Japan’s buyside giants are learning to use algos for equity execution but amid information leakage and HFT concerns, the path to adopting the new technology remains unclear.

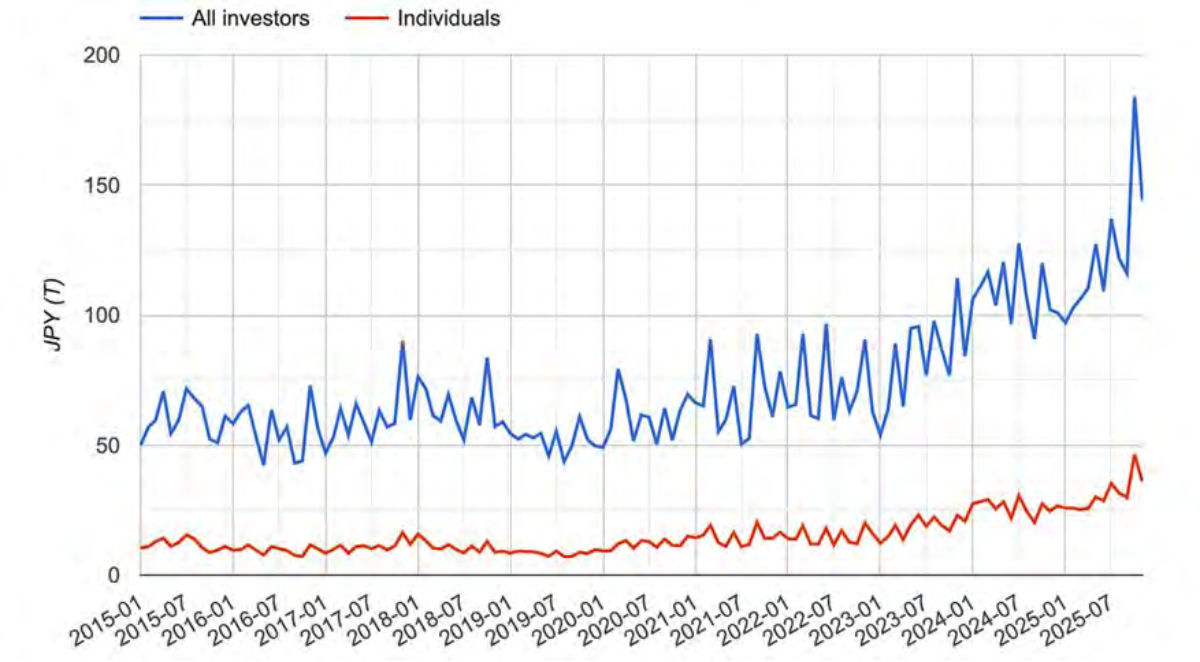

Japanese equity markets are on a roll. Volumes on the Tokyo Stock Exchange and JapanNext, the two main cash markets, are at all-time highs, as well as the index itself. Retail trading as a percentage of the total daily volume reached 31.5% in November according to TSE data.

Japanese equity trading volume (JPY).

Japanese equity trading volume (JPY).

Dealing with this increased flow are two kinds of buyside firms: big international asset management companies like BlackRock or JP Morgan AM, and Japanese domestic firms, such as the asset management arms of large financial services groups like Nomura or Mitsubishi UFJ. And their perspectives are very different.

Ako Nishi, Executive Director, Central Dealing, J.P. Morgan Asset Management

Ako Nishi, Executive Director, Central Dealing, J.P. Morgan Asset Management

(Asia Pacific).

The international firms serve as a funnel for global investor money into Japanese equities, says JP Morgan AM trader Ako Nishi. “Our diverse client base includes both domestic and international investors, representing a wide variety of ownership and investment profiles. In recent years, our fund strategies have broadened to incorporate active ETFs alongside traditional active funds, and trading turnover on the APAC desk has shown strong year-on-year growth, with a particularly notable increase in Japan-related activity. Additionally, global funds such as JPMorgan Global Select have achieved significant success, with Japanese equities included as part of these global portfolios,” she told Global Trading.

These flows pass through Nishi’s trading desk in Hong Kong, she explains. “For Japan-related flows, the JPMAM APAC Equity Trading desk executes orders in Japanese equities and equity-linked derivatives for portfolio managers across APAC, EMEA, and the US.”

For Nishi and her colleagues, trading Japanese stocks is only one part of a much bigger task of getting best execution across the group’s global trading flows. “Our team is structured into two main groups: one specialises in systematic and liquid flow, leveraging machine learning techniques, while the other focuses on large-size and illiquid trades, utilising a range of execution tools,” she says. “Orders are allocated to the most suitable execution method based on their specific characteristics, and our traders – each with unique backgrounds and specialised expertise – oversee every trade to ensure optimal execution.”

And naturally, that leads to broker algos with performance measured by transaction cost analysis (TCA). “For Japanese equity trading, as with most other APAC equity markets, we primarily engage brokers who demonstrate top execution performance according to our quantitative TCA model, which uses globally standardised benchmarks,” Nishi explains. “Over 50% of our desk flow is now automated through machine learning, with our proprietary quant model allocating eligible orders to the most suitable and best-performing broker algorithms based on historical data.”

A home disadvantage

For the domestic Japanese buyside firms, the picture is very different. They have obvious advantages in Japanese stocks compared with the international players. Their portfolio managers actually live in the same country and know the issuers well. They have insights into liquidity that are easily shared with their trader colleagues, who are familiar with domestic brokers who also know the market.

Kenji Takeda, head of equity trading, Nomura Asset Management.

Kenji Takeda, head of equity trading, Nomura Asset Management.

Yet the drive towards broker algos that has become a feature of most developed market buyside trading is uneven in Japan. Those firms with a significant international footprint, like Nomura Asset Management, have imported the methodology into Japan, says that firm’s head of equity trading Kenji Takeda.

“In recent years, most people on the buy side have started using algorithmic trading,” Takeda told delegates at the FIX Japan electronic trading conference in October. “The field of automated execution, such as algorithms, is rapidly evolving, and I feel that analytical capabilities and customisation capabilities are becoming increasingly important factors.

“Not many Japanese asset management companies have overseas trading desks, and in most cases, they handle their transactions mainly in Tokyo,” Takeda notes. “However, we are in the midst of fierce competition to acquire overseas mandates, so for us there is an increasing need to build a global standard execution system and automate our trading.”

Masatsugu Takiyama, MUFG Trust Bank.

Masatsugu Takiyama, MUFG Trust Bank.

That may be happening at Nomura AM, which has a large proportion of actively-managed funds, but less so at Mitsubishi UFG Trust Bank, which manages US$600 billion in mostly passive funds. “In terms of changes in the industry, automation of execution seems to be a trend, but we are more focused on other aspect of trading, such as confidentiality,” according to Masatsugu Takiyama, chief trader at MUFG Trust Bank. “However, we have started to consider updating our structure and system to implement automation of execution in the near future.”

Perhaps one reason for this mixed picture is that Japan’s equity market has unique challenges. For international funds that trade Japanese stocks alongside those of other countries, the problem is that the universe of stocks is much larger than other markets in the APAC region, and many are thinly traded. Also, the presence of high frequency trading (HFT) firms is higher than other markets, leading to well-known complaints about market impact. Frustration about HFTs in Tokyo runs so high that Nomura AM’s Takeda refers to it as a “signalling cost” on the buyside.

Japanese buyside firms that use non-order based liquidity in the form of indications of interest (IOIs) warn about the importance of transparency, because here there is also an information leakage problem, with ‘fake IOIs’ being present according to Takeda.

A question of trust

For Mitsubishi UFG Trust’s Takiyama, the challenge relates to programme trading in his fund’s passive portfolios. “Our firm has a high proportion of passive management, with many of our executions being primarily carried out through program trading desks,” he says.

Programme trading, which involves trading large baskets of stocks over a period of time, does not lend itself easily to algos. Buyside firms can execute programme trades bilaterally with brokers as a principal, but in Japan that poses a problem: The Tokyo Stock Exchange requires such bilateral trades to be reported daily on a platform called ToSTNeT (TSE Trading Network System). But with a fund management firm’s name appearing on the platform, hedge funds and HFTs get tipped off that a programme trade is underway, allowing front running to take place.

“Most Japanese buyside firms are using a principal to trade for their passive fund rebalancing,” Takiyama explains. “However, our trading is quite large, so if we trade on ToSTNeT everyone can see we are trading, they can see our inflows and outflows, and I think that’s not good for us and also our clients.”

As a result, Takiyama prefers to hand over the entire basket trade to a broker which acts as an agent, and whose larger flows mask their client’s programme trade. “We use agency PT for confidentiality reasons,” he told Global Trading. “It is extremely rare for it to be carried out by the principal. The agency commission tend to be cheaper than using algos.”

This willingness to rely on third parties extends to non-domestic stocks, as Japanese investors use domestic fund managers to access US and European markets. The traders serve as conduit for such activity.

“In the European and American markets, which account for the majority of our transactions, orders are mainly placed via program trading desks due to time difference. In the foreign equities, we place the greatest importance on ability to provide information and conduct research in overseas markets,” Takiyama observes. “Access to information is often difficult, including due to language barriers, so we believe that the information provided by traders is extremely important.”

IOIs fit naturally into this programme trading mindset, where brokers are keen to access Mitsubishi UFJ Trust’s client activity or ‘natural’ IOIs. “We use IOI natural flow,” Takiyama explains. “We ask the securities companies for this. Normally, we ask brokers to send us IOI by email, but for illiquid stocks we also use Bloomberg’s IOI. In such cases, we basically try to make use of natural flow and the unwind of a principal flow.”

Because of this reliance on brokers, Takiyama places huge reliance on trust and confidentiality with the brokers he uses.

Nomura AM’s Takeda says his trust in brokers has been dented by some bad IOI experiences. “People use IOI because they don’t want to have that impact, which means they don’t want to move the price, so they basically prioritise natural flow,” he says. “However, in cases where the entire portfolio is to be sold, we also use Principal IOI. Here, I strongly feel that we need brokers to present accurate information.”

By contrast, rather than relying on trust, JP Morgan AM is determined to ensure best execution using its global benchmarks. “We leverage IOIs regardless of whether the contra is natural or non-natural, and for each IOI cross transaction, we confirm the type through direct communication with brokers before accessing liquidity,” says Nishi, who uses her firm’s technology to detect and punish fake IOIs in the broker market.

“All transactions, including IOI crosses, are incorporated into our broker evaluations, enabling us to analyse the impact of each trade on overall performance,” she told Global Trading. “By applying systematic approaches to our trading operations, we ensure objective decision-making and strive to execute at the optimal broker and venue, ultimately benefiting JPMAM’s clients.”

The pressure to modernise

For domestic Japanese buyside firms, the message is increasingly clear that they need to up their game when it comes to systems and internal rules.

According to Nomura AM’s Takeda, “In our case, we do not currently conduct quantitative performance evaluations of execution. The reason is that we don’t often leave it in one algorithm and execute it. Each trader analyses the market situation and frequently changes strategies, so I think that our company’s execution performance on a day does not necessarily reflect the performance of the broker’s algorithm. We are currently considering making the orders placed on algo wheels quantitatively evaluated.”

The ability of many Japanese buyside firms to modernise their trading is hamstrung by aging technology.

Mitsubishi UFJ Trust’s Takiyama explains the challenge: “We need to update our systems and rules to use the latest technology,” Takiyama says. “Those are not designed to adapt to new technology.”

An example that Japanese firms might want to emulate could be JP Morgan AM’s APAC trading desk. “We place a strong emphasis on TCA and have two dedicated quant analysts in the region,” Nishi explains. “Our proprietary analytics tools and globally integrated order management system, Spectrum, ensure consistency across our organisation. For trading cost analysis, we utilise an independent third-party model, enabling us to evaluate costs objectively and comprehensively. Japanese execution, like other markets, is seamlessly incorporated into our globally standardised benchmarks.”

Domestic firms face a similar handicap when it comes to access new liquidity sources such as dark aggregators and alternative trading systems. According to one buyside trader, “To make sure we can use them, we have to be ready. We have to change our systems, and we have to maybe change our tools.”

JP Morgan AM, on the other hand, is ready, and Nishi welcomes the arrival of new entrants to shake up the Japanese market. “The development of advanced electronic liquidity sources is particularly attractive to us, especially in markets like Japan where the order book is thin and confidentiality is crucial – particularly for mid and small caps that are difficult to trade on screen,” she says. “Increasing the ability to secure liquidity electronically in an unbiased and confidential manner would provide greater confidence to information-sensitive participants and could help advance Japanese equity trading to the next level.”

In the absence of JP Morgan AM’s world-class AI and data tools, Mitsubish UFG Trust’s Takiyama wants something simpler and fairer – a consolidated tape, which in Japan remains just a dream. “We need to have a consolidated tape to make it easier to decide which trading venue has the best price at the time,” he complains. “Right now in Japan, if you want to trade at PTS, we have to make sure the price is same or better than the main market. We don’t have a consolidated tape, so we have to ask the broker to send us the report after the trade every day to check the trade, which is waste of time.”

This article forms part of the joint Global Trading & The DESK Special Report on Japan. To download the full Japan Report click on the image below:

AloJapan.com