Demand for Stainless Steel Welded Pipe in Japan Forecast and Outlook 2025 to 2035

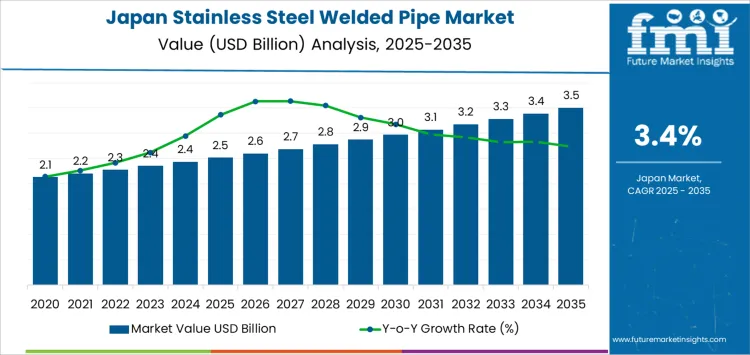

Demand for stainless steel welded pipe in Japan is valued at USD 2.5 billion in 2025 and is projected to reach USD 3.5 billion by 2035 at a CAGR of 3.4%. The industry is anchored in construction, automotive manufacturing, and water supply and distribution infrastructure, with steady pull from petrochemical and fertilizer facilities.

The 300 series dominates structural and fabrication use, while nickel alloy grades serve high-corrosion and high-temperature environments in oil and gas applications. Pipes in the 4 to 36 mm and 36 to 60 mm outer diameter ranges account for the bulk of building services and automotive tubing demand. Kanto, Chubu, and Kinki form the core consumption belt due to dense manufacturing and infrastructure activity. Key suppliers active in Japan include Nippon Steel, Hyundai Steel, ArcelorMittal S.A., Marcegaglia, and Sosta GmbH and Co. KG.

Quick Stats of the Stainless Steel Welded Pipe Industry in Japan

Demand for Stainless Steel Welded Pipe in Japan Value (2025): USD 2.5 billion

Demand for Stainless Steel Welded Pipe in Japan Forecast Value (2035): USD 3.5 billion

Demand for Stainless Steel Welded Pipe in Japan Forecast CAGR (2025 to 2035): 3.4%

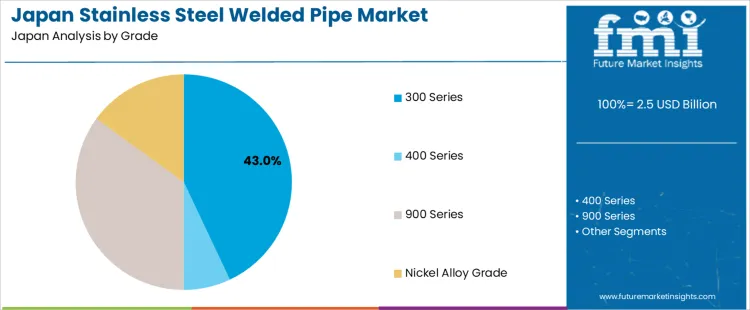

Stainless Steel Welded Pipe in Japan Leading Grade: 300 Series (43%)

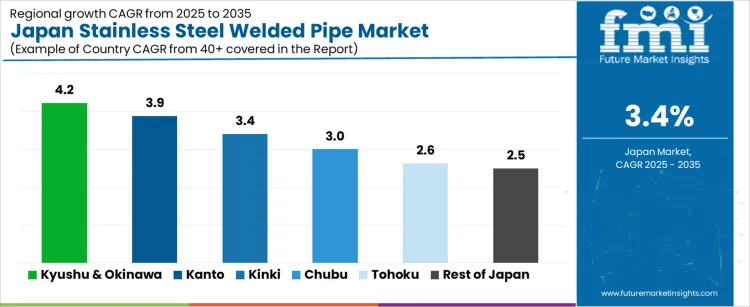

Stainless Steel Welded Pipe in Japan Key Growth Regions: Kyushu & Okinawa, Kanto, Kinki, Chubu

Stainless Steel Welded Pipe in Japan Top Players: Nippon Steel, Hyundai Steel, ArcelorMittal, Marcegaglia, Sosta GmbH & Co. KG

What is the Demand Forecast for Stainless Steel Welded Pipe in Japan through 2035?

After 2030, growth in the stainless steel welded pipe industry in Japan is shaped by replacement-driven infrastructure spending and equipment renewal in mature industrial facilities rather than large-scale greenfield expansion. Urban water distribution upgrades and seismic retrofit programs sustain baseline demand for medium-diameter welded pipes. Automotive output supports stable offtake of precision welded tubing for exhaust, structural reinforcement, and fluid handling systems.

Petrochemical and fertilizer facilities contribute episodic demand tied to plant maintenance cycles and corrosion management programs. Larger diameter segments above 150 mm remain project-dependent and linked to energy and chemical investments rather than continuous demand. Competitive positioning increasingly depends on dimensional accuracy, weld integrity certification, delivery reliability, and long-term supply agreements with construction contractors and industrial operators rather than short-term pricing tactics.

The demand for stainless steel welded pipe in Japan stands at USD 2.5 billion in 2025 and increases to USD 2.9 billion by 2030, creating an absolute rise of USD 0.4 billion during the first half of the forecast period. Historical progression from USD 2.1 billion in 2020 to USD 2.5 billion in 2025 reflects steady absorption across industrial piping, building services, food processing lines, and chemical handling infrastructure. The Japan stainless steel welded pipe industry remains closely linked to maintenance-driven replacement cycles rather than greenfield construction surges. Demand during this phase is stabilized by refinery upgrades, water treatment retrofits, and pharmaceutical manufacturing expansion, where corrosion resistance and sanitary compliance remain structurally essential.

From 2030 to 2035, demand advances from USD 2.9 billion to USD 3.5 billion, adding a larger USD 0.6 billion in the second half of the forecast window. Annual value increments widen from roughly USD 0.1 billion to USD 0.2 billion toward the latter years, indicating gradual strengthening of downstream consumption. This phase is supported by energy transition investments, hydrogen pipeline adaptation, semiconductor fabrication facility expansion, and high-purity fluid transport systems. Demand also strengthens across district cooling, data center utilities, and advanced building services where welded stainless piping offers cost-performance balance. By 2035, stainless steel welded pipe demand in Japan remains structurally embedded in industrial continuity and infrastructure renewal rather than cyclical construction booms.

Stainless Steel Welded Pipe Industry in Japan Key Takeaways

Metric

Value

Industry Value (2025)

USD 2.5 billion

Forecast Value (2035)

USD 3.5 billion

Forecast CAGR (2025 to 2035)

3.4%

What Is Driving the Demand for Stainless Steel Welded Pipe in Japan?

The demand for stainless steel welded pipe in Japan has been shaped by long standing strength in manufacturing, construction quality standards, and process industries that require corrosion resistant fluid handling. Historically, demand was anchored in chemical processing, food and beverage production, shipbuilding, and commercial construction where hygiene, durability, and pressure tolerance are mandatory.

Urban infrastructure development and replacement of aging water, gas, and industrial piping systems reinforced steady baseline demand across decades. Precision fabrication culture in Japan also favored welded pipes for their dimensional accuracy and consistent wall thickness in controlled environments. Demand further expanded through semiconductor fabrication, pharmaceutical plants, and clean room facilities where contamination control depends on high purity stainless steel piping networks.

Future demand for stainless steel welded pipe in Japan will be shaped by industrial modernization, energy transition projects, and infrastructure renewal rather than greenfield construction alone. Hydrogen handling systems, renewable energy facilities, advanced wastewater treatment, and high specification manufacturing plants will require corrosion resistant, high integrity welded piping. Seismic safety retrofitting across industrial buildings will also support pipe replacement cycles.

Barriers include high material costs, competition from alternative alloys and composite piping in low pressure systems, and labor constraints in fabrication and installation. Import pressure on raw stainless steel supply may add cost volatility. Long term demand will depend on how effectively domestic manufacturers align welded pipe production with clean energy, advanced manufacturing, and infrastructure resilience priorities across Japan industries.

What Is the Structural Breakdown of the Demand for Stainless Steel Welded Pipe in Japan by Grade and Application?

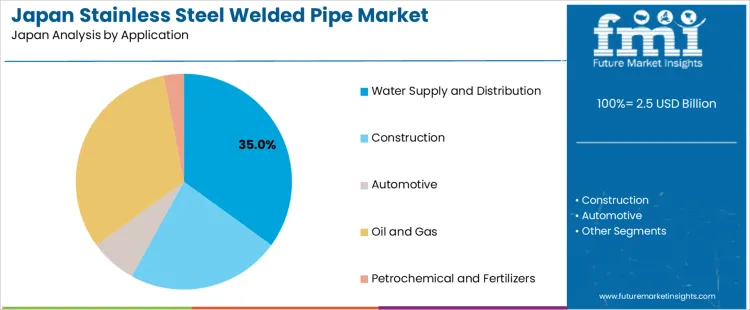

The demand for stainless steel welded pipe in Japan is segmented by grade and application. By grade, demand is classified into 300 series, 400 series, 900 series, and nickel alloy grades. By application, usage is distributed across construction, automotive, water supply and distribution, oil and gas, and petrochemical and fertilizer industries. These segment divisions reflect differences in corrosion tolerance, pressure handling, fabrication compatibility, and regulatory qualification across Japans infrastructure, transport manufacturing, and industrial processing systems. Urban density, seismic compliance standards, and controlled water management systems influence grade selection and purchasing behavior.

Why Does the 300 Series Dominate the Demand for Stainless Steel Welded Pipe in Japan by Grade?

The 300 series accounts for 43% of the demand for stainless steel welded pipe in Japan, reflecting its strong position in structural, sanitary, and industrial piping systems. Demand is driven by its corrosion resistance, formability, and stable performance under humid and coastal atmospheric conditions common in many regions of Japan. Consumption per project remains high in commercial construction, public infrastructure upgrades, and food processing facilities.

Procurement is largely conducted through long term supply arrangements linked to national infrastructure programs and industrial capital expenditure cycles. Price sensitivity remains moderate because installation life and maintenance reduction outweigh initial material cost. Specification control is strict due to seismic compliance, surface finish standards, and weld integrity requirements. Import dependence remains visible for high purity variants. Switching tendency remains low due to standardized fabrication practices and established qualification norms.

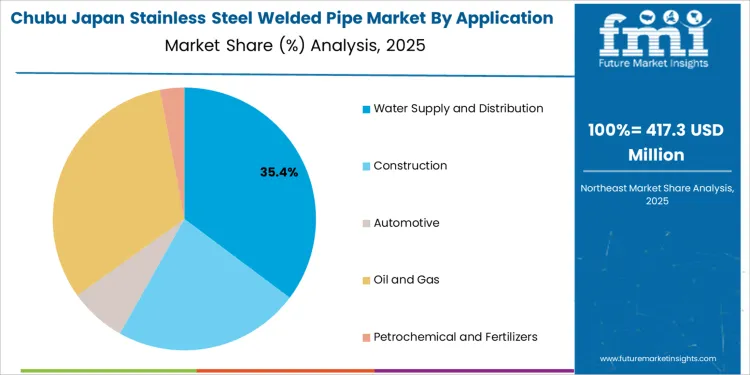

What Is Driving Water Supply and Distribution to Lead the Demand for Stainless Steel Welded Pipe in Japan by Application?

Water supply and distribution represents 35.0% of the demand for stainless steel welded pipe in Japan, reflecting continuous network renewal and strict water quality regulation. Usage intensity is driven by aging municipal pipelines, earthquake resilient city redesign projects, and leak reduction programs. Consumption per kilometer of pipeline remains high due to mandated corrosion protection and long service life requirements. Procurement is handled through multi year public tenders issued by municipal authorities and regional utilities.

Price elasticity remains low because lifecycle operating cost takes precedence over upfront pricing. Specification sensitivity is elevated due to flow hygiene standards, pressure stability, and joint failure prevention. Reusable infrastructure components drive steady replacement demand rather than expansion only. Substitution pressure from polymer pipes remains limited in high pressure urban zones. This structure ensures stable long term demand across Japans public water infrastructure system.

What Is Driving the Demand for Stainless Steel Welded Pipe in Japan Industrial and Infrastructure Systems?

Demand for stainless steel welded pipe in Japan is anchored in urban infrastructure renewal, industrial retrofitting, and hygienic process industries. Aging water supply networks, district heating upgrades, and seismic reinforcement projects require corrosion-resistant piping with consistent mechanical performance. Food processing, pharmaceuticals, and semiconductor fabrication continue to specify welded stainless pipes for contamination control and cleanability. Japan export-oriented manufacturing also drives standardization around precise dimensional tolerance and surface finish. Demand is therefore shaped by reliability expectations, regulatory compliance in hygienic applications, and long-term durability requirements rather than short-term construction cycles.

How Is Infrastructure Renewal Influencing Pipe Replacement Activity?

Japan large stock of aging commercial buildings, municipal water lines, and industrial plants is creating sustained pipe replacement demand. Stainless steel welded pipe is increasingly selected over carbon steel due to lower lifetime maintenance and resistance to internal scaling. Seismic retrofitting programs also favor flexible, high-integrity piping connections that withstand structural movement. Urban redevelopment projects in major metropolitan areas require standardized, flame-resistant, and corrosion-proof materials for HVAC, water, and fire protection systems. This replacement-driven demand is steady and engineering-led rather than speculative or capacity-driven.

Why Are Food, Semiconductor, and Pharmaceutical Facilities Strengthening Industrial Demand?

Japan export-driven electronics, semiconductor, and pharmaceutical sectors sustain strong demand for welded stainless steel pipe used in ultrapure water, chemical transfer, and clean steam systems. These facilities require tight weld integrity, low internal roughness, and strict alloy consistency to prevent particle contamination and corrosion. Food and beverage plants also specify stainless welded piping for wash-down durability and hygiene compliance. Regulatory inspection regimes reinforce replacement cycles based on surface integrity rather than only on leak failure. This industrial demand is governed by process precision and compliance renewal rather than volume manufacturing expansion alone.

How Do Project Phasing, Pricing Pressure, and Import Competition Restrain Growth?

Demand for stainless steel welded pipe in Japan is restrained by tightly phased public works spending and strong price competition from imported piping. Engineering contractors often stagger procurement to match budget release schedules, limiting bulk order acceleration. Domestic producers face margin pressure due to volatile nickel pricing and competition from lower-cost Asian imports. Qualification testing for imported pipes slows switching but does not prevent it. In addition, fabrication labor shortages can delay installation timelines. These factors constrain rapid volume expansion despite structurally steady long-term demand.

What is the Demand for Stainless Steel Welded Pipe in Japan by Region?

Region

CAGR (%)

Kyushu & Okinawa

4.2%

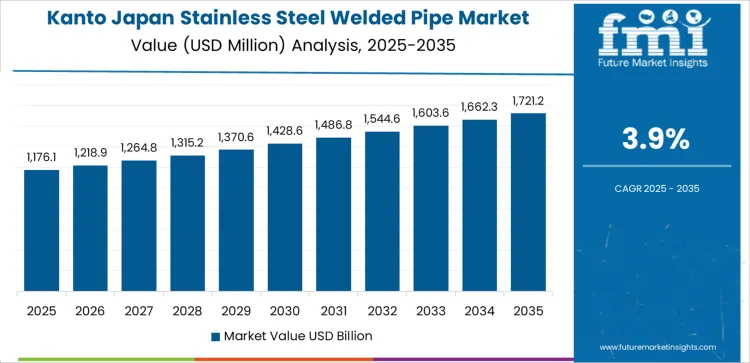

Kanto

3.9%

Kinki

3.4%

Chubu

3.0%

Tohoku

2.6%

Rest of Japan

2.5%

The demand for stainless steel welded pipe in Japan is growing steadily across industrial regions, with Kyushu and Okinawa leading at a 4.2% CAGR. Growth in this region is supported by energy infrastructure projects, chemical processing facilities, and port-based industrial development. Kanto follows at 3.9%, driven by large scale construction activity, water treatment upgrades, and dense manufacturing clusters requiring corrosion resistant piping.

Kinki records 3.4% growth, reflecting steady demand from food processing, pharmaceuticals, and building services applications. Chubu at 3.0% shows moderate uptake linked to automotive manufacturing, power generation, and plant maintenance activity. Tohoku and the Rest of Japan, at 2.6% and 2.5%, reflect slower expansion shaped by lower industrial density, limited new construction, and longer replacement cycles for existing piping networks.

How Is Industrial Expansion in Kyushu and Okinawa Influencing Stainless Steel Welded Pipe Demand?

Growth in Kyushu and Okinawa is progressing at a CAGR of 4.2% through 2035 for stainless steel welded pipe demand, supported by chemical processing expansion, port infrastructure upgrades, and rising use in food processing facilities. Fukuoka and Kagoshima continue to anchor industrial fluid handling projects across energy, water treatment, and manufacturing plants. Compared with Tohoku, procurement here is driven more by new capacity additions than system maintenance. Welded pipes are used for process piping, heat exchangers, and utility lines across industrial parks and coastal production zones.

Chemical processing plants sustain steady pipe demand

Port infrastructure upgrades support fluid transport projects

Food processing facilities expand hygienic piping systems

Industrial parks dominate bulk procurement volumes

What Is Driving Stainless Steel Welded Pipe Consumption Across High Density Projects in Kanto?

Expansion in Kanto reflects a CAGR of 3.9% through 2035 for stainless steel welded pipe usage, led by urban redevelopment, commercial construction, and large scale water supply upgrades across Tokyo and neighboring prefectures. Kanto differs from Kyushu and Okinawa through higher concentration of commercial HVAC and public utility projects rather than core manufacturing. Welded pipes are widely used in district cooling systems, high rise plumbing, metro infrastructure, and municipal water lines. Demand is supported by continuous renovation cycles rather than greenfield industrial development.

Urban redevelopment sustains consistent pipe replacement demand

District cooling systems drive HVAC related usage

Metro infrastructure supports large diameter installations

Municipal utilities anchor long term procurement programs

Why Is Manufacturing Corridor Development Supporting Welded Pipe Demand in Kinki?

Growth in Kinki is advancing at a CAGR of 3.4% through 2035 for stainless steel welded pipe demand, supported by industrial retrofitting, automotive supply chain facilities, and pharmaceutical plant upgrades. Osaka, Kobe, and Kyoto continue to serve as key hubs for precision manufacturing and process equipment installation. Kinki contrasts with Kanto through stronger dependence on factory modernization rather than commercial building projects. Welded pipes are used in clean process lines, compressed air systems, cooling networks, and chemical handling applications across production facilities.

Factory retrofitting supports steady piping replacement

Automotive supplier plants sustain utility system demand

Pharmaceutical facilities drive hygienic pipe installations

Manufacturing clusters concentrate bulk material purchasing

How Is Industrial Workforce Growth Shaping Welded Pipe Adoption in Chubu?

Expansion in Chubu reflects a CAGR of 3.0% through 2035 for stainless steel welded pipe demand, supported by automotive production growth, regional manufacturing investments, and power plant maintenance projects. Nagoya and nearby industrial cities continue to drive mechanical utility upgrades across production sites. Chubu differs from Kinki through stronger reliance on heavy manufacturing rather than diversified industrial use. Welded pipes are installed across boiler lines, cooling water systems, compressed gas networks, and process transport pipelines.

Automotive production sustains long term utility upgrades

Power plant maintenance supports corrosion resistant piping

Heavy manufacturing drives continuous system modifications

Regional suppliers anchor equipment linked installations

What Is Sustaining Moderate Stainless Steel Welded Pipe Uptake Across Tohoku Infrastructure Networks?

Growth in Tohoku is moving at a CAGR of 2.6% through 2035 for stainless steel welded pipe demand, supported by municipal water upgrades, food processing plants, and disaster resilience investments. Tohoku contrasts with Kanto and Chubu through lower industrial density and higher dependence on public infrastructure spending. Welded pipes are mainly deployed in water treatment systems, dairy processing facilities, and district heating networks. Slower commercial construction and limited heavy industry continue to restrain faster growth.

Municipal water projects anchor baseline pipe demand

Food processing supports hygienic transport systems

District heating sustains utility grade installations

Public funding cycles shape long term procurement pace

How Do Low Density Industrial Zones Influence Welded Pipe Demand in the Rest of Japan?

Growth in the Rest of Japan is advancing at a CAGR of 2.5% through 2035 for stainless steel welded pipe demand, shaped by small scale manufacturing, agricultural processing, and regional infrastructure maintenance. This region contrasts with Kanto and Kyushu and Okinawa through lower project scale and slower capital investment cycles. Welded pipes are primarily used for irrigation systems, food and beverage plants, small utilities, and local chemical handling facilities. Procurement remains tied to prefectural budgets and rural infrastructure programs.

Agricultural processing supports corrosion resistant piping needs

Small utilities sustain local transport system upgrades

Limited project scale restricts bulk installation volumes

Prefectural budgets guide procurement timing

What Is Driving the Demand for Stainless Steel Welded Pipe in Japan and Which Producers Control Supply

The demand for stainless steel welded pipe in Japan is shaped by infrastructure renewal cycles, chemical processing investment, and steady replacement demand across food, pharmaceutical, and thermal power facilities. Nippon Steel holds a central production role through domestic steelmaking capacity, downstream pipe processing, and long standing supply relationships with engineering contractors and plant operators.

The company supports demand for austenitic and ferritic welded pipes used in heat exchangers, pressure systems, and sanitary process lines. Marcegaglia participates through imported volumes serving general industrial fabrication, plant construction, and distributor led spot demand. ArcelorMittal supplies selected grades into specialty construction, energy, and OEM fabrication through trading houses active in Japan.

Hyundai Steel supports demand through welded pipe and strip based feedstock supplied to fabrication yards tied to shipbuilding, offshore structures, and heavy machinery lines operating in Japan. Sosta GmbH & Co. KG serves narrower high specification niches linked to corrosion sensitive process piping in chemical and pharmaceutical installations.

Procurement decisions in Japan are shaped by JIS conformity, weld integrity standards, dimensional tolerance control, and traceability documentation at the mill level. Buyer preference favors suppliers with domestic processing presence, stable lead times, and inspection certification aligned with Japanese utility and industrial safety codes. Demand visibility is linked to public infrastructure budgets, refinery maintenance cycles, and long term industrial plant renewal programs.

Key Players in the Stainless Steel Welded Pipe Industry in Japan

Marcegaglia

Sosta GmbH & Co. KG

ArcelorMittal S.A.

Nippon Steel

Hyundai Steel Co., Ltd

Scope of the report

Items

Values

Quantitative Units (2025)

USD billion

Grade

300 Series, 400 Series, 900 Series, Nickel Alloy Grade

Application

Water Supply and Distribution, Construction, Automotive, Oil and Gas, Petrochemical and Fertilizers

Outer Diameter

4 to 36 mm, 36 to 60 mm, 61 to 150 mm, 151 to 500 mm, 500 to 1000 mm

Regions Covered

Kyushu & Okinawa, Kanto, Kansai, Chubu, Tohoku, Rest of Japan

Key Companies Profiled

Marcegaglia, Sosta GmbH & Co. KG, ArcelorMittal S.A., Nippon Steel, Hyundai Steel Co., Ltd

Additional Attributes

Dollar by sales breakdown by region, grade, application, and diameter; growth projections through 2035; infrastructure replacement cycles; industrial and energy project consumption; domestic vs import supply influence; JIS and weld integrity compliance; seismic retrofit and water infrastructure impact; procurement patterns and long-term supply agreements; corrosion management and high-purity process use

Stainless Steel Welded Pipe Industry in Japan Segmentation

Grade:

300 Series

400 Series

900 Series

Nickel Alloy Grade

Application:

Water Supply and Distribution

Construction

Automotive

Oil and Gas

Petrochemical and Fertilizers

Outer Diameter:

4 to 36 mm

36 to 60 mm

61 to 150 mm

151 to 500 mm

500 to 1000 mm

Region

Kyushu & Okinawa

Kanto

Kansai

Chubu

Tohoku

Rest of Japan

Frequently Asked Questions

How big is the demand for stainless steel welded pipe in Japan in 2025?

The demand for stainless steel welded pipe in Japan is estimated to be valued at USD 2.5 billion in 2025.

What will be the size of stainless steel welded pipe in Japan in 2035?

The market size for the stainless steel welded pipe in Japan is projected to reach USD 3.5 billion by 2035.

How much will be the demand for stainless steel welded pipe in Japan growth between 2025 and 2035?

The demand for stainless steel welded pipe in Japan is expected to grow at a 3.4% CAGR between 2025 and 2035.

What are the key product types in the stainless steel welded pipe in Japan?

The key product types in stainless steel welded pipe in Japan are 300 series, 400 series, 900 series and nickel alloy grade.

Which application segment is expected to contribute significant share in the stainless steel welded pipe in Japan in 2025?

In terms of application, water supply and distribution segment is expected to command 35.0% share in the stainless steel welded pipe in Japan in 2025.

AloJapan.com