Japan Dairy Alternative Market Outlook

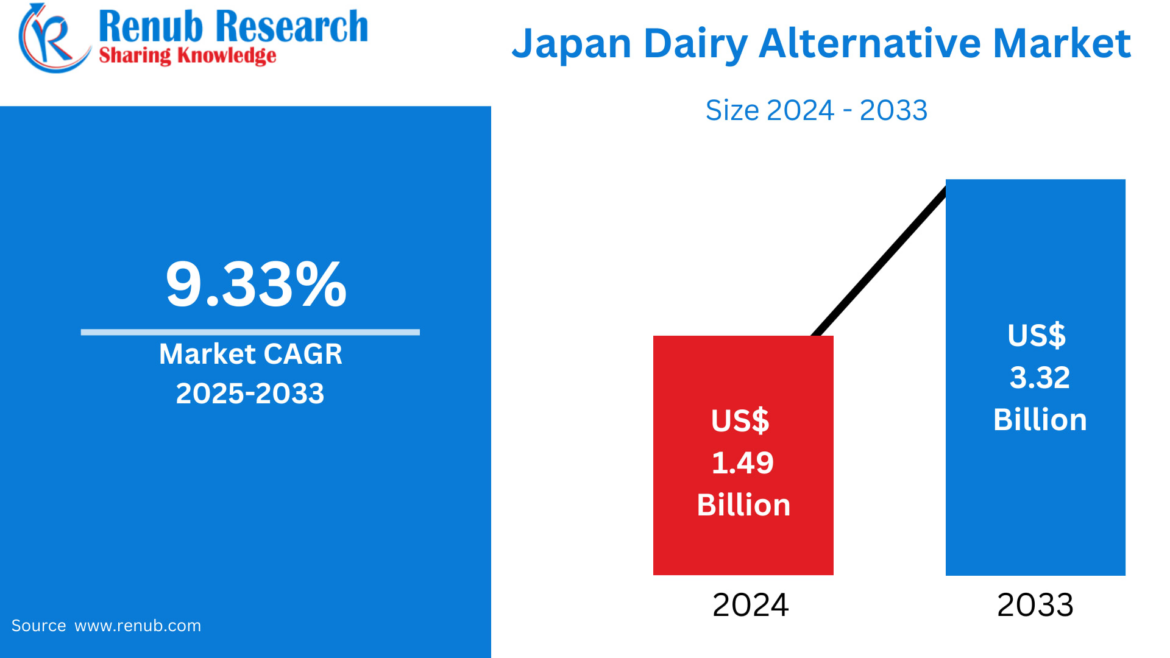

The Japan Dairy Alternative Market is undergoing a significant transformation as plant-based nutrition steadily enters the mainstream. According to Renub Research, the market is projected to grow at a CAGR of 9.33% between 2025 and 2033, expanding from US$ 1.49 billion in 2024 to US$ 3.32 billion by 2033. This impressive growth trajectory reflects changing dietary habits, high lactose intolerance rates, rising environmental awareness, and the influence of Western food consumption patterns in major Japanese cities.

Download Free Sample Report

Dairy alternatives—derived from soy, almonds, oats, coconut, rice, and other plant sources—are no longer niche products in Japan. They have evolved into essential components of everyday consumption, supported by product innovation, retail expansion, and strong acceptance among younger and health-conscious consumers.

Japan Dairy Alternative Market Overview

Dairy alternatives are plant-based substitutes for conventional dairy products such as milk, yogurt, cheese, butter, and creamers. These products are lactose-free and suitable for consumers with lactose intolerance, milk allergies, or those following vegan and flexitarian diets.

In Japan, dairy alternatives have experienced accelerating adoption over the past decade. A substantial portion of the population exhibits lactose intolerance, making traditional dairy consumption challenging for many consumers. Historically, soy milk has played a dominant role due to cultural familiarity and affordability. However, almond milk and oat milk are rapidly gaining popularity, particularly in urban areas, cafés, and premium retail channels.

The market is further strengthened by innovation from domestic food manufacturers and international brands, which are expanding product portfolios to include fortified, flavored, and ready-to-drink plant-based offerings. Convenience stores, supermarkets, and online platforms are playing a critical role in expanding accessibility across the country.

Key Growth Drivers in the Japan Dairy Alternative Market

Rising Lactose Intolerance and Health Awareness

Japan has one of the highest rates of lactose intolerance globally, which naturally fuels demand for dairy-free alternatives. Increasing awareness around digestive health, cholesterol reduction, and saturated fat intake is encouraging consumers to replace conventional dairy with plant-based substitutes.

In April 2025, Asahi Group launched LIKE MILK, Japan’s first yeast-based milk alternative produced using proprietary fermentation technology. The product offers protein and calcium levels comparable to cow’s milk, with 38% less fat and zero major allergens, reinforcing innovation-led growth in the sector. Broader health trends such as fitness culture, nutrition tracking apps, and preventive healthcare are also supporting long-term demand for dairy alternatives.

Shift Toward Plant-Based and Vegan Diets

Japan is witnessing a gradual yet consistent shift toward plant-based eating, particularly among millennials and Gen Z consumers. Ethical concerns related to animal welfare, sustainability, and carbon emissions are influencing purchasing decisions.

In February 2025, Tokyo-based startup Kinish raised funding to produce dairy-identical casein protein cultivated inside rice grains using molecular and vertical farming techniques. This breakthrough illustrates Japan’s growing role in next-generation food innovation and highlights how alternative dairy proteins could redefine the market over the coming decade.

Restaurants, cafés, and foodservice chains are increasingly offering vegan menus, further reinforcing consumer acceptance and market penetration.

Innovation and Product Diversification

Innovation remains a cornerstone of growth in the Japan dairy alternative market. Manufacturers are investing in improved textures, neutral flavors, calcium and protein fortification, and functional benefits such as probiotics.

In March 2025, Sargento expanded its portfolio with plant-inspired cheese innovations, while global players continue to introduce oat-based creamers, coconut yogurts, and dairy-free ice creams tailored to Japanese taste preferences. These developments are expanding usage occasions beyond beverages to cooking, baking, and snacking.

Challenges in the Japan Dairy Alternative Market

High Price Sensitivity

Dairy alternatives in Japan are often priced higher than traditional dairy due to import costs, processing complexity, and premium branding. This pricing gap limits adoption among cost-sensitive consumers, particularly in rural regions and older demographics.

Limited Awareness Among Older Consumers

While younger consumers are highly receptive, some older demographics still perceive plant-based dairy as unfamiliar or inferior in taste. Bridging this awareness gap through in-store education, sampling campaigns, and nutritional labeling will be essential for broader market penetration.

Japan Dairy Alternative Market by Product Type

Japan Milk Alternative Market

Milk substitutes represent the largest segment of the market. Soy milk continues to dominate due to cultural acceptance, while almond and oat milk are gaining traction for their lighter taste and café compatibility. These products are widely available across supermarkets, convenience stores, and coffee chains.

Japan Yogurt Alternative Market

Non-dairy yogurts are growing rapidly, driven by gut-health trends and demand for probiotic-rich foods. Soy yogurt leads the category, with coconut and almond yogurts emerging as premium alternatives. Japanese brands are refining texture and flavor to closely resemble traditional yogurt.

Japan Cheese and Ice Cream Alternatives

Plant-based cheese and ice cream remain niche but are expanding steadily. Improved melting properties and flavor replication are encouraging adoption among flexitarian consumers and foodservice operators.

Japan Dairy Alternative Market by Source

Soy-Based Alternatives

Soy remains the backbone of Japan’s dairy alternative market. It is affordable, nutritionally rich, and deeply embedded in Japanese food culture. Fortified and flavored soy-based products continue to dominate volume sales.

Almond-Based Alternatives

Almond dairy alternatives are gaining popularity among health-conscious and soy-allergic consumers. Almond milk’s low-calorie profile and mild taste make it especially attractive in urban markets.

Oat, Coconut, and Rice-Based Alternatives

Oat-based dairy alternatives are expanding quickly in cafés and premium retail, while coconut and rice-based products appeal to consumers seeking variety and allergen-free options.

Distribution Channel Analysis

Convenience Stores

Japan’s convenience stores are critical to market expansion. Chains such as 7-Eleven and Lawson are increasing shelf space for ready-to-drink plant-based milk and yogurt cups, catering to busy urban consumers and driving impulse purchases.

Online Retail

E-commerce is one of the fastest-growing channels, offering wider product selections, subscription models, and access to niche brands. Online platforms are particularly important for premium and specialty dairy alternatives.

Supermarkets and Hypermarkets

Large retail chains remain the primary sales channel, providing nationwide reach and enabling brands to educate consumers through in-store promotions and tastings.

Regional Insights

Tokyo Dairy Alternative Market

Tokyo leads the nation in dairy alternative consumption. A dense population of health-conscious consumers, expatriates, and trend-focused retailers makes the capital a testing ground for new plant-based products.

Aichi Dairy Alternative Market

Aichi Prefecture shows strong growth driven by its industrial workforce, rising health awareness, and expanding supermarket availability. The region supports both traditional soy milk and newer almond and oat-based products.

Market Segmentation Snapshot

By Product:

Milk

Yogurt

Cheese

Ice Cream

Creamer

Others

By Source:

Soy

Almond

Coconut

Rice

Oats

Others

By Distribution Channel:

Supermarkets & Hypermarkets

Convenience Stores

Online Retail

Others

Top Cities Covered:

Tokyo, Kansai, Aichi, Kanagawa, Saitama, Hyogo, Chiba, Hokkaido, Fukuoka, Shizuoka

Key Players Analysis

The Japan dairy alternative market features a mix of global leaders and regional specialists. Key players profiled with overviews, leadership insights, recent developments, SWOT analysis, and revenue analysis include:

Danone S.A.

SunOpta Inc.

Blue Diamond Growers Inc.

Noumi Limited

Vitasoy International Holdings Limited

Oatly Group AB

The Hain Celestial Group Inc.

Archer-Daniels-Midland Company

These companies are actively investing in product innovation, strategic partnerships, and localization strategies to strengthen their presence in Japan.

Final Thoughts

The Japan Dairy Alternative Market is transitioning from a specialized segment to a core pillar of the nation’s food and beverage industry. Supported by strong health awareness, lactose intolerance prevalence, sustainability concerns, and technological innovation, the market is well-positioned for sustained growth through 2033.

With Renub Research forecasting the market to reach US$ 3.32 billion by 2033, Japan stands out as one of Asia’s most promising dairy alternative markets. Continued innovation, pricing optimization, and consumer education will be key to unlocking its full potential and ensuring long-term success.

AloJapan.com