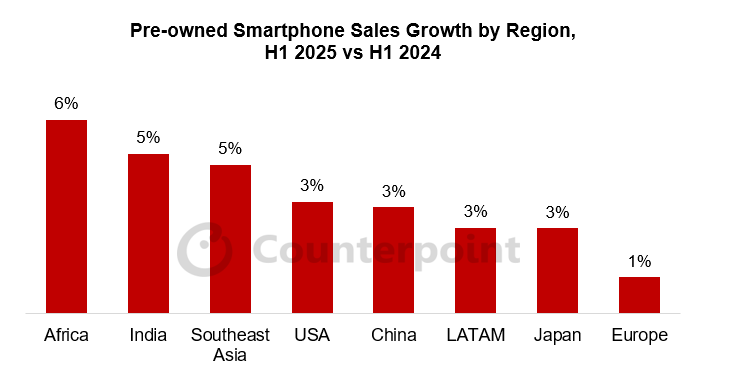

Mature pre-owned smartphone markets like Europe, the USA and Japan experienced flat to modest movement (average 1% YoY growth) in H1 2025, according to Counterpoint’s latest research. Factors like market fragmentation, rising costs and longer replacement cycles affected both supply and demand of used smartphones. In contrast, emerging markets like Africa, India, Southeast Asia, China and Latin America continued to drive overall momentum (average 4% YoY growth), reflecting stronger growth rates relative to the global average.

Africa’s pre-owned smartphone market had the strongest growth in H1 2025, rising 6% YoY due to various drivers across the value chain. Increasing numbers of organized players are pulling volumes from unorganized channels. Supportive government initiatives such as the ‘Bridge by Digital Africa’ program provide funding and resources to strengthen local refurbished ecosystems and scale regional operations. Imported used iPhones are seeing strong growth across countries, driven by financial constraints and perceived reliability and lifespan over new local units.

Key growth drivers for Africa:

Apple led the refurbished smartphone market with 7% YoY growth, driven by collaborations with premium resellers and a rising preference for newer models like the iPhone 13 and above.

Samsung secured the second spot with 4% YoY growth, supported by aggressive trade-in promotions offering up to 50% off on the Galaxy S and Z series devices, where healthy trade-in activity continues to fuel higher sales.

Models like the Apple iPhone 11, 12 and Samsung Galaxy S20 were among the top-selling refurbished devices in this region.

India’s pre-owned smartphone market grew 5% YoY in H1 2025, with Apple leading the surge. Organized retailers are solidifying buyback initiatives in both online and offline markets. These players are increasingly marketing a more ‘premium’ image, positioning refurbished devices – particularly flagship and high-end models as reliable, value-driven alternatives. Demand is shifting toward newer models, supported by retailer-driven exchange programs, extended warranty offerings, and rising consumer preference for recent premium smartphones.

Key growth drivers for India:

Samsung held the top spot with a slight 1% YoY decline, supported by steady demand for Galaxy S22 and S23 series. Additionally, the Samsung Galaxy S22 and S21 were among the top-selling models in India.

Apple grew 19% YoY to take the second spot, driven by rising consumer preference for premium models like the iPhone 13 and 14 series.

Southeast Asia’s pre-owned smartphone market also grew 5% YoY in H1 2025, fueled by its large unorganized channels and steady inflow of used devices and components from China. However, countries across the region have increasingly begun sourcing their own supply over the last 1-2 years, reducing import dependency. Online platforms are driving the consumer-to-consumer (C2C) market, especially for refurbished smartphones. This growth is fueled by increasing consumer trust, better supply chains, and the convenience of initiating negotiations and transactions digitally.

Key growth drivers for Southeast Asia:

Apple led the market, covering half of the market with 15% YoY growth, gaining strong traction in Indonesia and other SEA countries with iPhone 12 and 13 as top selling models. Most imports are still sourced from China , while trade-in programs by retailers and are strengthening the domestic supply chain.

Despite a 3% YoY overall decline, Samsung is actively running trade-in programs, including partnerships with Laku6 (Carousell Group), to simultaneously push for sustainability and boost after-sales engagement.

Mature markets like the USA, Europe, and Japan remained largely flat, with volumes tempered by limited supply and declining export flows to emerging markets.

In the USA, the market sentiment remained volatile. Retailers and OEMs maintained high inventories of spare parts in anticipation of potential policy shifts. Operators, OEMs and retailers continue to strengthen buy-back programs and collaborate with value chain partners to make sure stock continues to move.

Europe, however, faced increased challenges with profitability due to rising operations costs and tighter regulations, while tariff-related uncertainty from the US policy front further dampened secondary smartphone activity. Competition has increased in the retailer space and trade-in schemes have increased.

Meanwhile, in Japan, awareness of certified pre-owned devices sold by major carriers like NTT Docomo, and SoftBank is growing steadily while OEM-backed initiatives by Apple, and other brands are expanding consumer trust and accessibility, supported by government efforts to make smartphone pricing more transparent and affordable.

Across mature markets, the iPhone 12 and 13 series smartphones continue to dominate refurbished sales, but Samsung S series is likely to do better in select markets like the USA in the coming months due to increased demand. Counterpoint Research

AloJapan.com