To begin, I’d like to ask about interest rate trends. As of January 2025, Japan has finally begun to shift away from its zero interest rate policy, with rates rising to 0.5%. With the normalization of monetary policy underway, I imagine this has had a broad impact—from funding strategies to customer engagement models.

How has Shizuoka Bank, with banking at the core of its operations, responded to these environmental changes? Specifically, I’d appreciate your thoughts on changes in lending rates, depositor behavior, and future prospects for interest income.

Thank you for the question. As you rightly point out, approximately 70% of our loan portfolio currently consists of variable interest rate loans, both for individuals and businesses, primarily tied to prime rates or market rates. As a result, the rise in interest rates has generally had a positive impact on our earnings.

At the same time, “scale” is becoming increasingly critical. Deposit strategy, in particular, is drawing more attention than ever. Under the negative interest rate regime, there was little incentive to attract funds, as there was minimal yield on the assets funded. However, the current environment is markedly different—now, the volume of deposits, the very resource for business, has a direct impact on profitability. Consequently, funding strategies are being re-evaluated.

That said, we’re seeing changes in individual customer behavior. With rising prices, more people are dipping into their savings to manage daily expenses. In Shizuoka—our core market—we’re also seeing capital outflow to the Tokyo metropolitan area due to intergenerational asset transfers. Additionally, money is flowing toward high-interest internet banks and NISA (tax-free small investment accounts), causing some regional banks to experience a decline in personal deposits.

Of course, raising deposit interest rates is one way to attract funds—but it’s not a sustainable strategy on its own. Customers today can easily move their funds to higher-yielding options. That’s why our focus is on cultivating “sticky deposits.” Specifically, we prioritize everyday accounts such as payroll accounts, pension deposits, and business accounts. These types of deposits leverage our local advantage and represent a key strength for our bank.

Accordingly, enhancing customer touchpoints is becoming increasingly important. Naturally, we’re investing in digital channels, but we are also re-evaluating our physical branch network. While branches were once seen primarily as cost centers and targeted for downsizing, we are now shifting our approach to reinforce our local presence and strengthen ties with the communities we serve.

I see—very insightful. Let me shift to the next topic. In 2023, foreign direct investment (FDI) into Japan hit a record high of 53 trillion yen. As Japan enhances its presence in the global economy, how is Shizuoka Bank, as a regional financial institution, involved in supporting overseas companies or facilitating capital partnerships with local businesses?

Indeed, in the first quarter alone this year, over 8 trillion yen of FDI flowed into Japan, making this an increasingly important theme for regional financial institutions.

In Shizuoka Prefecture, manufacturing accounts for roughly 40% of the regional GDP. This sector is undergoing a significant structural shift with the transition to electric vehicles (EVs). According to data from the Ministry of Economy, Trade and Industry, nearly half of the internal combustion engine components may be replaced in Shizuoka in the EV era. Supporting local companies as they navigate this transformation is a key mission of our bank.

We go beyond simply providing loans. Through partnerships with startups, we act as a bridge between regional firms and emerging technologies. To date, we have invested over 30 billion yen across 41 venture capital funds, which collectively support around 1,100 startups. Moreover, our bank has provided nearly 32 billion yen in venture debt (growth capital) to about 140 of these companies.

These initiatives are helping to drive transformation in traditional industries such as auto parts, construction, and agriculture. Furthermore, since 2019, we’ve hosted a large-scale matching event called “Tech Beat Shizuoka,” which in 2024 featured 139 participating startups. In 2025, participation rose to around 178 companies.

Tea plantations

Mt. Fuji

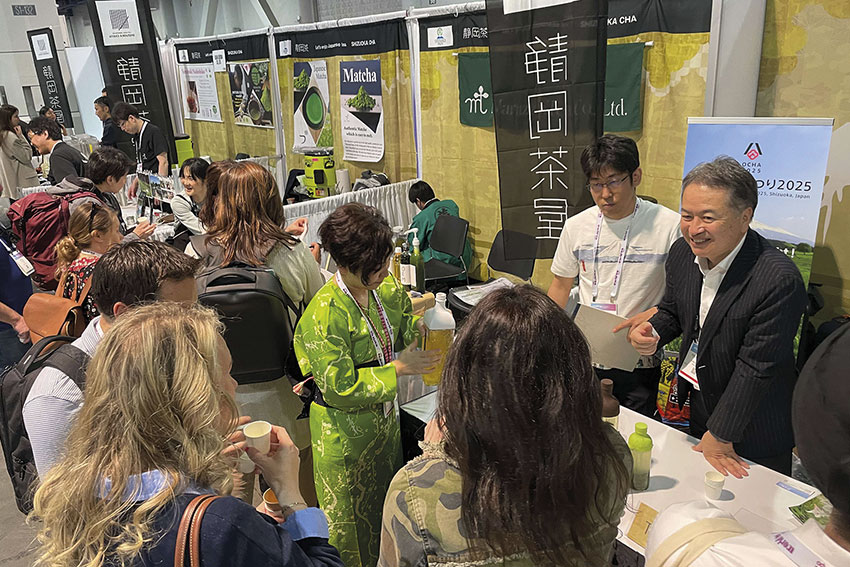

World Tea Expo (USA)

Previous Next

That’s an impressive set of initiatives. Have there been any recently announced partnerships or alliances you can share?

Yes. Between February and March of this year, we announced three major comprehensive business alliances.

The first is the Mt. Fuji・Alps Alliance, a comprehensive business partnership between Shizuoka Bank, Yamanashi Chuo Bank, and Hachijuni Bank—leading banks in Shizuoka, Yamanashi, and Nagano Prefectures. These three regions consistently rank among the most desirable places to relocate in Japan, yet they also share challenges such as population decline and business succession.

To address this, we’ve set a shared KPI: achieving population growth among the three prefectures. In June, the three banks jointly launched a relocation support project, which includes relocation support loans, talent matching services that connect jobseekers and potential migrants from Tokyo with local companies, and other support systems. Looking ahead, we aim to globally promote the Mt. Fuji・Alps brand to attract people, investment, and business from both Japan and abroad.

The second is a comprehensive business alliance with BDO Unibank, the largest bank in the Philippines. This initiative addresses social challenges facing both countries—Japan’s labor shortage and the high youth unemployment rate in the Philippines.

Through this partnership, we are helping Filipino workers secure fair financing before coming to Japan. Previously, it was common for workers to take out high-interest loans to prepare for relocation. We are now trialing a model where our bank provides guarantees and partners with BDO to improve access to affordable credit. In addition, we’re working with National University Philippines to offer language training, financial literacy education, and internship programs in Shizuoka.

Excellent initiatives. Do you plan to expand similar efforts beyond Asia?

At present, our focus remains on Asia. Shizuoka Bank’s international operations initially began to support local businesses expanding into Southeast Asia. We’ve supported their growth into markets such as Thailand and Indonesia. However, many of these companies are now transitioning into their next phase.

Our next step is to tap into the growth of Asian markets themselves. In Thailand, we expanded our alliance with Kasikornbank into a comprehensive partnership. Moving forward, we aim to scale the cooperative model we’ve built with BDO to other Southeast Asian markets via our relationship with Kasikorn.

Comprehensive business partnership with BDO Unibank

Mt.Fuji · Alps Alliance

TECH BEAT Shizuoka 2025

Business partnership with National University Philippines

Comprehensive business partnership with Kasikornbank

Previous Next

You clearly have a wealth of experience in international operations. Could you tell us more about the bank’s presence in Los Angeles and Silicon Valley?

We opened our Los Angeles Branch in 1982—it was our first overseas presence and a first for a regional bank in Japan. At the time, many automotive companies were expanding to the U.S. West Coast, and we followed our clients abroad. This reflects a core philosophy that distinguishes us from Tokyo-based megabanks: We go where our customers go. That principle continues to guide us today.

In 2021, we also opened a representative office in Silicon Valley to strengthen ties with local VCs and startups. We’ve invested in several VC funds and stationed personnel on the ground to gather information and deepen our collaborations. This aligns with our mission to connect regional companies with global innovation ecosystems.

One final, perhaps slightly difficult question: If you had to describe Shizuoka Bank in one phrase from an international perspective, what would it be?

That’s a great question. Shizuoka Bank was established in 1943 through the merger of Enshu Bank and Shizuoka Sanjugo Bank. Sanjugo was known for its sound management, while Enshu was based in Hamamatsu—a hub of innovation that gave rise to companies like Suzuki, Yamaha, and Toyota—and was a more daring region. That spirit of “Yaramaika”—which translates to “Let’s give it a try!”—is still passed down today as our DNA.

The fusion of prudence and challenging spirit forms the DNA of Shizuoka Bank. This balance is our greatest strength.

Whether it was establishing overseas branches early on, launching a securities subsidiary, executing share buybacks and cancellations, or pioneering venture finance—we’ve taken the lead in numerous areas as a regional bank.

If I had to summarize Shizuoka Bank in one phrase, it would be: “A bank where trust and innovation coexist.”

For more information, visit their website at: https://www.shizuokabank.co.jp/english/

AloJapan.com