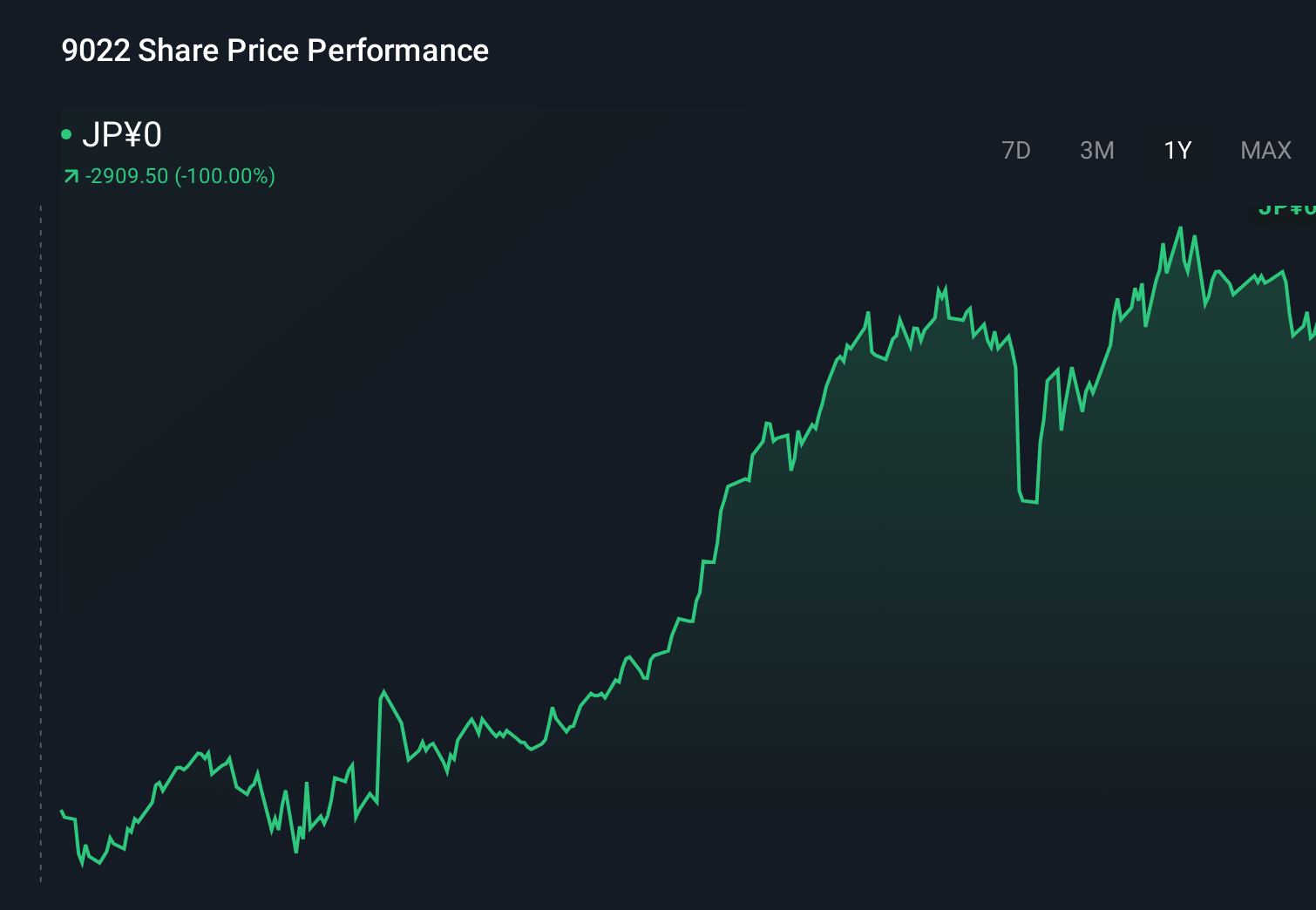

If you are wondering whether Central Japan Railway shares still offer value after recent attention, it helps to step back and consider what the current price reflects. The stock is trading at ¥4,307 after a 1.1% gain over the last 7 days, with a 50.4% return over 1 year and a 43.6% return over 3 years, alongside a 0.7% decline over 30 days and a 1.9% decline year to date. Recent news coverage has focused on Central Japan Railway as a key transport operator in Japan and its role in broader market discussions about rail and infrastructure companies. This context has kept the stock on the radar of investors who are weighing long term demand for rail services against current pricing. On our framework of 6 valuation checks, Central Japan Railway scores 3 out of 6. This suggests there may be some areas that point to value and others that call for a closer look. Next, we will compare several common valuation approaches before finishing with a perspective that can help you bring these methods together.

Central Japan Railway delivered 50.4% returns over the last year. See how this stacks up to the rest of the Transportation industry.

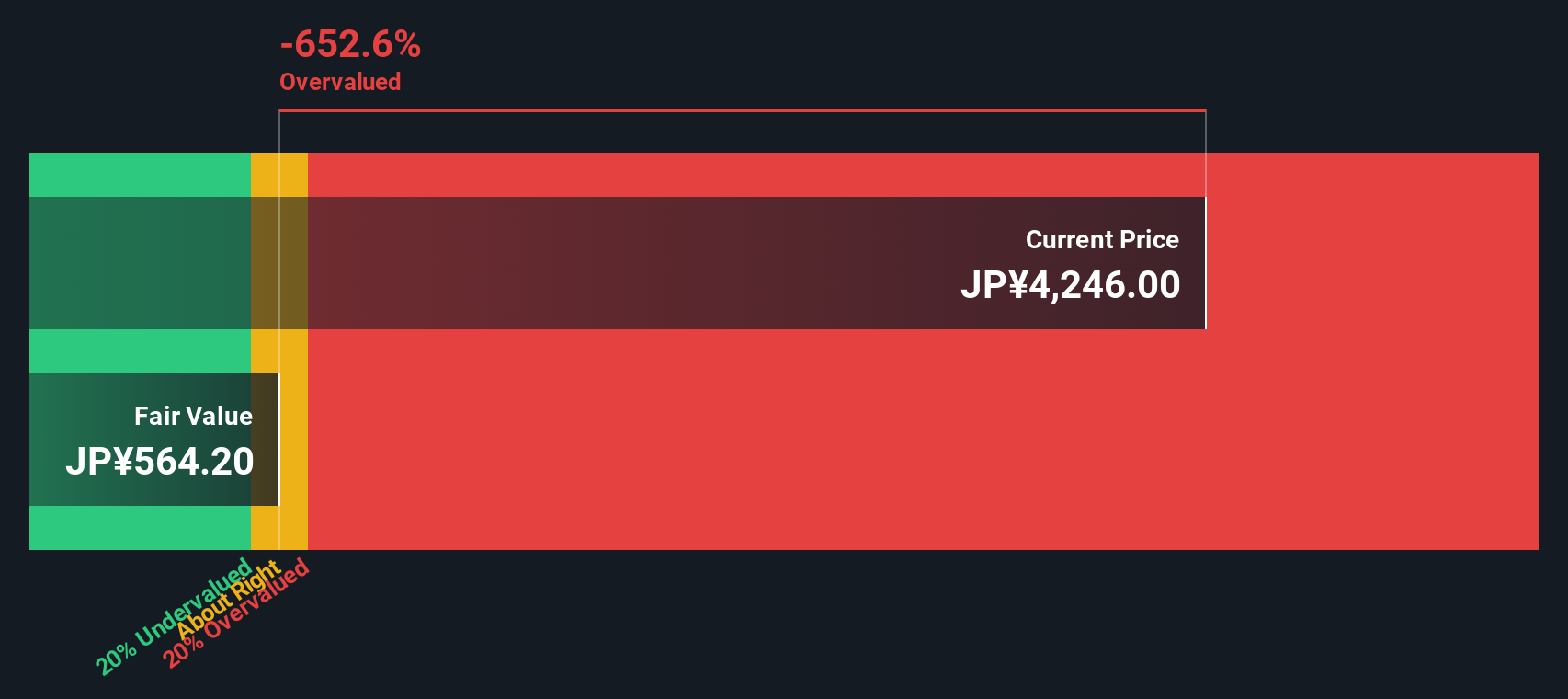

Approach 1: Central Japan Railway Dividend Discount Model (DDM) Analysis

The Dividend Discount Model looks at what a stock might be worth based on the dividends investors expect to receive, adjusted back to today. It is essentially asking whether the current share price is reasonable given the level and growth of future dividends.

For Central Japan Railway, the latest dividend per share used in the model is ¥33.95. The company’s return on equity in this framework is 9.68%, with a payout ratio of 7.17%. The long term dividend growth rate has been capped at 0.60%, even though the model’s underlying expected growth input is 8.99%. That cap is intended to keep the dividend outlook conservative and more sustainable over time.

Putting those inputs together, the DDM output suggests an intrinsic value of ¥564.32 per share. Compared with the current share price of ¥4,307, the model indicates the stock is very significantly overvalued, with an implied overvaluation of about 7x according to this approach.

Result: OVERVALUED

Our Dividend Discount Model (DDM) analysis suggests Central Japan Railway may be overvalued by 663.2%. Discover 873 undervalued stocks or create your own screener to find better value opportunities.

9022 Discounted Cash Flow as at Jan 2026

9022 Discounted Cash Flow as at Jan 2026

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Central Japan Railway.

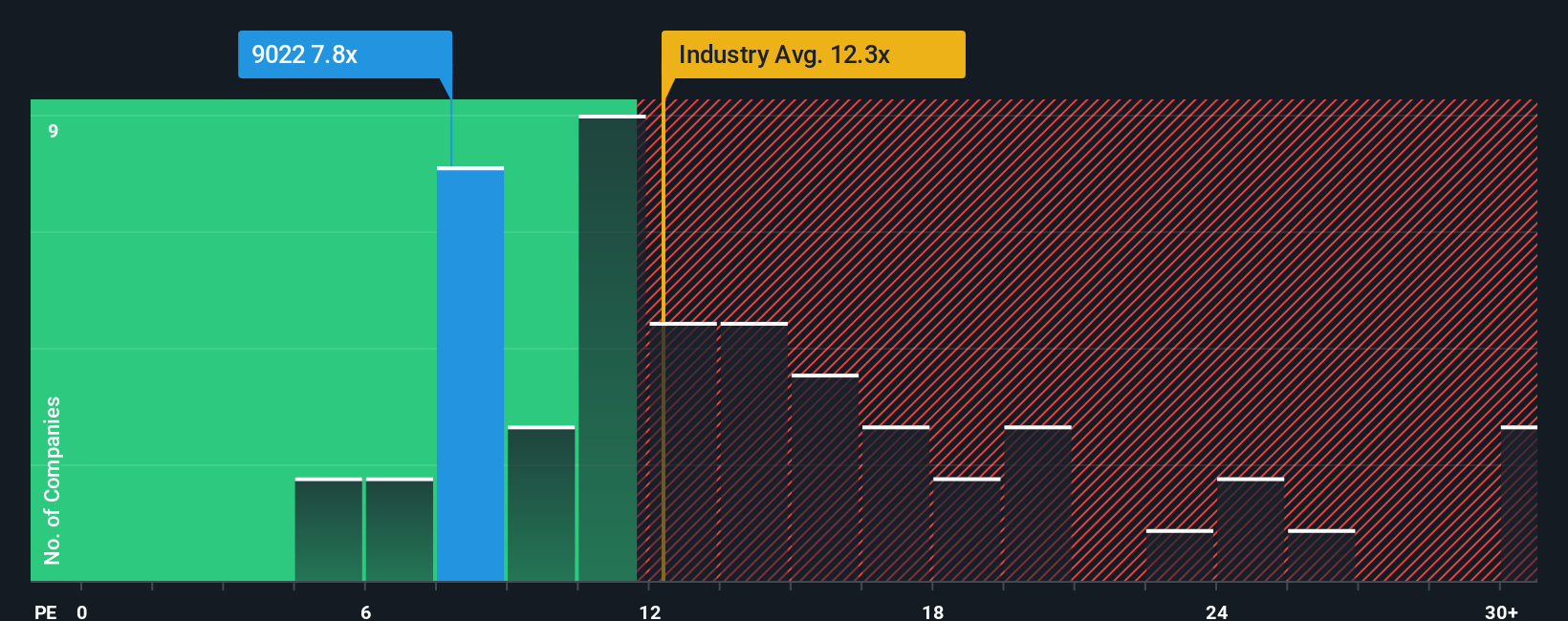

Approach 2: Central Japan Railway Price vs Earnings

For a profitable company like Central Japan Railway, the P/E ratio is a useful way to think about what you are paying for each unit of earnings. It gives a quick sense of how the market currently values those earnings in relation to other companies and to what might be considered typical for the business.

What counts as a reasonable P/E usually reflects how the market views a company’s growth potential and risk. Higher expected growth or lower perceived risk can support a higher P/E, while slower expected growth or higher risk often lines up with a lower multiple. With Central Japan Railway, the current P/E is 7.90x. That sits below the Transportation industry average of 12.25x and below the peer average of 14.00x.

Simply Wall St’s Fair Ratio is a proprietary estimate of what P/E might make sense for Central Japan Railway, given its earnings profile, industry, profit margins, market cap and risk factors. For this stock, the Fair Ratio sits at 17.30x, which aims to be more tailored than a simple comparison with peers or the industry because it incorporates company specific characteristics. Set against the current P/E of 7.90x, this framework characterizes Central Japan Railway as undervalued on this measure.

Result: UNDERVALUED

TSE:9022 P/E Ratio as at Jan 2026

TSE:9022 P/E Ratio as at Jan 2026

P/E ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1417 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Central Japan Railway Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is simply your story about a company, where you connect your view of its business with your own assumptions for future revenue, earnings and margins, and then translate that into a fair value. On Simply Wall St, Narratives sit inside the Community page and give you an easy tool to link a company’s story to a forecast and then to a number you can compare with today’s share price. That comparison between your Fair Value and the current Price can help you decide whether a stock belongs on your watchlist or whether it might be closer to something you would consider selling. Narratives on the platform update automatically when new information such as news or earnings is added, so your view is always tied to the latest data without extra effort. For Central Japan Railway, one investor might build a Narrative that focuses on long term passenger demand and assigns a higher fair value, while another might stress regulatory or cost risks and settle on a much lower fair value.

Do you think there’s more to the story for Central Japan Railway? Head over to our Community to see what others are saying!

TSE:9022 1-Year Stock Price Chart

TSE:9022 1-Year Stock Price Chart

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Explore Now for Free

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

AloJapan.com