This week’s developments hint at a renewed sense of optimism for Asia’s private markets, from the rising appetite of Japan’s powerhouse LPs to signs of life in the IPO market. We also discuss fresh opportunities in the infrastructure sector.

Japanese LPs step up focus on alt assets

Japanese LPs, who are among the largest in the world, have been increasingly stepping into the alternative investment space at a time when fundraising is faltering globally.

Global private market fundraising witnessed its weakest pace since the pandemic, falling 34.4% over the four quarters ending in Q2 2025, per Pitchbook data. The growing appetite from Japan’s heavyweight institutional investors signals their belief in finding excess returns in private markets. But they are being selective in their approach.

Take the case of the Government Pension Investment Fund (GPIF), which has started building a database to track fund performance. In the process, it is seen to be from simply working with gatekeepers to increasing its role as an LP by strategically accumulating assets and leaning into alternatives more intentionally.

GPIF’s upper limit for its alternative allocation is 5%, which, in the context of its scale and current exposure, means there is a lot of room for even more GPs to win commitments.

The Japan International Cooperation Agency (JICA) is also ramping up its LP position, with an aim to allocate $150 million annually for fund investments, focused on growth equity in the impact space. Its recent investments include funds of Openspace and Aavishkaar Capital.

Interestingly, a lot of these Japanese LPs are looking inward, despite a heavy focus on Western markets. GPIF’s Japan exposure during the last fiscal year ended March 2025 grew from 3% to 5% for infrastructure assets, and from 2% to 3% for private equity.

Japan Post Bank told DealStreetAsia earlier that it has gradually increased domestic exposure (to now 5%), and expected investments in the country to continue steadily.

For Japan Investment Corporation (JIC), local presence is more strategic than just a diversification push. In addition to developing startup innovation, its revised mandate also includes buyouts. The firm intends to invest up to 500 billion yen in Japan-focused buyout funds, which target to raise at least 200 billion yen and to do deals worth 100 billion yen or larger in enterprise value.

“Historically, domestic funds were unable to handle large projects due to their small size, but these funds are now growing in size and can begin to consider [large] projects,” JIC said in a report. Meanwhile, the entry of overseas GPs is on the rise, creating more potential LP-GP relationships for Japanese LPs like JIC.

GPs have also gained more time in tapping JIC as an LP as the latter’s operational period was extended to end-March 2050. Since 2019, the firm has committed about 1.7 trillion yen in PE and VC funds.

Beyond financial requirements, Japanese LPs are increasingly cognisant of sustainability in private markets. While JICA and JIC have had a gender and climate focus, GPIF is stepping up to integrate sustainability assessment in its fund selection. This actually creates an opportunity for PE funds to be considered as compelling investment avenues for LPs, as GPIF pointed out in its newly launched sustainability investment report that the composition of the PE portfolio is relatively weighted towards low-carbon industries.

As a local bank put it, Japanese LPs are not passive pockets of capital. They have a role to play in shaping GP behaviour around matters such as ESG and reporting.

China’s PE-backed IPOs revive

After a couple of subdued years, China’s private equity-backed IPOs are showing a clear turnaround, hinting at renewed optimism for exit activity and valuation recovery.

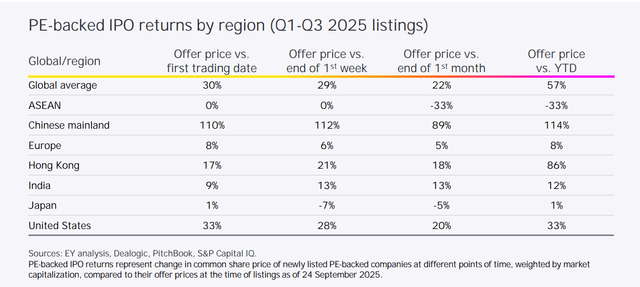

Greater China was among the markets that drove PE-backed IPOs in the first nine months of 2025, signalling confidence in public listings as viable exit routes for PE, according to EY’s Global IPO Trends report.

What’s striking is that mainland China and Hong Kong have re-emerged as global leaders in IPO returns. Both markets recorded double-digit year-on-year growth in deal volumes and proceeds through September, powered by strong demand for companies in advanced manufacturing, mobility, semiconductors, and electronics.

Major listings such as Contemporary Amperex Technology and Huadian New Energy Group each raised billions, ranking among the world’s top PE-backed IPO performers so far this year. A slew of big transactions are lined up, such as memory chipmaker ChangXin Memory Technologies and Leju Robotics.

“Greater China’s strong pipeline, backed by government efforts to enhance capital access, is now translating into tangible market activity. The momentum is anticipated to continue in the short term,” Ringo Choi, EY Asia-Pacific IPO Leader, said in the report.

In Hong Kong, policy measures to attract new listings, along with growing global investor participation, are also expected to sustain deal flow, particularly from mainland issuers.

Still, the optimism is tempered by persistent capital outflows from China. According to Rede Capital Partners, only 14% of investors currently hold a positive outlook on China, reflecting ongoing caution.

Historically, China made up over half of APAC’s private equity activity in deal flow, fundraising, and exits. But much of that capital has now shifted toward Japan and India, which are viewed as more stable or policy-friendly markets.

Investors are entering a new phase in China’s private equity market: deals are still being done, but the bar for capital deployment has risen sharply. Only investors with the right access and capabilities are likely to achieve meaningful returns, particularly those targeting sectors more insulated from external shocks and driven by domestic demand.

Infrastructure in play

The rapid growth and urbanisation in South and Southeast Asia are presenting robust opportunities for investments in infrastructure, from data centres to transportation and power generation facilities. But how attractive is the asset class really?

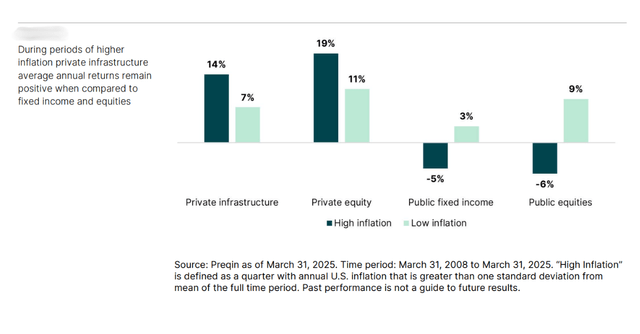

Infrastructure is positioned between traditional fixed income and private equity, as a yield-providing investment that is naturally anti-cyclical and anti-inflation owing to its long-term contracts. And, private investors are looking to ramp up their presence in the region through dedicated infrastructure funds as well as partnerships with major local players.

Funds with targeted allocations include KKR & Co.’s third and largest vehicle for the strategy, at a reported $9 billion; Brookfield’s $5 billion Catalytic Transition Fund; UK infrastructure investors Actis’ second fund; and Singapore-based Seraya Partners’ $1 billion vehicle.

An OECD report this month noted firms are also partnering with multilateral development banks, and creating blended finance platforms aimed at projects that are “struggling with bankability”.

The report stated: “There has been a strong interest in developing new infrastructure funds to capitalise on high returns.” These funds are drawing commitments from North American, European, and Australian institutional investors seeking exposure through strategies that span infrastructure debt and real estate to core equity.

In 2022, for instance, IFC allocated $5 billion to the region; in December 2023, it invested $500 million in Danish firm A.P. Moller Capital’s $1 billion Emerging Markets Infrastructure Fund II targeting Southeast Asia. Meanwhile, the European Investment Bank invested $6.5 billion in the region excluding China, with about a third going to transport infrastructure. Financing for India, the Philippines, and Indonesia totalled $3.2 billion, $338 million, and $289 million, respectively.

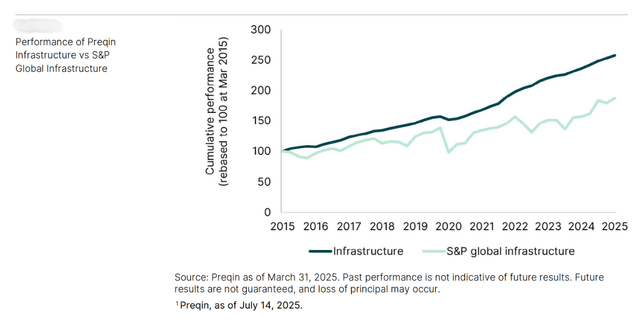

What are the returns that can be expected? In a report on the sector, investment manager Pantheon noted that over the last ten years, private infrastructure investments have consistently outperformed public benchmarks, while suffering the lowest volatility among all the private market asset classes.

Looking ahead, Pantheon noted, the three broad trends of decarbonisation, digitisation, and de-globalisation are reshaping the infrastructure investment landscape, including a shift towards more localised installations that account for regional nuances and regulatory divergence.

Despite the opportunities, investors will have to navigate regulatory fragmentation and discrepancies, limited institutional capacity, and the lack of flexible or innovative investment structures.

Top PE developments

Deals

Shanghai State-Owned Capital Investment has picked 10 GPs earlier this month to provide patient capital to fund biopharma innovations.

In the reinsurance sector, KKR has joined Portuguese fund Quadrantis Capital to buy minority stakes in Hong Kong reinsurance specialist Peak Re, while Carlyle and Fortitude launched Fortitude Carlyle Asia Reinsurance with more than $700 million in deployable capital.

IPOs and exits

Partners Group announced that it is selling its minority stake in Singapore-headquartered Apex Logistics, claiming to gain “a strong return”.

Vietnam Oman Investment said it had joined a pre-IPO fund round of Techcombank Securities, which later raised $410 million in its IPO.

People moves

Indonesian sovereign wealth fund Danantara has reportedly roped in former investment professionals from Singapore’s GIC. Daniel Lim, former portfolio manager at GIC, will oversee Danantara’s private credit investments, while Weihan Wong will be responsible for private equity.

AloJapan.com