Demand for Business Email in Japan Forecast and Outlook 2025 to 2035

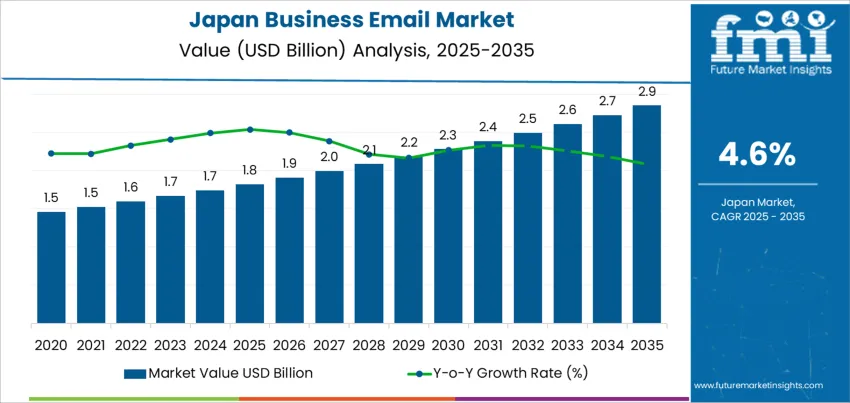

The demand for business email services in Japan is expected to grow from USD 1.8 billion in 2025 to USD 2.9 billion by 2035, driven by a compound annual growth rate (CAGR) of 4.6%. Email remains a core tool for communication in businesses, both for internal collaboration and for client interaction. As Japan’s corporate sector continues its digital transformation, the need for secure, reliable, and scalable email solutions is expanding. Businesses across various industries are adopting advanced email services to streamline communication, improve productivity, and maintain security.

With growing concerns over data security and privacy, businesses are increasingly seeking email solutions that ensure the protection of sensitive information. The rising importance of data protection regulations, both in Japan and globally, is driving companies to adopt secure email services that comply with privacy laws. Features like encrypted emails, secure file sharing, and automated email archiving are becoming standard in many organizations. As cyber threats continue to evolve, the integration of artificial intelligence (AI) into email systems for enhanced security, spam filtering, and automated threat detection is further fueling demand for advanced business email services.

Quick Stats of the Demand for Business Email in Japan

Demand for Business Email in Japan Value (2025): USD 1.8 billion

Demand for Business Email in Japan Forecast Value (2035): USD 2.9 billion

Demand for Business Email in Japan Forecast CAGR (2025-2035): 4.6%

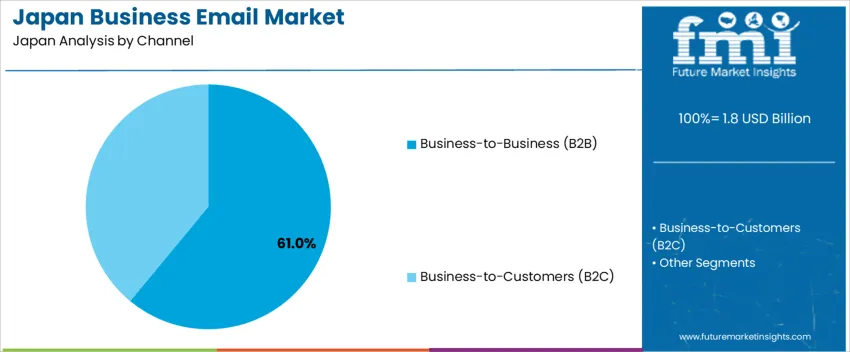

Demand for Business Email in Japan Key Channels: Business-to-Business (B2B), Business-to-Customers (B2C)

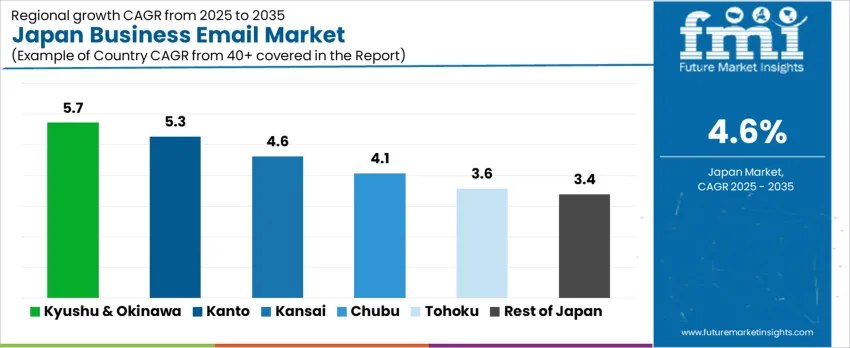

Demand for Business Email in Japan Key Growth Regions: Kyushu & Okinawa, Kanto, Kansai, Chubu, Tohoku, Rest of Japan

Demand for Business Email in Japan Top Players: Microsoft Outlook, Gmail (Google), Apple Mail, Zoho Mail, ProtonMail

What is the Growth Forecast for the Demand for Business Email in Japan through 2035?

From 2025 to 2030, demand for business email services is expected to grow from USD 1.8 billion to USD 2.4 billion, adding USD 600 million in value. This period will see strong growth, primarily driven by the widespread adoption of cloud-based email solutions. As businesses continue to expand their digital communication infrastructure, email remains a core tool for internal and external communication. The increasing need for secure communication platforms to address evolving workplace dynamics and cybersecurity concerns will further boost the demand for advanced email solutions. Companies are increasingly seeking secure, scalable, and flexible email services to ensure effective communication, especially as remote work and hybrid office models become more prevalent.

From 2030 to 2035, demand will continue to rise from USD 2.4 billion to USD 2.9 billion, contributing USD 500 million in value. Growth during this phase will be steady, with businesses increasingly transitioning to digital-first work environments. The ongoing focus on data security and compliance with privacy regulations will drive demand for more secure email solutions, including encryption and advanced spam filtering. Furthermore, the integration of artificial intelligence (AI) and automation within email platforms will enhance productivity and efficiency. Although the industry will mature during this period, businesses will still seek innovative email solutions to improve collaboration, streamline workflows, and ensure the protection of sensitive information. The continued significance of email for business communication will maintain strong demand for these services throughout the forecast period.

Demand for Business Email in Japan Key Takeaways

Metric

Value

Demand for Business Email in Japan Value (2025)

USD 1.8 billion

Demand for Business Email in Japan Forecast Value (2035)

USD 2.9 billion

Demand for Business Email in Japan Forecast CAGR (2025-2035)

4.6%

Why is the Demand for Business Email in Japan Growing?

The demand for business email in Japan is growing as organizations continue to rely on digital communication for both internal and external interactions. Business email remains a cornerstone of professional communication, allowing for secure, efficient, and documented exchanges of information. As more companies in Japan shift towards remote work, digital transformation, and cloud-based technologies, the need for reliable and secure business email services is increasing.

A significant driver of this growth is Japan’s ongoing emphasis on digitalization across various sectors, including finance, government, education, and healthcare. As organizations adopt cloud-based platforms and collaborate more extensively online, the need for integrated business email solutions that offer enhanced security, scalability, and collaboration features is rising. Email continues to be the primary tool for formal communication and documentation, particularly in industries that require high levels of security and compliance, such as banking and legal services.

The growing adoption of cybersecurity measures to protect sensitive business communications is fueling the demand for advanced business email solutions. With Japan’s increasing focus on protecting data privacy and adhering to regulations such as GDPR and Japan’s APPI (Act on the Protection of Personal Information), organizations are investing in more secure email systems to ensure compliance and safeguard against potential cyber threats. As the demand for secure, efficient, and scalable communication tools rises, the business email industry in Japan is expected to continue growing steadily through 2035.

What is the Segment-Wise Analysis of Demand for Business Email in Japan?

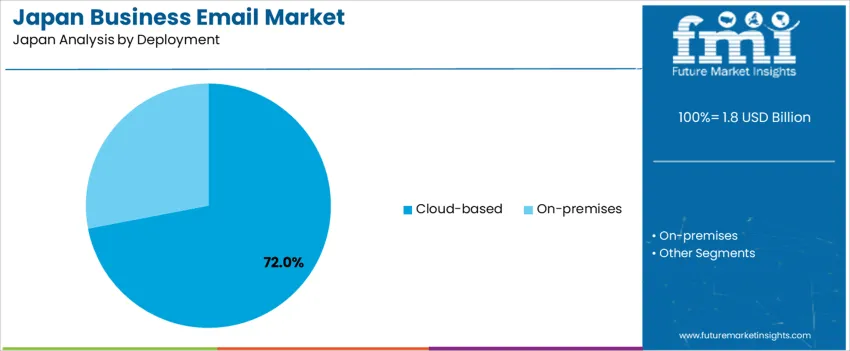

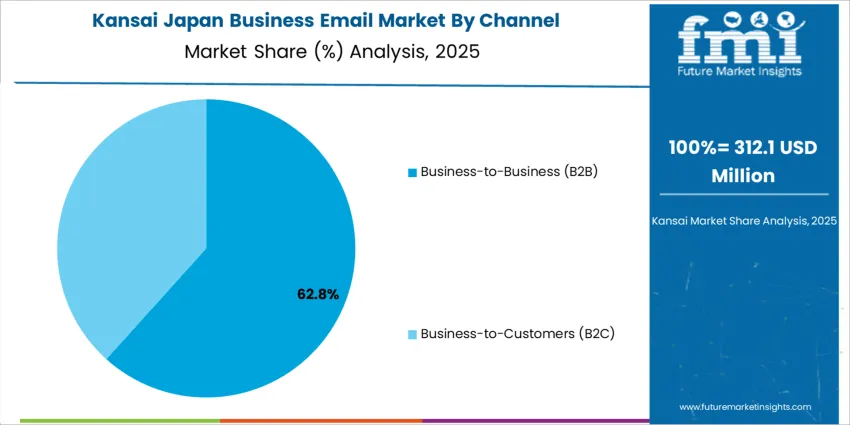

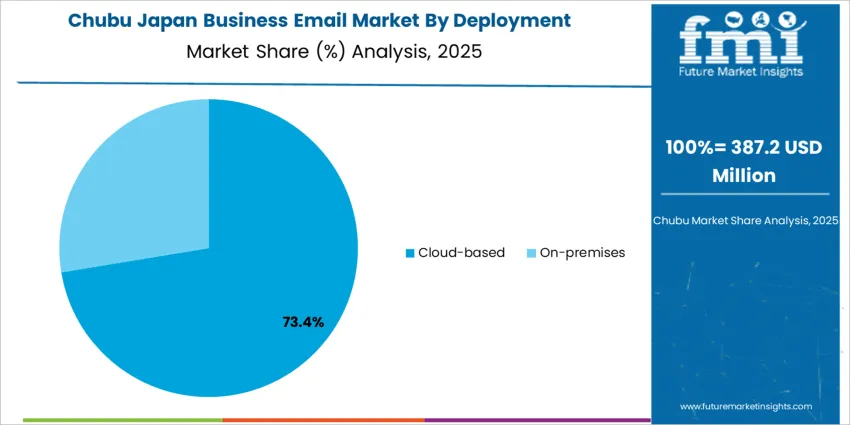

Demand for business email in Japan is segmented by channel, deployment, and region. By channel, demand is divided into business-to-business (B2B) and business-to-customers (B2C), with B2B leading at 61%. The demand is also segmented by deployment type, including cloud-based and on-premises, with cloud-based deployment accounting for 72%. Regionally, demand is distributed across Kyushu & Okinawa, Kanto, Kansai, Chubu, Tohoku, and the Rest of Japan.

Why Does B2B Lead the Demand for Business Email in Japan?

Business-to-business (B2B) accounts for 61% of the demand for business email in Japan, driven by the growing need for secure and efficient communication between businesses. In the B2B sector, email serves as a vital tool for coordinating projects, handling transactions, and exchanging sensitive information, making it essential for daily operations. The Japanese industry, with its strong focus on business efficiency, relies heavily on reliable email systems for collaboration, negotiations, and long-term partnerships.

B2B communications are more complex and involve higher volumes of professional correspondence compared to B2C, further contributing to the dominance of B2B email services. As Japan’s business landscape continues to expand and digitalization accelerates, demand for B2B business email solutions is expected to grow, particularly in sectors like manufacturing, finance, and technology, where secure and seamless communication is paramount.

Why Does Cloud-Based Deployment Lead the Demand for Business Email in Japan?

Cloud-based deployment accounts for 72% of the demand for business email in Japan, largely due to its scalability, flexibility, and cost-effectiveness. Cloud-based email solutions allow businesses to store and manage vast amounts of data while offering enhanced security, automatic updates, and remote accessibility. With the increasing shift toward digital transformation and the need for businesses to stay connected, cloud-based email systems provide a seamless way to ensure communication continues across various locations and devices.

The adoption of cloud technology is also driven by Japan’s strong focus on innovation and technological advancements. By leveraging cloud-based email services, businesses can reduce infrastructure costs, scale quickly, and access advanced features like spam filtering and encryption, which are critical for protecting sensitive information. As businesses in Japan continue to prioritize efficiency and scalability, cloud-based email solutions will remain the preferred choice, further driving demand.

What are the Key Trends, Drivers, and Restraints in Demand for Business Email in Japan?

Demand for business email in Japan is growing as businesses increasingly adopt digital communication and promoting strategies. As companies expand their online operations and customer outreach, especially via e‑commerce, digital services, and client relationship management, business email remains a trusted, formal channel for communication, notifications, billing, and customer support. High internet penetration and widespread use of smartphones ensure reliable email access for both companies and consumers. Email’s perceived professionalism and formality in Japanese business culture supports its continued use, particularly for official communication, order confirmations, and customer correspondence. Use of email for promoting and CRM campaigns remains robust due to relatively high open‑rates compared to global averages.

Why is Demand for Business Email Growing in Japan?

Business email demand is rising as Japanese companies and consumers expect reliable, formal, and documented digital communication. For e‑commerce retailers and service providers, email enables order confirmations, transactional notifications, customer support communication, and promoting newsletters all crucial for customer trust and satisfaction in an industry with high standards for service and reliability. As businesses seek to digitalize customer communication workflows and maintain record‑keeping, email remains a foundational tool. Many consumers in Japan regularly check email and treat it as a formal channel of communication with companies, making it effective for official and transactional correspondence. The combination of e‑commerce growth and demand for structured, documented communication reinforces business email usage.

How are Technological & Industry Innovations Driving Business Email Demand in Japan?

Advances in digital promoting tools, automation platforms, and integration with customer relationship management (CRM) systems are strengthening business email adoption in Japan. Many firms now leverage personalized email campaigns, automated order and delivery notifications, and mobile‑optimized email templates to cater to customers using smartphones, aligning with high mobile and internet penetration in Japan. Improvements in email deliverability, analytics, segmentation, and HTML‑based design make email a powerful tool for customer engagement and retention. Even as newer communication platforms emerge, email remains a stable, scalable, and relatively low‑cost channel, especially for businesses needing formal, trackable, and documentable communication.

What are the Key Challenges and Risks That Could Limit Business Email Demand in Japan?

Growing popularity of instant messaging and chat apps widely used in both personal and business contexts can reduce the reliance on email for quick or informal communication, especially among younger demographics. For time‑sensitive communication or collaborative workflows, chat platforms and real‑time tools may be preferred over email. Expectations around personalization, speed, and convenience increase pressure on email campaigns; poorly implemented emails (spam, impersonal content) may lose effectiveness. For businesses with limited digital infrastructure or smaller teams, managing email‑based communication and compliance (data privacy, security) can be a burden. Segments of the population especially older or less digitally engaged customers may be slower to adopt email‑based interactions, reducing reach in those audiences.

What is the Regional Demand Outlook for Business Email in Japan?

Region

CAGR (%)

Kyushu & Okinawa

5.7%

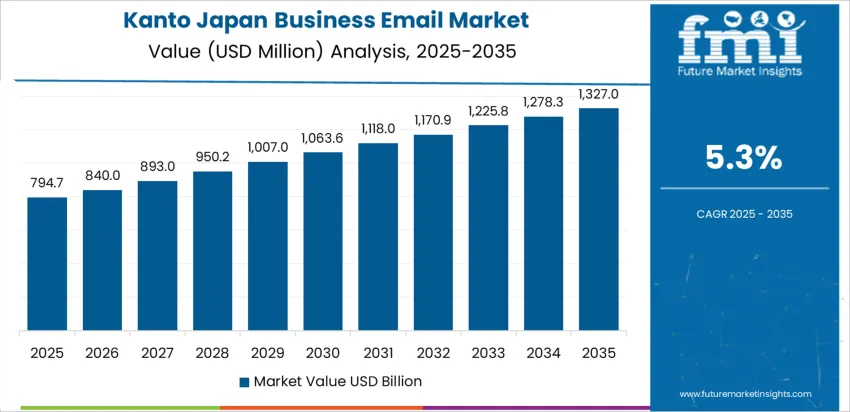

Kanto

5.3%

Kansai

4.6%

Chubu

4.1%

Tohoku

3.6%

Rest of Japan

3.4%

Demand for business email services in Japan is growing steadily, with Kyushu & Okinawa leading at a 5.7% CAGR due to industrial expansion and tourism. Kanto follows closely with a 5.3% CAGR, driven by its large business base and technological advancements. Kansai shows a 4.6% CAGR, supported by the region’s focus on digital transformation and industrial growth. Chubu experiences a 4.1% CAGR, fueled by the region’s manufacturing sector and growing digital adoption. Tohoku and the Rest of Japan show moderate demand growth, with CAGRs of 3.6% and 3.4%, respectively, driven by the increasing shift toward digital communication and cloud-based solutions.

How is Demand for Business Email Growing in Kyushu & Okinawa?

Kyushu & Okinawa leads the demand for business email, growing at a 5.7% CAGR. The region’s increasing industrialization, particularly in sectors like agriculture, tourism, and small businesses, drives the need for communication solutions like business email. Kyushu & Okinawa’s expanding tourism industry also contributes to demand, as businesses seek efficient communication channels to manage customer inquiries, reservations, and transactions. The growing trend of digital transformation across local businesses is driving the adoption of cloud-based email services. As e-commerce and remote work continue to rise, businesses in the region increasingly rely on secure and reliable email services. With the rise of new industries and the need for better communication infrastructures, demand for business email services in Kyushu & Okinawa is expected to continue growing steadily, supporting both small enterprises and large corporations in enhancing their communication strategies.

Why is Demand for Business Email Rising in Kanto?

Kanto is experiencing steady demand for business email, with a 5.3% CAGR, driven by its large industrial base and thriving digital economy. Tokyo, as the country’s economic hub, houses numerous large enterprises, government agencies, and service providers, all of which rely heavily on business email for internal and external communications. The increasing trend of digitalization in various sectors, such as finance, retail, and technology, further accelerates demand for reliable email solutions. Kanto’s focus on cloud services and cybersecurity also contributes to businesses’ growing reliance on secure email platforms. The rise of remote work, e-commerce, and collaboration tools has further emphasized the need for efficient and reliable communication channels. As Kanto continues to lead in technological innovation and business operations, the demand for business email services in the region is expected to remain strong and grow steadily.

How is Demand for Business Email Expanding in Kansai?

Kansai is seeing moderate demand for business email, growing at a 4.6% CAGR. The region’s industrial sectors, particularly in Osaka, Kyoto, and Kobe, are key drivers of this demand, as businesses seek secure and efficient email solutions for communication. The region’s focus on digital transformation and modernization, especially in sectors like manufacturing, technology, and retail, contributes to the increasing adoption of business email services. Kansai’s thriving economy, including its growing start-up ecosystem, also drives the need for effective communication tools. The rise in remote work and e-commerce further boosts the demand for business email in Kansai. As the region continues to embrace cloud-based technologies and prioritize cybersecurity, the demand for business email services will continue to rise, ensuring efficient communication for businesses of all sizes.

Why is Demand for Business Email Growing in Chubu?

Chubu is experiencing steady demand for business email, with a 4.1% CAGR, driven by the region’s growing industrial base, particularly in Nagoya. As a major manufacturing hub, especially in automotive and electronics, Chubu requires robust communication systems to support its diverse business activities. The demand for business email services is rising as companies in Chubu adopt digital solutions to enhance internal communication, customer service, and e-commerce. The region’s ongoing push toward digitalization and technological innovation further contributes to this demand, with businesses prioritizing secure and reliable email platforms. The rise of remote work and increased collaboration across various industries in Chubu is driving the need for efficient communication tools. As Chubu continues to invest in digital infrastructure, the demand for business email services will continue to grow, supporting businesses of all sizes in streamlining communication and improving productivity.

How is Demand for Business Email Expanding in Tohoku?

Tohoku is seeing moderate demand for business email, with a 3.6% CAGR. While the region is not as industrialized as other areas, its increasing focus on digital transformation and modernization is contributing to the steady growth of business email usage. Tohoku’s strong presence in agriculture, manufacturing, and local businesses is driving the need for secure and efficient communication channels. As more small and medium-sized enterprises (SMEs) in Tohoku embrace digital communication tools, the demand for business email services is rising. The region’s focus on improving infrastructure and adopting new technologies to enhance productivity further fuels the growth of business email. The growing trend of remote work and e-commerce in the region also boosts the demand for reliable email solutions. As Tohoku continues to develop its business landscape, the demand for business email services will grow steadily, supporting regional economic activities.

Why is Demand for Business Email Steady in the Rest of Japan?

The Rest of Japan is experiencing steady demand for business email, with a 3.4% CAGR. While demand in rural areas is smaller compared to major urban regions, the growing shift towards digitalization and cloud-based solutions in local industries is driving this demand. As more businesses, particularly in agriculture, local manufacturing, and retail, adopt digital communication tools, the need for secure and efficient email platforms continues to rise. The increase in remote work, as well as the adoption of e-commerce and digital services, further contributes to the demand for business email services. The focus on improving infrastructure and communication systems in rural and suburban areas ensures steady growth in business email adoption. As businesses in the Rest of Japan embrace new technologies and improve productivity, the demand for business email services will remain consistent, contributing to the region’s ongoing digital transformation.

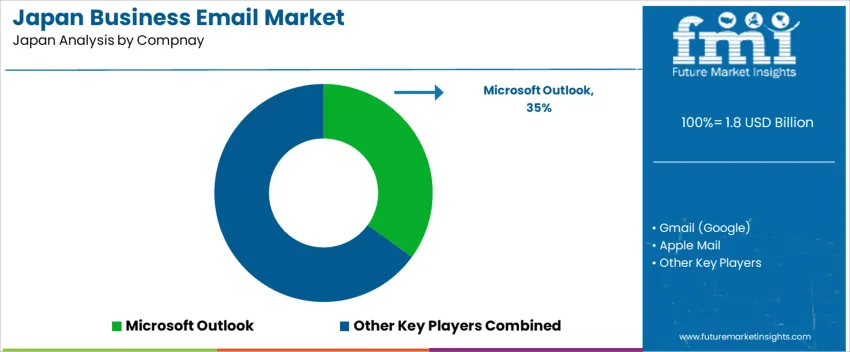

What is the Competitive Landscape of Business Email Demand in Japan?

The demand for business email services in Japan is growing as organizations continue to rely on secure, efficient, and user-friendly communication platforms. As remote work and digital collaboration tools become more common, businesses seek email services that offer seamless integration with productivity applications, strong security, and reliable service. With the increase in cybersecurity concerns, businesses are particularly focused on email services that ensure data protection and confidentiality. The need for effective communication solutions in a fast-paced, tech-driven business environment is fueling the demand for robust business email platforms in Japan

Leading providers in the business email industry in Japan include Microsoft Outlook, Gmail (Google), Apple Mail, Zoho Mail, and ProtonMail. Microsoft Outlook holds the largest share of 35.0%, offering a comprehensive suite of email features along with seamless integration with Microsoft Office applications. Gmail (Google) is another key player, offering Google Workspace, a widely adopted solution known for its simplicity and integration with Google’s suite of productivity tools. Apple Mail is favored by users in the Apple ecosystem, offering a smooth experience across macOS and iOS devices. Zoho Mail provides an affordable and secure email solution, particularly appealing to small and medium businesses. ProtonMail focuses on privacy, offering end-to-end encryption and appealing to businesses concerned with secure email communication.

Competition is driven by factors such as security, integration with other productivity tools, pricing, and user experience. Companies are increasingly prioritizing email services that offer enhanced data protection, spam filtering, and encryption. Seamless integration with existing business systems and scalable solutions for businesses of all sizes are important competitive differentiators. As the demand for secure and efficient communication platforms continues to rise, companies that can offer high-performance, reliable, and customizable email solutions will maintain a competitive edge in the industry.

Key Players in Japan Business Email Demand

Microsoft Outlook

Gmail (Google)

Apple Mail

Zoho Mail

ProtonMail

Scope of Report

Items

Values

Quantitative Units (2025)

USD billion

Channel

Business-to-Business (B2B), Business-to-Customers (B2C)

Deployment

Cloud-based, On-premises

Region

Kyushu & Okinawa, Kanto, Kansai, Chubu, Tohoku, Rest of Japan

Countries Covered

Japan

Key Companies Profiled

Microsoft Outlook, Gmail (Google), Apple Mail, Zoho Mail, ProtonMail

Additional Attributes

Dollar sales by channel, deployment, and region; regional CAGR and adoption trends; demand trends in business email services; growth in B2B and B2C email communications; technology adoption for cloud-based and on-premises solutions; vendor offerings including email platforms; regulatory influences and industry standards

Japan Business Email Demand by Key Segments Channel:

Business-to-Business (B2B)

Business-to-Customers (B2C)

Deployment:

Region:

Kyushu & Okinawa

Kanto

Kansai

Chubu

Tohoku

Rest of Japan

Frequently Asked Questions

How big is the demand for business email in Japan in 2025?

The demand for business email in Japan is estimated to be valued at USD 1.8 billion in 2025.

What will be the size of business email in Japan in 2035?

The market size for the business email in Japan is projected to reach USD 2.9 billion by 2035.

How much will be the demand for business email in Japan growth between 2025 and 2035?

The demand for business email in Japan is expected to grow at a 4.6% CAGR between 2025 and 2035.

What are the key product types in the business email in Japan?

The key product types in business email in Japan are business-to-business (b2b) and business-to-customers (b2c).

Which deployment segment is expected to contribute significant share in the business email in Japan in 2025?

In terms of deployment, cloud-based segment is expected to command 72.0% share in the business email in Japan in 2025.

AloJapan.com