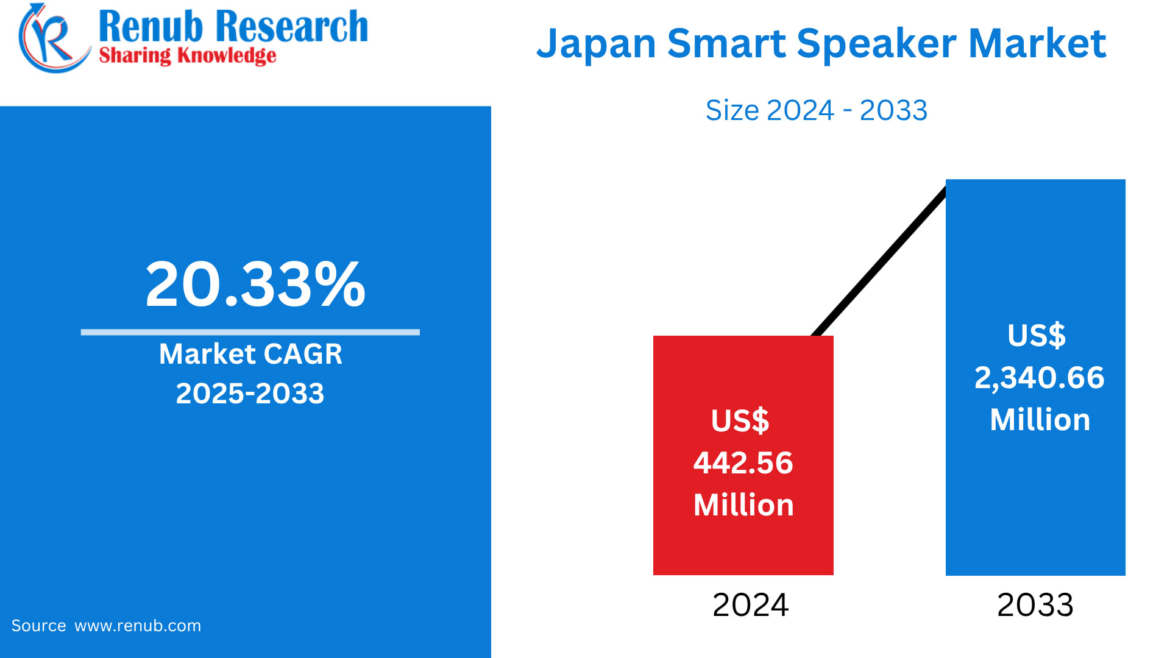

The Japan Smart Speaker Market is entering a transformative decade, supported by rapidly advancing artificial intelligence, rising smart home adoption, and the country’s broader vision of building Society 5.0 — a hyper-connected, high-tech society driven by intelligent systems. According to Renub Research, the market is projected to grow from US$ 442.56 million in 2024 to US$ 2,340.66 million by 2033, expanding at a powerful CAGR of 20.33% during 2025–2033. With Japanese consumers increasingly embracing connected living, smart speakers are no longer niche gadgets — they are becoming essential household interfaces for communication, entertainment, and home automation.

This growth is fueled not only by global giants like Amazon and Google, but also by influential domestic players such as LINE, which has uniquely localized its products for Japanese language and cultural preferences. As homes, cars, and workplaces become more digital, the smart speaker is evolving into the new command center of everyday life across Japan.

Download Sample Report

Japan Smart Speaker Market Overview

Japan’s smart speaker industry is growing at an impressive pace thanks to rapid advancements in natural language processing (NLP) and artificial intelligence (AI), which have significantly improved the usability, accuracy, and cultural relevance of voice-based devices. These technologies have enhanced voice recognition for complex aspects of Japanese communication, including keigo (formal honorific speech), regional dialects, and rapid linguistic shifts used in daily conversation.

Smart speakers are now deeply integrated into Japan’s evolving smart home ecosystem, performing tasks such as device control, entertainment, news updates, scheduling, and energy management. As Japan accelerates its Society 5.0 initiative — aimed at harmonizing digital automation with human needs — smart speakers play a critical role in enabling seamless human-machine interaction.

The presence of strong competitors has also accelerated growth. Amazon Echo, Google Nest, Apple HomePod, and LINE Clova each offer localized experiences to appeal to Japanese linguistic and cultural expectations. Japan’s robust digital infrastructure, expanding fiber-optic networks, widespread smartphone penetration, and proactive smart city initiatives further reinforce the growing demand.

Yet, challenges remain. Data privacy fears, concerns around voice surveillance, and issues in multi-dialect recognition occasionally slow adoption. Additionally, intense market competition requires companies to innovate constantly while offering attractive price points.

Still, the trajectory is unmistakably strong — Japan is poised to become one of Asia’s most innovative smart speaker hubs through 2033.

Key Factors Driving Market Growth

1. Breakthroughs in AI and Voice Recognition Technology

Recent developments in NLP and AI have addressed historically difficult features of the Japanese language. Modern smart speakers now offer:

Higher accuracy in recognizing regional dialects (Kansai-ben, Hakata-ben, etc.)

Better comprehension of keigo and conversational shifts

Enhanced contextual understanding allowing natural, human-like conversations

Personalized recommendations based on behavioral patterns

Continuous learning that adapts to speech habits

These improvements make voice interaction more intuitive, reliable, and enjoyable — a necessity in a market where consumers expect flawless precision.

As AI becomes more embedded in daily life, smart speakers are transforming into personal assistants capable of managing tasks, monitoring home systems, guiding elder care, and even supporting language learning.

2. Seamless Integration With Smart Home Ecosystems

Japan’s rapid adoption of smart home devices — from thermostats and lighting systems to connected appliances and robot cleaners — makes smart speakers increasingly essential.

Smart speakers serve as the central command hub for:

Home security systems

Smart lighting

Connected kitchen appliances

Entertainment systems

HVAC and energy management

Door locks and safety devices

For time-strapped urban residents, voice automation brings efficiency, convenience, and comfort. As more Japanese households transition to smart apartments — especially in Tokyo, Osaka, Aichi, and Kanagawa — this integration trend will only accelerate.

3. Strong Presence of Local and International Market Players

Japan benefits from a unique mix of local and global competitors:

Amazon Alexa: strong distribution, localized services, wide smart home compatibility

Google Assistant: superior natural language understanding and Android integration

LINE Clova: tailored to Japanese culture, messaging platform connectivity, music services

Panasonic, Sony, Lenovo, LG: expanding IoT and smart home offerings

Localization is crucial in Japan. LINE, for instance, integrates popular domestic services like LINE Music, LINE Messaging, and Japanese content libraries to win consumer loyalty.

This diverse competition pushes continuous innovation while offering consumers more options across price ranges, voice assistants, and design preferences.

Challenges in the Japan Smart Speaker Market

1. Language Complexity and Regional Dialects

Despite huge progress, recognizing all Japanese dialects with perfect accuracy remains a challenge. Certain complexities include:

Intonation variations

Region-specific vocabulary

Fast conversational transitions

Use of honorifics

Misinterpretation can reduce user satisfaction and discourage frequent use. Companies must continue investing in voice datasets, regional voice training, and context-aware AI models.

2. Market Saturation and Competitive Pricing Pressure

Japan’s smart speaker market is becoming densely competitive, with many models offering similar functions. This leads to:

Frequent price cuts

Short product life cycles

Consumer confusion due to too many options

High marketing and localization costs

Thin profit margins

To stand out, companies must differentiate with superior AI performance, deeper smart home integration, unique content partnerships, and design innovation.

Japan Smart Speaker Market: Regional Insights

Tokyo

Tokyo dominates the market due to:

High digital literacy

Strong fiber-optic internet availability

Fast adoption of smart home technologies

Tech-driven lifestyles

Early adoption behavior

Residents commonly use smart speakers for automation, music, scheduling, news, and shopping. However, privacy worries still exist — especially concerning voice data collection in small apartments, where conversations are easily overheard.

Kansai (Osaka, Kyoto, Kobe)

Kansai displays robust growth driven by:

Demand for lifestyle-enhancing technologies

Increased incorporation of smart home features in mid-range apartment complexes

Local tech giants like Panasonic creating smart ecosystem products

Rising use of voice assistants for remote work and digital entertainment

Osaka’s business-heavy environment and Kyoto’s design-conscious residents encourage adoption of aesthetically appealing, high-function devices.

Aichi (Nagoya)

Aichi — known for its strong manufacturing and automotive industries — is adopting smart speakers rapidly due to:

High purchasing power

Strong interest in automation

Smart city initiatives

Widespread industrial IoT awareness

As global players and domestic tech brands push new devices, Aichi’s consumer base is increasingly integrating smart speakers into home and work environments.

Recent Industry Development

March 2024: SoundHound AI introduced Japan’s first virtual assistant with integrated ChatGPT for in-vehicle applications — a major milestone in voice AI.

This development signals the beginning of smarter, more conversational voice assistants in both automotive and consumer smart speaker segments.

Japan Smart Speaker Market Segmentation

By Component

Hardware

Software

By Intelligent Virtual Assistant

Amazon Alexa

Google Assistant

Siri

Cortana

Others

By Connectivity

Wi-Fi

Bluetooth

By Price Range

Low-Range (Below $100)

Mid-range ($101–$200)

Premium (Above $200)

By Distribution Channel

Online

Offline

By End User

Personal

Commercial

By Cities Covered

Tokyo

Kansai

Aichi

Kanagawa

Saitama

Hyogo

Chiba

Hokkaido

Fukuoka

Shizuoka

Key Companies Covered

Alibaba Group Holding Limited

Amazon.com Inc.

Apple Inc.

Baidu Inc.

Bose Corporation

Lenovo Group Limited

LG Electronics Inc.

Panasonic Corporation

Sonos Inc.

Each company is assessed by:

Overview

Key Persons

Recent Developments

SWOT Analysis

Revenue Analysis

Final Thoughts

Japan’s smart speaker market is on the cusp of explosive transformation. With AI becoming more conversational and smart homes becoming mainstream, smart speakers are evolving from simple music players to essential digital companions. The next decade will highlight deeper integration into daily routines — from kitchens and bedrooms to cars and commercial spaces.

The shift toward Society 5.0, Japan’s aging demographics, and the rise of AI-driven interfaces will all shape how voice-enabled devices become part of the nation’s cultural and technological fabric.

As companies innovate with localized features, stronger privacy controls, and seamless multi-device integration, Japan’s smart speaker market is set to become a benchmark for intelligent home ecosystems across Asia.

AloJapan.com