Softer January Tokyo inflation data eases pressure on the BoJ to hike rates again soon, despite a still-tight labour market.

Summary:

Tokyo inflation slowed across headline, core and underlying measures in January, undershooting expectations.

Core CPI eased back to 2.0%, while the ex-food-and-energy gauge also moderated, signalling softer demand-driven price pressure.

The data reduces urgency for further Bank of Japan rate hikes after December’s move to a 30-year high.

Labour market conditions remain firm, with unemployment steady and job availability slightly improving.

Policymakers remain vigilant, but the data supports a cautious, data-dependent policy path.

Japanese inflation pressures showed further signs of cooling at the start of the year, with January Tokyo consumer price data coming in softer across key measures and easing near-term pressure on the Bank of Japan to press ahead with additional rate increases.

Headline Tokyo CPI slowed to 1.5% year-on-year in January, down from 2.0% in December. Core inflation, which excludes fresh food, also eased, rising 2.0% from a year earlier compared with a market forecast of 2.2% and a prior reading of 2.3%. The moderation brings core inflation back in line with the BoJ’s 2% target, after several months of firmer outcomes.

More importantly for policymakers, the Tokyo CPI excluding both fresh food and energy — a gauge closely watched by the BoJ as a measure of demand-driven inflation — rose 2.4% year-on-year, slowing from 2.6% previously. A separate measure excluding food and energy was reported at 2.0%, down from 2.3%, reinforcing the signal that underlying price momentum is cooling rather than re-accelerating.

Tokyo inflation data is seen as a leading indicator for nationwide CPI trends, and the January figures suggest that the recent inflation pulse may be losing some traction. This comes after the BoJ raised interest rates to 0.75% in December, the highest level in around 30 years, marking another step away from decades of ultra-loose monetary policy.

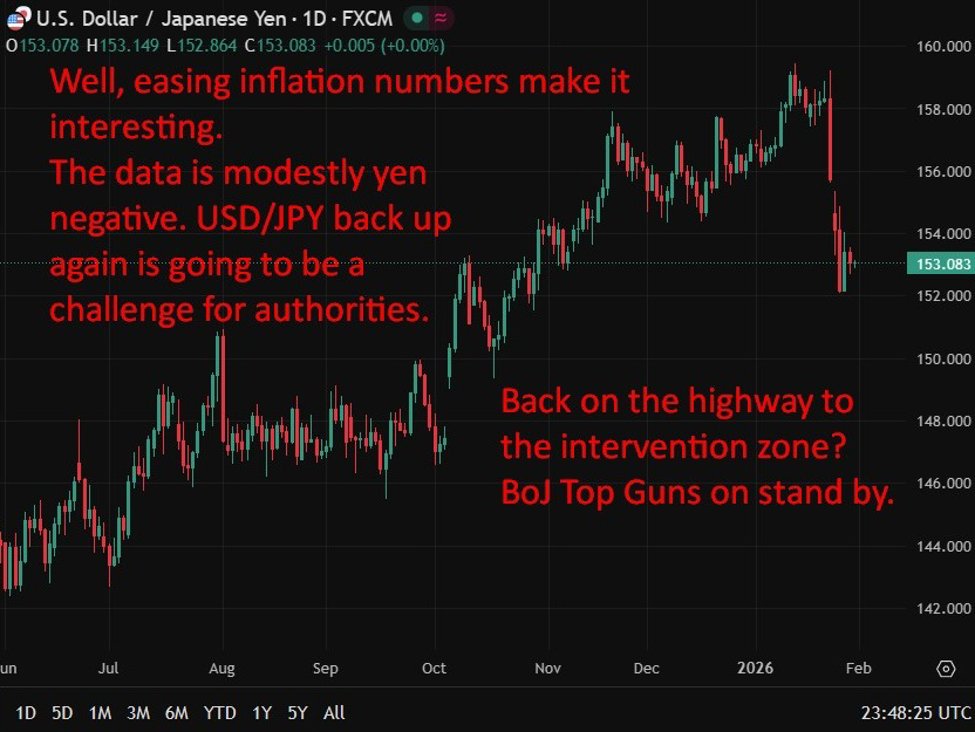

While the central bank retained a hawkish tone in its latest communications and stressed vigilance toward inflation risks linked to a weak yen, the softer Tokyo readings reduce the urgency for immediate follow-up tightening. Instead, they support the BoJ’s preference for a gradual, data-dependent approach as it assesses whether inflation can be sustained around target without continued policy support.

Labour market data released alongside the CPI figures remained stable. Japan’s unemployment rate held at 2.6% in December, matching expectations and unchanged from the previous month. The jobs-to-applicants ratio edged up to 1.19 from 1.18, signalling ongoing tightness in the labour market and steady demand for workers.

For markets, the combination of easing inflation momentum and firm employment conditions points to a slower normalisation path. While further rate hikes remain on the table later in the year, January’s Tokyo CPI data suggests the BoJ can afford to move cautiously rather than act with urgency.

USD/JPY back up into the intervention danger zone soon? I guess so!

AloJapan.com