Report Overview

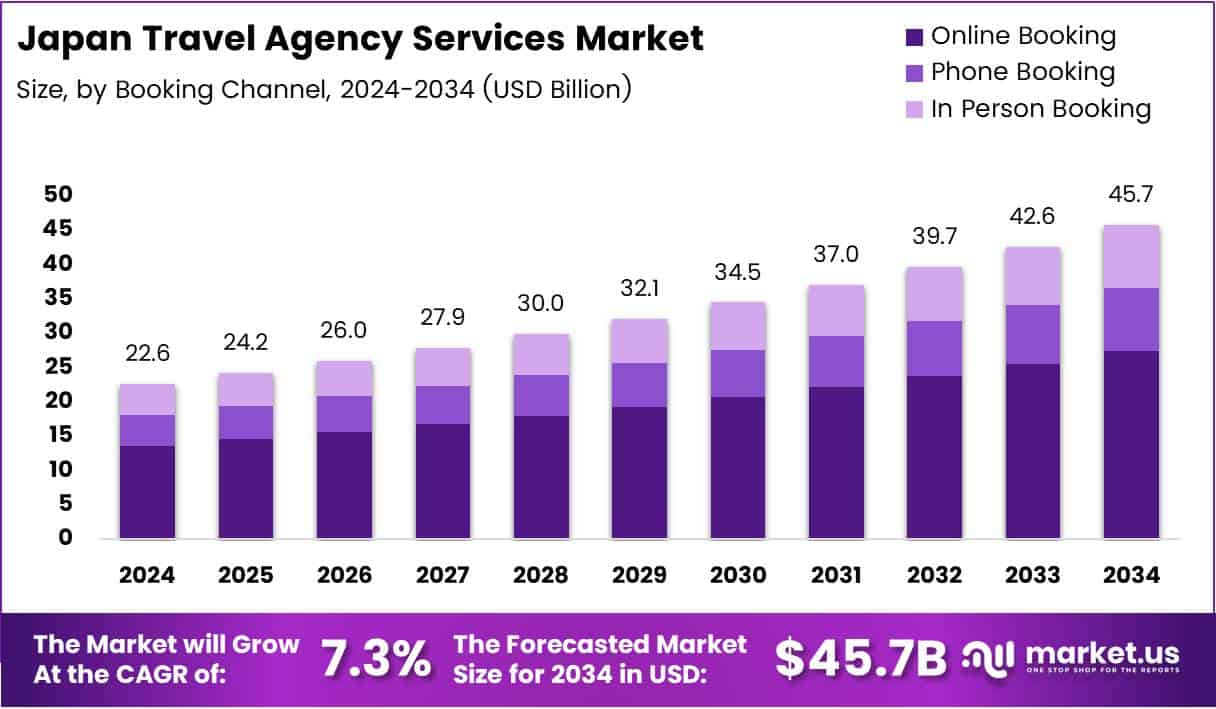

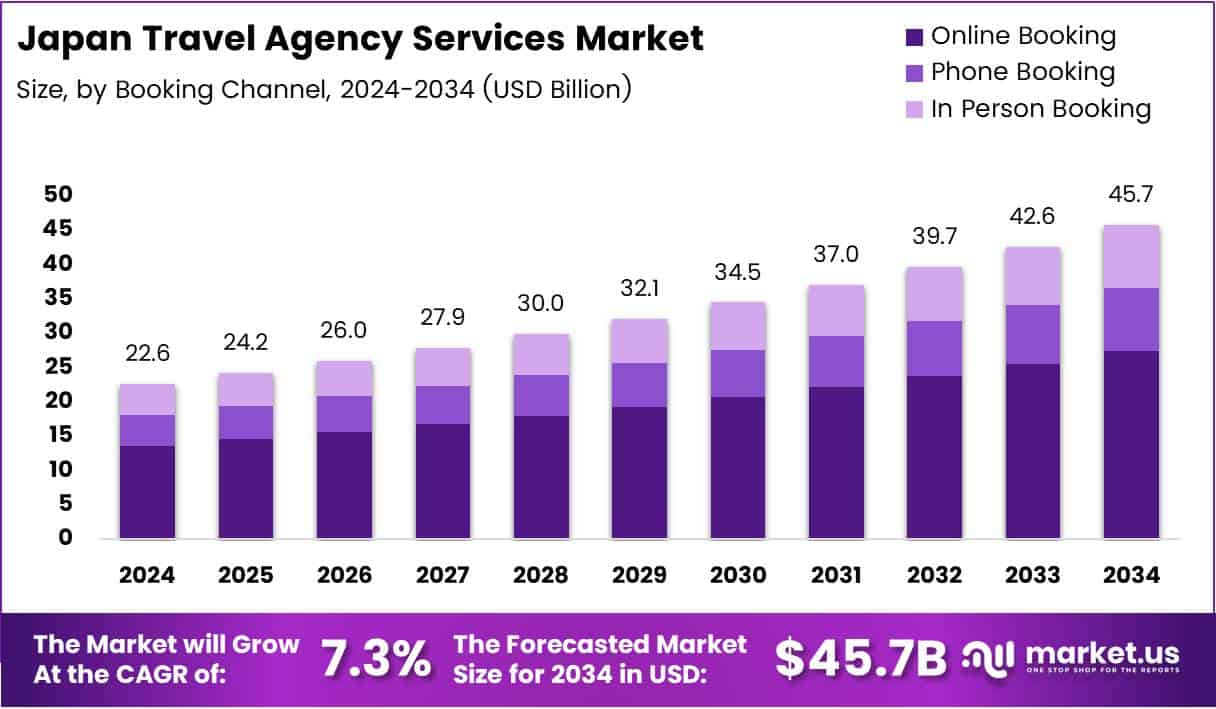

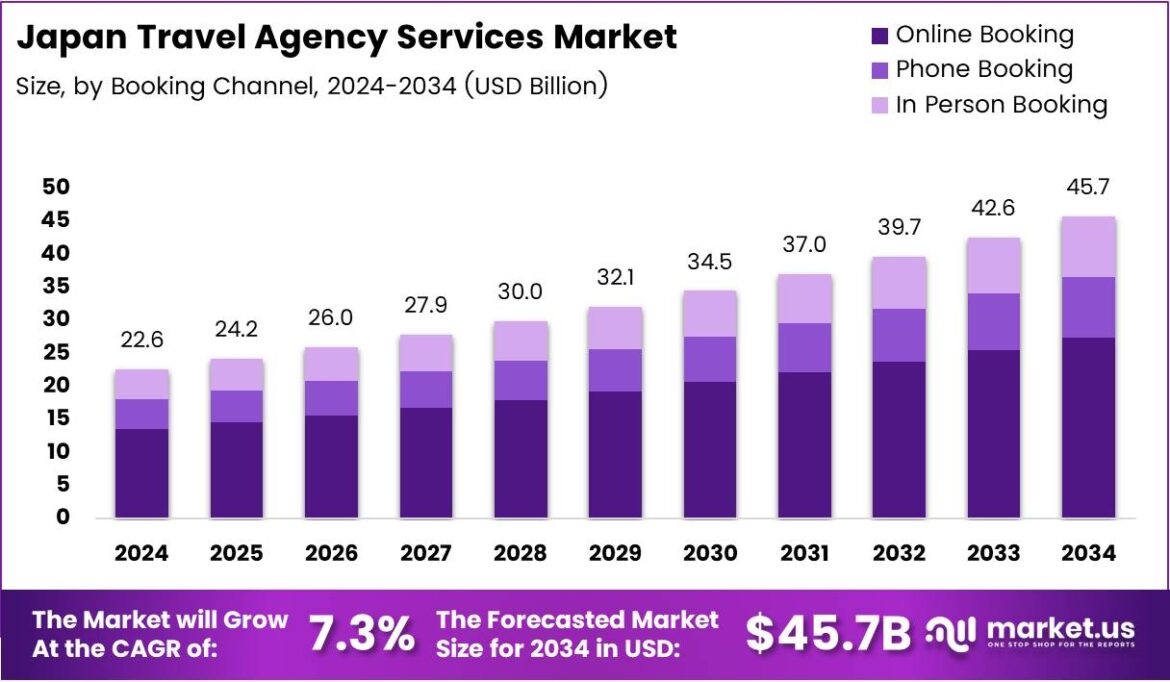

Japan Travel Agency Services Market is projected to reach USD 45.7 Billion by the forecast period from USD 22.6 Billion, expanding at a CAGR of 7.3%. This growth reflects Japan’s robust tourism recovery and increasing global traveler interest. The market encompasses full-service travel arrangements, partial services, and diverse booking channels serving domestic and international tourists.

Japan’s travel agency sector demonstrates remarkable resilience post-pandemic. Furthermore, the industry benefits from strong government support and visa facilitation programs. Consequently, agencies are experiencing heightened demand across leisure and corporate segments. Additionally, technological integration enhances operational efficiency and customer experience significantly.

The market presents substantial opportunities through digital transformation initiatives. Meanwhile, AI-powered platforms enable dynamic packaging and personalized itinerary optimization. Moreover, hybrid service models combining digital convenience with human expertise attract diverse customer segments. Therefore, agencies investing in technology gain competitive advantages in this evolving landscape.

Experiential travel spending among millennials and active seniors drives market expansion. Similarly, MICE tourism with sustainability compliance packages creates lucrative revenue streams. However, agencies must navigate labor shortages and yen-driven cost volatility challenges. Nevertheless, strategic adaptation positions operators for sustained growth.

Government initiatives promoting inbound tourism strengthen market fundamentals. Indeed, according to the Japan National Tourism Organization, Japan logged 21.5 million foreign visitors in the first half of 2025, passing the 20-million line at a record pace. Additionally, according to Research report, Japan welcomed around 36.9 million foreign tourists in 2024, approximately 16% above the previous record of 31.9 million in 2019.

Total inbound travel spending demonstrates impressive performance metrics. Specifically, according to Research report, total spending hit approximately ¥8.1 trillion, with per-capita spending around ¥227,000.

Furthermore, according to the Ministry of Land, Infrastructure, Transport and Tourism, total tourism consumption in Japan in 2023 reached ¥28.1 trillion, slightly +0.5% versus 2019. Domestic tourism consumption stood at ¥21.9 trillion, representing -0.1% versus 2019, while domestic guest nights by Japanese travelers reached 281.35 million and same-day trips totaled 216.23 million.

Key Takeaways

Japan Travel Agency Services Market projected to reach USD 45.7 Billion from USD 22.6 Billion at 7.3% CAGR

Full-service Travel Arrangements segment dominates with 73.8% market share

Online Booking channel leads with 59.9% share in booking channel segment

Domestic tourists represent 66.4% of tourist type segment

Independent Traveller segment captures 48.2% in tour type analysis

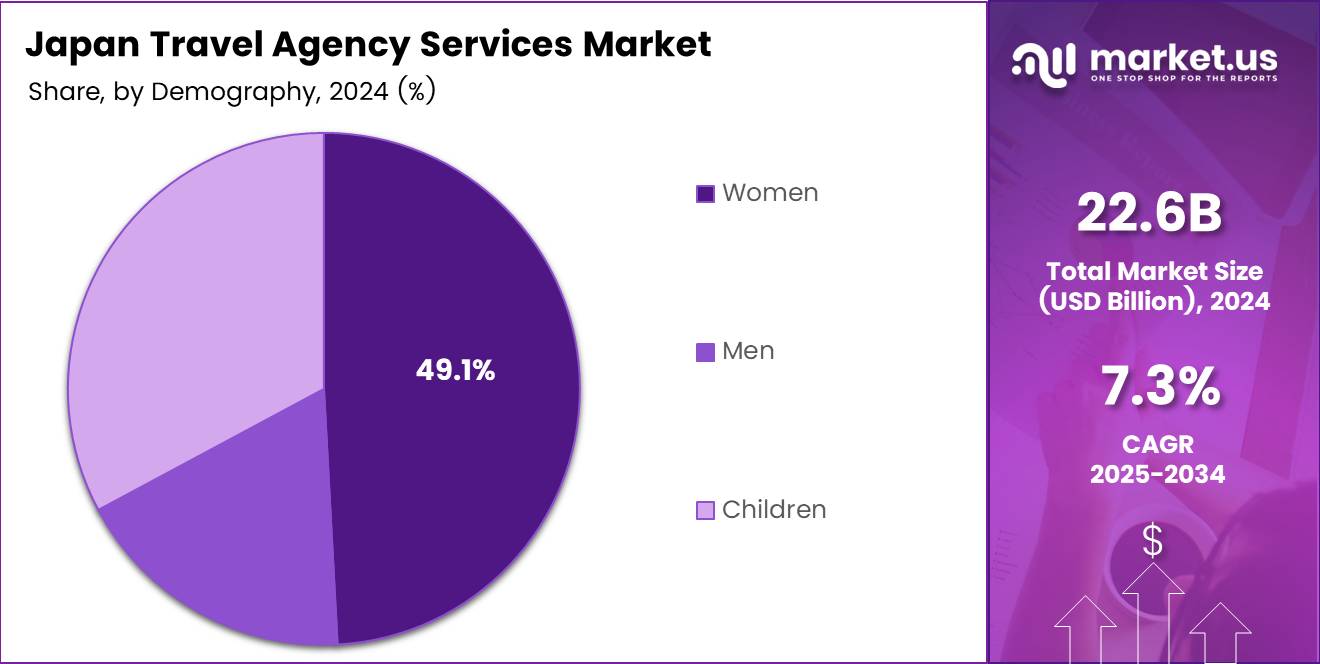

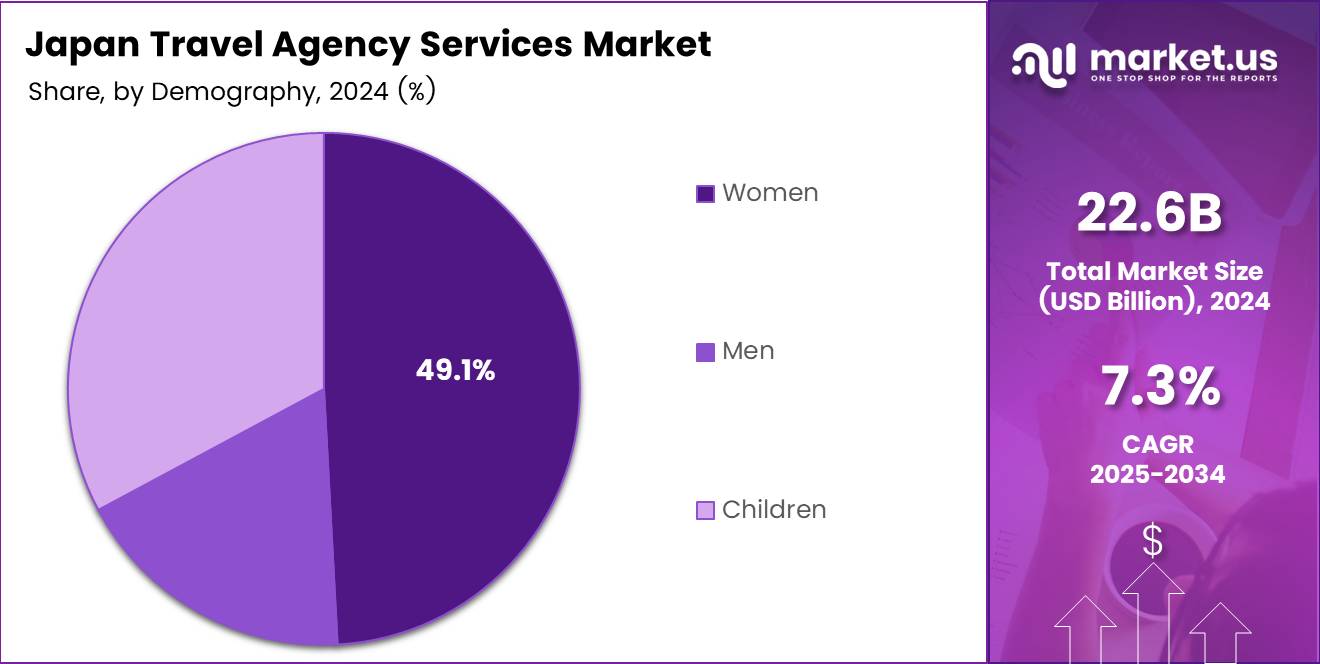

Women travelers account for 49.4% in demographic segment

Segments Overview

By Services Provided Analysis

Full-service Travel Arrangements dominates with 73.8% due to comprehensive service integration and customer convenience preferences.

In 2024, Full-service Travel Arrangements held a dominant market position in the By Services Provided segment of Japan Travel Agency Services Market, with a 73.8% share. This segment encompasses complete travel planning including transportation, accommodation, activities, and documentation support.

Consequently, travelers prefer bundled services that eliminate coordination complexities. Moreover, full-service agencies provide personalized consultation and emergency assistance throughout journeys. Therefore, this offering remains highly valued among corporate clients and leisure travelers seeking hassle-free experiences.

Partial Travel Services cater to experienced travelers requiring specific assistance components. Meanwhile, these services include flight booking, hotel reservations, or tour guide arrangements individually. Additionally, cost-conscious customers utilize partial services to maintain budget control.

Furthermore, digital-savvy tourists combine self-planning with selective professional support. Hence, this segment serves niche markets effectively while complementing full-service operations.

By Booking Channel Analysis

Online Booking dominates with 59.9% driven by digital accessibility and real-time availability transparency.

In 2024, Online Booking held a dominant market position in the By Booking Channel segment of Japan Travel Agency Services Market, with a 59.9% share. Digital platforms enable customers to compare options, read reviews, and book instantly. Consequently, online channels provide superior convenience and 24/7 accessibility. Moreover, agencies invest heavily in mobile applications and AI-powered recommendation engines. Therefore, younger demographics particularly favor online booking for its efficiency and transparency.

Phone Booking maintains relevance for complex itineraries requiring detailed consultation. Meanwhile, customers seeking personalized advice utilize phone channels for immediate clarifications. Additionally, senior travelers often prefer voice interaction over digital interfaces. Furthermore, urgent changes and special requests get resolved quickly through direct communication. Hence, phone support remains integral despite digital channel growth.

In Person Booking serves customers valuing face-to-face consultation and relationship building. Similarly, corporate clients establishing long-term partnerships prefer physical meetings. Additionally, high-value bookings for luxury travel benefit from personal interaction. Therefore, physical agencies maintain strategic locations in business districts and travel hubs.

By Tourist Type Analysis

Domestic tourists dominate with 66.4% reflecting strong local travel culture and regional exploration trends.

In 2024, Domestic tourists held a dominant market position in the By Tourist Type segment of Japan Travel Agency Services Market, with a 66.4% share. Japanese travelers actively explore regional attractions, cultural sites, and natural landscapes nationwide.

Consequently, domestic tourism generates consistent revenue throughout the year. Moreover, weekend getaways and seasonal festivals drive domestic booking volumes. Furthermore, government campaigns promoting regional revitalization encourage local travel. Therefore, agencies develop specialized domestic packages targeting diverse preferences.

International tourists contribute significant high-value spending and destination diversity. Meanwhile, foreign visitors seek authentic cultural experiences and iconic attractions. Additionally, agencies provide multilingual support and visa assistance for international segments.

Furthermore, inbound tourism recovery exceeds pre-pandemic levels, creating growth opportunities. Hence, international tourist services represent strategic expansion areas for Japanese travel agencies.

By Tour Type Analysis

Independent Traveller dominates with 48.2% due to flexibility preferences and personalized exploration desires.

In 2024, Independent Traveller held a dominant market position in the By Tour Type segment of Japan Travel Agency Services Market, with a 48.2% share. Solo travelers and couples prefer creating customized itineraries matching individual interests. Consequently, agencies offer flexible booking options without rigid schedules.

Moreover, independent travelers value freedom to explore destinations at personal pace. Furthermore, digital tools enable self-guided exploration with agency-provided support. Therefore, this segment reflects evolving travel preferences toward autonomy.

Package Traveller appeals to customers seeking convenience and predetermined comprehensive arrangements. Meanwhile, all-inclusive packages eliminate planning stress and guarantee service quality.

Additionally, first-time visitors and group travelers prefer structured itineraries. Furthermore, package tours offer cost predictability and bundled discounts. Hence, this segment maintains steady demand among specific customer demographics seeking worry-free travel experiences.

Tour Group serves social travelers and corporate team-building activities effectively. Similarly, educational tours and cultural exchange programs utilize group arrangements. Additionally, senior citizen groups appreciate organized travel with peer companionship. Therefore, agencies coordinate logistics for multiple participants simultaneously, ensuring cohesive experiences.

By Demography Analysis

Women travelers dominate with 49.4% reflecting growing female travel independence and purchasing power.

In 2024, Women held a dominant market position in the By Demography segment of Japan Travel Agency Services Market, with a 49.4% share. Female travelers increasingly pursue solo adventures, wellness retreats, and cultural exploration independently. Consequently, agencies develop safety-focused packages addressing women-specific travel concerns.

Moreover, women demonstrate higher engagement with experiential and educational travel offerings. Furthermore, female travelers prioritize authentic local experiences and sustainable tourism practices. Therefore, this demographic segment drives innovation in personalized service development.

Men represent substantial market share with preferences toward adventure activities and business travel. Meanwhile, male travelers often combine work trips with leisure extensions. Additionally, sporting events and outdoor activities attract significant male participation. Therefore, agencies curate specialized packages addressing masculine travel interests effectively.

Children significantly influence family travel decisions and destination selections. Similarly, family-oriented packages incorporate kid-friendly attractions and educational experiences. Additionally, theme parks, interactive museums, and nature activities appeal to younger demographics.

Furthermore, multi-generational travel trends increase demand for age-appropriate itineraries. Hence, children-focused services enhance overall family travel satisfaction and booking conversion rates.

Key Market Segments

By Services Provided

Full-service Travel Arrangements

Partial Travel Services

By Booking Channel

Online Booking

Phone Booking

In Person Booking

By Tourist Type

By Tour Type

Independent Traveller

Package Traveller

Tour Group

By Demography

Drivers

Post-Pandemic Surge in Outbound Leisure and Corporate Travel Demand Drives Market Growth

Travel restrictions lifting accelerated pent-up demand across leisure and business segments. Consequently, Japanese travelers actively book international destinations postponed during pandemic years. Moreover, corporate travel resumes as companies prioritize face-to-face meetings and conferences.

Additionally, remote work flexibility enables extended leisure trips combining business and pleasure. Therefore, agencies experience increased booking volumes across all service categories significantly.

Government initiatives promoting tourism recovery strengthen market fundamentals considerably. Meanwhile, visa facilitation programs reduce entry barriers for international travelers. Furthermore, tourism promotion campaigns attract global visitors to Japanese destinations.

Similarly, AI-powered platforms enable dynamic packaging and personalized itinerary optimization efficiently. Hence, technological advancement enhances operational efficiency while improving customer satisfaction and loyalty consistently.

Restraints

Persistent Labor Shortages in Multilingual Tour Operations Impact Service Quality and Scalability

Japan’s aging population creates workforce challenges across hospitality-linked services. Consequently, travel agencies struggle to recruit qualified multilingual tour operators and guides. Moreover, language barriers limit service quality for international tourist segments.

Additionally, training costs increase as agencies invest in employee development programs. Therefore, labor constraints restrict operational expansion and service diversification efforts considerably.

Yen-driven cost volatility significantly impacts supplier contracts and agency margin stability. Meanwhile, currency fluctuations affect pricing strategies and profitability projections. Furthermore, agencies face difficulty maintaining competitive pricing amid exchange rate uncertainties.

Similarly, supplier contract renegotiations become frequent due to currency-related cost variations. Hence, financial unpredictability challenges long-term business planning and investment decisions substantially.

Growth Factors

Expansion of Hybrid Digital-Concierge Assisted Group Tours Creates New Revenue Opportunities

Hybrid service models combining digital convenience with human expertise attract diverse customers. Consequently, agencies integrate technology while maintaining personalized consultation services. Moreover, digital-concierge platforms provide real-time support throughout traveler journeys.

Additionally, group tours benefit from automated coordination and manual customization balance. Therefore, this approach enhances customer experience while optimizing operational efficiency significantly.

Scaling private-label travel apps integrated with rail-air-hotel ecosystems strengthens competitive positioning. Meanwhile, seamless booking across transportation and accommodation platforms improves user convenience. Furthermore, cross-border MICE tour growth with sustainability compliance packages attracts corporate clients.

Similarly, developing local cultural-masterclass and licensed insider guide networks differentiates service offerings. Hence, agencies investing in these growth factors capture emerging market opportunities effectively and sustainably.

Emerging Trends

Real-Time Travel Support via Generative-Chat Travel-Agent Avatars Transforms Customer Engagement

AI-powered chatbots provide instant responses to customer queries throughout booking journeys. Consequently, agencies reduce response times while maintaining service quality standards. Moreover, generative chat avatars handle multiple languages and cultural nuances effectively.

Additionally, automated support reduces operational costs while improving customer accessibility significantly. Therefore, this technology transforms traditional customer service models fundamentally.

Social-commerce trip discovery through creator-led live streams drives booking conversions effectively. Meanwhile, influencer partnerships enable authentic destination showcasing and immediate purchase options. Furthermore, subscription-based annual domestic exploration passes encourage frequent travel among loyal customers.

Similarly, carbon-transparent booking filters and eco-scored itinerary rankings appeal to environmentally conscious travelers. Hence, agencies adopting these trends position themselves strategically for future market demands and customer expectations.

Country Analysis

Japan Travel Agency Services Market Demonstrates Strong Domestic Foundation with Growing International Integration

Japan represents the primary market with robust domestic tourism infrastructure and cultural travel traditions. The market benefits from comprehensive transportation networks connecting urban centers and regional attractions. Moreover, government initiatives actively promote both inbound and outbound tourism growth. Additionally, digital infrastructure supports seamless booking experiences across online and offline channels. Therefore, Japan continues strengthening its position as a major travel services hub regionally.

Asia Pacific markets demonstrate increasing connectivity with Japanese travel agencies through partnership expansions. Regional collaboration enables cross-border tour packages and cultural exchange programs. Furthermore, growing middle-class populations across Asia drive demand for Japanese destination experiences. Hence, agencies expand regional presence to capture emerging market opportunities effectively.

Key Japan Travel Agency Services Company Insights

The Japan Travel Agency Services Market features established global players and regional specialists driving innovation. Expedia Group leverages its extensive online platform to offer comprehensive booking solutions and loyalty programs. The company’s technology infrastructure enables seamless user experiences across devices and markets.

Booking Holdings maintains strong market presence through diverse brand portfolios serving various customer segments. Their data analytics capabilities optimize pricing strategies and inventory management effectively.

TUI Group combines tour operations with travel agency services, providing integrated vacation experiences. Their vertical integration model enhances service quality control and customer satisfaction levels.

American Express Global Business Travel specializes in corporate travel management with premium service offerings. They deliver expense management solutions and traveler safety support for business clients. Viator focuses on experiential travel and activity bookings, connecting travelers with local experiences. Their platform enables real-time availability and instant confirmation for tours and activities.

These companies demonstrate strategic focus on digital transformation and customer-centric service models. Moreover, investments in AI-powered personalization enhance booking conversion rates and customer loyalty. Additionally, sustainability initiatives align with growing consumer preferences for responsible travel practices.

Furthermore, partnerships with local suppliers and cultural institutions strengthen authentic experience offerings. Therefore, leading players maintain competitive advantages through innovation, technology integration, and comprehensive service portfolios addressing evolving market demands effectively.

Key Companies

Expedia Group

Booking Holdings

TUI Group

American Express Global Business Travel

Viator

Recent Developments

In May 2024, Tokyo-Based Adventure acquired Singapore TMC Silkway Travel Asia, expanding regional presence and corporate travel management capabilities significantly.

In October 2025, Rakuten Travel expanded its hotel booking platform worldwide, providing access to over 400,000 international properties globally.

In August 2025, JTB Corporation agreed to acquire Northstar Travel Group from investment funds managed by EagleTree Capital, strengthening business intelligence offerings.

Report Scope

AloJapan.com