Has Osaka Gas (TSE:9532) Quietly Become a Value Play for Investors?

Osaka Gas (TSE:9532) just posted another day in the red, with shares finishing lower over the past 7 days and month. While this slide may not be headline-grabbing, it is enough to get investors pausing, especially after a solid rebound earlier this year. With market attention frequently focused on big tech or aggressive growth names, a steady player like Osaka Gas moving quietly yet consistently might signal an underlying shift in how the market values utility stocks now.

The recent softness in the share price caps a year that has seen momentum build for Osaka Gas. Despite a slight drop in top-line and net profits over the last year, the company’s stock is up approximately 33% since this time last year, and has more than doubled in the past three years. That is a substantial comeback story for any established utility. While there have been no major headlines or dramatic shifts, this stock’s longer-term trajectory stands out among its peers, even as day-to-day moves remain modest.

After a year of steady gains with a recent pullback, is Osaka Gas now trading at a discount that offers real upside, or is the market already accounting for its future prospects?

Price-to-Earnings of 11x: Is It Justified?

Based on its price-to-earnings ratio, Osaka Gas appears undervalued compared to both its industry peers and the broader Japanese market. This may make it attractive to value-focused investors.

The price-to-earnings (P/E) ratio measures how much investors are willing to pay for each unit of earnings. For utility companies like Osaka Gas, this metric is often used to gauge whether the market is fairly valuing long-term profitability given their typically stable but slower-growth earnings profile.

In this case, Osaka Gas trades at an 11x P/E ratio, which is lower than the average among Asian gas utility peers (13.4x) as well as the broader Japanese market (14.9x). This suggests the market is pricing Osaka Gas below its competitors despite its steady performance and recent earnings growth. It raises the question of whether investors are under-appreciating the company’s profit strength or bracing for headwinds ahead.

Result: Fair Value of ¥4,276 (ABOUT RIGHT)

See our latest analysis for Osaka Gas.

However, slower revenue and profit growth, as well as broader market uncertainties, could challenge the case for Osaka Gas as a clear value pick moving forward.

Find out about the key risks to this Osaka Gas narrative. Another View: What Does Our DCF Model Say?

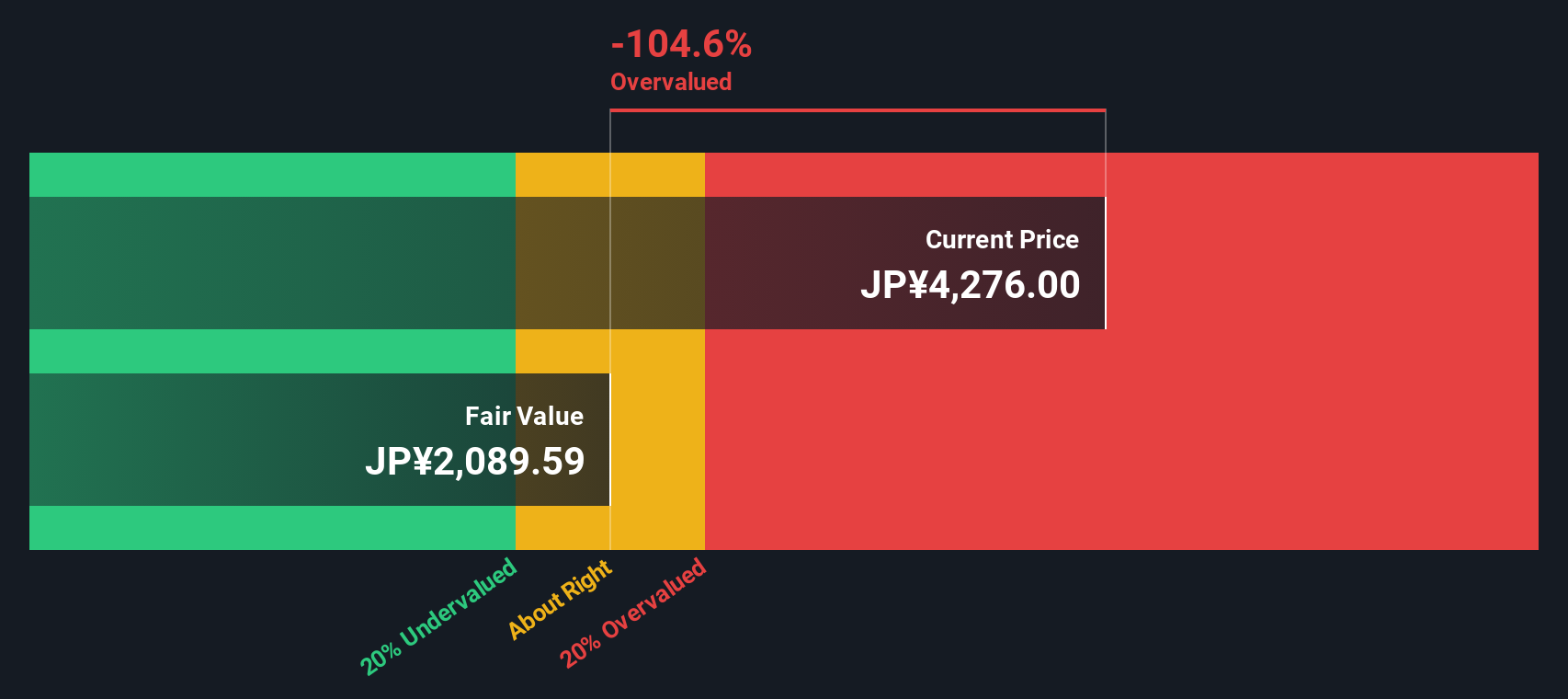

Switching gears to the SWS DCF model, this method suggests a less optimistic take and sees Osaka Gas as overvalued, even though it has an attractive earnings ratio. Could this point to market optimism running ahead of fundamentals?

Look into how the SWS DCF model arrives at its fair value.  9532 Discounted Cash Flow as at Sep 2025 Stay updated when valuation signals shift by adding Osaka Gas to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

9532 Discounted Cash Flow as at Sep 2025 Stay updated when valuation signals shift by adding Osaka Gas to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Osaka Gas Narrative

If you see things differently or want to dig deeper into the numbers yourself, you have the tools to craft your own view in just a few minutes, so why not Do it your way?

A great starting point for your Osaka Gas research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for More Investment Opportunities?

Uncover fresh angles on the market by checking out new companies and sectors. Take control of your investing journey before these ideas slip past you.

Tap into emerging technology leaders shaking up healthcare by heading to healthcare AI stocks. These companies are tackling medical challenges with smart solutions. Spot undervalued companies with strong cash flow potential when you use undervalued stocks based on cash flows. Position yourself ahead of the broader market. Supercharge your search for high-yield investments by browsing dividend stocks with yields > 3%, which features companies offering attractive income opportunities above 3% yields.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Explore Now for Free

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

AloJapan.com