Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Strong demand for Japanese government bonds helped to steady Asian markets on Tuesday, a day after hawkish comments from the central bank governor sparked a global sell-off.

The yen steadied and equity markets were flat, with investors reassured by demand at an auction of Japanese government bonds. The benchmark Nikkei 225 and the broader Topix both closed up 0.1 per cent, while the yen weakened 0.1 per cent against the dollar.

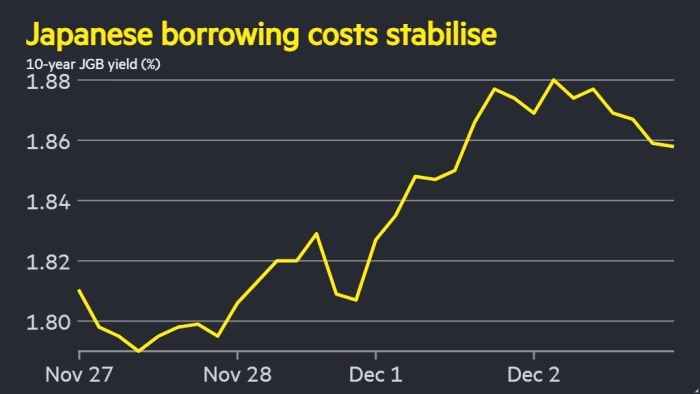

The auction of 10-year Japanese bonds attracted relatively solid demand, including from pension funds, helped by the yield of 1.88 per cent on the benchmark note — a 17-year high — immediately prior to the auction.

The auction was held a day after comments from Bank of Japan governor Kazuo Ueda suggested to investors that the central bank was ready to raise interest rates this month for the first time in almost a year.

“The market seems to think that [a rate increase in December] is pretty much a done deal,” said Shoki Omori, chief desk strategist at Mizuho.

The renewed speculation around a potential BoJ rate increase drove shares in Japan’s biggest banks higher. Shares in MUFG, the country’s largest lender, rose 2.5 per cent on Tuesday, while shares in its closest rival, SMFG, ended the day 3 per cent higher.

The yen’s continuing weakness against the US dollar, said analysts, will increase the chances of a BoJ move in December.

“We have a situation where the Japanese ministry of finance has signalled that it is standing by to intervene to prop up the yen if needs be, and we have signs that small and medium-sized businesses are feeling the pain from high input costs because of the weak currency,” said Neil Newman, Japan strategist at Astris Advisory. “I think the BoJ has to go for it in December.”

Ueda’s comments pushed yields on Japanese government debt to multiyear highs — yields move inversely to prices — and triggered declines in other bond markets around the world. Higher yields on safer assets contributed to a fall of more than 5 per cent in the price of bitcoin.

The recent sharp moves in JGB yields, coupled with the steady slide in the yen in the two months since Sanae Takaichi took over as prime minister, have fuelled speculation of an unwinding of the so-called yen carry trade. The carry trade refers to the strategy of cheaply borrowing yen to finance investments in other assets.

But Benjamin Shatil, senior economist at JPMorgan, said that there did not appear to be any immediate catalyst for such an unwind and that low volatility in the yen meant that it was possible investors were still putting more yen carry trades on.

Elsewhere in Asia, the Hang Seng was flat while China’s CSI 300 rose 0.5 per cent. Korea’s Kospi rose 1.7 per cent.

AloJapan.com