Japan Anti-aging Products Market Trends

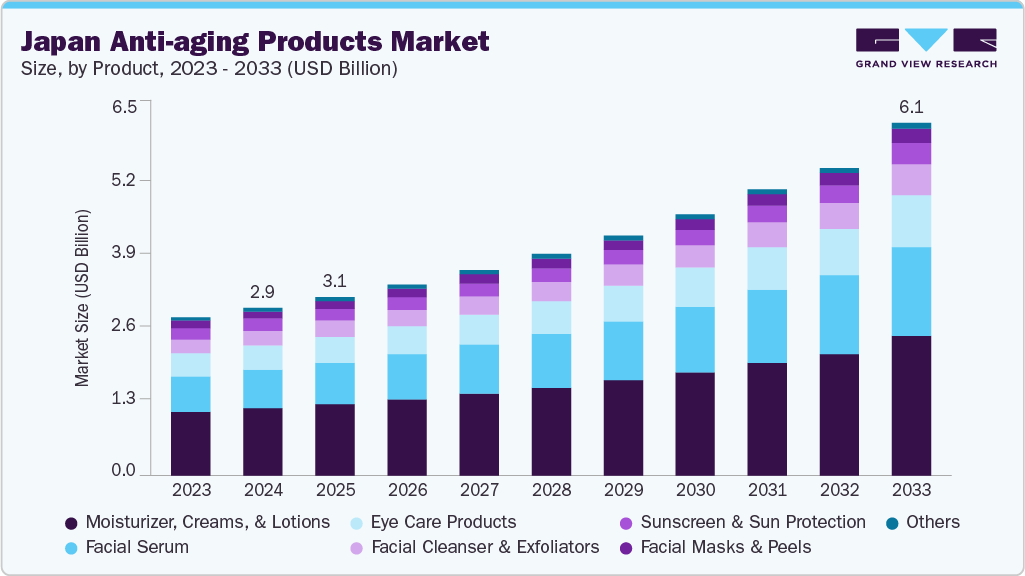

The Japan anti-aging products market size was estimated at USD 2,919.7 million in 2024 and is expected to reach USD 6,147.3 millionby 2033, growing at a CAGR of 8.9% from 2025 to 2033. Japan’s aging population and a culturally ingrained emphasis on skincare are driving demand for advanced anti-aging solutions in cosmetic industry. Consumers increasingly seek high-efficacy, multifunctional products rooted in modern biotechnology and traditional ingredients. The market is also expanding due to rising interest in men’s grooming, gender-neutral formulations, and minimalist beauty routines, prioritizing long-term skin health, convenience, and visible results.

Japanese beauty consumers increasingly adopt skinimalism, a trend emphasizing simplified skincare routines using fewer but more effective products. This shift reflects a growing preference for high-performance, multi-functional formulations that deliver visible results while reducing unnecessary steps. Instead of elaborate multi-step regimens, users now focus on essentials supporting skin barrier health, hydration, and time-efficient anti-aging. For instance, Hada Labo’s Gokujyun Alpha Lotion combines intense hydration with anti-aging benefits, serving as both a toner and moisturizer in one.

Fermented skincare is a growing trend in Japan, rooted in the country’s long-standing connection with nature and traditional wellness practices. The fermentation process breaks down natural ingredients like rice bran, sake, and soy, making their nutrients more bioavailable and easier for the skin to absorb. These bioactive compounds help brighten skin tone, improve elasticity, and support a healthy skin microbiome, making them especially effective for anti-aging. A well-known example is the SK-II Facial Treatment Essence, which features Pitera, fermented yeast extract rich in amino acids, vitamins, and minerals that promote radiant, youthful-looking skin.

Wabi-sabi beauty, rooted in the Japanese philosophy of embracing imperfection and simplicity, is increasingly influencing contemporary makeup trends in Japan. This approach emphasizes a refined, natural aesthetic over bold or dramatic styles, highlighting features such as a dewy complexion, soft blush, minimal eye makeup, and sheer, understated lip color. The overall effect is an effortless elegance that enhances an individual’s natural appearance rather than concealing it.

Japanese brands increasingly prioritize sustainability by adopting refillable packaging, biodegradable materials, and ethically sourced botanical ingredients. There is also a marked preference for clean formulations free from parabens, synthetic fragrances, and other potentially harmful substances. This shift reflects a broader cultural alignment with the values of ecological responsibility and harmony with nature. For instance, FANCL’s Mild Cleansing Oil has a preservative-free formulation, environmentally conscious packaging, and a minimalist ingredient profile.

Consumer Insights & Surveys

There is an increasing trend among younger generations, particularly Gen Z and Millennials, to adopt anti-aging products earlier than previous generations. This trend is driven by a desire for preventive solutions rather than corrective ones, with consumers increasingly seeking multi-functional products like moisturizers that provide hydration, sun protection, and anti-aging benefits in a single formulation. Sustainability is one of the key preferences for younger generations. According to the 2024 survey, 73% of Gen Z shoppers in Japan are willing to pay more for sustainable brands.

Japanese beauty consumers are increasingly recognized for their technological sophistication. They actively embrace innovations such as virtual try-on tools and personalized product recommendations as part of the overall beauty experience.

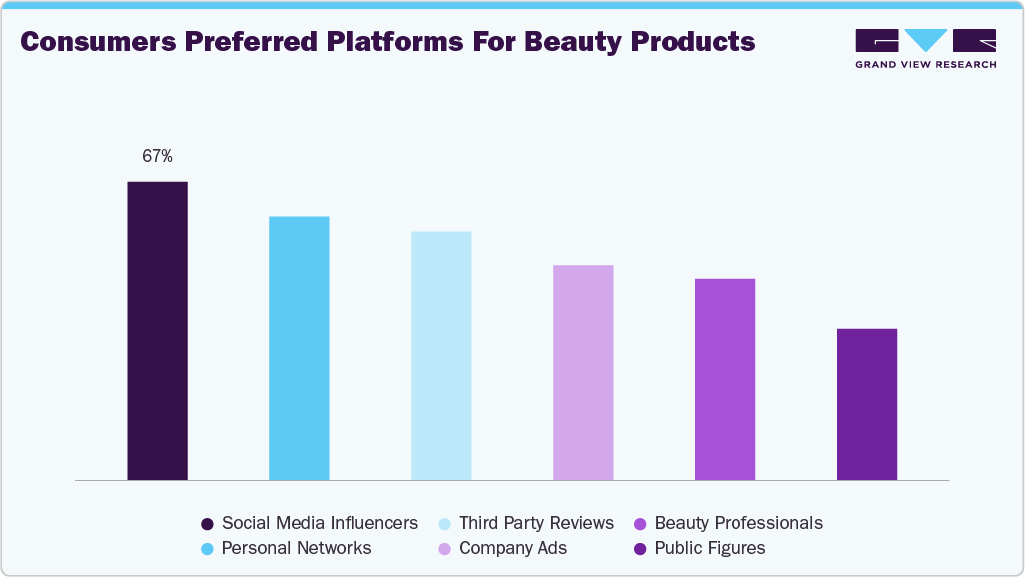

In addition, the widespread use of social media and influencer marketing plays a significant role in driving the popularity of beauty products in Japan. Approximately 80% of beauty shoppers engage with Instagram daily, and 67% report relying on influencers to discover and explore new beauty offerings.

Product Insights

Moisturizer, creams, & lotions accounted for the revenue share of 39.79% of Japan anti-aging products market in 2024, due to their integral role in daily skincare routines and widespread usage across all age groups. These products are valued for their multi-functional properties. The rising demand is also linked to advancements in dermatological research and product innovation. With continuous scientific breakthroughs, skincare formulations have become more effective, utilizing high-performance ingredients such as hyaluronic acid, peptides, collagen boosters, and plant-based extracts. For instance, Shiseido’s Benefiance Wrinkle Smoothing Cream is a widely used anti-aging moisturizer in Japan, formulated with ReNeura Technology+ and Kombu-Bounce Complex to address fine lines, dryness, and skin elasticity effectively.

The demand for facial serum is projected to grow at a CAGR of 9.8% from 2025 to 2033 in Japan anti-aging product industry. Facial serums are concentrated formulations designed to deliver powerful active ingredients deep into the skin, making them particularly effective for targeting specific concerns such as fine lines, wrinkles, dullness, and dryness. Furthermore, the rise of skincare awareness has encouraged many women to adopt more personalized and structured routines based on specific skin concerns, driving interest in professional-grade and dermatologically tested products. In contrast, men have typically followed simpler regimens focused on cleansing and moisturizing. These differences are influenced by variations in skin biology, lifestyle, and product preferences, with women often engaging in multi-step routines that include cleansing, toning, serums, moisturizers, sun protection, and specialized treatments such as vitamin C serums.

Distribution Channel Insights

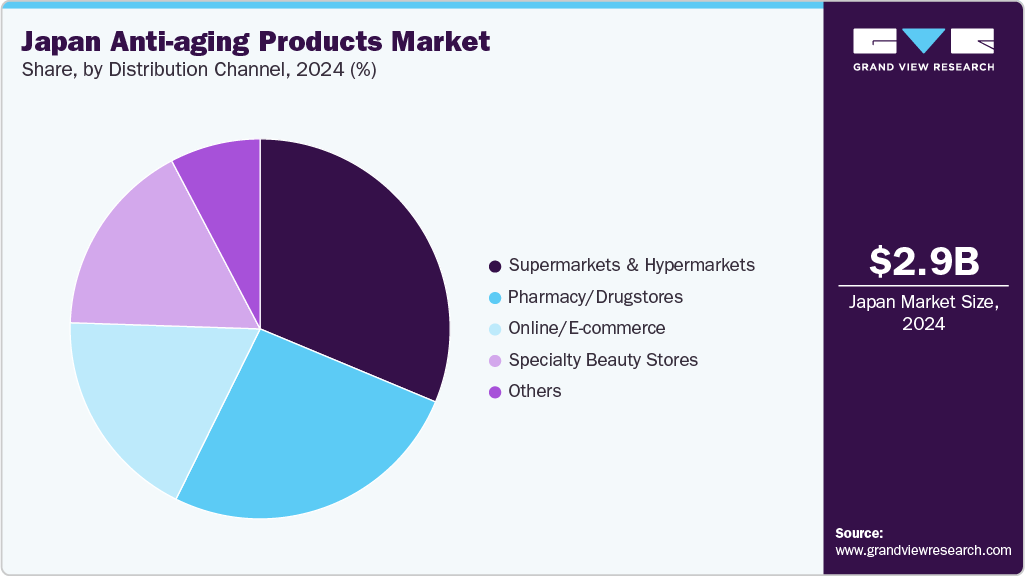

The sale of anti-aging products in Japan through supermarkets and hypermarkets accounted for a revenue share of 31.28% in 2024. Supermarkets and hypermarkets offer a wide selection of anti-aging skincare, haircare, and wellness products from multiple brands, enabling consumers to compare products and make well-informed purchasing choices. Furthermore, the growing awareness of personal care and wellness has contributed to the rising demand for anti-aging products in supermarkets and hypermarkets. With a shift in consumer preferences towards preventive skincare and age-defying solutions, these retail chains have expanded their offerings to include organic, dermatologically tested, and clinically approved products. The ability to physically inspect and test products before purchase also enhances the shopping experience, making these outlets a preferred distribution channel for anti-aging products.

The sale of anti-aging products in Japan through online/E-commerce retail channels is expected to grow at a CAGR of 10.6% from 2025 to 2033. The rising demand for convenience has significantly boosted the popularity of online and e-commerce channels in the industry. With increasing digital access, consumers prefer browsing, comparing, and purchasing skincare products from home, supported by detailed product information, reviews, and competitive pricing. Social media and digital marketing, through influencer partnerships, targeted ads, and promotional campaigns, further drive online sales by making product discovery easier and more engaging. As a result, e-commerce continues to play a pivotal role in the growth of the anti-aging market.

Key Japan Anti-aging Products Company Insights

The anti-aging products market in Japan is marked by the presence of both established global players and innovative domestic brands, all aiming to cater to consumers’ sophisticated and evolving demands. To maintain a competitive edge, leading companies heavily invest in product innovation, incorporating cutting-edge ingredients, biotechnological advancements, and dermatological research into their skincare formulations.

Kao Corporation is one of Japan’s leading consumer goods companies, recognized for its strong skincare and anti-aging market presence. Founded in 1887 and headquartered in Tokyo, Kao has developed a diverse portfolio of skincare brands, including Sofina, Curel, Biore, and est, catering to mass-market and premium consumers. The company emphasizes advanced dermatological research, particularly in moisturizing and barrier-repair technologies, making its products especially suitable for sensitive and aging skin.

Fancl Corporation is a prominent Japanese skincare and health supplement company known for its preservative-free and additive-free formulations. Founded in 1980 and headquartered in Yokohama, Fancl has built a strong reputation for offering gentle yet effective skincare products that cater to sensitive skin, including anti-aging solutions. The brand emphasizes scientific research and safety, maintaining skin barrier health, and preventing premature aging. Its anti-aging lines, such as the Fancl Enrich+ series, incorporate cutting-edge ingredients like collagen boosters and antioxidants to improve skin elasticity and reduce fine lines.

Key Japan Anti-aging Products Companies:

Kao Corporation

Pola Orbis Holdings Inc.

Shiseido Co.,Ltd.

The Procter & Gamble Company

Fancl Corporation

Decencia Inc.

Beiersdorf AG

Henkel AG

Hada Labo Tokyo

DHC Corporation

Recent Developments

In June 2025, Shiseido introduced a new-generation anti-aging serum called Slow Ageing Cycle Serum. The serum addresses skin concerns caused by internal and external stressors. The product supports the skin’s natural regenerative cycle and is a key innovation in Shiseido’s strategy to lead the anti-aging segment. This serum blends advanced dermatological science with holistic skincare principles to help maintain youthful skin longer.

In January 2025, Shiseido’s luxury brand Clé de Peau Beauté launched Serum Vitalité Au Précieux, an anti-aging serum infused with 24K Gold Retinol GL Complex and Radiant Lily Extract GL. Designed for women with active lifestyles, the serum aims to restore skin vitality by enhancing hydration, strengthening the moisture barrier, and protecting against environmental stressors. Its luxurious texture and floral fragrance offer a premium skincare experience that boosts radiance, firmness, and elasticity over time.

In October 2024, Japanese beauty tech brand Ya-Man launched a new skincare product featuring 24K gold microneedles. The product aims to enhance skin regeneration and the absorption of active ingredients. The innovation reflects the brand’s focus on combining dermatological science with luxury beauty. The microneedles dissolve into the skin, delivering anti-aging benefits such as improved elasticity and hydration. This launch aligns with Japan’s rising demand for high-efficacy, tech-driven skincare.

In September 2024, Epionce introduced its Intense Recharge Mask, a new anti-aging skincare product designed to revitalize and restore fatigued skin. The mask delivers antioxidant-rich hydration and targets signs of aging, such as fine lines and dullness. Formulated with botanical ingredients and barrier-repairing actives, it is suitable for all skin types and supports overnight skin recovery. This launch reflects Epionce’s commitment to science-backed, dermatology-focused skincare.

In September 2024, Estée Lauder launched a new skincare line, Aqua Charge, in Japan. Developed and produced locally, the range includes serum, cream, and lotion, all designed for sensitive skin. The brand collaborated with sake brewery Yushin Shuzo to incorporate Rice Power, a fermented rice extract known to boost skin hydration and improve moisture retention. The products feature Self-Hydro Technology and contain Japan-approved quasi-drug ingredients with clinically tested anti-aging benefits. This initiative reflects Estée Lauder’s strategy of blending Eastern and Western skincare innovations.

Japan Anti-aging Products Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3,108.7 million

Revenue forecast in 2033

USD 6,147.3 million

Growth rate (Revenue)

CAGR of 8.9% from 2025 to 2033

Actual data

2021 – 2024

Forecast period

2025 – 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel

Country scope

Japan

Key companies profiled

Kao Corporation; Pola Orbis Holdings Inc.; Shiseido Co.,Ltd.; The Procter & Gamble Company; Fancl Corporation; Decencia Inc.; Beiersdorf AG; Henkel AG; Hada Labo Tokyo; DHC Corporation.

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Japan Anti-aging Products Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Japan anti-aging products market report based on product and distribution channel:

Product Outlook (Revenue, USD Million, 2021 – 2033)

Facial Serum

Moisturizer, Creams, & Lotions

Eye Care Products

Facial Cleanser & Exfoliators

Facial Masks & Peels

Sunscreen & Sun Protection

Others (Facial Oil, Lip Care Products, etc.)

Distribution Channel Outlook (Revenue, USD Million, 2021 – 2033)

Supermarkets & Hypermarkets

Pharmacy/Drugstores

Specialty Beauty Stores

Online/E-commerce

Others (Department Stores, etc.)

AloJapan.com