Demand for Frozen Cooked Ready Meals in Japan Forecast and Outlook 2025 to 2035

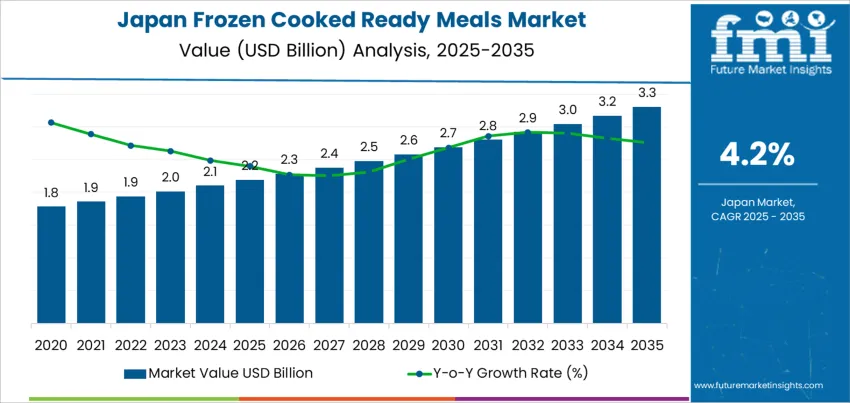

The demand for frozen cooked ready meals in Japan is expected to grow from USD 2.2 billion in 2025 to USD 3.3 billion by 2035, reflecting a CAGR of 4.2%. This growth is driven by the increasing demand for convenient, time-saving food solutions, particularly in urban areas where busy lifestyles dominate. The growing preference for ready-to-eat meals, which require minimal preparation, is propelling the demand for frozen cooked meals. As Japan’s aging population seeks easy meal options, frozen cooked ready meals provide a practical solution, offering nutritional value and variety. The rising popularity of single-serve meals and the ongoing trend of smaller household sizes contribute to the demand for these convenient food options.

The frozen cooked ready meals sector in Japan will also benefit from innovations in food quality and variety. Manufacturers are focusing on improving the taste, texture, and nutritional value of frozen meals, making them more appealing to health-conscious consumers. The sector will also see increased offerings of traditional Japanese dishes, along with global cuisine, catering to diverse consumer tastes. The demand for premium frozen meals, featuring organic ingredients or specific dietary needs such as low-sodium or low-fat options, is expected to continue growing. The combination of convenience, taste, and variety will drive the sector’s expansion, despite challenges such as the high competition in the convenience food sector.

Quick Stats of the Demand for Frozen Cooked Ready Meals in Japan

Demand for Frozen Cooked Ready Meals in Japan Value (2025): USD 2.2 billion

Demand for Frozen Cooked Ready Meals in Japan Forecast Value (2035): USD 3.3 billion

Demand for Frozen Cooked Ready Meals in Japan Forecast CAGR (2025-2035): 4.2%

Demand for Frozen Cooked Ready Meals in Japan Leading Product Type: Non-vegetarian Meals

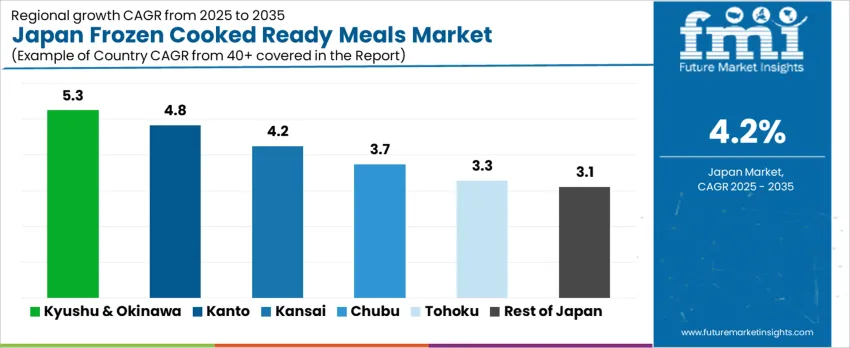

Demand for Frozen Cooked Ready Meals in Japan Key Growth Regions: Kyushu & Okinawa, Kanto, Kansai, Chubu, Tohoku, Rest of Japan

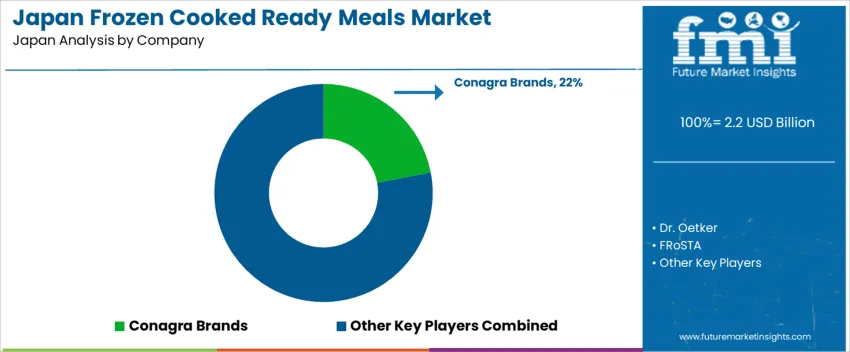

Demand for Frozen Cooked Ready Meals in Japan Top Players: Conagra Brands, Dr. Oetker, FRoSTA, General Mills, Pinnacle Foods

What is the Growth Forecast for the Demand for Frozen Cooked Ready Meals in Japan through 2035?

From 2025 to 2030, the demand for frozen cooked ready meals in Japan will grow from USD 2.2 billion to USD 2.8 billion, adding USD 0.6 billion in value. This phase will experience strong growth driven by increasing consumer demand for convenient, time-saving meal solutions, especially in urban areas where fast-paced lifestyles are prevalent. The growing preference for ready-to-eat meals that require minimal preparation, alongside the need for convenient, nutritious options, will fuel this demand. As Japan’s aging population seeks practical meal solutions, the sector will continue to thrive, with a rising number of individuals turning to frozen cooked meals for their variety and ease of use.

From 2030 to 2035, the industry will grow from USD 2.8 billion to USD 3.3 billion, contributing USD 0.5 billion in value. While growth continues, it will slow as the industry matures and faces greater competition in the convenience food sector. As the sector reaches a more saturated stage, companies will focus on product differentiation and improving quality to sustain demand. Manufacturers will emphasize innovation, enhancing the nutritional value, taste, and variety of frozen meals to meet evolving consumer preferences. This period will be marked by the demand for premium frozen meal options and an emphasis on dietary-specific products, ensuring steady growth despite a more competitive environment.

Demand for Frozen Cooked Ready Meals in Japan Key Takeaways

Metric

Value

Demand for Frozen Cooked Ready Meals in Japan Value (2025)

USD 2.2 billion

Demand for Frozen Cooked Ready Meals in Japan Forecast Value (2035)

USD 3.3 billion

Demand for Frozen Cooked Ready Meals in Japan Forecast CAGR (2025-2035)

4.2%

Why is the Demand for Frozen Cooked Ready Meals in Japan Growing?

The demand for frozen cooked ready meals in Japan is growing as busy lifestyles and the increasing need for convenient food solutions drive consumer preferences. Frozen cooked meals offer the convenience of quick and easy preparation while maintaining high-quality flavors and nutrition. This makes them an ideal choice for individuals and families seeking time-saving meal solutions, especially in urban areas where fast-paced living requires efficient dining options. As more people turn to ready-to-eat food, the frozen cooked meals sector is experiencing a steady rise.

A key factor behind the growth of frozen cooked ready meals is the increasing demand for convenience and time-saving solutions in Japan’s food industry. With a rising number of dual-income households and individuals with hectic schedules, there is a growing preference for meals that require minimal preparation while still offering taste and nutritional value. The variety of frozen cooked meals available, including local Japanese dishes as well as international cuisines, is expanding, further boosting the popularity of these products across different consumer segments.

The focus on innovation in the frozen food sector is contributing to the growing demand. Manufacturers are continually improving the quality, packaging, and taste of frozen cooked meals, making them more appealing to health-conscious consumers. These improvements, combined with advancements in freezing and preservation techniques, ensure that the meals retain their nutritional value and flavor, attracting a wider consumer base. As the demand for convenient, high-quality, and nutritious meal solutions rises, the demand for frozen cooked ready meals in Japan is expected to grow through 2035.

What is the Segment-Wise Analysis of Demand for Frozen Cooked Ready Meals in Japan?

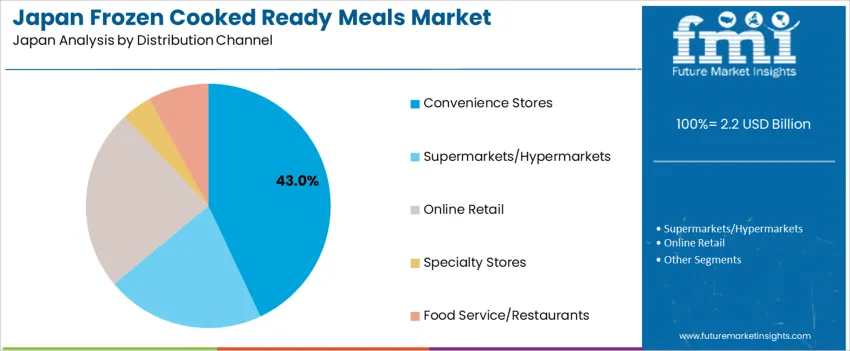

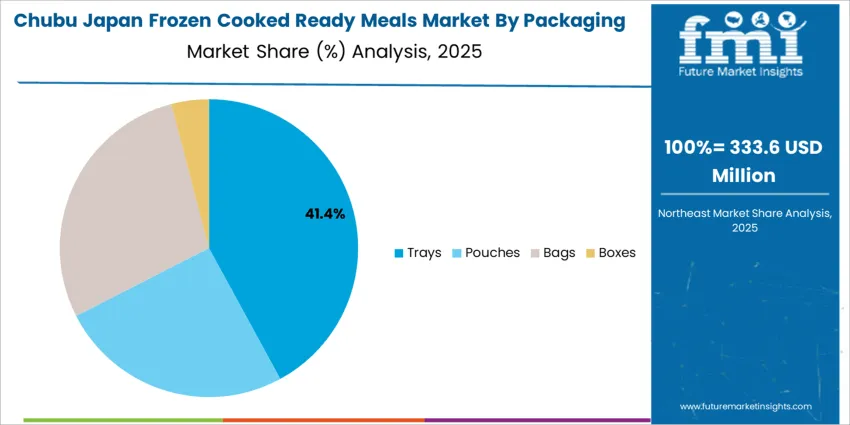

Demand for frozen cooked ready meals in Japan is segmented by product type, distribution channel, packaging, and region. By product type, demand is divided into non-vegetarian meals and vegetarian meals, with non-vegetarian meals leading at 59%. The demand is also segmented by distribution channel, including convenience stores, supermarkets/hypermarkets, online retail, specialty stores, and foodservice/restaurants, with convenience stores leading at 43%. In terms of packaging, demand is divided into trays, pouches, bags, and boxes, with trays being the most popular option. Regionally, demand is spread across Kyushu & Okinawa, Kanto, Kansai, Chubu, Tohoku, and the rest of Japan.

Why Do Non-Vegetarian Meals Lead the Demand for Frozen Cooked Ready Meals in Japan?

Non-vegetarian meals account for 59% of the demand for frozen cooked ready meals in Japan, driven by the widespread consumption of meat-based products and the convenience of ready-to-eat meals. These meals typically include popular options such as chicken, beef, pork, and seafood, which are staples in Japanese diets. Non-vegetarian meals are favored for their rich flavors, nutritional content, and the variety of cooking styles they offer, making them a preferred choice for busy consumers looking for a quick meal solution. With the demand for time-saving and easy-to-prepare meals increasing, non-vegetarian frozen ready meals have become a go-to option for households and individuals. The growing number of working professionals and urban dwellers who prioritize convenience further strengthens the demand for non-vegetarian frozen meals in Japan.

Why Do Convenience Stores Lead the Demand for Frozen Cooked Ready Meals in Japan?

Convenience stores account for 43% of the demand for frozen cooked ready meals in Japan, driven by their accessibility, extensive product variety, and quick meal options. With Japan’s high density of convenience stores, these retail outlets are strategically positioned to cater to the busy, urban population looking for easy-to-prepare meals on the go. Consumers can purchase a wide range of frozen cooked ready meals, from non-vegetarian to vegetarian options, all available for quick reheating and consumption. The growing trend of ready-to-eat and single-serve meal options has contributed to the dominance of convenience stores in the industry. Convenience stores often offer smaller portions, which cater to individuals or small households. As Japan’s fast-paced lifestyle continues to demand time-saving solutions, convenience stores will remain a leading distribution channel for frozen cooked ready meals.

What are the Key Trends, Drivers, and Restraints in Demand for Frozen Cooked Ready Meals in Japan?

Frozen ready meals allow consumers to have quick, easy‑to‑prepare meals that require minimal cooking effort. This demand is boosted by growth in single person households, dual income families, and older adults who may prefer simple meal preparation. The rise of convenience food culture and frequent use of convenience stores and supermarkets for everyday meals support this trend. However, cost pressures on ingredients and logistics, concerns about nutritional balance and freshness compared to freshly cooked meals, and competition with alternative meal options, such as fresh ready to eat meals or meal kits, restrain rapid expansion of demand.

Why is Demand for Frozen Cooked Ready Meals Growing in Japan?

Demand grows because many Japanese consumers face time constraints due to work, commuting, and busy daily schedules. Frozen ready meals offer a practical solution just heat and eat without the need for extensive cooking or meal planning. As more households rely on convenience stores and supermarkets rather than cooking from scratch, frozen ready meals meet the need for quick meals at home or at work. Aging demographics and households with fewer members also contribute, as these segments value shelf stability, portion control, and ease of storage. Broader availability through retail and grocery outlets further enhances access and encourages trial and repeat purchase of frozen cooked meals in everyday diets.

How are Technological & Industry Innovations Driving Frozen Cooked Ready Meal Demand in Japan?

Advances in freezing technology, packaging, and food processing have improved the quality, safety, and convenience of frozen cooked ready meals in Japan. Improved freezing and thawing methods help retain taste, texture, and nutritional value making frozen meals closer in quality to freshly prepared dishes. Manufacturers are also offering a wider variety of dishes, including international cuisines, healthier or portion controlled meals, and premium quality ready meals to meet changing consumer tastes. Packaging innovations improve shelf life and ease of reheating while ensuring food safety. As supply chain and cold chain logistics improve, distribution becomes more reliable, enabling frozen ready meals to reach a broader consumer base in urban and rural areas alike.

What are the Key Challenges and Risks That Could Limit Frozen Cooked Ready Meal Demand in Japan?

Despite growing adoption, several factors could limit demand for frozen cooked ready meals in Japan. Consumers increasingly value freshness, nutritional balance, and minimally processed foods concerns that can deter some from choosing frozen meals regularly. Price sensitivity remains, especially as higher quality frozen meals or premium varieties may cost more than home cooked alternatives. Competition from fresh ready to eat meals, meal kits, home delivery options and restaurant take outs may also limit growth. Logistics and cold chain costs for producers and retailers add to final prices. Lastly, demographic shifts such as households preferring traditional cooking or meals prepared from scratch may restrain long term demand growth for frozen cooked ready meals.

What is the Regional Demand Outlook for Frozen Cooked Ready Meals in Japan?

Region

CAGR (%)

Kyushu & Okinawa

5.3%

Kanto

4.8%

Kinki

4.2%

Chubu

3.7%

Tohoku

3.3%

Rest of Japan

3.1%

Demand for frozen cooked ready meals in Japan is growing across all regions, with Kyushu & Okinawa leading at a 5.3% CAGR, driven by the increasing demand for convenient meal solutions. Kanto follows with a 4.8% CAGR, supported by its large urban population and busy lifestyles. Kinki shows a 4.2% CAGR, driven by its strong foodservice sector and increasing consumer preference for ready-to-eat meals. Chubu experiences a 3.7% CAGR, with rising demand in both urban and rural areas, particularly for frozen meal solutions. Tohoku and the Rest of Japan see moderate growth at 3.3% and 3.1%, respectively, reflecting a steady adoption of frozen cooked ready meals as consumers seek convenience and time-saving meal options.

How is Demand for Frozen Cooked Ready Meals Growing in Kyushu & Okinawa?

Kyushu & Okinawa leads the demand for frozen cooked ready meals, growing at a 5.3% CAGR. The region’s increasing focus on convenience and busy lifestyles is driving the demand for ready-to-eat meal solutions. With a growing population and tourism sector, particularly in Okinawa, there is rising demand for frozen meals that provide quick, easy, and nutritious options for both locals and visitors. The region’s foodservice sector, including hotels and resorts, is increasingly relying on frozen cooked meals for efficiency and cost-effectiveness. As the population becomes more health-conscious and seeks quick meal solutions without compromising quality, the demand for frozen cooked ready meals is expected to grow steadily in Kyushu & Okinawa, supported by both the local population and the growing tourism industry.

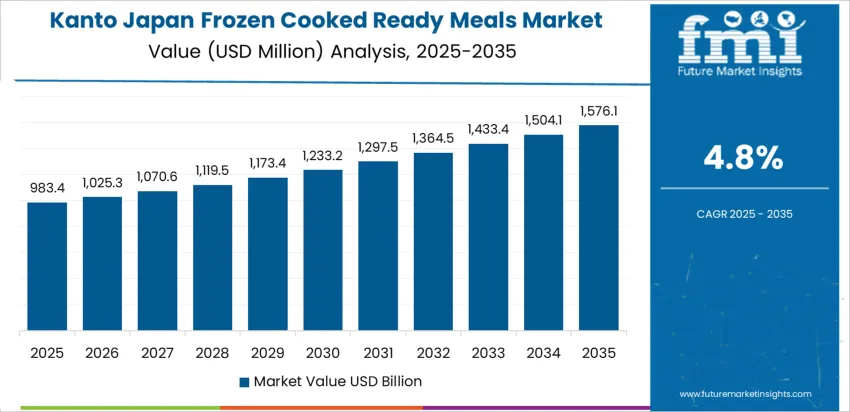

Why is Demand for Frozen Cooked Ready Meals Rising in Kanto?

Kanto is experiencing strong demand for frozen cooked ready meals, with a 4.8% CAGR. The region’s large urban population, particularly in Tokyo, drives the demand for convenient meal options. As consumers face busy work and lifestyle schedules, frozen cooked meals offer a time-saving solution without compromising on taste or nutrition. The growing trend of smaller households and single-person households in Kanto is contributing to the demand for individual or small-size frozen meals. With rising awareness of health and wellness, consumers in Kanto are seeking healthier frozen meal options that provide balanced nutrition. The foodservice industry, including corporate cafeterias, quick-service restaurants, and convenience stores, is increasingly turning to frozen cooked ready meals for their efficiency and cost-effectiveness. As this trend continues, demand for frozen cooked meals in Kanto is expected to grow steadily.

How is Demand for Frozen Cooked Ready Meals Expanding in Kinki?

Kinki shows steady demand for frozen cooked ready meals, with a 4.2% CAGR. The region’s strong foodservice sector, particularly in cities like Osaka, is driving the adoption of frozen meals, as businesses seek cost-effective, time-saving meal solutions. As Kinki’s busy urban population increasingly embraces convenient, ready-to-eat meals, frozen cooked meals are gaining popularity for their quality, ease of use, and long shelf life. The region’s growing interest in health-conscious eating is influencing demand for nutritious frozen meal options. With both residential consumers and businesses seeking meals that combine convenience and healthy ingredients, the demand for frozen cooked ready meals in Kinki is expected to grow steadily. The rise in smaller households and dual-income families in the region is further supporting this trend, as consumers turn to frozen meals to meet their time constraints.

Why is Demand for Frozen Cooked Ready Meals Growing in Chubu?

Chubu is experiencing steady demand for frozen cooked ready meals, growing at a 3.7% CAGR. The region’s diverse population, which includes both urban and rural areas, is increasingly turning to frozen meals as a convenient, time-saving solution. As consumer lifestyles in Chubu become more fast-paced, especially in industrial hubs like Nagoya, there is rising demand for quick and easy meal options that require minimal preparation. The region’s foodservice industry is embracing frozen cooked meals for their efficiency and ability to serve a wide range of consumers. As the focus on health and wellness continues to grow, there is also an increasing demand for nutritious frozen meal options. With this trend, Chubu is expected to see steady growth in the demand for frozen cooked ready meals, driven by both consumer preferences for convenience and the foodservice sector’s need for efficient meal solutions.

How is Demand for Frozen Cooked Ready Meals Expanding in Tohoku?

Tohoku is seeing moderate demand for frozen cooked ready meals, with a 3.3% CAGR. While the region’s consumption of frozen meals is smaller compared to urban centers, there is a steady increase in demand as consumers seek convenient meal solutions. The region’s growing focus on health and convenience, along with rising urbanization, is contributing to the adoption of frozen cooked ready meals. As Tohoku’s foodservice industry modernizes and adapts to evolving consumer needs, there is greater availability of frozen meal options. Smaller households and busy working individuals in Tohoku are increasingly turning to frozen cooked meals for their convenience, affordability, and variety. As local food producers and retailers respond to the rising demand for convenient meal solutions, the region is expected to experience steady growth in frozen cooked ready meal consumption.

Why is Demand for Frozen Cooked Ready Meals Steady in the Rest of Japan?

The Rest of Japan is experiencing steady demand for frozen cooked ready meals, with a 3.1% CAGR. Although the demand is lower than in urban regions, there is gradual growth as smaller cities and rural areas embrace the convenience of frozen meals. With increasing time constraints and smaller households, consumers in these areas are turning to frozen cooked meals as an affordable and quick meal solution. The growth in the foodservice sector in rural areas, including inns, restaurants, and small retailers, is contributing to the rise in frozen meal consumption. As the demand for healthier and convenient meal options continues to grow, the Rest of Japan is expected to see steady adoption of frozen cooked ready meals, driven by both local businesses and increasing consumer preference for time-saving meal solutions.

What is Driving the Demand for Frozen Cooked Ready Meals in Japan and Who Are the Key Players Shaping the Industry?

The demand for frozen cooked ready meals in Japan is increasing as consumers seek convenient, time-saving meal solutions without compromising on quality or taste. With the busy lifestyles of modern consumers, particularly in urban areas, the need for quick and easy meal options has surged. Frozen cooked ready meals provide the convenience of prepared meals that can be heated and enjoyed in minutes, making them an attractive option for busy professionals, families, and single-person households. Japan’s aging population has further fueled the demand, as older adults increasingly prefer ready-to-eat meals that are easy to prepare and consume.

Key players shaping the frozen cooked ready meals industry in Japan include Conagra Brands, Dr. Oetker, FRoSTA, General Mills, and Pinnacle Foods. Conagra Brands leads the industry with a significant share of 22.0%, offering a variety of frozen meal options catering to different tastes and dietary preferences. These companies are innovating by introducing healthier, high-quality, and culturally relevant meals to meet the demands of Japanese consumers. Their focus on product variety, including options for specific dietary needs such as low-sodium or low-calorie meals, continues to drive growth in the frozen ready meals sector.

The growth of the frozen cooked ready meals industry in Japan is also supported by the increasing demand for healthier, premium meal options that offer convenience without sacrificing nutrition. As consumer preferences shift toward more diverse, international, and high-quality ready meals, the industry for frozen cooked meals is expected to continue expanding. With a growing focus on convenience, variety, and nutritional value, frozen ready meals are positioned to remain an integral part of Japan’s evolving food landscape.

Key Players in Japan Frozen Cooked Ready Meals Demand

Conagra Brands

Dr. Oetker

FRoSTA

General Mills

Pinnacle Foods

Scope of Report

Items

Values

Quantitative Units (2025)

USD billion

Product Type

Non-vegetarian Meals, Vegetarian Meals

Packaging

Trays, Pouches, Bags, Boxes

Distribution Channel

Convenience Stores, Supermarkets/Hypermarkets, Online Retail, Specialty Stores, Food Service/Restaurants

Regions Covered

Kyushu & Okinawa, Kanto, Kansai, Chubu, Tohoku, Rest of Japan

Countries Covered

Japan

Key Companies Profiled

Conagra Brands, Dr. Oetker, FRoSTA, General Mills, Pinnacle Foods

Additional Attributes

Dollar sales by product type and packaging; regional CAGR and growth trends; increasing demand for convenient and quick meals; rise in popularity of frozen vegetarian options.

Japan Frozen Cooked Ready Meals Demand by Key Segments Product Type

Non-vegetarian Meals

Vegetarian Meals

Packaging

Distribution Channel

Convenience Stores

Supermarkets/Hypermarkets

Online Retail

Specialty Stores

Food Service/Restaurants

Region

Kyushu & Okinawa

Kanto

Kansai

Chubu

Tohoku

Rest of Japan

Frequently Asked Questions

How big is the demand for frozen cooked ready meals in Japan in 2025?

The demand for frozen cooked ready meals in Japan is estimated to be valued at USD 2.2 billion in 2025.

What will be the size of frozen cooked ready meals in Japan in 2035?

The market size for the frozen cooked ready meals in Japan is projected to reach USD 3.3 billion by 2035.

How much will be the demand for frozen cooked ready meals in Japan growth between 2025 and 2035?

The demand for frozen cooked ready meals in Japan is expected to grow at a 4.2% CAGR between 2025 and 2035.

What are the key product types in the frozen cooked ready meals in Japan?

The key product types in frozen cooked ready meals in Japan are non-vegetarian meals and vegetarian meals.

Which packaging segment is expected to contribute significant share in the frozen cooked ready meals in Japan in 2025?

In terms of packaging, trays segment is expected to command 43.0% share in the frozen cooked ready meals in Japan in 2025.

AloJapan.com