Kanematsu (TSE:8020) is participating in the Tokyo Metropolitan Government’s eVTOL aircraft demonstration project. The company is involved in installing and operating vertiport infrastructure for Tokyo’s first eVTOL demonstration flights. The project is being carried out in collaboration with SkyDrive and Mitsubishi Estate.

Kanematsu, trading at ¥2,073.5, is taking a direct role in urban air mobility through this vertiport initiative. For investors, the move comes after very large 3 year and 5 year share price gains and a 64.3% return over the past year, which together indicates that the market has already reassessed the company in light of recent developments.

The eVTOL project links Kanematsu to a potential new segment of urban transport infrastructure, which may be important if this mode of travel gains wider use. As this is an early stage initiative, the key questions for investors are how repeatable these projects are and whether they develop into meaningful, scalable business lines over time.

Stay updated on the most important news stories for Kanematsu by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Kanematsu.

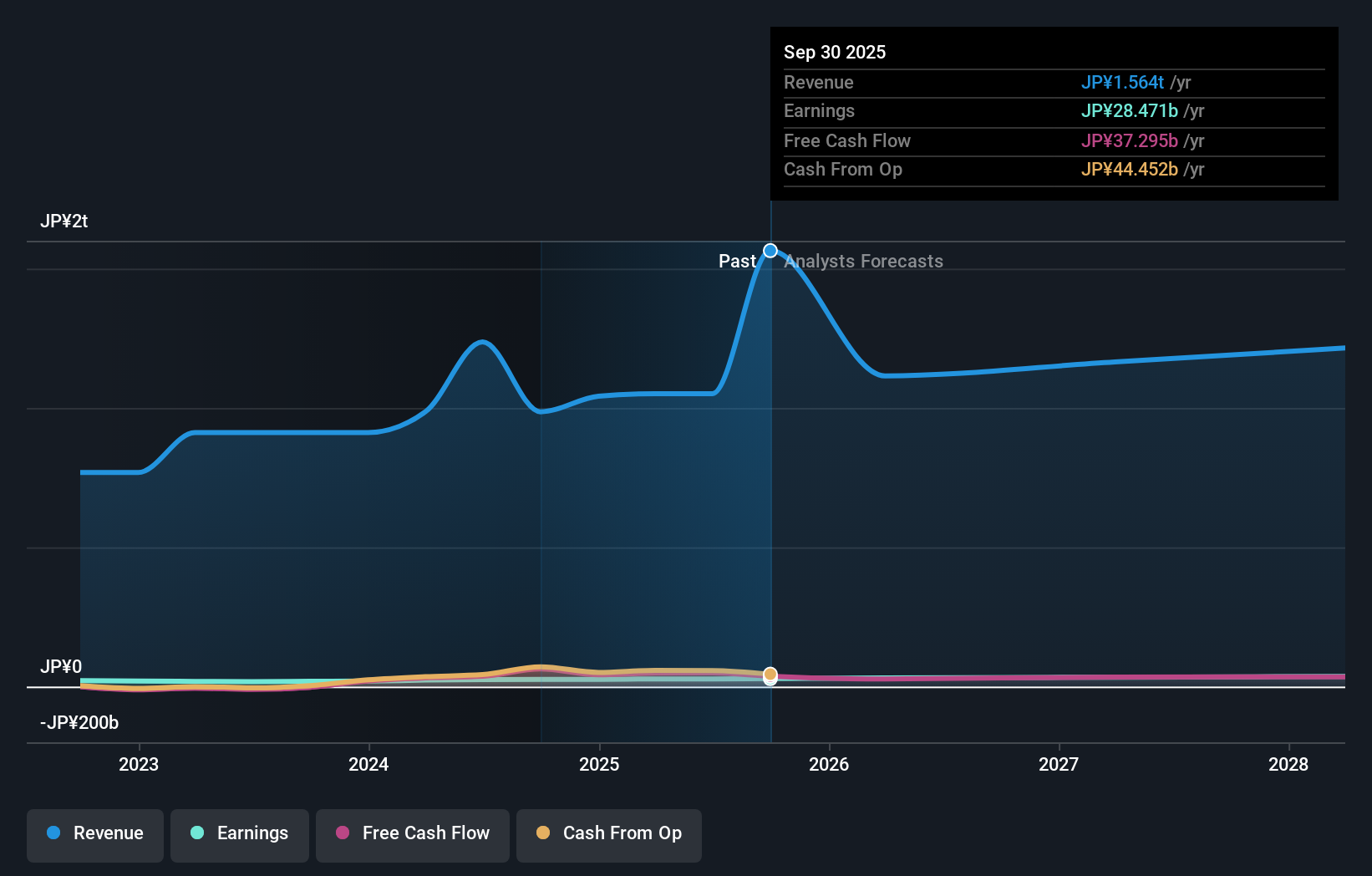

TSE:8020 Earnings & Revenue Growth as at Feb 2026

TSE:8020 Earnings & Revenue Growth as at Feb 2026

How Kanematsu stacks up against its biggest competitors

Quick Assessment ✅ Price vs Analyst Target: At ¥2,073.5 vs a ¥2,602.5 target, the price sits about 25% below the analyst view. ✅ Simply Wall St Valuation: Our model flags the shares as trading 32.4% below estimated fair value. ✅ Recent Momentum: The 30 day return of 10.82% suggests the stock has had a strong recent run.

Check out Simply Wall St’s

in depth valuation analysis for Kanematsu.

Key Considerations 📊 The eVTOL collaboration links Kanematsu to urban air mobility infrastructure, which could broaden its transport related revenue sources over time. 📊 Watch how management discloses eVTOL related contracts, capital spend and profitability, along with any follow on projects with SkyDrive and Mitsubishi Estate. ⚠️ A net profit margin of 1.8% and a high debt position mean new projects need disciplined returns so they do not strain the balance sheet. Dig Deeper

For the full picture including more risks and rewards, check out the

complete Kanematsu analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we’re here to simplify it.

Discover if Kanematsu might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free Analysis

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

AloJapan.com