Company Logo

Key market opportunities include the rise of AI-driven manufacturing, growing demand for EVs enhancing use of precise coatings, trends towards sustainable processes, and tech advances like dripless and high-precision plating

Semiconductor Plating System Market

Semiconductor Plating System Market · GlobeNewswire Inc.

Dublin, Jan. 28, 2026 (GLOBE NEWSWIRE) — The “Semiconductor Plating System Market Report 2026” has been added to ResearchAndMarkets.com’s offering.

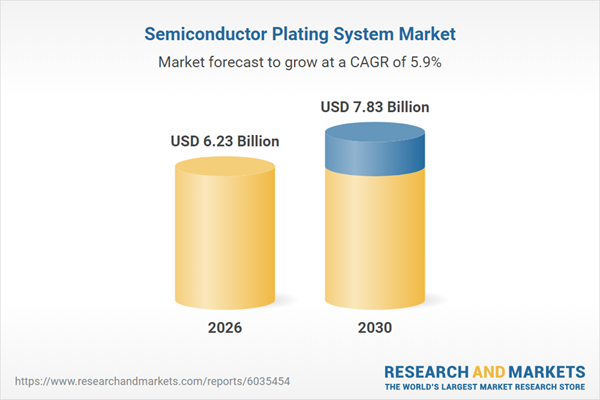

The semiconductor plating system market has witnessed robust growth in recent years, expanding from $5.86 billion in 2025 to a projected $6.23 billion in 2026, reflecting a compound annual growth rate (CAGR) of 6.2%. This uptick is driven by increased demand for integrated circuits, the expansion of semiconductor fabrication, advancements in electroplating technology, and the growth of consumer electronics.

Looking forward, the market is anticipated to grow to $7.83 billion by 2030, with a CAGR of 5.9%. Key drivers include the adoption of 3D packaging, AI-driven semiconductor manufacturing, high-performance computing chips, automotive electronics, and the need for environmentally friendly plating processes. Trends such as automation, high-precision deposition, and component miniaturization are expected to dominate the forecast period.

The rising adoption of electric vehicles (EVs) significantly boosts the semiconductor plating system market. EVs rely on semiconductor plating systems to enhance power management, battery control, and electronic systems, thereby improving conductivity and reliability. As reported in January 2024 by the U.S. Energy Information Administration, hybrid, plug-in hybrid, and battery electric vehicles made up 16.3% of total U.S. light-duty vehicle sales in 2023, up from 12.9% in 2022, showcasing growing consumer demand for sustainable transportation.

Major industry players are investing in advanced technologies like dripless plating to enhance process efficiency and environmental sustainability. For instance, ACM Research introduced the Ultra ECDP electrochemical deplating tool in September 2025. This tool supports advanced packaging flows for copper pillar and UBM processes, offering improved uniformity and reduced undercut.

In a strategic move, DuPont de Nemours Inc. partnered with YMT Co., Ltd. in September 2023 to advance high-end PCB material solutions. This collaboration focuses on enhancing service responsiveness and delivering comprehensive solutions for advanced segments, such as IC substrates and high-density interconnects.

However, global trade relations and tariffs present challenges, affecting costs and supply chains, particularly in Asia-Pacific regions like China and Taiwan. Nonetheless, these challenges also encourage local manufacturing and innovation in plating technologies that may fortify regional resilience.

Leading companies such as Applied Materials Inc., Solvay SA, and Tokyo Electron Limited are capitalizing on these opportunities to foster market growth. The report also covers essential market statistics, industry trends, regional shares, and in-depth analysis of current and future industry scenarios.

The semiconductor plating system market is characterized by the presence of metal deposition chambers, photoresist coatings, and post-processing equipment, with values representing the revenues gained from the sale of goods and services within specific geographic markets.

Asia-Pacific led the market in 2025, with North America expected to experience rapid growth. The covered regions include Asia-Pacific, South East Asia, Western and Eastern Europe, North and South America, the Middle East, and Africa. The report provides a comprehensive analysis, essential for navigating the evolving landscape of the semiconductor plating system industry.

Research Coverage:

The market characteristics section addresses key products and services, brand differentiation, product features, and innovation trends.

The supply chain analysis explores the value chain, highlighting essential materials, resources, and supplier standings at various levels.

Insightful trends and strategies focus on digital transformation, automation, sustainability initiatives, and AI-driven innovations shaping the market.

The regulatory and investment section reviews key frameworks and policies affecting market growth and innovation funding.

The market size area presents historical data and forecasts, considering current technological impacts, geopolitical tensions, trade tariffs, inflation, and interest rates.

The TAM analysis defines market potential, offering strategic insights for growth opportunities.

Market attractiveness evaluates growth potential, competitive dynamics, and strategic alignment using scoring metrics.

Regional and country analyses outline market size and growth in specific geographies, highlighting recent supply chain shifts to regions like Southeast Asia and Taiwan.

The competitive landscape discusses market nature, key players, and notable financial deals influencing the market landscape.

Company scoring matrices rank leading firms based on market share, revenues, innovation, and brand recognition.

Markets Covered:

By Type: Fully Automatic; Semi-Automatic; Manual

By Wafer Size: Up To 100 mm; 100 mm To 200 mm; Above 200 mm

By Technology: Electroplating; Electroless

By Applications: Through Silicon Via (TSV); Copper Pillar; Redistribution Layer (RDL); Under Bump Metallization (UBM); Bumping; Other Applications

Subsegments:

Fully Automatic: Batch Processing Systems; Inline Processing Systems; Automated Control Systems

Semi-Automatic: Manual Override Systems; Semi-Automatic Batch Systems; User-Controlled Systems

Manual: Manual Plating Systems; Handheld Plating Tools; Manual Control Systems

Data: Market size and growth ratios, GDP proportions, and expenditure per capita.

Key Attributes

Report Attribute

Details

No. of Pages

250

Forecast Period

2026-2030

Estimated Market Value (USD) in 2026

$6.23 Billion

Forecasted Market Value (USD) by 2030

$7.83 Billion

Compound Annual Growth Rate

5.9%

Regions Covered

Global

The companies featured in this Semiconductor Plating System market report include:

Applied Materials Inc.

Solvay SA

Tokyo Electron Limited

Lam Research Corporation

Hitachi High-Tech Corporation

JBT Corporation

ACM Research Inc.

Hitachi Kokusai Electric Inc.

Atotech

JCU International Inc.

Ishihara Chemical Co. Ltd.

RENA Technologies GmbH

Singulus Technologies AG

Intevac Inc.

Akrion Technologies Inc.

Semsysco GmbH

Magneto Special Anodes GmbH

Raschig GmbH

Moses Lake Industries Inc.

Yamato Denki Co. Ltd.

Mitomo Semicon Engineering Co. Ltd.

XiLong Scientific Co. Ltd.

Meltex Inc.

For more information about this report visit https://www.researchandmarkets.com/r/hz4hqg

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world’s leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900

AloJapan.com