Demand for Tennis Equipment in Japan Forecast and Outlook 2025 to 2035

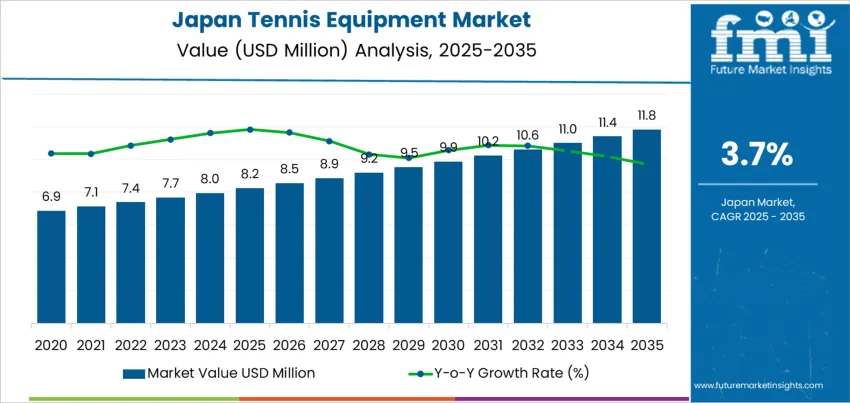

The demand for tennis equipment in Japan is expected to grow from USD 8.2 million in 2025 to USD 11.8 million by 2035, reflecting a compound annual growth rate (CAGR) of 3.7%. Tennis equipment, including racquets, balls, shoes, and apparel, remains in steady demand, driven by ongoing interest in tennis as both a recreational and competitive sport. As the popularity of tennis continues to grow, with increasing participation at the amateur and professional levels, demand for high-quality, performance-enhancing tennis equipment is expected to rise steadily.

The market will experience consistent growth, starting at USD 8.2 million in 2025 and gradually increasing to USD 8.5 million in 2026, USD 8.9 million in 2027, and USD 9.2 million in 2028. The demand for tennis equipment is expected to continue rising at a steady pace, reaching USD 9.9 million by 2029 and USD 10.6 million by 2030. By 2035, the market is forecasted to reach USD 11.8 million, reflecting steady growth fueled by sustained interest in tennis and increasing participation across various age groups.

Quick Stats of the Demand for Tennis Equipment in Japan

Demand for Tennis Equipment in Japan Value (2025): USD 8.2 million

Demand for Tennis Equipment in Japan Forecast Value (2035): USD 11.8 million

Demand for Tennis Equipment in Japan Forecast CAGR (2025-2035): 3.7%

Demand for Tennis Equipment in Japan Key Product Type: 32% Rackets

Demand for Tennis Equipment in Japan Key Growth Regions: Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan

Demand for Tennis Equipment in Japan Key Players: Wilson Sporting Goods Co., Babolat Vibration, Head Sports GmbH, Prince Global Sports LLC, Yonex Co., Ltd.

What is the Growth Forecast for the Tennis Equipment Industry in Japan through 2035?

The tennis equipment market in Japan is expected to experience steady growth through 2035. From USD 8.2 million in 2025, the market will increase to USD 8.5 million in 2026, and USD 8.9 million in 2027. Demand will continue to grow gradually, reaching USD 9.2 million in 2028, USD 9.5 million in 2029, and USD 9.9 million in 2030. By 2035, the market is expected to reach USD 11.8 million, driven by the ongoing popularity of tennis and the increasing demand for high-quality sports equipment.

The growth rate volatility index for tennis equipment indicates that the market will experience low volatility, with steady, incremental growth expected year over year. This suggests a stable and predictable upward trend without significant fluctuations or sharp spikes in demand. The steady growth rate reflects the ongoing popularity of tennis in Japan, supported by both grassroots participation and the professional level. While the market will grow at a consistent pace, it will likely remain resistant to high volatility, with gradual increases contributing to overall market expansion.

Key Takeaways of Tennis Equipment Industry in Japan

Metric

Value

Industry Sales Value (2025)

USD 8.2 million

Industry Forecast Value (2035)

USD 11.8 million

Industry Forecast CAGR (2025-2035)

3.7%

Why is the Demand for Tennis Equipment in Japan Growing?

Demand for tennis equipment in Japan is rising because participation in tennis continues at a stable level and interest remains across age groups. The national governing body for tennis estimates the number of people playing tennis, including amateurs, at several million. Recreational interest, fitness trends, and the appeal of racket sports among urban populations support continued demand. The market benefits when new players take up the sport and existing players replace or upgrade their gear. Tennis also ranks among popular sports in Japan, reflecting a long tradition of both casual playing and clubbased tennis.

At the same time, the structure of the tennis equipment market in Japan reflects diversification across equipment types, with demand for racquets, footwear, apparel, balls, strings, bags, and accessories. Modern developments in materials and manufacturing produce lighter racquets, better strings, and improved shoes. These technical improvements attract both hobbyist and serious players seeking enhanced performance or comfort. Retail expansion, including online sales and specialty sports stores, also improves accessibility. As long as tennis remains a popular sport and consumers continue to value performance, comfort, and convenience, demand for tennis equipment in Japan is likely to grow steadily in coming years.

What Is the Current State of the Demand for Tennis Equipment in Japan in Terms of Product Type and Sales Channel?

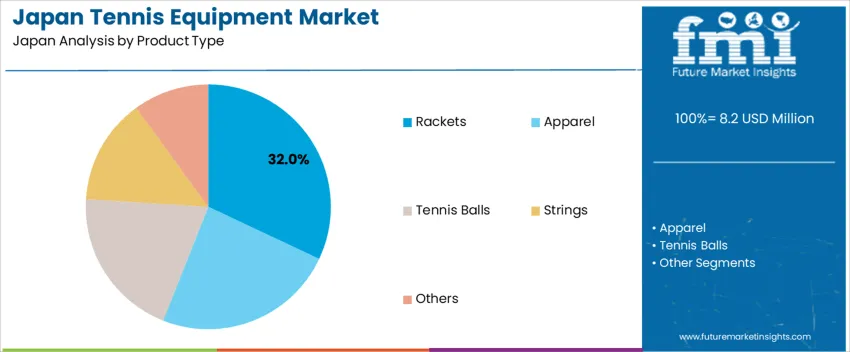

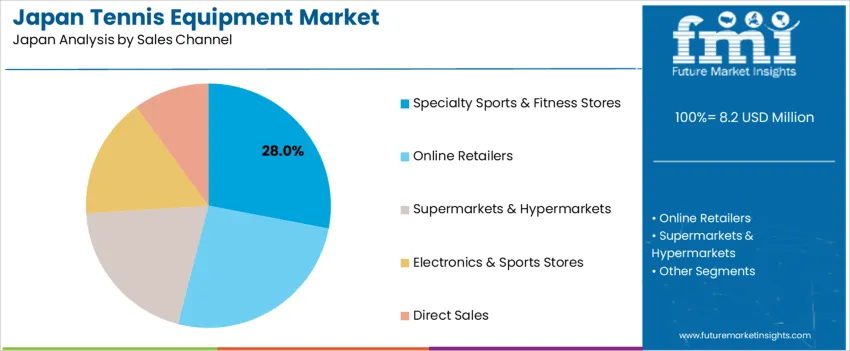

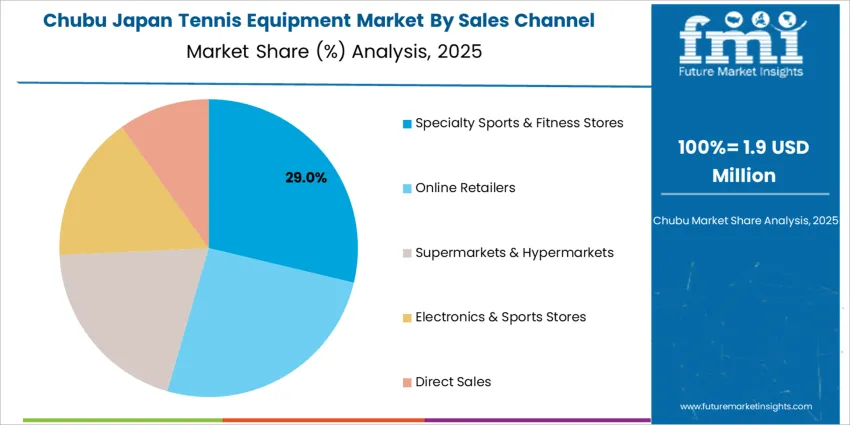

The demand for tennis equipment in Japan is primarily driven by product type and sales channel. The leading product type is rackets, accounting for 32% of the market share, while specialty sports & fitness stores is the dominant sales channel, capturing 28% of the demand. Tennis equipment, which includes a variety of items such as rackets, balls, apparel, and strings, continues to see strong demand driven by Japan’s active sports culture and the popularity of tennis. As interest in the sport grows, so does the demand for high-quality tennis equipment through various retail channels.

How Are Rackets Leading the Demand for Tennis Equipment in Japan?

Rackets lead the demand for tennis equipment in Japan, holding 32% of the market share. Tennis rackets are the most essential piece of equipment for any player, from beginners to professionals. The demand for rackets is driven by advancements in racket technology, with manufacturers offering improved designs for better performance, including enhanced power, control, and comfort. As tennis continues to grow in popularity, particularly among recreational players, there is a strong demand for rackets that cater to a variety of playing styles and preferences.

The demand for tennis rackets is also influenced by the increasing number of tennis enthusiasts and the growing focus on fitness and well-being in Japan. Racket manufacturers continue to innovate with lightweight materials, ergonomic designs, and advanced technologies that offer players enhanced performance and injury prevention. As tennis remains a popular sport, both recreationally and professionally, the demand for rackets is expected to continue to lead the market for tennis equipment in Japan.

How Are Specialty Sports & Fitness Stores Leading the Sales Channel Demand for Tennis Equipment in Japan?

Specialty sports & fitness stores are the leading sales channel for tennis equipment in Japan, capturing 28% of the market share. These stores are dedicated to sporting goods, offering a wide selection of tennis equipment that caters to the needs of both amateur and professional players. Specialty stores provide expert advice, custom fittings, and access to the latest products, which makes them a preferred choice for tennis enthusiasts looking for high-quality equipment.

The demand for tennis equipment through specialty sports & fitness stores is driven by the personalized shopping experience and the convenience of finding a full range of products. These stores also often offer in-store services such as racket stringing, which further attracts customers. As tennis continues to be a popular sport in Japan, specialty sports stores will remain a key distribution channel, providing customers with access to the best tennis products and fostering the growth of the tennis community.

What is the Summary of Demand for Tennis Equipment in Japan?

Demand for tennis equipment in Japan is growing gradually as more people engage in tennis for recreation, fitness, and leisure. The market is expected to see steady growth with an increasing number of amateur players and recreational users. Products such as rackets, balls, shoes, apparel, and accessories are not only used by competitive players but also by casual and recreational users. The strong tradition of tennis in Japan, supported by various tennis clubs, training facilities, and coaching programs, continues to drive demand. Over the next decade, demand for tennis gear is expected to remain stable, driven by new purchases and the replacement of worn-out equipment.

What are the Drivers of Demand for Tennis Equipment in Japan?

Rising participation in tennis among all age groups supports growing demand for equipment. More people are taking up tennis for exercise, fun, or social activity, which increases the need for rackets, balls, and other gear. Health and fitness trends also contribute to increased demand for sports like tennis, especially as people look for activities that combine physical activity with social interaction. The availability of tennis clubs and courts across urban and suburban areas further supports equipment demand. Additionally, rising disposable income and interest in leisure activities lead to more purchases of higher-quality or performance-oriented tennis gear. Replacement cycles also contribute, as players regularly replace worn-out or outdated equipment.

What are the Restraints on Demand for Tennis Equipment in Japan?

Demand for tennis equipment may be restrained by competition from other sports and leisure activities that require less equipment or offer lower costs. In urban areas, limited access to tennis courts may discourage regular participation, thus reducing the need for tennis gear. High-quality tennis equipment can be expensive, which may deter some players, especially those who play occasionally or are just beginning. The aging population in Japan may also limit demand, as younger people are typically the most active participants in tennis. Additionally, some individuals may prefer other sports or activities that are more convenient or accessible.

What are the Key Trends Influencing Demand for Tennis Equipment in Japan?

A significant trend is the rising interest in tennis for recreational and fitness purposes rather than only for competitive play. This trend has led to increased demand for affordable, easy-to-use gear, catering to a broader audience of casual players and families. Another trend is the growing popularity of tennis among youth, with an increasing number of junior players and beginner kits entering the market. The steady demand for replacement equipment as players look to upgrade or replace worn gear also supports market growth. The ongoing interest in health, fitness, and outdoor recreation continues to fuel the demand for tennis equipment.

What is the Regional Demand Outlook for Tennis Equipment in Japan?

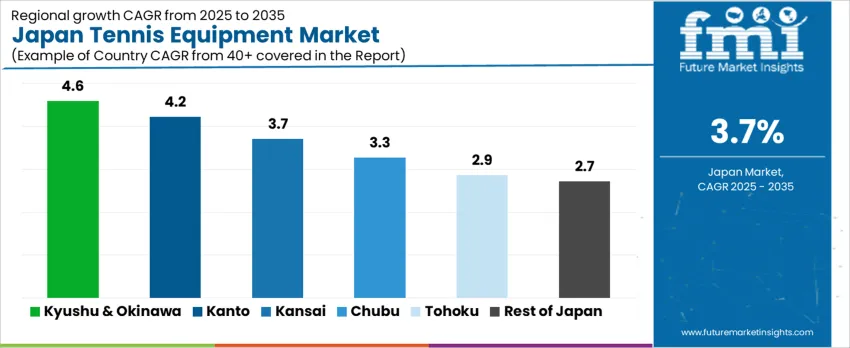

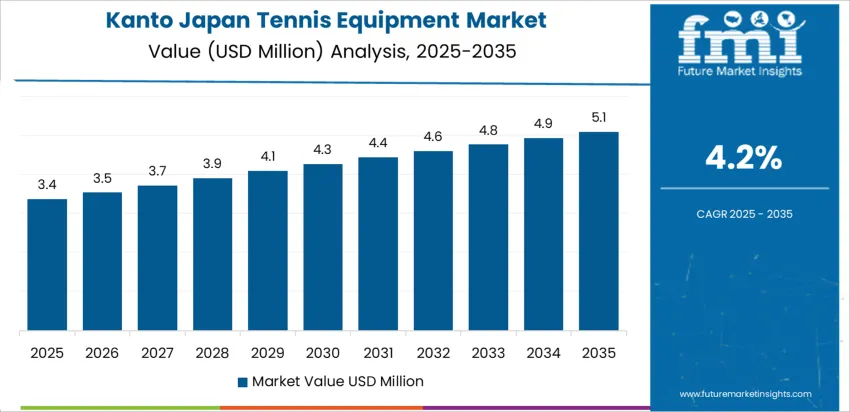

The demand for tennis equipment in Japan shows steady growth across regions, with Kyushu & Okinawa leading at a CAGR of 4.6%. Kanto follows with a CAGR of 4.2%, supported by the region’s large sports market and infrastructure. The Kinki region shows moderate growth at 3.7%, while Chubu, Tohoku, and the Rest of Japan exhibit slower growth, with respective CAGRs of 3.3%, 2.9%, and 2.7%. These differences reflect regional variations in sports participation, consumer interest in tennis, and local access to tennis clubs and facilities.

Region

CAGR (%)

Kyushu & Okinawa

4.6

Kanto

4.2

Kinki

3.7

Chubu

3.3

Tohoku

2.9

Rest of Japan

2.7

What factors are driving the demand for tennis equipment in Kyushu & Okinawa?

The demand for tennis equipment in Kyushu & Okinawa is projected to grow at a CAGR of 4.6%, driven by the region’s increasing interest in sports and fitness. Kyushu & Okinawa are seeing a rise in recreational and competitive tennis, supported by local tennis clubs, schools, and growing interest in sports tourism. The region’s emphasis on outdoor and health-focused activities is contributing to the rising demand for tennis equipment, including rackets, balls, and shoes. As tennis becomes more popular among both youth and adults in Kyushu & Okinawa, the demand for quality sports equipment is expected to rise steadily, driven by both recreational players and serious athletes seeking high-performance gear.

Why is the demand for tennis equipment increasing in Kanto?

In Kanto, the demand for tennis equipment is expected to grow at a CAGR of 4.2%, supported by the region’s large sports market and infrastructure. Kanto, home to Tokyo and its surrounding areas, has a well-developed sports culture, with tennis being a popular activity in schools, universities, and recreational centers. The region’s strong tennis community, including numerous tennis clubs and professional training facilities, drives the demand for high-quality tennis equipment. Additionally, Kanto’s large population and increasing participation in tennis, particularly as a recreational and fitness activity, contribute to the rising demand. As more people of all ages engage in the sport, demand for tennis equipment continues to grow in the region, from beginner gear to advanced equipment for experienced players.

What influences the demand for tennis equipment in Kinki?

The demand for tennis equipment in Kinki is projected to grow at a CAGR of 3.7%, reflecting steady growth driven by the region’s focus on sports and wellness. Kinki, including cities like Osaka and Kyoto, has a strong sports culture and a growing interest in tennis as both a recreational and competitive sport. The region’s tennis infrastructure, including tennis courts, clubs, and academies, is expanding, leading to increased participation. As consumer awareness of the health benefits of sports grows, more individuals are taking up tennis, fueling the demand for quality tennis equipment. While growth in Kinki is slower than in Kyushu & Okinawa and Kanto, the region’s consistent interest in tennis ensures steady demand for equipment.

How is the demand for tennis equipment growing in Chubu?

The demand for tennis equipment in Chubu is expected to grow at a CAGR of 3.3%, driven by the region’s sports participation and increasing focus on fitness. Chubu, home to cities like Nagoya, has a growing number of tennis enthusiasts and clubs. As interest in recreational sports continues to rise, more consumers are investing in tennis equipment, particularly as a means of improving their health and fitness. Chubu’s increasing awareness of the importance of outdoor activities and sports, combined with the region’s strong manufacturing base, contributes to the demand for quality tennis gear. However, growth in Chubu is more moderate compared to other regions due to its relatively smaller tennis market.

What factors are influencing the demand for tennis equipment in Tohoku?

In Tohoku, the demand for tennis equipment is projected to grow at a CAGR of 2.9%, reflecting moderate growth compared to other regions. Tohoku has a smaller tennis market, but growing interest in sports, especially among youth and schools, is contributing to the steady rise in demand for tennis equipment. The region’s efforts to promote physical fitness and outdoor activities are encouraging more individuals to take up tennis, particularly as a recreational sport. As schools, universities, and recreational centers in Tohoku expand their sports programs, the demand for tennis rackets, balls, and apparel will continue to grow, albeit at a slower pace than more urbanized regions.

How is the demand for tennis equipment evolving in the Rest of Japan?

In the Rest of Japan, the demand for tennis equipment is expected to grow at a CAGR of 2.7%, reflecting gradual adoption in rural areas and smaller cities. While this region has fewer large-scale tennis clubs or facilities compared to urban centers, the increasing awareness of the benefits of physical activity and sports is contributing to the rise in tennis participation. As local tennis clubs and schools adopt more inclusive programs to engage new players, the demand for tennis equipment is expected to grow slowly but steadily. The Rest of Japan’s focus on promoting sports and wellness will likely contribute to incremental growth in the demand for tennis equipment over the long term.

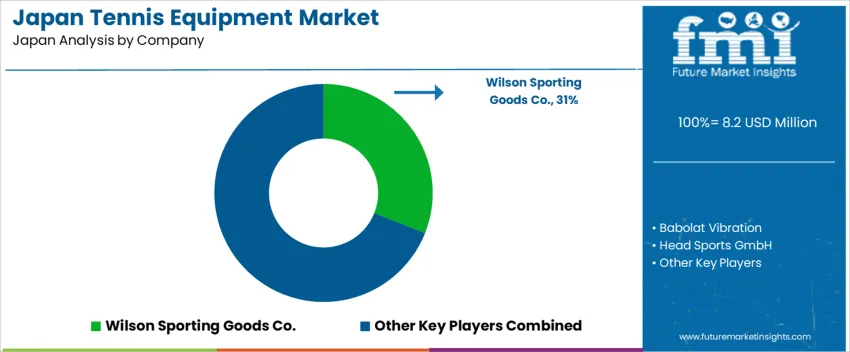

How Are Companies Competing in the Tennis Equipment Industry in Japan?

Demand for tennis equipment in Japan remains healthy thanks to steady interest in both recreational and competitive tennis, along with growing participation among younger and older age groups. Major brands are Wilson Sporting Goods Co. (holding about 31% of market share in the segment), Babolat, Head Sports GmbH, Prince Global Sports LLC, and Yonex Co., Ltd.. These companies supply rackets, strings, balls, apparel, footwear, and accessories to a wide audience: from casual players to competitive club members and professional coaches.

Competition in this market is shaped by product quality, technological innovation, and brand reputation. Companies emphasise racket performance — power, control, feel — via frame materials, string technologies, and balanced weight distribution. Another competitive factor is diversity in product lines: light, beginnerfriendly gear; intermediate gear for regular players; and highend gear for competitive players. Brands also compete by offering complementary items such as grip systems, damping aids, and apparel tailored for local preferences. Pricing, local availability, and aftersales support through sports shops and online retailers influence consumer choices strongly. Companies that deliver consistent product performance, reliable availability, and good value are best positioned to grow their presence in Japan’s tennis equipment industry.

Key Players of the Tennis Equipment Industry in Japan

Wilson Sporting Goods Co.

Babolat Vibration

Head Sports GmbH

Prince Global Sports LLC

Yonex Co., Ltd.

Scope of the Report

Items

Details

Quantitative Units

USD Million

Regions Covered

Japan

Product Type

Rackets, Apparel, Tennis Balls, Strings, Others

Sales Channel

Specialty Sports & Fitness Stores, Online Retailers, Supermarkets & Hypermarkets, Electronics & Sports Stores, Direct Sales

Key Companies Profiled

Wilson Sporting Goods Co., Babolat Vibration, Head Sports GmbH, Prince Global Sports LLC, Yonex Co., Ltd.

Additional Attributes

The demand for tennis equipment in Japan is driven by the country’s strong interest in sports and physical fitness, particularly in tennis, with growing participation across age groups. Rackets and tennis balls dominate the product segments, while apparel and strings also contribute significantly. Sales channels include both specialized sports retailers and growing online platforms, reflecting changes in consumer behavior. Companies like Wilson, Yonex, and Babolat are prominent in the market, offering a wide range of equipment designed for different skill levels. The market sees consistent growth, supported by tennis’ increasing popularity, sports events, and Japan’s reputation in professional tennis.

Key Segments of the Demand for Tennis Equipment in Japan Product Type:

Rackets

Apparel

Tennis Balls

Strings

Others

Sales Channel:

Specialty Sports & Fitness Stores

Online Retailers

Supermarkets & Hypermarkets

Electronics & Sports Stores

Direct Sales

Region:

Kyushu & Okinawa

Kanto

Kinki

Chubu

Tohoku

Rest of Japan

Frequently Asked Questions

How big is the demand for tennis equipment in Japan in 2025?

The demand for tennis equipment in Japan is estimated to be valued at USD 8.2 million in 2025.

What will be the size of tennis equipment in Japan in 2035?

The market size for the tennis equipment in Japan is projected to reach USD 11.8 million by 2035.

How much will be the demand for tennis equipment in Japan growth between 2025 and 2035?

The demand for tennis equipment in Japan is expected to grow at a 3.7% CAGR between 2025 and 2035.

What are the key product types in the tennis equipment in Japan?

The key product types in tennis equipment in Japan are rackets, apparel, tennis balls, strings and others.

Which sales channel segment is expected to contribute significant share in the tennis equipment in Japan in 2025?

In terms of sales channel, specialty sports & fitness stores segment is expected to command 28.0% share in the tennis equipment in Japan in 2025.

AloJapan.com