been above 50 since 2006. Meanwhile, 91.8% of respondents still expect prices to rise over the next year, keeping pressure on the BoJ even if shoppers stay cautious.

Why should I care?

For markets: The BoJ can’t just watch inflation anymore.

The central bank wants a self-sustaining cycle of wage gains and spending before it fully moves on from its ultra-easy era. Softer sentiment and weak real wage momentum argue for patience, but inflation and elevated price expectations push the other way. That tension matters for Japanese government bonds, bank stocks, and the yen, because it shapes how quickly policymakers normalize rates and shrink stimulus.

Zooming out: Breaking the deflation mindset is still hard.

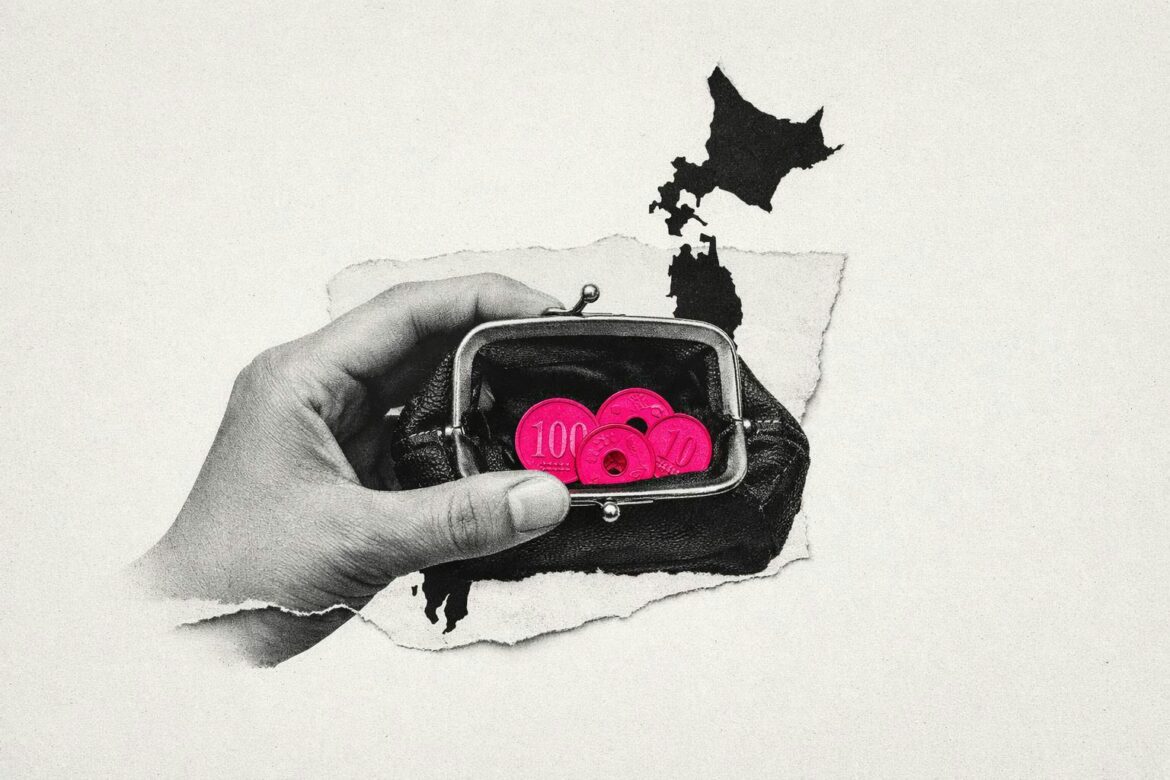

Two decades of sub-50 confidence shows how entrenched Japan’s caution has been after years of weak growth and low inflation. Today’s mix is tricky: people feel downbeat but still expect higher prices, which can squeeze purchasing power if pay doesn’t keep up. This survey, based on 8,400 households polled mid-December, is one of the quickest reads on whether Japan’s demand-led recovery is really taking hold.

AloJapan.com