Demand for Port Wine in Japan Forecast and Outlook 2025 to 2035

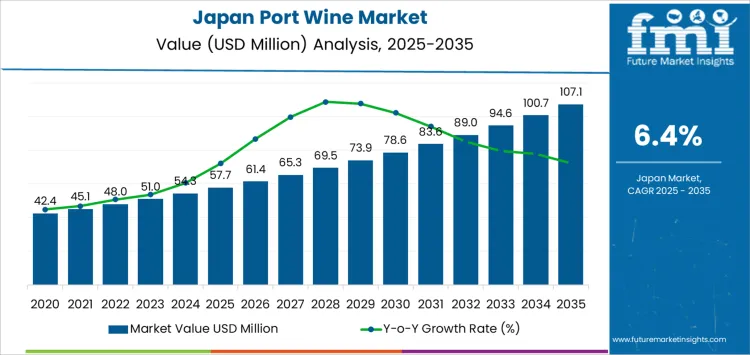

The demand for port wine in Japan is expected to grow from USD 57.7 million in 2025 to USD 107.1 million by 2035, with a CAGR of 6.4%. The growing interest in premium alcoholic beverages and the increasing popularity of international wine varieties in Japan are contributing significantly to the rise in demand for port wine. Japan’s sophisticated wine culture, which has traditionally favored wines from regions like Bordeaux and Tuscany, is now embracing fortified wines, including port. As consumers become more adventurous in their tastes and explore new varieties, port wine’s rich, sweet, and complex flavor profile is gaining a wider following.

The trend towards premiumization in the Japanese alcoholic beverage sector is another key factor driving demand for port wine. As disposable incomes rise and consumers seek higher-quality products, port wine is viewed as an affordable luxury for those looking to indulge in finer beverages. Port wine’s versatility in pairing with food, especially desserts, cheeses, and rich meats, enhances its appeal among both casual and serious wine drinkers. Its unique production process, which involves fortification with brandy, further distinguishes it from other types of wine, adding to its allure for those seeking something distinct and luxurious.

Quick Stats of the Demand for Port Wine in Japan

Demand for Port Wine in Japan Value (2025): USD 57.7 million

Demand for Port Wine in Japan Forecast Value (2035): USD 107.1 million

Demand for Port Wine in Japan Forecast CAGR (2025-2035): 6.4%

Demand for Port Wine in Japan Leading Product Type: Vintage

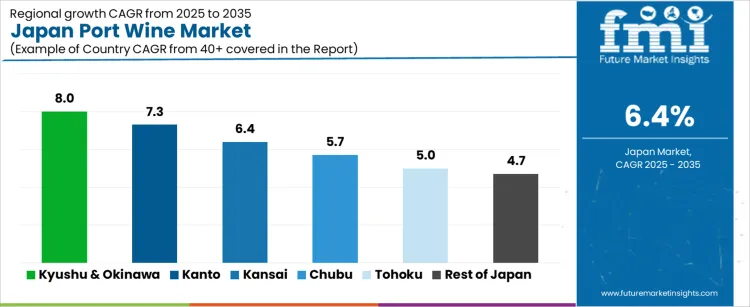

Demand for Port Wine in Japan Key Growth Regions: Kyushu & Okinawa, Kanto, Kansai, Chubu, Tohoku, Rest of Japan

Demand for Port Wine in Japan Top Players: Grupo Sogevinus Fine Wines, Davy & Co Limited, Adriano Ramos Pinto, Quinta Do Crasto, The Fladgate Partnership

What is the Growth Forecast for the Demand for Port Wine in Japan through 2035?

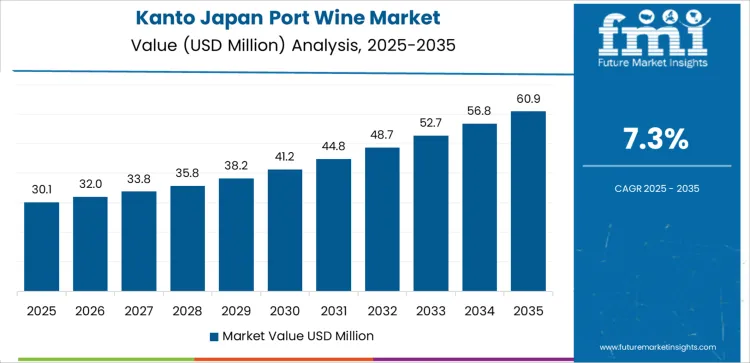

From 2025 to 2030, the demand for port wine will steadily rise. Starting at USD 57.7 million in 2025, it is expected to reach USD 61.4 million in 2026. The industry will continue its growth, with a projected demand of USD 65.3 million in 2027, USD 69.5 million in 2028, and USD 73.9 million in 2029. By 2030, the demand for port wine will reach USD 78.6 million. This steady rise in demand is driven by an increasing number of Japanese consumers seeking premium international wines and a growing appreciation for port wine’s rich, diverse varieties. The rise of wine education programs and events in Japan has helped cultivate interest in wines like port, further supporting its demand.

From 2030 to 2035, the growth trajectory will continue, albeit at a slightly faster pace. The demand for port wine will grow from USD 78.6 million in 2030 to USD 107.1 million by 2035. During this period, factors such as a broader distribution network, enhanced availability through online retailers, and rising interest in vintage and rare ports will contribute to this growth. As port wine becomes more established in the Japanese industry, more retailers and bars will introduce it to their wine lists, broadening its exposure. By 2035, port wine is expected to be a staple in Japan’s premium alcoholic beverage category, reflecting continued interest in global wine trends and consumer preferences for indulgent and unique drinking experiences.

Demand for Port Wine in Japan Key Takeaways

Metric

Value

Demand for Port Wine in Japan Value (2025)

USD 57.7 million

Demand for Port Wine in Japan Forecast Value (2035)

USD 107.1 million

Demand for Port Wine in Japan Forecast CAGR (2025-2035)

6.4%

Why is the Demand for Port Wine in Japan Growing?

The demand for port wine in Japan is growing as consumer tastes evolve towards more diverse and premium alcoholic beverages. Port wine, a fortified wine with a rich, sweet flavor, has become increasingly popular among Japanese consumers who seek unique, high-quality drinks. As Japanese wine culture continues to expand, consumers are increasingly appreciating the distinctive characteristics of port wine, which pairs well with various cuisines, desserts, and even cheeses. Its appeal is particularly strong among those who enjoy luxurious and indulgent beverages.

A key driver behind the growth of port wine is the increasing demand for premium and niche alcoholic beverages. As Japan’s alcohol industry shifts toward higher-end products, port wine is gaining popularity due to its rich history, complex flavors, and versatility. Port wine’s ability to be consumed as a standalone drink or paired with a variety of foods makes it a desirable choice for those seeking a more refined drinking experience. Growing interest in European wines, particularly those from regions like Portugal, is further boosting the appeal of port wine in Japan.

The increasing availability of port wine in retail and dining establishments is contributing to its growing popularity. With more distributors and restaurants offering a variety of port wine options, Japanese consumers have greater access to this premium product. As the trend towards high-quality, specialty beverages continues, the demand for port wine in Japan is expected to rise steadily through 2035.

What is the Segment-Wise Analysis of Demand for Port Wine in Japan?

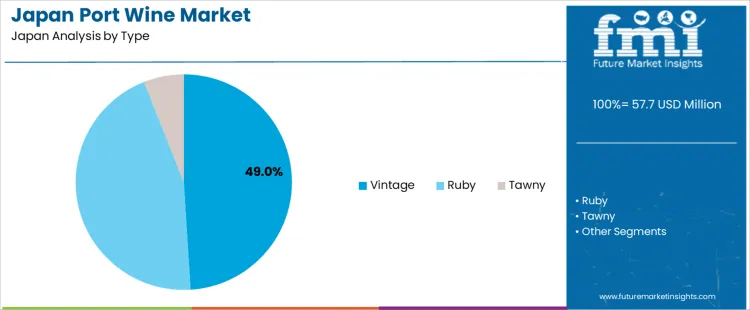

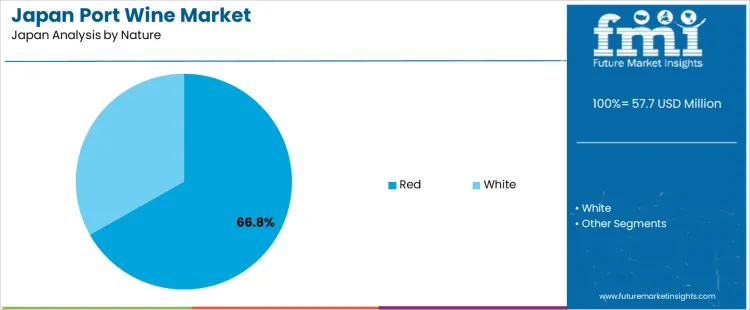

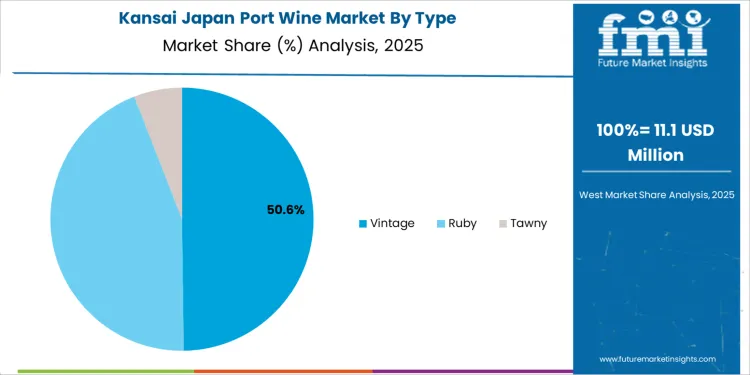

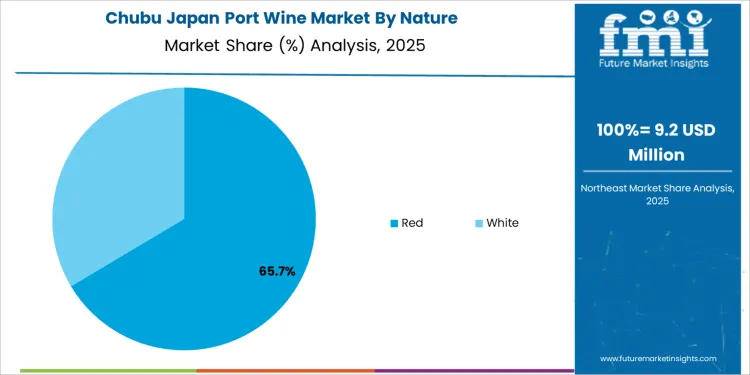

Demand for port wine in Japan is segmented by type, nature, and region. By type, demand is divided into vintage, ruby, and tawny, with vintage port leading at 49%. The demand is also segmented by nature, including red and white port wines, with red port leading at 67%. Regionally, demand is spread across Kyushu & Okinawa, Kanto, Kansai, Chubu, Tohoku, and the rest of Japan.

How Does Vintage Port Lead the Demand for Port Wine in Japan?

Vintage port accounts for 49% of the demand for port wine in Japan, driven by its premium status, exceptional flavor profile, and association with high quality and tradition. Vintage port is regarded as the finest style of port wine, made from the best grapes of a single harvest and often aged for many years before being released. Its complexity and depth appeal to wine connoisseurs and collectors in Japan, an industry known for appreciating high-end, aged wines. Vintage port’s role in fine dining and special occasions further boosts its demand, as it is often chosen for gifting or celebratory events. As Japanese consumers seek premium, top-quality wines, vintage port maintains its prestigious position in the industry, remaining the dominant choice for those who value exceptional taste and exclusivity.

Why Does Red Port Lead the Demand for Port Wine in Japan?

Red port accounts for 67% of the demand for port wine in Japan, driven by its full-bodied flavor, rich color, and versatility in food pairings. Red port, which includes both ruby and tawny styles, is the most popular type of port wine in Japan, praised for its depth and complexity. The robust taste of red port makes it ideal for pairing with a wide variety of foods, such as cheese, chocolate, and red meats, which aligns with Japanese consumers’ growing appreciation for food and wine pairings. Red port’s flexibility and its ability to complement both casual and formal settings contribute to its dominant position in the industry. As Japan’s wine culture continues to grow, red port remains the preferred choice for daily enjoyment and special occasions due to its well-established reputation and versatile flavor profile.

What are the Key Trends, Drivers, and Restraints in Demand for Port Wine in Japan?

Port wine, known for its rich, sweet flavors and high alcohol content, is appealing to consumers looking for dessert wines or a more indulgent wine experience. Despite this, the demand for port wine remains limited compared to other types of wine due to its niche status and relatively low consumer familiarity. Competition from mainstream wines and other alcoholic beverages, such as beer and sake, and price sensitivity among consumers, restrict the widespread adoption of port wine in Japan.

Why is Demand for Port Wine Growing in Japan?

Demand for port wine is growing as Japanese consumers become more interested in diverse wine experiences. The rising popularity of wine culture in Japan, with more people exploring various wine styles beyond traditional reds and whites, is contributing to this growth. Port wine, with its unique characteristics and rich history, attracts consumers seeking novelty, as well as those interested in pairing wines with desserts or special meals. The increasing availability of port wine in retail outlets, restaurants, and wine bars further supports its growth. Younger generations and expatriates are also contributing to this trend, as they embrace global wine offerings and appreciate the distinct flavors that port wine provides.

How are Technological & Industry Innovations Driving Port Wine Demand in Japan?

Technological advancements in logistics and wine distribution have made port wine more accessible in Japan. Improved supply chains and streamlined importation processes ensure consistent quality and availability of port wine in both traditional retail outlets and online platforms. Wine education, including tastings and seminars, has played a role in raising awareness about port wine and its versatility in pairings with food, especially desserts. The growing trend toward premiumisation in the Japanese wine industry also supports interest in high-quality, specialty wines like port. As consumers become more interested in experiencing a range of global wines, the wider distribution of port wine and its availability at restaurants and bars is driving demand.

What are the Key Challenges and Risks That Could Limit Port Wine Demand in Japan?

Despite the growing interest, several factors limit the adoption of port wine in Japan. Wine consumption per capita in Japan remains relatively low, with many consumers still preferring mainstream beverages like beer or sake. Port wine faces competition from more familiar, less expensive wines, which may be more appealing to price-sensitive consumers. The relatively small industry for fortified wines, including port, means that many consumers are unfamiliar with its flavors or the occasions suitable for drinking it. As a niche product, port wine is not as widely promoted compared to other types of wine, which limits its exposure and consumer awareness.

What is the Regional Demand Outlook for Port Wine in Japan?

Region

CAGR (%)

Kyushu & Okinawa

8.0%

Kanto

7.3%

Kansai

6.4%

Chubu

5.7%

Tohoku

5.0%

Rest of Japan

4.7%

Demand for port wine in Japan is growing across all regions, with Kyushu & Okinawa leading at an 8.0% CAGR, driven by rising interest in premium and imported alcoholic beverages. Kanto follows with a 7.3% CAGR, supported by the region’s large urban population and its growing interest in wine culture. Kansai shows a 6.4% CAGR, with increasing demand driven by the region’s food culture and rising interest in wine pairings. Chubu experiences a 5.7% CAGR, as demand for port wine rises with changing consumer preferences and greater availability. Tohoku and the Rest of Japan see moderate growth at 5.0% and 4.7%, respectively, as wine consumption continues to expand in rural and smaller urban areas.

How is Demand for Port Wine Growing in Kyushu & Okinawa?

Kyushu & Okinawa leads the demand for port wine, growing at an 8.0% CAGR. The region’s rising interest in premium and imported alcoholic beverages, particularly in Okinawa’s vibrant tourism sector, is driving the demand for port wine. As tourists and locals alike seek new and unique alcoholic beverages, port wine has gained popularity for its rich flavor and versatility. The region’s growing focus on fine dining and wine pairings is contributing to the rising demand for port wine in both restaurants and retail. As Okinawa continues to attract international visitors and the local population becomes more adventurous in their wine choices, port wine’s popularity is expected to continue growing in Kyushu & Okinawa. The region’s expanding wine culture and increasing availability of imported wines will further support this upward trend.

Why is Demand for Port Wine Rising in Kanto?

Kanto is experiencing strong demand for port wine, with a 7.3% CAGR. The region’s large urban population, particularly in Tokyo, plays a significant role in driving this demand. As Kanto embraces a growing wine culture, more consumers are seeking premium imported wines like port wine to diversify their drinking preferences. The increasing interest in wine pairing with gourmet meals in fine dining establishments is also contributing to the demand.

Kanto’s wine retailers and restaurants are offering a wider selection of port wines to cater to this expanding interest. The region’s large expatriate population and tourism sector further fuel demand, as international visitors often seek familiar premium wines. With rising consumer awareness and the increasing availability of port wine, demand in Kanto is expected to remain strong, driven by both locals and tourists looking for new wine experiences.

How is Demand for Port Wine Expanding in Kansai?

Kansai shows steady demand for port wine, growing at a 6.4% CAGR. Known for its rich culinary culture, particularly in Osaka and Kyoto, Kansai’s food and beverage sector is increasingly embracing wine pairings, including port wine. The region’s expanding interest in fine dining and upscale restaurants, as well as a growing wine culture, is driving the rise in port wine demand. Consumers are becoming more adventurous in their wine choices, with port wine becoming a popular option due to its versatility with both traditional and modern Japanese cuisines.

Kansai’s increasing wine consumption and interest in premium products are further fueling the demand for port wine, especially among younger, health-conscious consumers who appreciate its rich flavors and potential health benefits. As Kansai’s food and wine culture continues to evolve, port wine is expected to remain a popular choice for both local consumers and international visitors.

Why is Demand for Port Wine Growing in Chubu?

Chubu is experiencing steady demand for port wine, growing at a 5.7% CAGR. The region’s increasing interest in fine dining and premium alcoholic beverages is contributing to the rise in port wine consumption. With urban centers like Nagoya driving demand, Chubu’s growing wine culture is seeing more consumers exploring various wine options, including port wine, for its distinctive flavors and rich taste.

As Chubu’s foodservice industry adapts to evolving consumer preferences for high-quality wines, port wine is gaining popularity as a choice for pairing with gourmet meals. The increasing availability of imported wines in Chubu’s specialty wine shops is further supporting the demand for port wine. As consumer interest in diverse and premium wines continues to rise, Chubu is expected to see steady growth in port wine consumption, driven by both upscale dining experiences and at-home wine enthusiasts.

How is Demand for Port Wine Expanding in Tohoku?

Tohoku is seeing moderate demand for port wine, with a 5.0% CAGR. While port wine consumption in Tohoku is smaller compared to urban centers, there is a growing appreciation for premium wines, especially among the region’s more affluent and health-conscious consumers. The increasing availability of port wine in local stores and restaurants is helping to expand its reach in the region. The rise of food tourism in Tohoku is contributing to the growing demand for port wine, as visitors seek local dining experiences that include unique wine pairings.

As consumer awareness of different wine varieties rises, demand for port wine is expected to gradually increase, especially as Tohoku’s food culture becomes more inclusive of global wine trends. With the continued rise in wine consumption across the region, demand for port wine is likely to follow an upward trajectory.

Why is Demand for Port Wine Steady in the Rest of Japan?

The Rest of Japan is experiencing steady demand for port wine, with a 4.7% CAGR. Although the demand is smaller than in urban regions, there is a gradual increase in port wine consumption as more consumers in rural and smaller urban areas embrace premium wine options. The growing awareness of wine as a quality drink and the increasing availability of port wine in local retailers are helping boost its popularity.

As more restaurants and foodservice establishments in the Rest of Japan introduce wine pairings with traditional Japanese meals, port wine is gaining recognition as a versatile option. The rising interest in health-conscious drinking, coupled with increased exposure to wine cultures through media and tourism, is fueling this trend. As the awareness of global wine options spreads across Japan, demand for port wine in rural areas is expected to continue growing at a steady pace.

What is Driving the Demand for Port Wine in Japan and Who Are the Key Players Shaping the Industry?

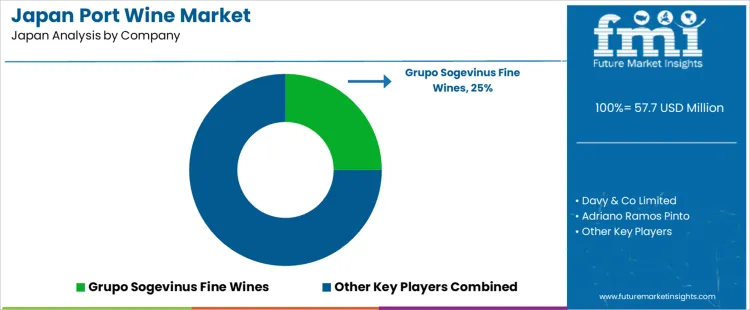

The demand for port wine in Japan is increasing as consumers continue to explore more premium, diverse alcoholic beverages. Known for its rich, sweet, and complex flavor profile, port wine is gaining popularity in Japan, particularly among wine enthusiasts and those seeking unique, high-quality drinks. The growing interest in wine culture, combined with a rising preference for sophisticated and distinctive alcoholic beverages, is driving the demand for port wine. The increasing focus on wine pairing with food, as well as the popularity of wine tasting events and gourmet experiences, has boosted the consumption of port wine in Japan, especially in premium restaurants and retail spaces.

Key players shaping the port wine industry in Japan include Grupo Sogevinus Fine Wines, Davy & Co Limited, Adriano Ramos Pinto, Quinta Do Crasto, and The Fladgate Partnership. Grupo Sogevinus Fine Wines holds a leading share of 25%, offering a range of high-quality port wines that cater to the sophisticated tastes of Japanese consumers. These companies focus on providing top-tier port wine that meets the growing demand for premium products in the Japanese industry. Their expertise in production, promoting, and distribution plays a crucial role in ensuring port wine’s place in Japan’s expanding wine culture.

The growth of the port wine industry in Japan is also supported by the increasing interest in international wines, with port being regarded as a prestigious and traditional choice. As Japanese consumers continue to embrace a wider variety of global wines and refine their palates, port wine is expected to remain a popular and growing segment in Japan’s wine industry. This demand is expected to continue as the appreciation for quality, heritage, and new tasting experiences grows in the country.

Key Players in Japan Port Wine Demand

Grupo Sogevinus Fine Wines

Davy & Co Limited

Adriano Ramos Pinto

Quinta Do Crasto

The Fladgate Partnership

Scope of Report

Items

Values

Quantitative Units (2025)

USD million

Product Type

Vintage, Ruby, Tawny

Nature

Red, White

Regions Covered

Kyushu & Okinawa, Kanto, Kansai, Chubu, Tohoku, Rest of Japan

Countries Covered

Japan

Key Companies Profiled

Grupo Sogevinus Fine Wines, Davy & Co Limited, Adriano Ramos Pinto, Quinta Do Crasto, The Fladgate Partnership

Additional Attributes

Dollar sales by product type and nature; regional CAGR and growth trends; increasing consumer interest in premium and vintage port wine; rise of online channels for port wine distribution in Japan.

Japan Port Wine Demand by Key Segments

Type

Tawny

Region

Kyushu & Okinawa

Kanto

Kansai

Chubu

Tohoku

Rest of Japan

Frequently Asked Questions

How big is the demand for port wine in Japan in 2025?

The demand for port wine in Japan is estimated to be valued at USD 57.7 million in 2025.

What will be the size of port wine in Japan in 2035?

The market size for the port wine in Japan is projected to reach USD 107.1 million by 2035.

How much will be the demand for port wine in Japan growth between 2025 and 2035?

The demand for port wine in Japan is expected to grow at a 6.4% CAGR between 2025 and 2035.

What are the key product types in the port wine in Japan?

The key product types in port wine in Japan are vintage, ruby and tawny.

Which nature segment is expected to contribute significant share in the port wine in Japan in 2025?

In terms of nature, red segment is expected to command 66.8% share in the port wine in Japan in 2025.

AloJapan.com