Report Overview

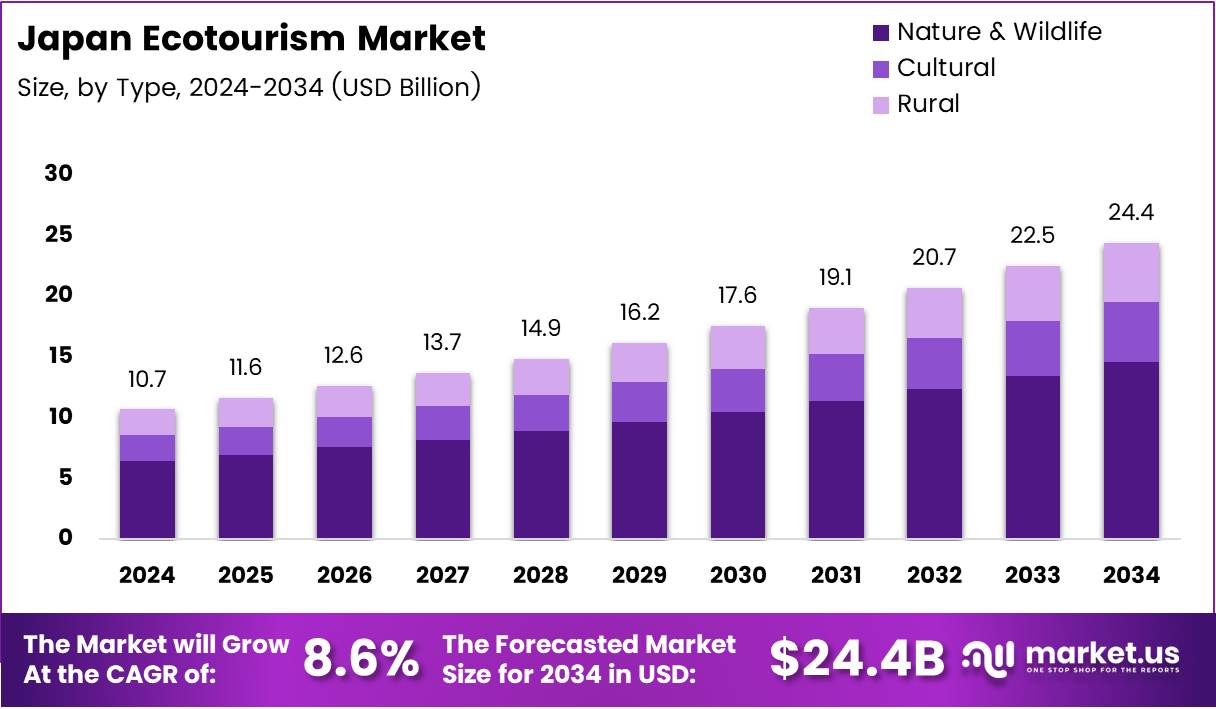

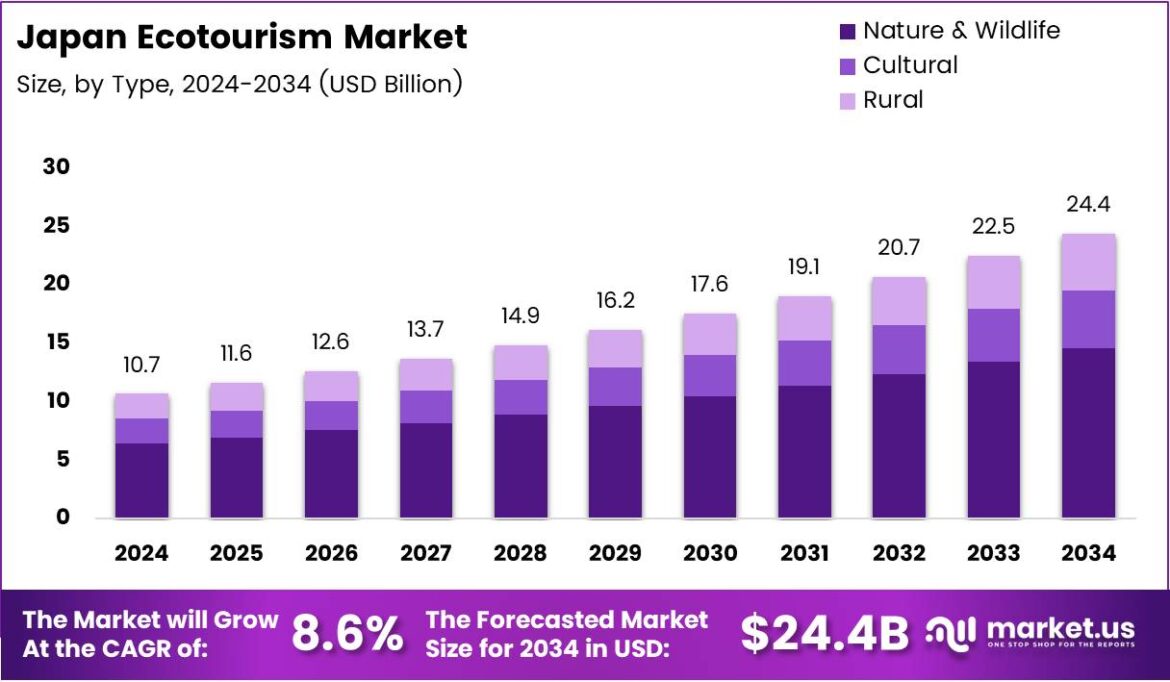

Japan Ecotourism Market size is expected to be worth around USD 24.4 Billion by 2034 from USD 10.7 Billion in 2024, growing at a CAGR of 8.6% during the forecast period from 2025 to 2034. This remarkable expansion reflects Japan’s strategic commitment to sustainable tourism development and environmental conservation.

Ecotourism in Japan represents responsible travel to natural areas that conserves the environment, sustains local communities, and creates educational experiences. The market encompasses nature-based tourism, cultural heritage exploration, wildlife observation, and rural community engagement across Japan’s diverse landscapes.

The Japanese ecotourism sector is experiencing unprecedented momentum driven by both domestic and international travelers seeking authentic, sustainable experiences. Government initiatives promoting regional revitalization and environmental stewardship have accelerated market development. National parks, UNESCO sites, and protected areas continue expanding their eco-certified offerings.

Growing environmental consciousness among travelers has positioned Japan as a premier ecotourism destination. The integration of traditional culture with conservation practices creates unique value propositions. Forest bathing, wildlife trails, and community-based tourism programs attract visitors seeking meaningful connections with nature and local traditions.

Infrastructure development in rural prefectures presents significant opportunities for market expansion. Digital transformation through smart tourism platforms enhances accessibility to remote eco-destinations. Low-carbon travel solutions and green accommodation options are reshaping visitor preferences and travel patterns.

The market benefits from Japan’s rich biodiversity, seasonal variations, and cultural depth. Regional governments collaborate with NGOs and private developers to establish sustainable tourism frameworks. Educational programs focusing on biodiversity and climate awareness drive engagement among younger demographics.

According to the Japan National Tourism Organization and the Japan Tourism Agency, about 36.9 million foreign tourists visited Japan in 2024, surpassing the previous record of 31.9 million in 2019 by approximately 16%. Furthermore, total spending by inbound tourists reached a historic high of approximately JPY 8.1 trillion (USD 53.3 billion), with per capita spending estimated at around JPY 227,000 (USD 1,493). This tourism surge creates substantial demand for nature-based and sustainable travel experiences across Japanese regions.

Key Takeaways

Japan Ecotourism Market is projected to reach USD 24.4 Billion by 2034 from USD 10.7 Billion in 2024, at a CAGR of 8.6%

Nature & Wildlife segment dominates the market with 56.8% share

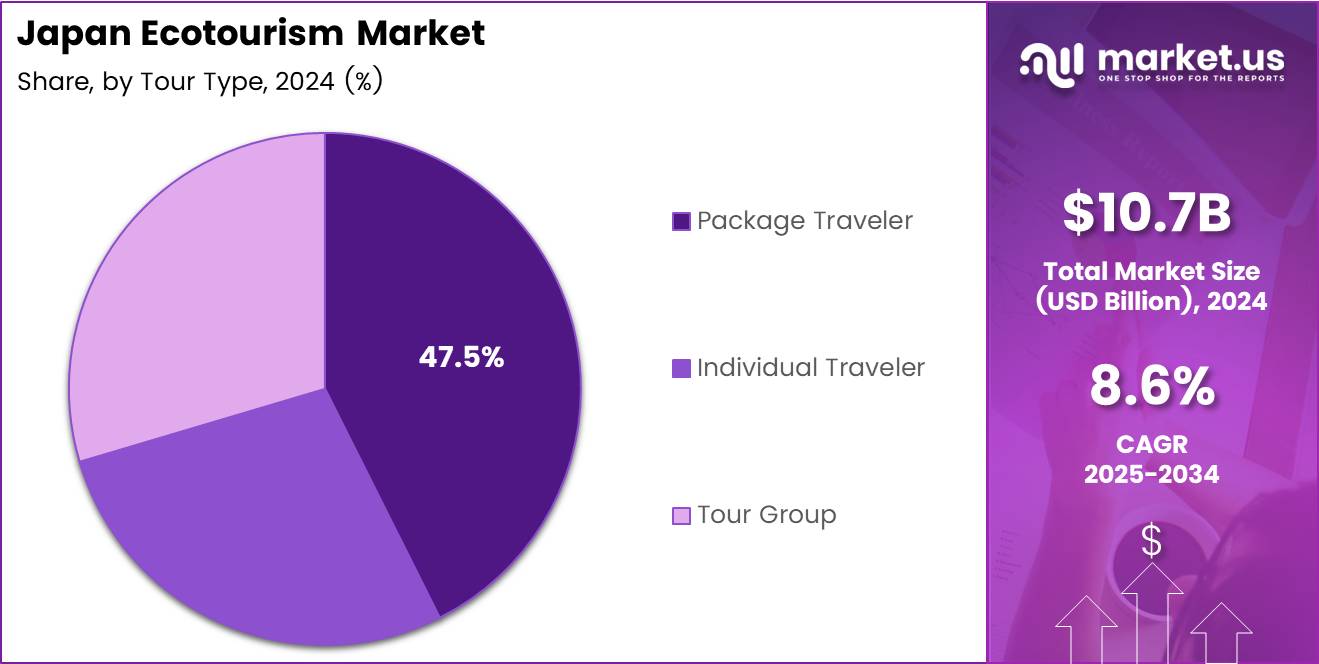

Package Traveler segment leads Tour Type category with 47.5% market share

Domestic tourists represent 61.3% of the total ecotourism market

Women travelers account for 52.1% of ecotourism participants

Age group 26 to 35 Years holds 31.9% market share

Online Platforms command 44.2% of tourism channel bookings

Type Analysis

Nature & Wildlife dominates with 56.8% due to Japan’s diverse ecosystems and growing demand for authentic nature experiences.

In 2024, Nature & Wildlife held a dominant market position in the By Type segment of Japan Ecotourism Market, with a 56.8% share. This segment attracts travelers seeking immersive experiences in Japan’s national parks, mountain ranges, and coastal ecosystems. Wildlife observation opportunities include seasonal bird migrations, marine life encounters, and endemic species discovery. Forest bathing experiences and guided nature trails generate substantial visitor engagement across prefectures.

Cultural ecotourism integrates traditional heritage with sustainable travel practices across historic sites and rural communities. Visitors explore temple stays, traditional craft workshops, and cultural festivals while supporting local preservation efforts. This segment emphasizes authentic interactions with Japanese customs, architecture, and performing arts. Heritage conservation programs attract travelers interested in understanding Japan’s cultural evolution and traditional environmental practices.

Rural ecotourism focuses on agricultural experiences, farm stays, and village-based tourism in depopulating regions. Travelers participate in seasonal farming activities, local cuisine preparation, and traditional lifestyle immersion. This segment supports regional revitalization initiatives while providing income opportunities for aging rural populations. Community-based tourism models strengthen connections between urban visitors and countryside traditions.

Tour Type Analysis

Package Traveler dominates with 47.5% due to convenience, comprehensive itineraries, and growing preference for organized eco-experiences.

In 2024, Package Traveler held a dominant market position in the By Tour Type segment of Japan Ecotourism Market, with a 47.5% share. Organized packages provide curated eco-experiences combining accommodation, transportation, and guided activities. Tour operators design sustainable itineraries featuring multiple destinations and diverse ecological zones. Package offerings include eco-certification, carbon offsetting, and local community partnerships that appeal to environmentally conscious travelers.

Individual Travelers seek personalized ecotourism experiences with flexible itineraries and independent exploration. This segment values self-guided trails, digital navigation tools, and spontaneous destination choices. Independent travelers often spend longer periods in single locations, developing deeper connections with local environments. Growing availability of eco-lodges, sustainable transport options, and online resources supports individual travel preferences.

Tour Groups facilitate shared ecotourism experiences for educational institutions, corporate teams, and special interest communities. Group tours enable cost-effective access to remote destinations while ensuring environmental compliance through professional guidance. Educational groups focus on biodiversity studies, conservation awareness, and sustainability workshops. Corporate groups pursue team-building activities aligned with environmental social responsibility objectives.

Tourist Type Analysis

Domestic tourists dominate with 61.3% reflecting strong local engagement with sustainable tourism and regional exploration trends.

In 2024, Domestic tourists held a dominant market position in the By Tourist Type segment of Japan Ecotourism Market, with a 61.3% share. Japanese residents increasingly seek nature-based getaways and rural experiences within their own country. Domestic demand surges during seasonal periods when urban populations escape to natural environments. Government campaigns promoting regional tourism and sustainability drive domestic participation. Local travelers demonstrate high awareness of environmental issues and support eco-certified accommodations.

International tourists contribute substantially to ecotourism revenue through longer stays and higher per-capita spending patterns. Foreign visitors seek unique Japanese nature experiences unavailable in their home countries. Growing global interest in Japanese culture, cuisine, and traditional practices attracts international eco-travelers. Visa facilitation and improved accessibility enhance international market penetration. Overseas travelers prioritize authentic experiences that combine natural beauty with cultural immersion.

Demography Analysis

Women travelers dominate with 52.1% demonstrating higher engagement rates in nature-based and wellness-oriented ecotourism activities.

In 2024, Women held a dominant market position in the By Demography segment of Japan Ecotourism Market, with a 52.1% share. Female travelers show strong preferences for wellness retreats, forest bathing, and community-based tourism experiences. Women participate actively in educational ecotourism programs focused on sustainability and cultural preservation. Solo female travel to eco-destinations has increased significantly with enhanced safety measures and dedicated services.

Men travelers engage primarily in adventure ecotourism, wildlife photography, and outdoor sporting activities within natural settings. Male participants favor trekking expeditions, mountain climbing, and marine exploration experiences. This demographic demonstrates interest in conservation technology and environmental research tourism. Men increasingly participate in sustainable fishing, eco-agriculture, and traditional craft learning experiences.

Children represent growing ecotourism participants through family travel and educational programs. Youth engagement in nature discovery, environmental education, and outdoor activities shapes future sustainability awareness. Family-oriented eco-packages combine learning with recreation, fostering environmental consciousness among younger generations. Schools increasingly incorporate ecotourism into curriculum through field trips and study programs.

Age Group Analysis

Age group 26 to 35 Years dominates with 31.9% reflecting millennial preferences for sustainable travel and authentic experiences.

In 2024, the 26 to 35 Years age group held a dominant market position in the By Age Group segment of Japan Ecotourism Market, with a 31.9% share. This demographic demonstrates highest engagement with eco-certified accommodations and carbon-neutral travel options. Young professionals seek work-life balance through nature retreats and sustainable getaways. Digital fluency enables this group to discover remote destinations through online platforms and social media.

The 15 to 25 Years segment engages actively through educational tourism, adventure activities, and group travel experiences. Students and young adults participate in volunteer tourism and conservation projects. This age group values social media sharing of eco-experiences and influences peers through digital content. Budget-conscious travel patterns favor community-based accommodations and sustainable transport options.

The 36 to 45 Years demographic focuses on family ecotourism combining education with recreation for children. This group demonstrates willingness to pay premium prices for quality sustainable experiences. Mid-career professionals seek stress reduction through forest bathing and wellness-oriented nature programs. Established income levels support longer stays and diverse activity participation.

The 46 to 55 Years segment pursues cultural ecotourism and moderate outdoor activities aligned with health consciousness. This demographic values guided experiences with professional interpretation and comfortable accommodations. Pre-retirement travelers explore diverse regions while supporting local community development. Interest in traditional practices and heritage conservation characterizes this age group.

The 56 to 65 Years category demonstrates strong participation in slow travel and extended rural stays. Retirees and semi-retired individuals have flexible schedules enabling off-peak travel and deeper regional immersion. This segment appreciates accessibility features and health-focused ecotourism offerings. High disposable income supports luxury eco-resort stays and premium guided experiences.

Tourism Channel Analysis

Online Platforms dominate with 44.2% reflecting digital transformation and consumer preferences for direct booking convenience.

In 2024, Online Platforms held a dominant market position in the By Tourism Channel segment of Japan Ecotourism Market, with a 44.2% share. Digital channels provide comprehensive destination information, real-time availability, and transparent pricing for eco-travelers. Mobile applications enable seamless booking processes and integrated travel planning. Online reviews and eco-certifications influence purchasing decisions among environmentally conscious consumers. Smart tourism solutions enhance user experiences through personalized recommendations and digital guides.

Travel Agencies maintain significant market presence through expertise in complex itinerary planning and personalized service delivery. Traditional agencies specialize in group tours, corporate bookings, and customized packages combining multiple destinations. Agency partnerships with eco-certified providers ensure sustainable tourism standards. Professional consultation services help travelers navigate regional options and seasonal variations.

Direct Bookings enable travelers to engage immediately with eco-lodges, tour operators, and local service providers. This channel fosters authentic relationships between visitors and host communities. Direct communication allows customization and flexibility in experience design. Local businesses benefit from higher profit margins and direct customer feedback.

Luxury Tour Operators cater to premium ecotourism segments seeking exclusive sustainable experiences with high-end amenities. This channel combines environmental responsibility with personalized service and comfort. Private guided tours, luxury eco-resorts, and bespoke itineraries characterize luxury offerings. High-net-worth individuals prioritize unique experiences that balance conservation with exceptional hospitality.

Key Market Segments

By Type

Nature & Wildlife

Cultural

Rural

By Tour Type

Package Traveler

Individual Traveler

Tour Group

By Tourist Type

By Demography

By Age Group

15 to 25 Years

26 to 35 Years

36 to 45 Years

46 to 55 Years

56 to 65 Years

By Tourism Channel

Online Platforms

Travel Agencies

Direct Bookings

Luxury Tour Operators

Drivers

Government-Led Promotion of Sustainable Tourism Drives Market Expansion

National environmental policies increasingly prioritize sustainable tourism development across Japanese regions. Government initiatives align economic growth with conservation objectives through strategic funding and regulatory frameworks. Ministry programs support eco-certification standards and infrastructure development in rural areas. Regional authorities implement incentive schemes encouraging private sector investment in green tourism facilities.

Rising inbound demand for nature-based experiences extends beyond traditional urban destinations like Tokyo and Osaka. International travelers seek authentic encounters with Japan’s diverse natural landscapes and seasonal variations. Marketing campaigns target environmentally conscious visitors through digital channels and international tourism partnerships. Visa facilitation and improved transportation connectivity enhance accessibility to remote eco-destinations.

Strong cultural integration of conservation practices reinforces Japan’s ecotourism appeal. Traditional values emphasizing harmony with nature resonate with global sustainability trends. Heritage preservation efforts combine cultural assets with environmental protection creating unique tourism offerings. Community participation in tourism development ensures authentic experiences while distributing economic benefits across regions.

Restraints

Infrastructure Limitations in Remote Regions Constrain Market Growth

Limited eco-friendly infrastructure in remote and rural tourism regions restricts visitor capacity and experience quality. Many promising ecotourism destinations lack sustainable accommodation options, proper waste management systems, and low-impact transportation. Aging infrastructure in depopulating areas requires substantial investment for tourism development. Seasonal accessibility challenges affect year-round operations in mountainous and coastal regions.

High operational costs for sustainable lodging and low-impact tour services create profitability challenges for operators. Eco-certification processes, renewable energy systems, and sustainable building materials increase initial investment requirements. Small-scale operators in rural areas struggle with financial resources for infrastructure upgrades. Premium pricing necessary to cover sustainable operations may limit market accessibility for budget-conscious travelers.

Growth Factors

Community-Based Ecotourism Development Creates Expansion Opportunities

Development of community-based ecotourism in depopulating rural prefectures addresses regional revitalization challenges while expanding market reach. Local residents become active participants in tourism value chains through hosting, guiding, and craft demonstrations. Income diversification opportunities attract younger generations back to rural areas. Authentic cultural exchanges enhance visitor experiences while preserving traditional knowledge and practices.

Eco-trail, wildlife, and forest-bathing tourism around national parks and UNESCO sites capitalize on Japan’s protected natural assets. Expansion of national park boundaries and improved trail networks increase visitor capacity. Scientific tourism combining recreation with environmental education attracts specialized segments. Seasonal wildlife viewing opportunities create year-round tourism flows across different regions.

Integration of smart tourism, digital guides, and low-carbon travel solutions modernizes ecotourism infrastructure. Mobile applications provide real-time trail information, species identification, and safety alerts. Digital payment systems and multilingual support enhance international visitor experiences. Carbon footprint tracking and offsetting features appeal to environmentally conscious travelers.

Emerging Trends

Regenerative Tourism and Wellness Integration Shape Market Evolution

Growing popularity of slow travel, nature retreats, and regenerative tourism reflects shifting consumer values beyond traditional sustainability. Travelers seek experiences that actively contribute to environmental restoration and community wellbeing. Extended stays in single locations allow deeper engagement with local ecosystems and cultures. Regenerative practices include volunteer conservation work, ecosystem restoration participation, and sustainable agriculture support.

Increasing demand for carbon-neutral travel and green accommodation choices drives industry innovation in sustainable operations. Hotels and resorts implement comprehensive environmental management systems covering energy, water, and waste. Carbon-offsetting programs and renewable energy adoption become standard expectations rather than premium features. Transportation providers develop electric and hybrid vehicle fleets for eco-tour operations.

Rise of educational ecotourism focused on biodiversity and climate awareness attracts academically oriented travelers. Universities and research institutions collaborate with tourism operators on citizen science programs. Workshops on traditional ecological knowledge connect visitors with indigenous practices and environmental wisdom. Custom eco-experiences combining wellness, local cuisine, and cultural immersion create holistic sustainable tourism products.

Key Japan Ecotourism Company Insights

Farm To Farm Tours specializes in agricultural ecotourism connecting urban travelers with rural farming communities across Japan. The company designs immersive experiences where participants engage in seasonal farming activities, traditional food preparation, and sustainable agriculture practices. Their programs support regional revitalization by generating income for aging farming populations while preserving traditional agricultural knowledge.

A.C.T. Tours focuses on adventure and cultural ecotourism combining outdoor activities with environmental education throughout Japanese regions. The operator offers guided trekking expeditions, wildlife observation tours, and forest bathing experiences in national parks and protected areas. Their commitment to low-impact tourism practices includes small group sizes, eco-certified accommodations, and carbon-neutral transportation options.

AAA Travel provides comprehensive ecotourism packages integrating nature-based experiences with cultural exploration across multiple Japanese destinations. The company maintains partnerships with eco-certified hotels, sustainable transport providers, and local conservation organizations. Their offerings range from luxury eco-resort stays to community-based tourism programs in rural prefectures.

AGRILYS Voyages specializes in agricultural and rural ecotourism connecting international travelers with Japanese farming traditions and countryside lifestyles. The company designs customized itineraries featuring farm stays, traditional craft workshops, and seasonal agricultural experiences across various prefectures. Their programs support sustainable rural development while providing authentic cultural immersion opportunities.

Key Players

Recent Developments

In September 2025, Tourism EXPO Japan 2025 was held in Aichi Prefecture, bringing together tourism stakeholders from over 80 countries and promoting travel discovery, including off-the-beaten-path and eco-friendly tourism offerings. The event showcased innovative sustainable tourism solutions and facilitated partnerships between international operators and Japanese regional destinations.

Report Scope

AloJapan.com