Source: FE Fundinfo. All relevant fund data converted to US dollars for comparative purposes. Performance, alpha and volatility are annualised over three years with data as reported at the end of last month. Information ratio (IR) aims to measure a portfolio manager’s consistent ability to generate excess returns relative to a benchmark. The higher the IR, the more consistent the manager is.

Source: FE Fundinfo. All relevant fund data converted to US dollars for comparative purposes. Performance, alpha and volatility are annualised over three years with data as reported at the end of last month. Information ratio (IR) aims to measure a portfolio manager’s consistent ability to generate excess returns relative to a benchmark. The higher the IR, the more consistent the manager is.

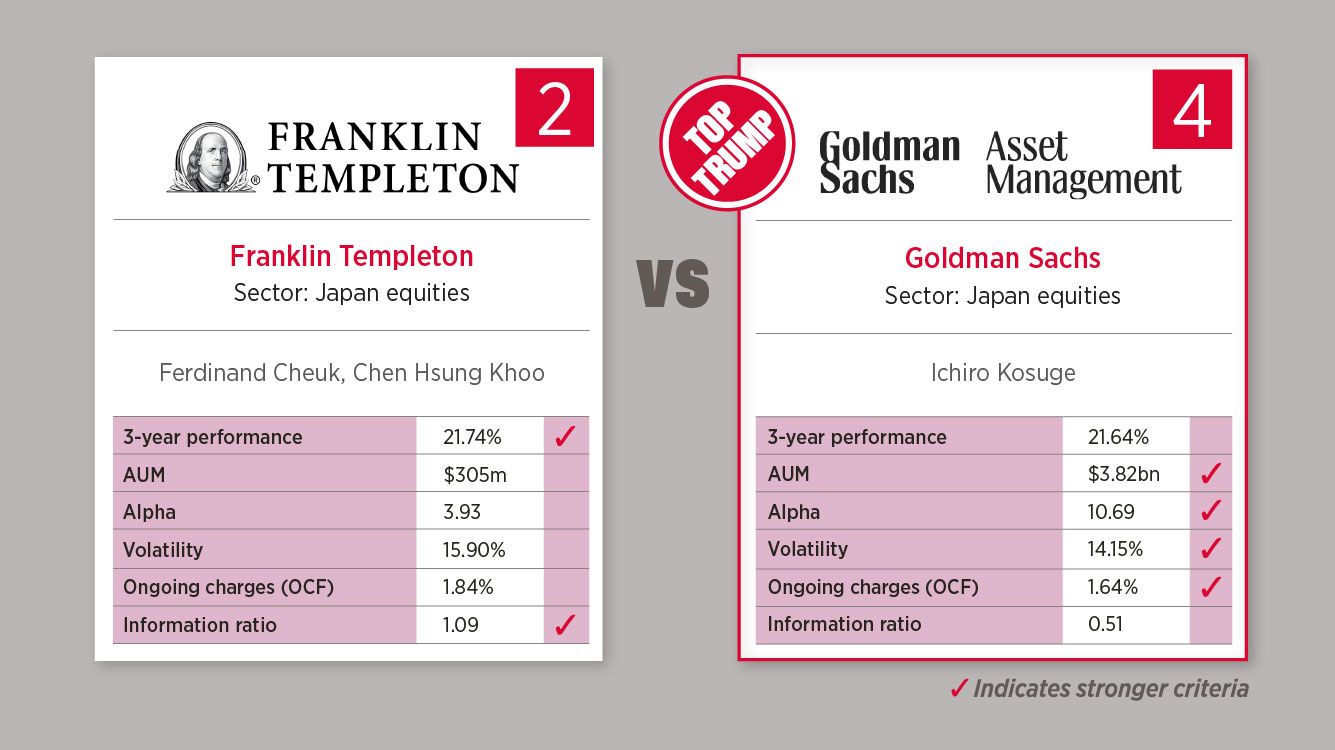

Based on the popular 80s card game, each week we select an asset class and use FE fundinfo data to compare two funds based on their three-year performance, assets under management, alpha, volatility, ongoing charges and information ratio to decide which is the Top Trump.

This week, the Goldman Sachs Japan Equity Partners Portfolio fund beats the (Franklin) Templeton Japan fund: 4-2.

Goldman Sachs Japan Equity Partners Portfolio

The fund’s objective to appreciate capital without a need for income.

Top 10 holdings:

Mitsubishi UFG Financial (6.1%)

Sony (6.1%)

Hitachi (6.0%)

Tokio Marine (5.8%)

Tokyo Electron (4.8%)

Hoya (4.7%)

NEC (4.3%)

Daifuku (4.0%)

Recruit (4.0%)

Asics (4.0%)

Templeton Japan Fund

The fund seeks long-term investment growth, through growth of capital. The fund mainly invests in equities of companies of any market capitalisation that are located in, or derive significant business in Japan.

Top 10 holdings:

Toyota (6.4%)

Mizuho Financial (6.4%)

Sugi (5.5%)

SBI (5.4%)

Ebara (5.4%)

Asics (4.4%)

GMO Payment Gateway (3.9%)

Kinden (3.6%)

Sumitomo Mitsui Financial (3.3%)

IHI (3.2%)

AloJapan.com