From the start of the year, Japanese stocks surged on bets that Prime Minister Sanae Takaichi would cement power through a snap election and then ramp up spending. Then on Tuesday, the so-called Takaichi trade unraveled.

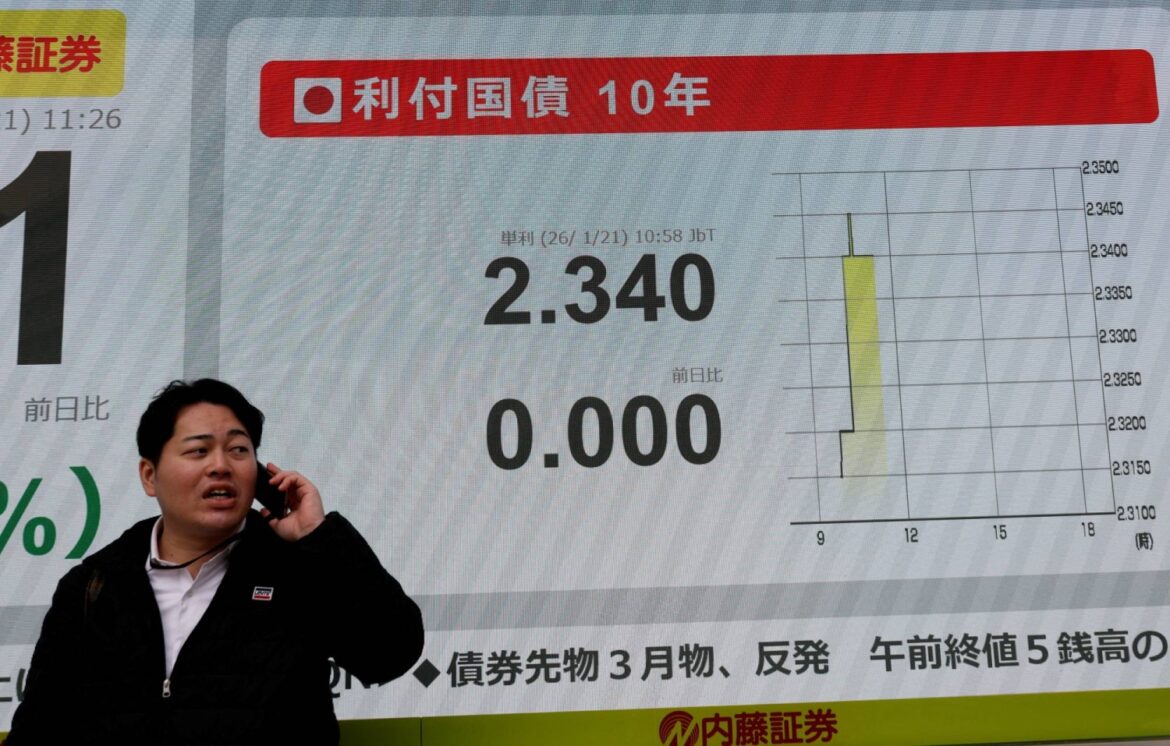

A bond slump that sent yields soaring to records on her election pitch to cut taxes on food rippled through markets in Tokyo, spurring a two-day decline in the benchmark Topix that was its biggest since mid-November. And while markets somewhat stabilized toward the end of the trading week, the Topix still finished with a weekly decline, trailing a broader gauge of Asian shares.

Equity investors see reasons to be on guard as sentiment remains fragile in the runup to the Feb. 8 election.

AloJapan.com