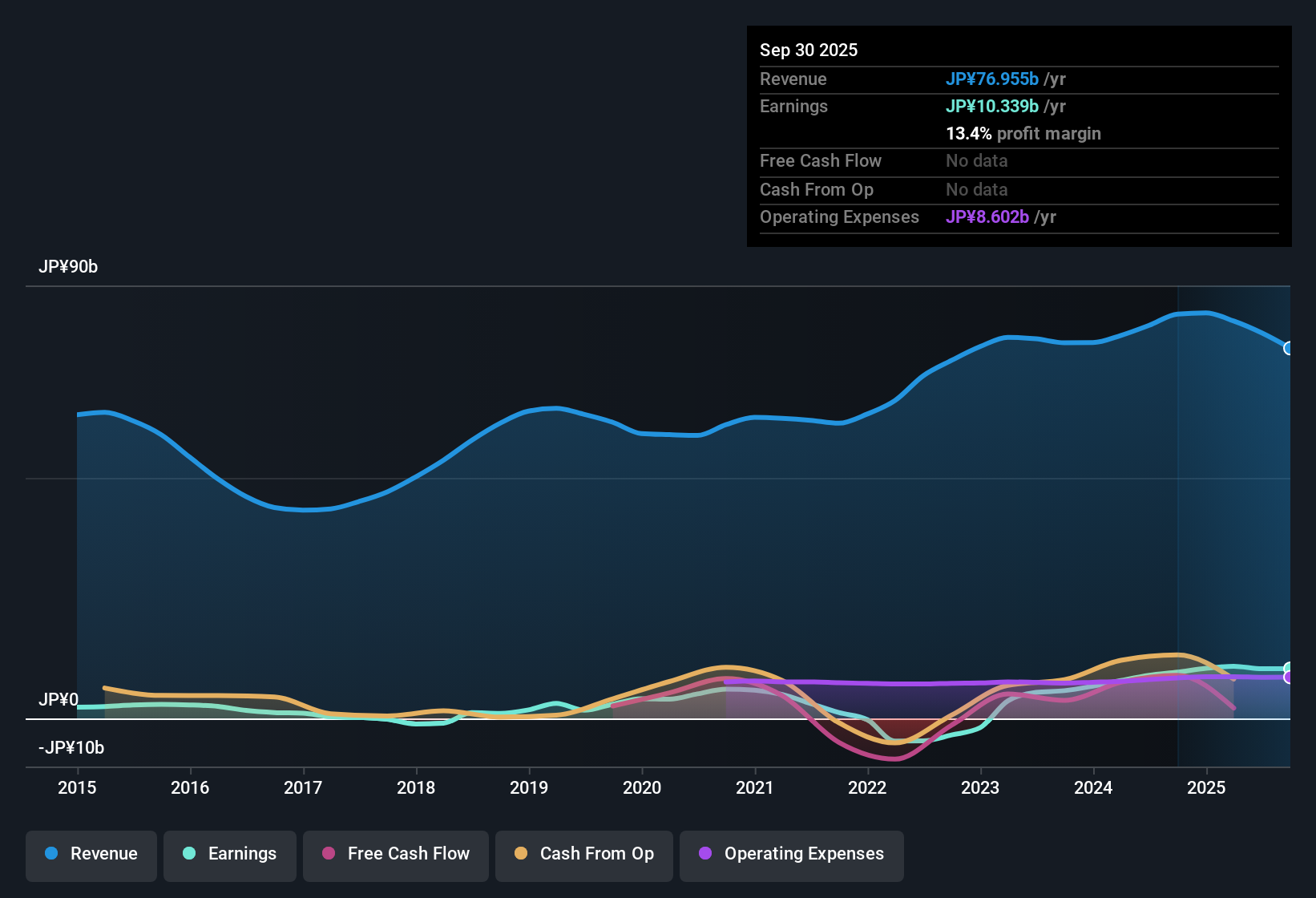

TSE:5445 Earnings & Revenue History as at Nov 2025 Margins Outpace Industry Norms Profit margins rose to 13.4%, surpassing the prior year’s 11.5% and comfortably above many sector peers. This solidifies Tokyo Tekko’s operations as higher quality relative to typical steelmakers. Prevailing market view underscores that this margin strength supports perceptions of management’s cost control and operational steadiness, even as competing steel firms contend with volatile input prices.

TSE:5445 Earnings & Revenue History as at Nov 2025 Margins Outpace Industry Norms Profit margins rose to 13.4%, surpassing the prior year’s 11.5% and comfortably above many sector peers. This solidifies Tokyo Tekko’s operations as higher quality relative to typical steelmakers. Prevailing market view underscores that this margin strength supports perceptions of management’s cost control and operational steadiness, even as competing steel firms contend with volatile input prices.

The contrast between current margins and the sector’s cost-driven headwinds keeps Tokyo Tekko favored as a steady performer. With no negative surprises revealed in the latest filing, the margin trend lends real credibility to those describing it as resilient within the industry. Valuation Gap Widens Further Shares trade at a Price-To-Earnings ratio of 4.6x, significantly discounted compared to both the sector (12.9x) and peer average (14.5x). The current share price (¥5,640) lags the DCF fair value of ¥9,129.20 by a wide margin. The prevailing market view points out that this deep discount aligns with the narrative of Tokyo Tekko as a low-risk, defensive value play, attractive to those seeking steadiness amid sector turbulence.

Investors attentive to defensive allocations are likely to see the strength in valuation, especially as no signs of overvaluation emerge from the updated results. Although the stock lacks explosive growth, its pricing supports a reputation as a safe harbor in uncertain phases of the steel cycle. Dividend Sustainability Questioned The main risk cited in company disclosures centers on dividend sustainability. This is a crucial consideration given sector unpredictability and the company’s low Price-To-Earnings ratio. Prevailing market view calls out that, while profit margins and valuation metrics impress, the lack of a confident signal on long-term dividend reliability introduces a contrasting note for value-focused investors.

Steady earnings and attractive pricing can be undercut if dividend payouts come under pressure during sector downturns. This risk, though not reflected in recent profitability figures, warrants close monitoring for those with income priorities.

Analysts watching this dividend risk amid strong fundamentals are dissecting whether the valuation discount is a lasting opportunity or a warning sign of sector volatility. See what the community is saying about Tokyo Tekko

Next Steps

Don’t just look at this quarter; the real story is in the long-term trend. We’ve done an in-depth analysis on Tokyo Tekko’s growth and its valuation to see if today’s price is a bargain. Add the company to your watchlist or portfolio now so you don’t miss the next big move.

See What Else Is Out There

Despite robust profitability and valuation metrics, Tokyo Tekko’s lack of dividend certainty signals a risk for those prioritizing reliable income streams.

If dependable payouts matter to you, consider these 2000 dividend stocks with yields > 3% to pinpoint companies offering yields above 3% and a stronger record of dividend consistency.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we’re here to simplify it.

Discover if Tokyo Tekko might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free Analysis

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

AloJapan.com