Lately, Osaka Soda (TSE:4046) has caught the eye of many investors following a relatively muted period, reigniting debates around its true value. The absence of any major news or material events behind the recent price action leaves some shareholders wondering whether something is stirring beneath the surface or if this is simply routine market movement. In moments like these, the question quickly turns from “why now?” to “what’s next?” for a company with a long operating history and solid fundamentals.

Looking at the stock’s performance over the past year, momentum has been on the quieter side. Despite a 2% uptick in the past three months, Osaka Soda’s share price has dropped nearly 10% since the start of the year and sits almost 2% lower than this time last year. These shifts come in the context of steady revenue and net income growth, as well as Osaka Soda’s impressive compounding returns for shareholders over longer stretches, with the share price more than doubling over the last five years.

After a year of modest declines punctuated by glimmers of growth, is Osaka Soda merely treading water or is the current share price understating the company’s future potential?

Price-to-Earnings of 20.8x: Is it justified?

Osaka Soda currently trades at a price-to-earnings (P/E) ratio of 20.8x, making it more expensive than both its peers in the Japanese Chemicals sector and the broader market average. This relatively high valuation suggests that the market may have strong expectations for future profit growth, or that investors are paying a premium for perceived business quality or stability.

The price-to-earnings ratio is a common tool investors use to quickly compare how much they are paying for each unit of a company’s earnings. For chemical sector stocks like Osaka Soda, which can experience cyclical swings in profits, the P/E offers a lens into market sentiment and expected consistency of returns.

However, Osaka Soda’s higher-than-average P/E compared to industry peers implies that either the market anticipates substantially higher forthcoming earnings, or the stock is potentially overpriced when fundamentals are considered. With the company’s solid earnings growth, investors may believe the premium is justified, but on a pure multiple basis, the stock currently screens as expensive.

Result: Fair Value of ¥1,372 (OVERVALUED)

See our latest analysis for Osaka Soda.

However, any unforeseen slowdown in earnings growth or sudden market volatility could quickly shift sentiment around Osaka Soda’s current valuation.

Find out about the key risks to this Osaka Soda narrative. Another View: What Does the SWS DCF Model Say?

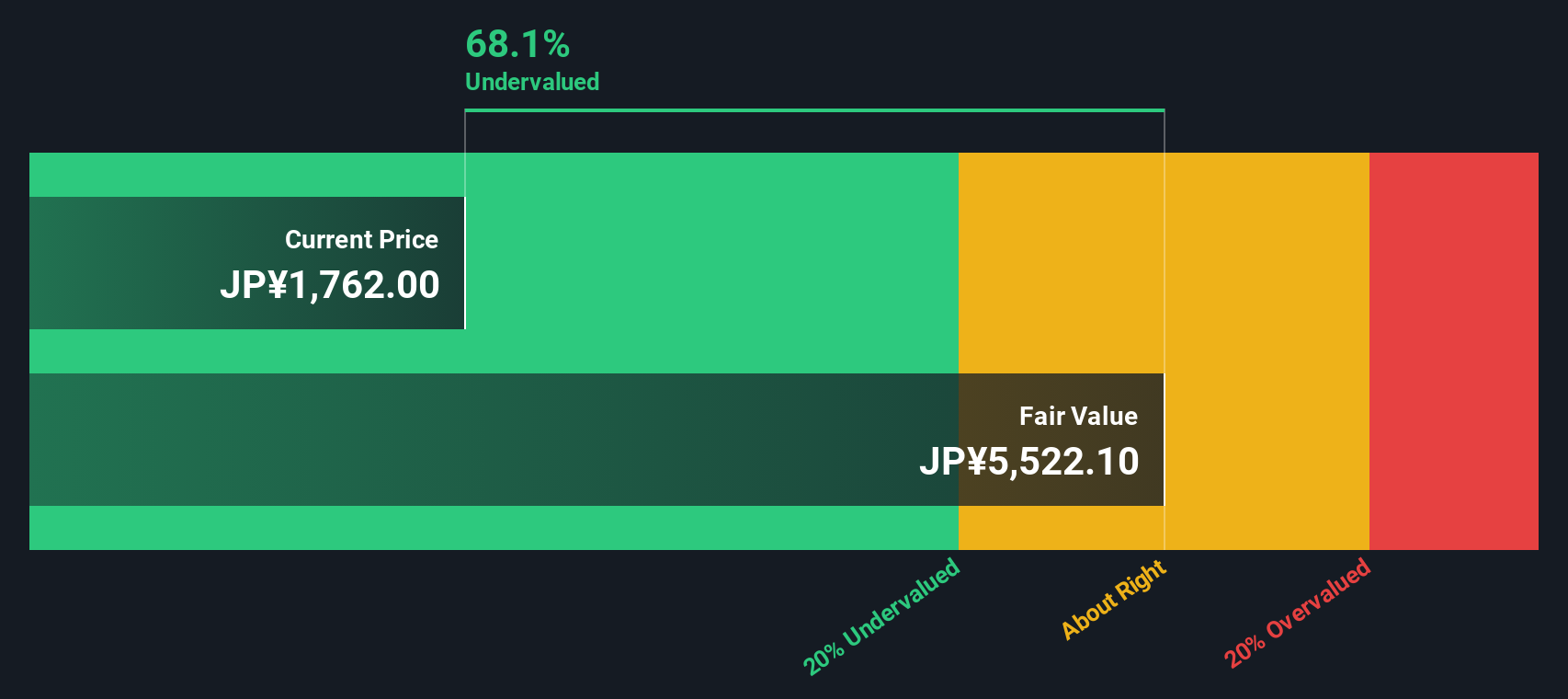

Looking from a different perspective, our DCF model indicates that Osaka Soda appears materially undervalued based on its long-term cash flows. This is in sharp contrast to what the current trading multiples indicate. Could the market be overlooking something important?

Look into how the SWS DCF model arrives at its fair value.  4046 Discounted Cash Flow as at Sep 2025 Stay updated when valuation signals shift by adding Osaka Soda to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

4046 Discounted Cash Flow as at Sep 2025 Stay updated when valuation signals shift by adding Osaka Soda to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Osaka Soda Narrative

If you see things differently or want to dive deeper into the numbers yourself, you can craft your own view in just a few minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Osaka Soda.

Looking for More Investment Ideas?

Don’t let your next opportunity slip away. The Simply Wall Street Screener helps you uncover stocks that fit your future. Start your search from any of these standout categories:

Spot potential bargains and jump on undervalued companies with upside before the wider market catches on. See for yourself with our undervalued stocks based on cash flows. Capture reliable income streams by finding shares with attractive dividend yields. Get a head start with our selection of dividend stocks with yields > 3%. Tap into the world of machine learning and automation by targeting companies advancing artificial intelligence, all highlighted in our AI penny stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Explore Now for Free

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

AloJapan.com