Japan Oral Care Market Outlook (2025–2033)

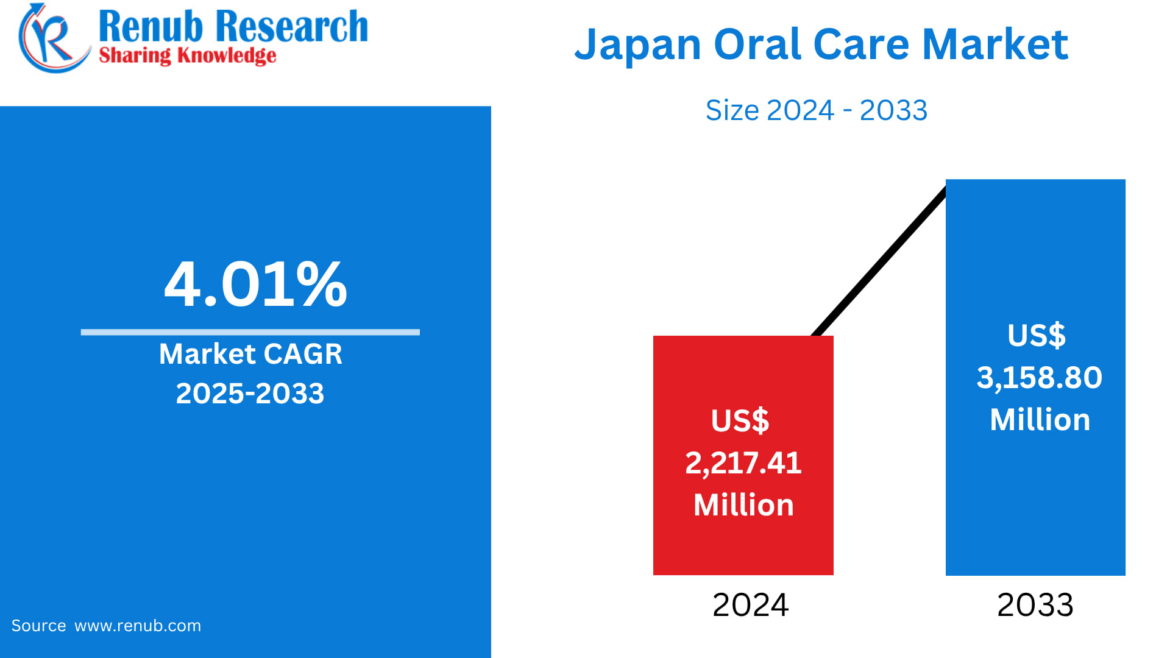

The Japan Oral Care Market is on a steady growth trajectory, reflecting the country’s deep-rooted culture of hygiene, preventive healthcare, and technological innovation. According to Renub Research, the market is expected to expand from US$ 2,217.41 million in 2024 to US$ 3,158.80 million by 2033, registering a compound annual growth rate (CAGR) of 4.01% during 2025–2033.

Download Free Sample Report

This growth is primarily fueled by government-sponsored healthcare programs, extensive dental insurance coverage, and a rapidly aging population determined to preserve oral health well into later life. In parallel, rising interest in cosmetic dentistry, coupled with advancements in digital and AI-enabled dental technologies, is reshaping how oral care products and services are delivered across Japan.

Unlike many markets where oral care is largely consumer-driven, Japan’s ecosystem is uniquely balanced between professional dental services and high-quality retail oral hygiene products, making it one of the most mature and innovation-oriented oral care markets globally.

Japan Oral Care Industry Overview

Japan’s oral care industry is both well-established and rapidly evolving. The country places exceptional importance on preventive dental care, resulting in high penetration of routine dental check-ups, professional cleanings, and daily oral hygiene practices. This preventive mindset is embedded culturally and reinforced institutionally through national healthcare policies.

As Japan’s population continues to age, the focus of oral care is increasingly shifting toward geriatric dentistry, addressing issues such as periodontal disease, tooth loss, dry mouth (xerostomia), and denture care. At the same time, Japanese consumers—particularly in urban centers—demonstrate a strong preference for aesthetic dentistry, including orthodontics, veneers, and tooth whitening, further expanding the market’s scope.

Technology plays a transformative role. The integration of artificial intelligence (AI) in diagnostics, CAD/CAM systems, 3D imaging, and the growing adoption of tele-dentistry are improving clinical accuracy and patient convenience. Additionally, virtual reality (VR) and augmented reality (AR) are being used for dental education and patient engagement, reducing anxiety and improving treatment acceptance.

Overall, Japan’s oral care market reflects a convergence of demographic trends, policy support, cultural values, and technological sophistication, ensuring sustainable long-term growth.

Key Factors Driving the Japan Oral Care Market Growth

Population Aging and Preventive Healthcare

Japan has one of the oldest populations in the world, and this demographic reality is a central driver of oral care demand. Age-related dental conditions such as gum disease, tooth sensitivity, and tooth loss become increasingly prevalent with advancing age, prompting greater reliance on both professional dental services and specialized oral care products.

Government-led initiatives, most notably the “8020 Movement”, encourage citizens to retain at least 20 natural teeth by the age of 80. Such programs have significantly raised public awareness about oral hygiene and the importance of early intervention. As a result, preventive products such as medicated toothpaste, therapeutic mouthwashes, denture cleaning solutions, and soft-bristle toothbrushes see consistent demand among senior consumers.

Technological Advancements in Dentistry

Japan is a global leader in adopting advanced healthcare technologies, and dentistry is no exception. AI-powered diagnostic tools enable dentists to detect cavities, periodontal issues, and oral cancers at earlier stages. Tele-dentistry platforms are improving access for patients in remote or mobility-constrained areas, particularly the elderly.

Furthermore, digital impressions, CAD/CAM prosthetics, and 3D-printed dental components are reducing treatment time while enhancing precision. These innovations not only improve clinical outcomes but also cater to Japan’s growing demand for cosmetic dental procedures, strengthening overall market growth.

Comprehensive Health Insurance Coverage

Japan’s universal health insurance system plays a crucial role in sustaining oral care market expansion. Dental services such as routine check-ups, fillings, and periodontal treatments are partially covered, making professional dental care accessible and affordable for a broad segment of the population.

This widespread coverage encourages regular dental visits and early treatment, reducing the prevalence of severe oral diseases while driving steady demand for oral care products. By integrating dental health into broader public healthcare policy, the government fosters a culture of continuous oral care—benefiting manufacturers, clinics, and consumers alike.

Challenges in the Japan Oral Care Market

Population Decline and Demographic Imbalance

While aging fuels demand for geriatric oral care, Japan’s declining birth rate presents a long-term challenge. A shrinking younger population may reduce demand for pediatric and adolescent oral care products, such as children’s toothpaste and orthodontic services.

Manufacturers and service providers must adapt by focusing on senior-centric solutions, including denture care, periodontal therapies, and dry-mouth treatments, while also innovating to keep younger consumers engaged through premium, lifestyle-oriented oral care offerings.

High Cost of Advanced Treatments and Technologies

Although technological innovation drives market growth, it also introduces cost-related barriers. AI diagnostics, 3D imaging systems, and cosmetic dentistry procedures require significant investment, limiting adoption among smaller clinics, especially in rural areas.

For patients, advanced treatments may remain expensive and only partially covered by insurance, potentially restricting access. Addressing affordability and scalability will be key to ensuring that innovation benefits a wider population segment.

Japan Oral Care Market Regional Analysis

Japan’s oral care market shows clear regional variations, shaped by population density, income levels, and healthcare infrastructure.

Tokyo Oral Care Market

Tokyo stands at the forefront of Japan’s oral care industry. With a dense concentration of dental clinics and specialists, the city leads in adopting digital imaging, AI diagnostics, and cosmetic dentistry solutions. High health awareness and strong aesthetic preferences drive robust demand for both preventive and cosmetic dental services, making Tokyo a trendsetter for the national market.

Kansai Oral Care Market

The Kansai region—including Osaka, Kyoto, and Kobe—accounts for over 30% of Japan’s oral care market. Osaka, in particular, is a hub for digital dentistry, with more than half of dental clinics reportedly using CAD/CAM systems and 3D imaging technologies. A diversified urban population and strong healthcare infrastructure position Kansai as a dynamic growth region.

Aichi Oral Care Market

Centered around Nagoya, Aichi Prefecture benefits from strong industrial activity and above-average income levels. Rising awareness of oral health and growing adoption of preventive and cosmetic dental procedures support market growth. Increasing integration of digital tools further enhances diagnostic accuracy and treatment efficiency in the region.

Japan Oral Care Market News and Developments

In April 2025, a Japanese research team led by Dr. Katsu Takahashi, in collaboration with Kyoto University, announced a groundbreaking dental innovation. The team developed TRG-035, a drug designed to regenerate a third set of human teeth by deactivating the USAG-1 protein. Successful animal trials suggest the potential to revolutionize global dental care in the future.

In June 2024, Fujitsu Japan Limited partnered with Kamoenai Village in Hokkaido to promote preventive dentistry. Using the Fujitsu Preventive Dentistry Cloud Service, oral examinations were conducted for school children, enabling parents and students to monitor dental health digitally and take early preventive actions.

Market Segmentation

By Product

Toothpaste

Toothbrushes & Accessories

Mouthwash / Rinses

Dental Accessories / Ancillaries

Denture Products

Dental Prosthesis Cleaning Solutions

Others

By Distribution Channel

Supermarkets & Hypermarkets

Convenience Stores

Pharmacies

Online Stores

Others

By Application

Adults

Kids

Infants

By Cities

Tokyo

Kansai

Aichi

Kanagawa

Saitama

Hyogo

Chiba

Hokkaido

Fukuoka

Shizuoka

Competitive Landscape and Company Analysis

The Japanese oral care market is highly competitive, featuring strong global and domestic players focused on innovation, brand trust, and product quality. Key companies include:

Colgate-Palmolive

Unilever

Procter & Gamble

GlaxoSmithKline

Henkel

Johnson & Johnson

Dabur India Ltd

Philips

Lion Corporation

These companies compete on product innovation, preventive formulations, smart oral care devices, and sustainability, while leveraging Japan’s strong retail and pharmacy networks.

Final Thoughts

The Japan Oral Care Market is a model of maturity, innovation, and preventive healthcare integration. Supported by strong government policies, universal insurance coverage, and a technologically advanced healthcare system, the market is poised for steady growth through 2033.

While demographic challenges and high technology costs pose risks, opportunities in geriatric care, cosmetic dentistry, AI-enabled solutions, and digital health platforms will continue to shape the industry’s evolution. For stakeholders across manufacturing, retail, and dental services, Japan remains one of the most attractive and forward-looking oral care markets in the world.

AloJapan.com