Introduction

The Tokyo Stock Exchange (TSE) has advanced governance reforms through Japan’s Corporate Governance Code and related initiatives, with the aim of supporting sustainable growth and enhancing corporate value over the mid- to long-term. In April 2022, TSE restructured its market segments to provide an attractive cash equity market that underpins the sustainable growth and corporate value creation of listed companies, while gaining strong support from a diverse base of domestic and international investors.

Among the new market segments, the Prime Market has been positioned as one “centered on constructive dialogue with global investors.” Correspondingly, the revised Corporate Governance Code introduced specific requirements applicable only to Prime Market companies, most notably the raising of the minimum threshold for independent outside directors to one-third of the board and the strengthening of English disclosures which has been a longstanding request, particularly from overseas investors. These measures go beyond the traditional “defensive” role of governance, such as preventing corporate scandals, and place equal emphasis on “proactive” governance, which enhances companies’ capacity to generate earnings. The latter has gained particular importance as Japan seeks to shift from a deflationary, cost reduction-oriented economy toward a growth economy driven by wage increases and investment, where companies are expected to take appropriate risk in pursuit of sustainable growth and corporate value enhancement.

Against this backdrop, in March 2023 TSE launched a new initiative requesting that listed companies implement “management that is conscious of the cost of capital and stock price” (hereafter, the “TSE Initiative”). The TSE Initiative seeks to encourage management to strengthen capital efficiency and pursue strategies that enhance mid- to long-term corporate value by improving profitability, raising valuation metrics, and earning investor confidence. The TSE Initiative has attracted significant attention both domestically and abroad, serving as a reference point for other exchanges in Asia.

This article will revisit the rationale behind the TSE Initiative, review its progress to date, and provide an assessment of its current status.

Purpose and Overview of the TSE Initiative

The primary objective of the market restructuring implemented in April 2022 was to encourage listed companies to enhance their corporate value. The restructuring itself, however, represented only the starting point. Even after the restructuring, indicators of capital efficiency and valuation, such as return on equity (ROE) and price-to-book ratio (PBR), which serve as representative benchmarks, lagged behind those of developed global market peers. This underscored the necessity for listed companies to voluntarily engage more actively in their initiatives aimed at improving corporate value.

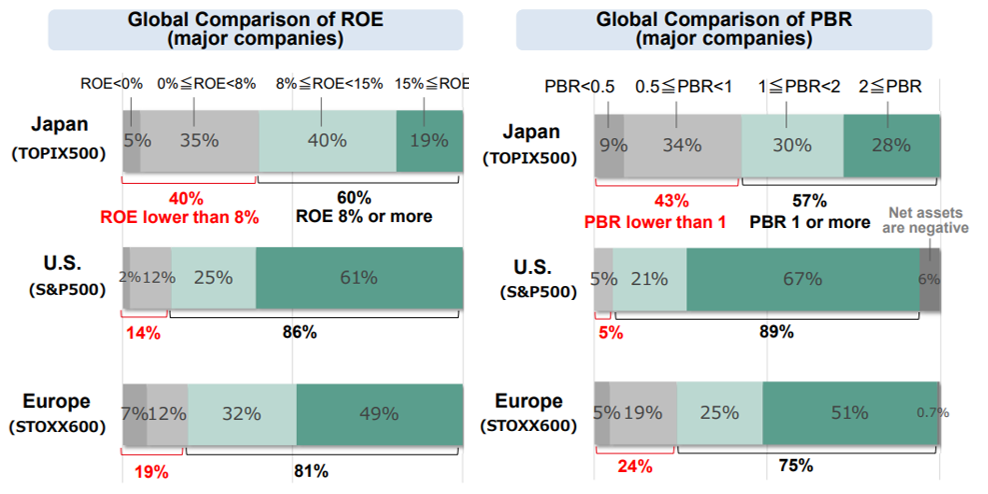

For instance, as of July 2022, 40% of companies within the TOPIX 500 universe posted an ROE below 8%, compared with 14% for the S&P 500 in the United States and 19% for the STOXX 600 in Europe. Similarly, 43% of Japanese companies traded at a PBR below one, while the comparable figures were only 5% in the United States and 24% in Europe (see Figure 1).

Figure1: Global Comparison of ROE and PBR (as of July 1, 2022)

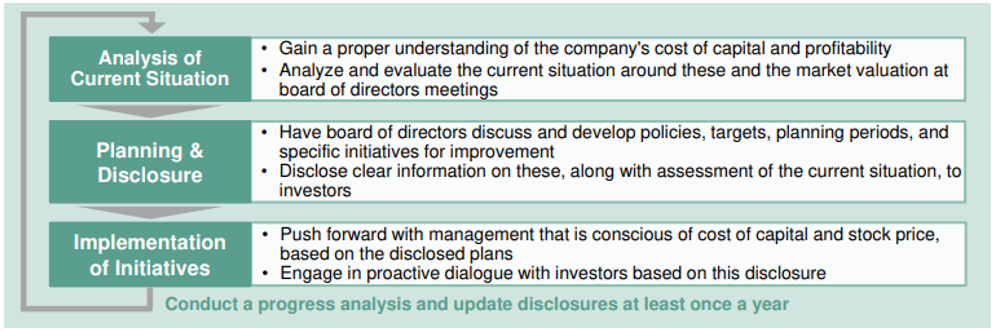

In response to these circumstances, TSE issued an official statement requesting all companies listed on the Prime and Standard Markets to take action aimed at achieving management that is conscious of the cost of capital and stock price (hereafter, the “Request”). The purpose of the Request is to encourage listed companies to raise awareness and literacy with respect to their cost of capital and stock price, as well as to undertake initiatives for improvement. Specifically, management teams and boards of directors are asked to gain an accurate understanding of their company’s cost of capital and capital efficiency, to discuss the assessment of their current situation and to develop plans for improvement, and to disclose policies, concrete strategies, and progress toward enhancement. Together with the Request, TSE also presented a framework outlining the series of actions expected from companies (see Figure 2).

Figure2: The Framework regarding The Request

Key Features of the Request are as follows.

(1) Top-down Implementation

Unlike the administrative, staff-driven approaches often observed in Japanese companies, the Request expects actions to be driven in a top-down manner, with senior management taking the lead based on the basic management policies established by the board of directors.

(2) Realization of Sustainable Growth

While the Request does not preclude shareholder returns aimed at improving capital efficiency, it emphasizes the appropriate allocation of management resources to achieve sustainable growth. This includes promoting initiatives such as investment in R&D and human capital that contribute to the creation of intellectual property and intangible assets, capital expenditures, and restructuring of business portfolios.

(3) Dialogue with Investors

Companies are expected to present their actions, including policies, targets, and specific initiatives, in a manner that investors can readily understand, and to refine their responses through proactive dialogue with investors based on disclosure, thereby gaining investor feedback.

Importantly, the framework under the Request is not intended as a one-off exercise. Companies are expected to review their status at least annually, engage in dialogue with investors based on disclosure, and to continue to improve their initiatives.

From a technical perspective, it is notable that the Request does not mandate compliance under listing rules, but instead relies on voluntary initiatives by companies. This reflects the cultural importance of consensus-building in Japan: mandatory requirements risk provoking corporate resistance or perfunctory compliance. At the same time, the Request is designed to naturally leverage peer pressure. Once a leading company responds, it is expected to act as a catalyst, prompting other companies to follow suit in an industry-wide manner.

Additional Measures Following the Request

Since the issuance of the Request, both domestic and international investors have shown strong interest in how companies have been responding. To raise investor awareness of corporate initiatives and to further encourage companies’ efforts, TSE began, in January 2024, publishing a list of companies that have made disclosures pursuant to the Request (hereafter, the “List”). While the List includes only companies that have made such disclosures, and therefore does not explicitly identify those that have not, some securities firms and investors have reportedly engaged in reverse engineering, using the List to infer which companies had not responded and to assess companies’ willingness to engage within each industry. As a result, peer pressure appears to have intensified within industries, further promoting responses from companies.

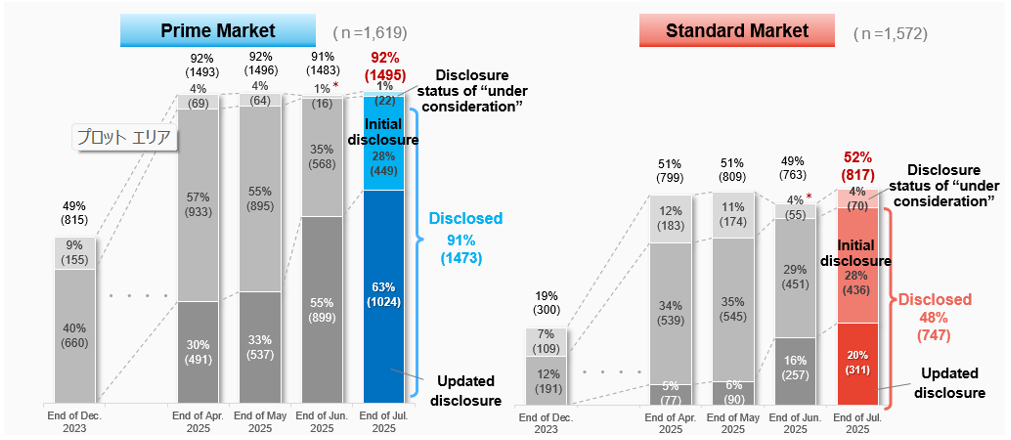

Since then, company responses have steadily improved. In particular, the disclosure rate among Prime Market companies has exceeded 90% since March 2025. Moreover, as initially anticipated, these efforts have not ended as one-off disclosures: as of July 2025, more than 60% of companies had updated their initial disclosures. By contrast, the disclosure rate among Standard Market companies has remained around 50%, with only about 20% of those companies providing updates (see Figure 3).

Figure3: Disclosure Rate of Companies that Have Responded to the Request

At present, nearly all companies listed on the Prime Market have responded to the Request. In light of this, TSE has shifted its focus from pursuing disclosure rates alone to addressing the qualitative aspects of the responses. Investors, both domestic and international, have pointed out that while many companies have technically “disclosed,” the quality of disclosure varies significantly. In many cases, disclosures are perceived as perfunctory or lacking the depth of analysis and planning that investors expect. To ensure that company responses are truly meaningful from an investor’s perspective, TSE has introduced several supplementary measures.

One particularly impactful measure has been the publication of a set of Best Practices, which highlights key elements that investors expect from corporate initiatives as well as actual disclosure examples that have been positively evaluated by investors. The Best Practices introduce 55 case studies across market capitalization sizes and industry sectors, with company names explicitly identified, that are publicly available on TSE’s website. Initially regarded as a mere educational document lacking in novelty, the Best Practices have proven highly effective in an environment where peer pressure is prevalent: many companies have sought to strengthen their own disclosures by following the examples of peers featured in the Best Practices.

Furthermore, TSE has also released examples of disclosures that fall short of investor expectations. While these cases were published on an anonymous basis, the combination of reputational concerns and cultural aversion to embarrassment in Japan encouraged many companies to make relevant improvements. In this regard, companies have shown a strong appetite for learning from the Best Practices and TSE seminars on the Best Practices have consistently attracted several hundred participants.

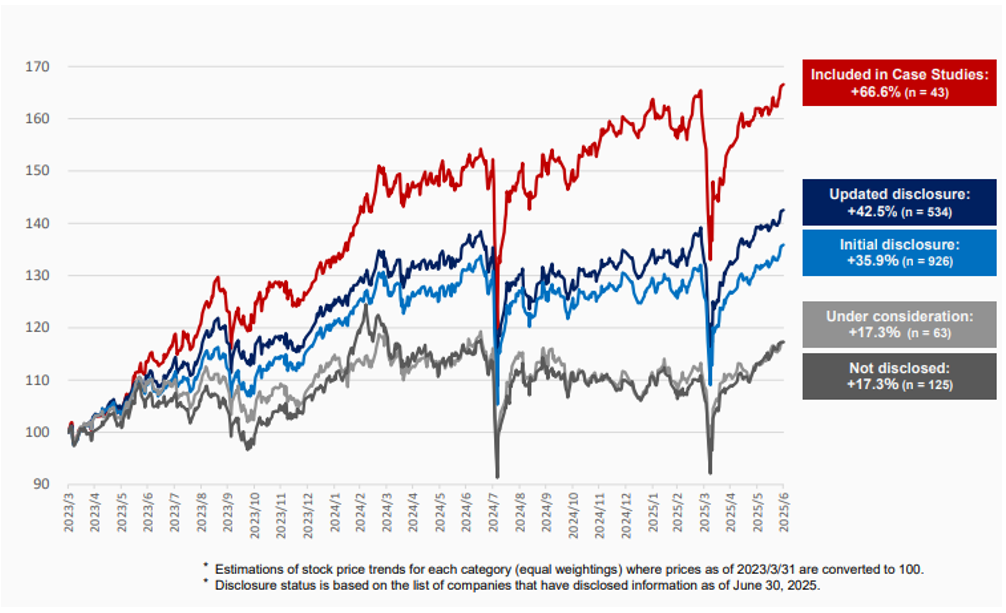

Additionally, TSE has analyzed post-Request stock price performance across several groups of companies. The analysis revealed that stock returns of companies were found to generally correspond from high to low in terms of the following: companies featured in the Best Practices, those that have updated their disclosures at least once, those that have not updated since their initial disclosure, those that merely stated in their disclosure that matters were “under consideration,” and those that have not made disclosures at all. This finding suggests that what is being evaluated by the market is not merely whether disclosure is made, but rather the quality of disclosure and the continuity of companies’ efforts (see Figure 4).

Figure4: Stock Performances after the Request (Prime Market)

In order for companies to undertake high quality corporate initiatives, dialogue with investors is crucial. However, many companies, despite their willingness to engage, have had limited opportunities to connect with institutional investors due to factors such as not being covered by sell side securities firms. To address this gap and to provide such proactive companies with greater opportunities for engagement, TSE has recently introduced the option for companies that wish to engage more actively in dialogue to be tagged within the List. If a company requests it, TSE will tag its interest in greater engagement in the List, along with the company’s designated point of contact. This mechanism enables investors to identify companies, even those with relatively small scale or limited name recognition, that are actively seeking dialogue, and to approach them directly.

Three Years after the Request

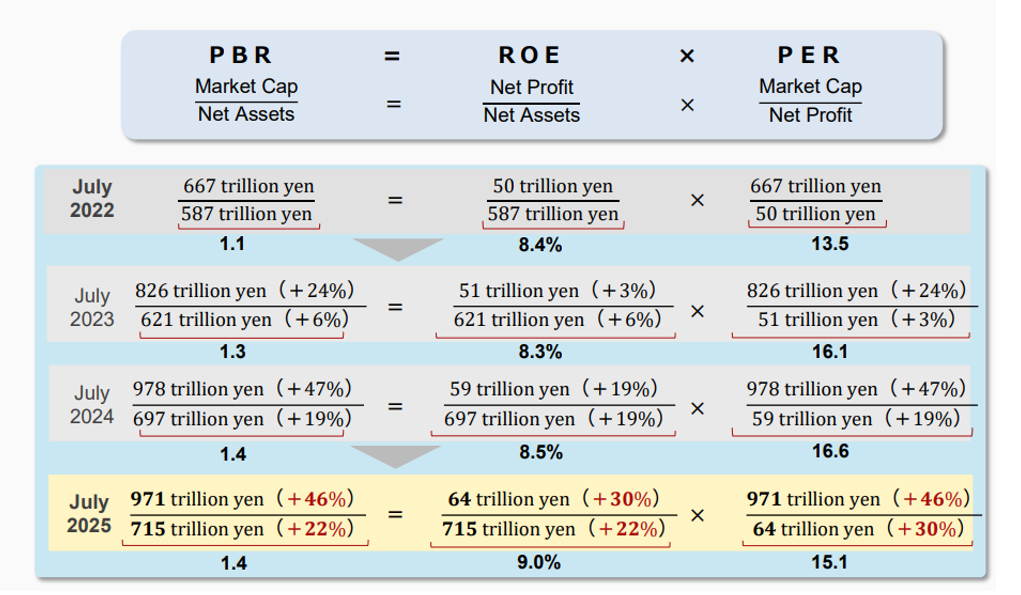

Looking back, two and a half years after the initial Request, positive changes can be observed in the overall market indicators of ROE and PBR, which had long been identified as challenges for publicly listed Japanese companies. The average PBR improved from 1.1 in July 2022, when the TSE initiative was launched, to 1.4 after three years, while ROE rose from 8.4% to 9.0% (see Figure 5).

Figure 5: Changes in Components of PBR, ROE and PER (Prime Market)

There is no definitive conclusion to the corporate governance reforms led by TSE. Instead, TSE will continue to encourage companies to improve their practices on an ongoing basis. Over the medium term, TSE aims to foster a market environment in which initiatives that meet investor expectations are regarded as the norm among listed companies, thereby laying the foundation for firms to strengthen their performance and profitability on their own. To this end, it is essential to revitalize market dynamism, including the exit of listed companies when appropriate, and to design listing rules and shareholder value enhancing measures such as the Request, in a manner that sustains healthy discipline in TSE’s market. TSE believes these efforts will attract a diverse range of investors, including global institutional investors, and secure Japan’s position as the most preferred market in Asia and beyond.

AloJapan.com