Revised earnings guidance puts Hokkaido Electric in focus

Hokkaido Electric Power Company (TSE:9509) updated its earnings guidance for the fiscal year ending March 31, 2026, flagging expected operating revenue of ¥867,000 million and operating income of ¥59,000 million.

The company also guided for profit attributable to owners of parent of ¥28,000 million and basic earnings per share of ¥129.49. These figures give investors additional context to reassess how the current share price lines up with expected profitability.

See our latest analysis for Hokkaido Electric Power Company.

The updated guidance lands after a weak short term stretch, with a 1 day share price return of 4.67% decline and a year to date share price return of 9.09% decline. However, longer term performance remains strong, with a 1 year total shareholder return of 38.63% and a 5 year total shareholder return of 141.86%, suggesting earlier momentum has cooled recently.

If this kind of guidance update has you rethinking your watchlist, it could be a good moment to broaden your search and check out fast growing stocks with high insider ownership.

With the shares recently weaker and guidance pointing to earnings of ¥129.49 per share, the key question is whether Hokkaido Electric still trades at a discount or if the market is already pricing in future growth.

Price-to-earnings of 3.6x: Is it justified?

On a P/E of 3.6x at a last close of ¥1,000, Hokkaido Electric looks cheap relative to both the wider Japanese market and the Asian electric utilities industry.

The P/E ratio compares the current share price to earnings per share, so a lower figure can indicate the market is putting a modest value on each unit of profit. For a regulated utility with steady demand for electricity, that kind of discount can catch the eye of investors who focus on earnings based measures.

Here, the company trades on a P/E of 3.6x compared with about 16.1x for the Asian electric utilities industry and 14.7x for the broader JP market, which is a wide gap. It also sits below an estimated fair P/E of 9.9x, a level the market could move towards if sentiment shifts or earnings hold up in line with forecasts.

Explore the SWS fair ratio for Hokkaido Electric Power Company

Result: Price-to-earnings of 3.6x (UNDERVALUED)

However, the low P/E could also reflect concerns around regulated returns, future electricity demand, or the way Hokkaido Electric balances capital spending with profitability.

Find out about the key risks to this Hokkaido Electric Power Company narrative.

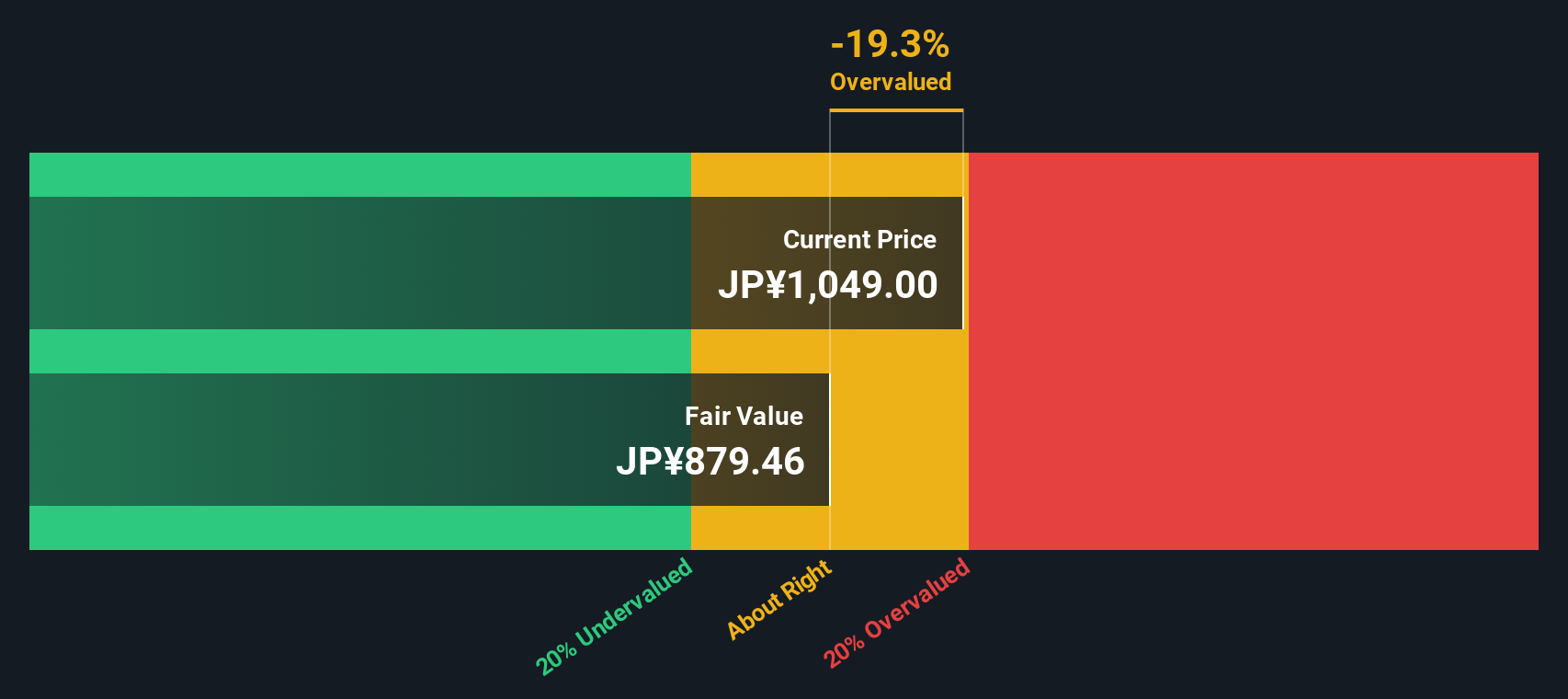

Another view using our DCF model

While the 3.6x P/E suggests Hokkaido Electric looks cheap, our DCF model indicates a different picture. At ¥1,000 the shares sit above our estimated future cash flow value of ¥879.46, which implies less margin for error if earnings or cash generation soften.

Look into how the SWS DCF model arrives at its fair value.

9509 Discounted Cash Flow as at Feb 2026

9509 Discounted Cash Flow as at Feb 2026

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Hokkaido Electric Power Company for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 887 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match – so you never miss a potential opportunity.

Build Your Own Hokkaido Electric Power Company Narrative

If you are not fully aligned with this take, or simply prefer to rely on your own work, you can test the same data yourself and shape a personalised view in just a few minutes with Do it your way.

A great starting point for your Hokkaido Electric Power Company research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Hokkaido Electric has sharpened your interest, do not stop here, broaden your radar so you are not missing opportunities that better fit your style.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we’re here to simplify it.

Discover if Hokkaido Electric Power Company might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free Analysis

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

AloJapan.com