Last week, Resonac Corporation’s progress with JOINT3, a new semiconductor initiative, was a focal point in the tech industry. Tokyo Electron (TSE:8035), part of this consortium, experienced an 11.6% increase in share price, a significant move compared to the broader market’s rise. This rally likely reflects the positive sentiment surrounding JOINT3’s potential impact. Other market factors, such as the Nasdaq’s record highs driven by tech gains, may have bolstered this momentum. However, with the market’s overall modest upward movement of 1.8%, Tokyo Electron’s specific advancements played a central role in distinguishing its performance.

Tokyo Electron has 2 warning signs we think you should know about.

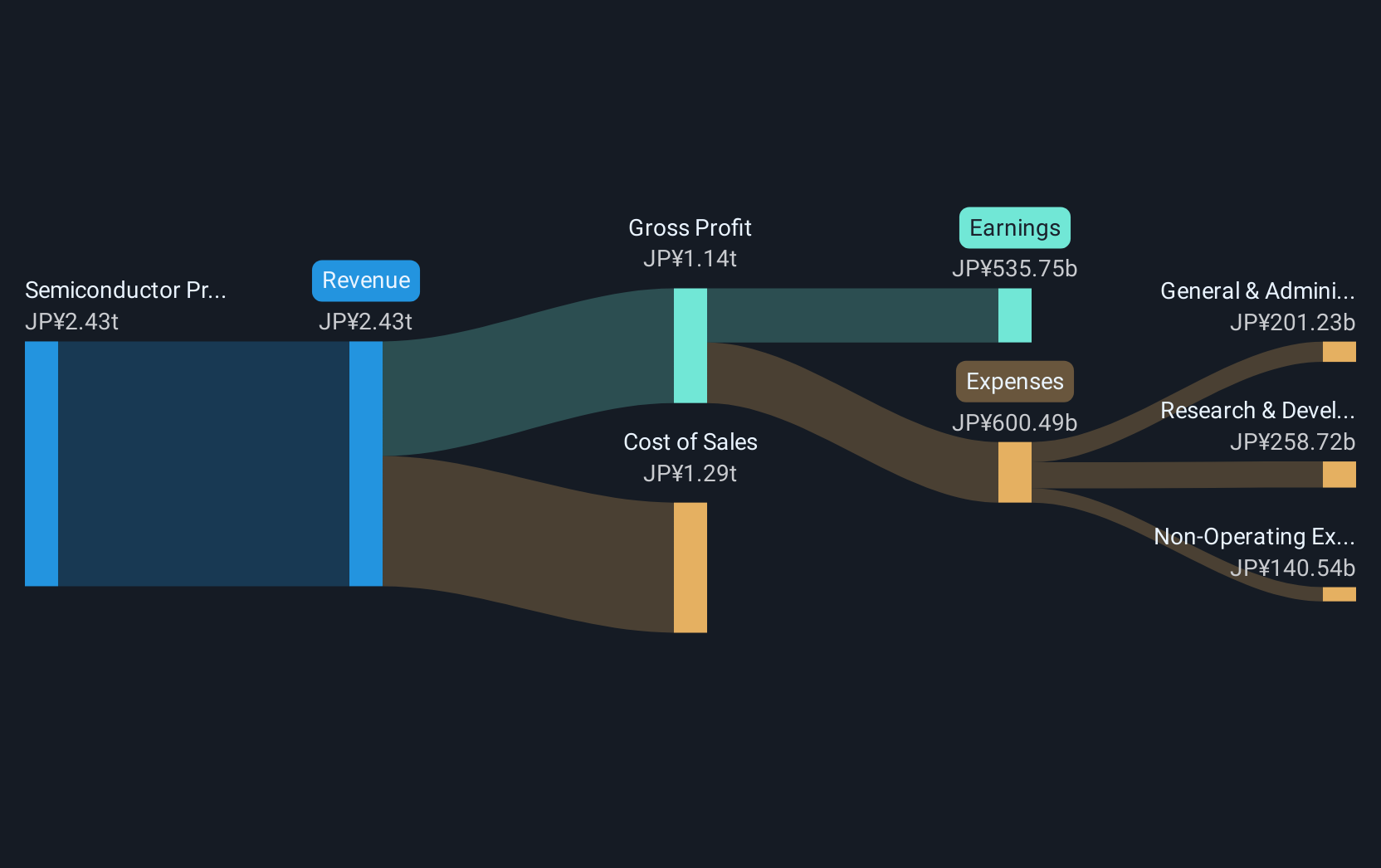

TSE:8035 Revenue & Expenses Breakdown as at Sep 2025

TSE:8035 Revenue & Expenses Breakdown as at Sep 2025

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

The recent progress with JOINT3 has created significant buzz, not only lifting Tokyo Electron’s shares by 11.6%, but also energizing investor sentiment regarding its prospects within the semiconductor sector. This collaboration positions Tokyo Electron to potentially benefit from robust demand for advanced semiconductor tools, aligning with their narrative of growth driven by digital transformation trends. Analysts remain optimistic about favorable revenue and earnings forecasts, as the company’s ongoing innovation supports recurring revenue and margin stability amidst temporary investment delays. With a revenue of ¥2.43 trillion and earnings of ¥535.75 billion, the new initiative is expected to bolster the company’s top-line and earnings growth trajectory.

Over the last five years, Tokyo Electron’s total return, including dividends, was 192.78%. This performance illustrates a substantial increase amid ongoing digital and technological advancements, contrasting with its underperformance against both the JP Semiconductor industry and the broader JP market over the past year. Despite this, the 23% discount between the current share price of ¥22,585.00 and the consensus price target of ¥27,499.09 highlights potential for upward movement, reflecting analyst confidence in the long-term viability of Tokyo Electron amid emerging technology trends.

Click here to discover the nuances of Tokyo Electron with our detailed analytical financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we’re here to simplify it.

Discover if Tokyo Electron might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free Analysis

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

AloJapan.com