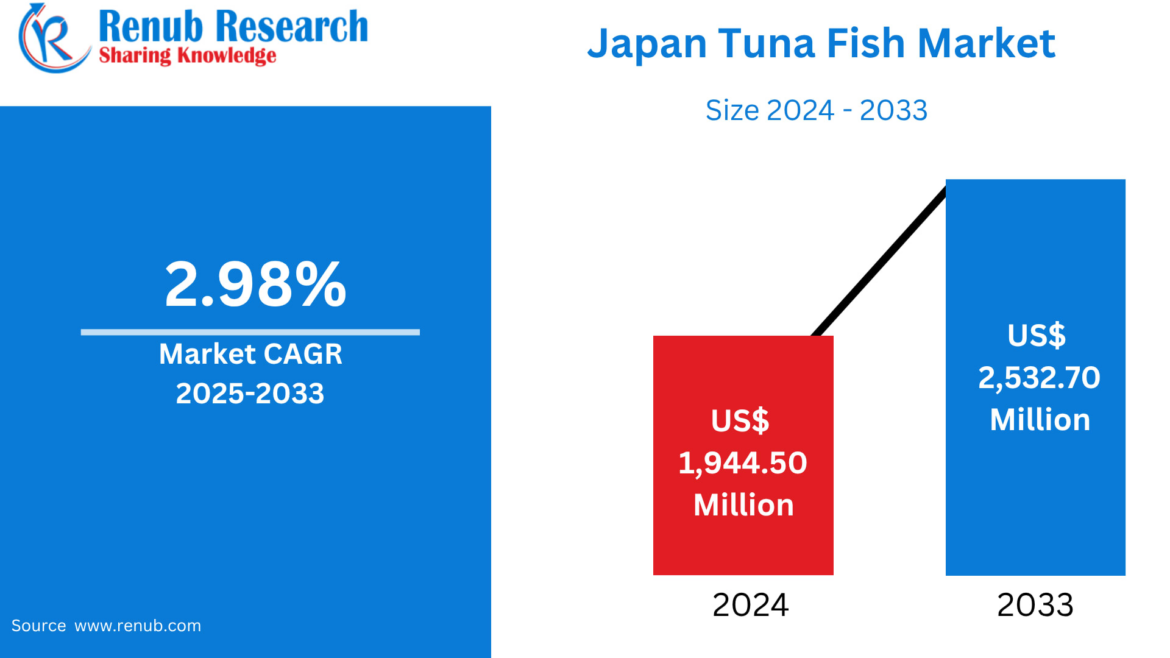

The Japan Tuna Fish Market is anticipated to grow to US$ 1,944.50 million in 2024 and is further expected to reach US$ 2,532.70 million by 2033, exhibiting a CAGR of 2.98% during the forecast period of 2025 to 2033, according to Renub Research. Japan’s deep-rooted seafood culture, an expanding foodservice sector, growing retail sales, and consistent consumer preference for premium-quality tuna continue to push the market forward. With tuna being an iconic staple in Japanese cuisine—especially in sushi and sashimi—this demand is unlikely to slow down.

From traditional culinary practices to modern retail innovation, Japan’s tuna market exemplifies how culture, convenience, and technology continue to transform its seafood landscape.

Download Sample Report

Japan Tuna Fish Market Outlook

Tuna—loved for its rich taste, firm texture, and versatility—stands as one of Japan’s most treasured seafood items. Whether served raw as sashimi, sliced atop sushi rice, or used in more humble forms such as canned tuna for salads and donburi, the fish occupies a central role in everyday Japanese dining.

The Bluefin variety, in particular, commands tremendous cultural respect as a culinary delicacy and symbol of quality. At Tokyo’s Toyosu Market, Bluefin tuna auctions attract international attention each year, often breaking records for premium fish. Alongside Bluefin, Skipjack tuna remains essential to Japanese cooking, especially for katsuobushi (bonito flakes), the backbone of traditional dashi broth.

Across retail shelves, home kitchens, sushi bars, and high-end restaurants, Japan exhibits an insatiable appetite for tuna. This stable, nationwide consumption pattern—paired with advancements in processing and distribution—continues to sustain Japan’s position among the world’s largest tuna-consuming countries.

Key Growth Drivers in the Japan Tuna Fish Market

1. Cultural and Culinary Significance

The Japanese Fisheries Agency reports that per capita seafood consumption reached 22 kilograms in 2022, reaffirming the nation’s strong preference for fish-based diets. Tuna, however, holds a uniquely revered place in Japanese culture.

For generations, tuna has remained central to:

Sushi and sashimi traditions

Seasonal festivities and celebrations

Home cooking and modern quick meals

High-end dining experiences

Demand for premium tuna—especially Bluefin, Yellowfin, and Skipjack—remains consistently high as consumers place enormous importance on freshness, texture, and provenance. This cultural allegiance creates a naturally resilient market, ensuring steady consumption across demographics and regions.

2. Booming Foodservice Industry

Japan’s foodservice ecosystem—from conveyor-belt sushi chains to luxury omakase restaurants—is a cornerstone of the tuna market. As tourism rebounds and domestic dining-out culture strengthens, demand for fresh and frozen tuna continues to surged.

In an example of technological integration, Pronto Corporation’s 2022 collaboration with TechMagic led to the development of an automated pasta-making robot capable of producing dishes in just 45 seconds. Such technology-driven upgrades across restaurants indicate how the industry is modernizing—boosting efficiency while supporting steady seafood procurement.

As Japan’s foodservice sector evolves, so does its reliance on premium tuna cuts, ensuring continued growth and higher import volumes where domestic supply falls short.

3. Innovation in Processing, Packaging & Logistics

Advancements in flash-freezing, cold chain logistics, and vacuum packaging have significantly improved the shelf life and quality retention of tuna. These developments have:

Made high-quality tuna more accessible across Japan’s supermarkets

Supported rising retail demand for frozen and ready-to-use seafood

Reduced waste and improved handling efficiency

Enhanced year-round availability

In November 2024, Genki Global—the parent company behind Genki Sushi and Uobei—celebrated surpassing 242 global outlets, including 185+ in Japan. This growth directly reflects rising consumer interest in fast, fresh, and high-quality seafood options.

Additionally, nutrition-focused product innovations—such as reduced-sodium canned tuna and protein-fortified ready meals—are boosting retail performance, especially among health-conscious consumers seeking clean-label, minimally processed foods.

Challenges in the Japan Tuna Fish Market

1. Sustainability & Overfishing Constraints

Bluefin tuna—a highly prized species—has long been threatened by overfishing. International conservation regulations and catch quotas from bodies such as ICCAT and WCPFC place strict limits on available supply. These measures are crucial for long-term sustainability but can:

Increase wholesale and retail prices

Reduce availability

Create uncertainty for restaurants

Pressure domestic fishermen

Sustainability concerns remain the most pressing challenge for Japan’s tuna supply chain.

2. Price Volatility & Supply Chain Risks

The tuna market is sensitive to:

Climate and ocean temperature variations

Fishing quota changes

Global supply chain disruptions

Fuel price fluctuations

Currency exchange rates

As tuna prices fluctuate globally, both retailers and consumers experience occasional instability. Japan’s dependence on imports for several species makes the market vulnerable to external shocks.

Segment-Specific Market Insights

Japan Canned Tuna Fish Market

Canned tuna remains a household staple thanks to its:

Affordability

Convenience

Long shelf life

Versatility in quick meal prep

Busy lifestyles and an increasing focus on protein-rich diets have kept this category resilient. From children to elderly consumers, canned tuna enjoys persistent multi-generational demand.

Japan Fresh Tuna Fish Market

Fresh tuna is indispensable in Japan’s culinary identity. Consumers are highly selective, prioritizing:

Marbling (for Bluefin and fatty cuts like otoro)

Freshness levels

Fishing source

Processing methods

Seasonal demand spikes during festivals, holidays, and food-themed events. Fresh tuna remains the premium category driving Japan’s sushi and sashimi culture.

Japan Skipjack Tuna Fish Market

Skipjack tuna dominates daily Japanese cuisine through katsuobushi production, a foundation of traditional broth (dashi). It is also widely used in:

Canned tuna

Affordable sashimi assortments

Ready-to-eat meals

Because of its indispensable culinary role, Skipjack maintains a stable consumption base across Japan.

Japan Bluefin Tuna Fish Market

Bluefin represents the luxury tier of Japan’s tuna market—frequently associated with status, craftsmanship, and exceptional culinary quality. Toyosu Market’s annual Bluefin auctions often capture global attention for their sky-high bids.

Despite sustainability concerns, demand remains extraordinarily strong in premium restaurants and metropolitan regions.

Japan Tuna Fish Retail Market

Retail channels—supermarkets, department stores, and convenience chains—provide consumers with a combination of:

Fresh cuts

Frozen fillets

Ready-to-cook tuna steaks

Canned tuna

Marinated and value-added tuna products

Seasonal promotions and health-marketing campaigns further drive sales as tuna continues to be positioned as a lean, omega-rich protein source.

Japan Tuna Fish Foodservice Market

Sushi restaurants, izakayas, seafood grills, and hotel dining halls heavily rely on consistent tuna supplies. As post-pandemic tourism surges in cities like Tokyo, Kyoto, and Osaka, the foodservice demand for both standard and premium tuna varieties is increasing rapidly.

Regional Market Highlights

Tokyo Tuna Fish Market

Tokyo—home to the world-famous Toyosu Market—remains Japan’s nerve center for tuna trade. The city’s dense network of sushi restaurants and luxury dining establishments sets national pricing trends.

Aichi Tuna Fish Market

Aichi, particularly Nagoya, benefits from thriving fishing ports and a strong local preference for fresh seafood. Its strategic location allows efficient distribution throughout central Japan.

Saitama Tuna Fish Market

Despite being landlocked, Saitama benefits from Tokyo’s supply chain ecosystem. With high population density and increasing demand for affordable seafood, the region has become a growing market for tuna products.

Shizuoka Tuna Fish Market

Shizuoka—home to major fishing ports like Yaizu—plays a vital role in tuna processing and export. Its skilled workforce and state-of-the-art facilities make it a key hub in Japan’s tuna supply chain.

Market Segmentation

By Type

Canned

Fresh

Frozen

By Species

Skipjack

Albacore

Yellowfin

Bigeye

Bluefin

Others

By End Use

Retail

Food Service

Industrial

Top 10 Cities

Tokyo, Kansai, Aichi, Kanagawa, Saitama, Hyogo, Chiba, Hokkaido, Fukuoka, Shizuoka

Key Player Profiles (5 Viewpoints Each: Overview, Key Person, Developments, SWOT, Revenue)

Century Pacific Foods Inc.

ITOCHU Corporation

Thai Union Group Inc.

IBL Ltd.

Bolton Group

Grupo Albacore S.A.

Dongwon Enterprises Co. Ltd.

These companies dominate Japan’s tuna supply ecosystem through diversified product portfolios, strong distribution channels, and global fishing operations.

Final Thoughts

Japan’s Tuna Fish Market stands at the intersection of tradition, innovation, and global influence. While sustainability and supply-chain risks present challenges, the market’s deep cultural roots, strong retail adoption, and thriving foodservice sector continue to drive consistent growth.

Looking ahead to 2033, Japan’s tuna market is expected to remain robust as technological upgrades, evolving consumer preferences, and value-added product innovations shape the next decade of seafood consumption.

AloJapan.com