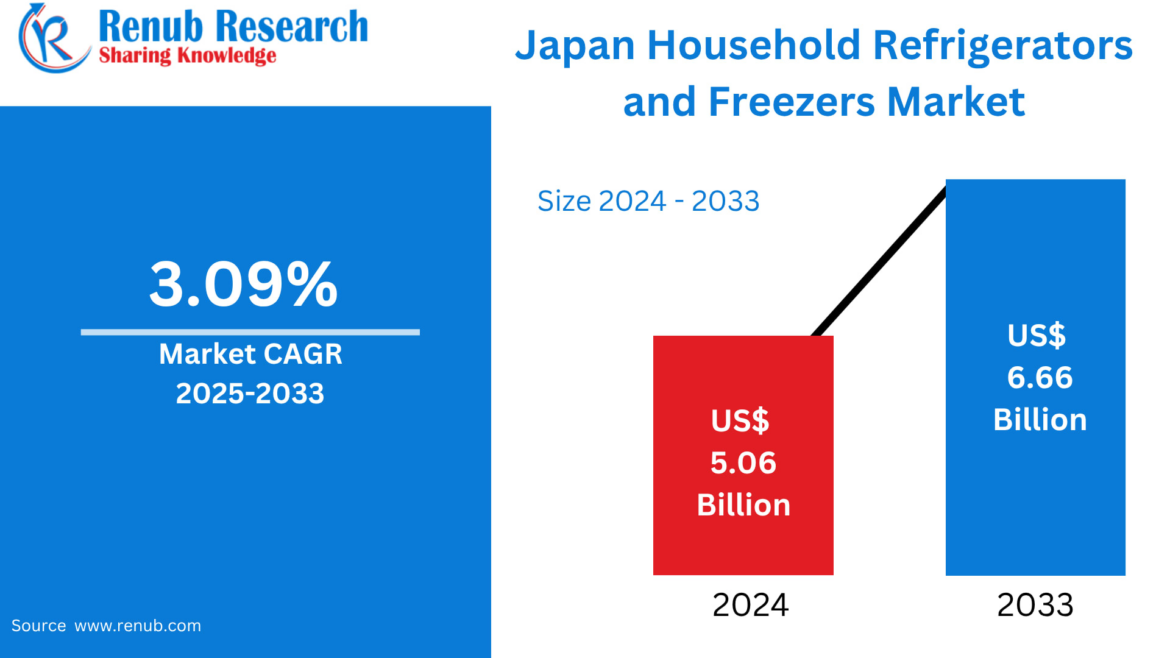

The Japan Household Refrigerators and Freezers Market, valued at US$ 5.06 billion in 2024, is projected to rise to US$ 6.66 billion by 2033, growing at a CAGR of 3.09% during 2025–2033, according to Renub Research. The consistent market expansion reflects Japan’s evolving consumer lifestyles, rapid technological advancement, demographic transformation, and a strong national emphasis on energy conservation.

From compact apartments in Tokyo to multi-generational households in Shizuoka, refrigerators remain an essential component of Japanese living. But unlike many global markets driven by first-time buyers, Japan’s growth stems from replacement demand, innovations in smart connectivity, and the rising need for energy-efficient, ergonomically designed appliances suited to an aging population.

Download Free Sample Report

Japan Household Refrigerators and Freezers Market Overview

Refrigerators are universal in Japanese homes, where freshness, hygiene, and culinary culture are core values. Japanese households prioritize appliances that are space-efficient, quiet, and packed with smart technology—reflecting both compact living environments and the country’s thriving digital ecosystem.

Modern Japanese refrigerators are typically equipped with:

Inverter compressors for energy savings

Vacuum insulation to retain cooling

Multi-door formats, especially in urban centers

Smart controls and app integration

Ergonomic layouts for improved access

The growing popularity of home cooking—even among younger demographics—also increases dependence on functional cold-storage solutions. Government incentives for eco-friendly appliances further push consumers to upgrade older units, fueling the replacement cycle.

The merging of AI and IoT into everyday appliances is setting Japan apart globally. As highlighted by an April 2025 ITBusinessToday report, Japan’s home appliances—from smart rice cookers to intelligent refrigerators—exemplify how technology is transforming lifestyle convenience and energy savings.

Growth Drivers in the Japanese Household Refrigerators & Freezers Market

✔ Rising Domestic Demand for Energy-Efficient Appliances

Japan enforces some of the world’s strictest energy-efficiency standards, influencing both consumer choices and manufacturer strategies. Higher utility prices, environmental awareness, and government-led sustainability campaigns have created strong demand for:

Energy Star-compliant models

Advanced inverter technologies

Improved insulation materials

Eco-friendly refrigerants

Manufacturers are responding by designing greener models that appeal to budget-conscious and eco-conscious buyers alike. Notably, in May 2025, AKAI introduced its Direct Cool Single Door Refrigerators in India, showcasing Japan’s influence in producing globally appealing, energy-saving appliances across sizes ranging from 48 to 230 liters.

✔ Impact of Japan’s Aging Population

Japan’s rapidly aging demographic is reshaping product design across industries. For refrigerators, this means:

Easy-to-open doors

Wider shelving and accessible compartments

Intuitive, simplified controls

Bottom-freezer and side-by-side layouts to minimize bending

Voice-assisted or touchless access features

The aging population not only shapes consumer priorities but also inspires manufacturers to design appliances suited for small families, assisted living homes, and seniors living independently.

✔ Smart Home Integration and Technological Advancements

Japan’s smart home ecosystem is expanding swiftly. Connected refrigerators equipped with:

AI monitoring

Interior cameras

Wi-Fi connectivity

Remote temperature control

Inventory tracking systems

are now increasingly common in metropolitan hubs.

Humidity control, multi-zone cooling, dual-inverter compressors, and antibacterial coatings are becoming mainstream for higher-end models.

In line with these innovations, the Japanese Ministry of Economy, Trade and Industry (METI) updated its energy labeling system in 2022 to improve consumer understanding—a move that supports adoption of next-generation, energy-efficient appliances.

Market Limitations and Challenges

■ Limited Living Space in Urban Japan

Tokyo, Osaka, and other dense urban regions face unique challenges due to compact housing layouts. Many apartments are too small for large refrigerators, limiting consumer options and pushing manufacturers toward compact, high-functionality designs.

Manufacturers must balance:

Storage capacity

Energy efficiency

Performance

Slim, space-saving builds

Additionally, delivery and installation in narrow stairways and tightly constructed buildings remain operational challenges.

■ Market Saturation and Replacement-Driven Growth

With nearly every household owning a refrigerator, Japan’s market is mature. Growth depends primarily on:

Replacement cycles

Technological upgrades

Differentiated features

Brand loyalty

Consumers hesitate to replace appliances due to cost and the long lifespan of energy-efficient units, making innovation essential for market competitiveness.

Analysis by Refrigerator Type

Top-Mounted Refrigerators (Freezer on Top)

These models remain highly popular due to:

Affordability

Simplicity

Space efficiency

Practical vertical storage

Ideal for small families, rental apartments, and elderly consumers, this category continues to be a reliable revenue stream.

French Door Refrigerators

Demand is rising among premium buyers and large households. Benefits include:

Large interior space

Flexible shelving

Lower freezer drawers

Energy-efficient two-door design

These models appeal to families embracing open kitchen designs and premium aesthetics.

More Than 30 cu. ft Refrigerators

A niche but growing category, dominated by:

High-income consumers

Tech-heavy smart households

Rural or suburban families with larger kitchens

These refrigerators often include temperature zones, touchscreens, and advanced smart-home integration.

Distribution Channel Dynamics

Specialty Stores – Still a Trusted Option

Japanese consumers value in-store demonstrations and expert advice for high-value appliances. Specialty stores offer:

Personal guidance

Installation support

In-store warranties

Product comparisons

They remain especially popular with older buyers and premium shoppers.

E-commerce – A Fast-Expanding Channel

Online platforms such as Rakuten, Amazon Japan, and Yodobashi are reshaping refrigerator purchasing behavior.

Drivers include:

Competitive pricing

Wide product availability

Consumer reviews

Convenience of home delivery

Challenges include installation logistics and returns management.

Increasingly, retailers are adopting AR/VR visualization tools to help consumers preview appliances in their homes.

Regional Analysis

Tokyo

Leads market share due to dense population

High demand for smart, compact, quiet refrigerators

Strong e-commerce adoption

Preference for eco-friendly models

Saitama

Suburban families prefer mid-size and multi-door units

Government subsidies boost demand

Mix of online and in-store purchasing

Aichi

Strong industrial and residential base

Preference for high-performance Japanese-made appliances

Growing adoption of energy-saving innovations

Shizuoka

Rural homes favor large-capacity models

Urban centers prefer compact units

Strong preference for durable, long-lasting appliances

Aging demographics increase demand for user-friendly designs

Market Segmentation

By Door Type

Top Mounted

Bottom Mounted

Side-by-Side

French Door

By Capacity

Less than 15 cu. ft

16 to 30 cu. ft

More than 30 cu. ft

By Distribution Channel

Supermarkets/Hypermarkets

E-commerce

Specialty Stores

Others

Top 10 City Markets

Tokyo, Kansai, Aichi, Kanagawa, Saitama, Hyogo, Chiba, Hokkaido, Fukuoka, Shizuoka

Key Players Covered

Each company is analyzed with: Overview, Key Person, Recent Developments, SWOT Analysis, Revenue Analysis.

General Electric

Haier Group

LG Electronics

Robert Bosch GmbH

Panasonic Holdings Corporation

Samsung Electronics

Whirlpool Corporation

Final Thoughts

Japan’s Household Refrigerators and Freezers Market is entering a new era defined by smart innovation, demographic transformation, eco-consciousness, and premiumization. While space constraints and market maturity impose challenges, the sector continues to evolve with high-efficiency technologies, voice-enabled interfaces, and compact multi-functional designs tailored to modern Japanese living.

As Japan embraces a future of smart homes and sustainable lifestyles, manufacturers who blend technology, ergonomic design, and energy efficiency will lead the market through 2033 and beyond.

AloJapan.com