data showed net selling by funds. Meanwhile in the US, a solid 10-year Treasury auction helped calm nerves, and Fed commentary suggested policy is “well positioned” to guide inflation toward 2% without a sharp hit to jobs.

Why should I care?

For markets: Rates are doing the talking again.

US CPI is the near-term hinge for global rate expectations, and a surprise could quickly reprice bonds, currencies, and equities. Supply is the other wildcard: upcoming long-dated Treasury sales can push yields up if demand fades, even after a strong 10-year auction. That matters because higher US yields tend to tighten financial conditions worldwide and can keep pressure on rate-sensitive corners of markets.

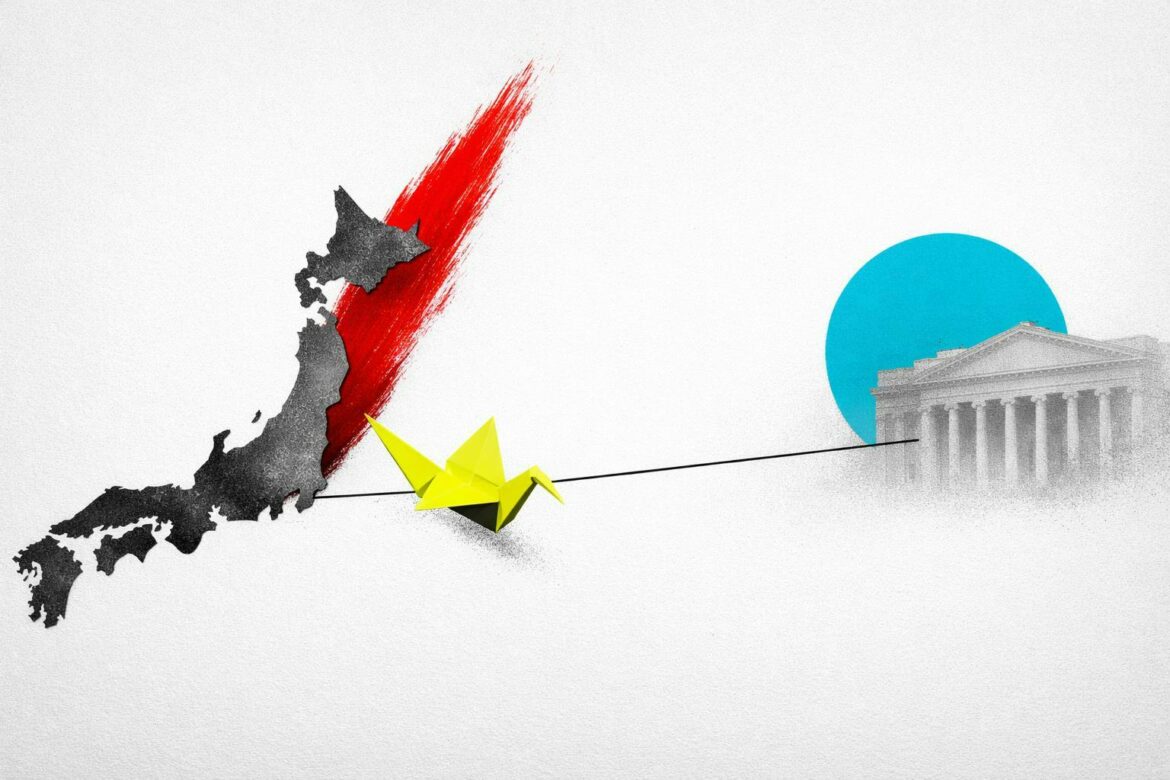

The bigger picture: Japan still matters to the world’s cost of money.

Japan remains a key source of global capital, so sharp moves in Japanese government bond yields can echo through overseas borrowing costs and risk pricing. With major central banks still fighting inflation and governments issuing lots of debt, markets are increasingly reacting to policy credibility and auction demand – not just company earnings. In other words, politics, inflation prints, and bond supply are all competing to set the price of money in 2026.

AloJapan.com