Report Overview

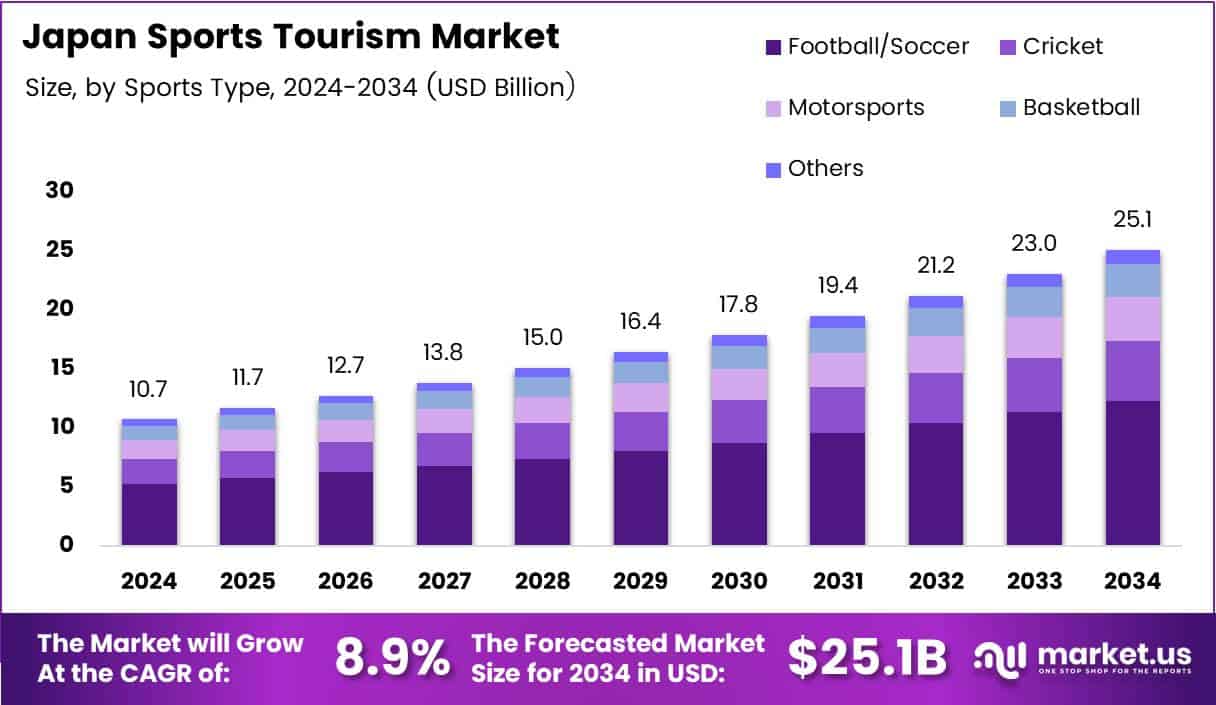

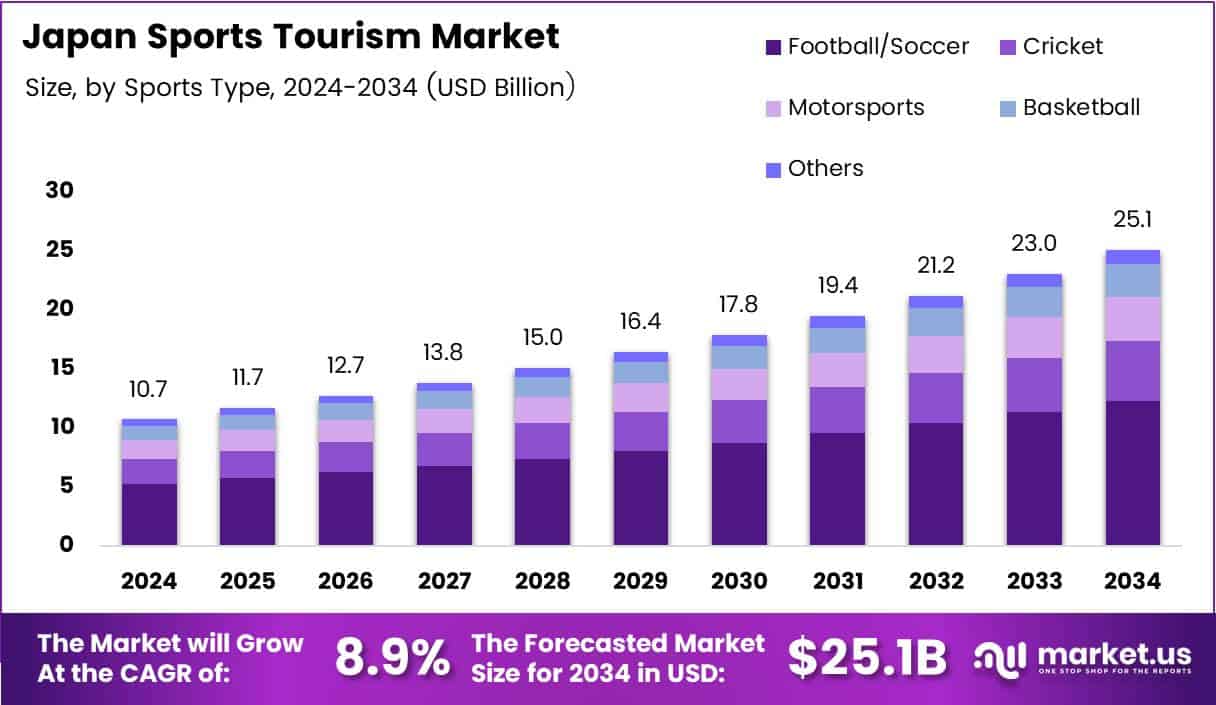

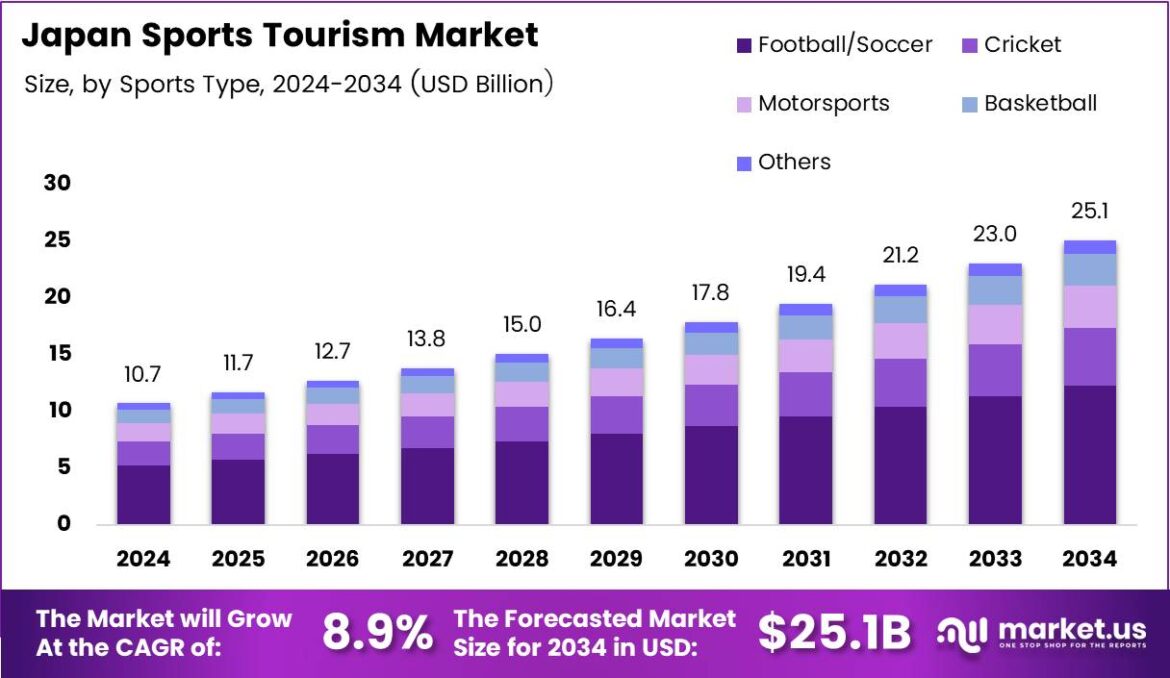

Japan Sports Tourism Market size is expected to be worth around US$ 10.7 Billion by 2034 from US$ 8.9 Billion in 2024, growing at a CAGR of 8.9% during the forecast period 2025 to 2034.

Japan’s sports tourism landscape represents a dynamic convergence of traditional athletic events and modern experiential travel. The market demonstrates robust expansion driven by strategic government initiatives supporting sports infrastructure development. Furthermore, evolving consumer preferences toward active lifestyle experiences significantly bolster market momentum. Rising disposable incomes among Asian travelers particularly accelerate inbound sports tourism participation rates.

Tokyo’s successful Olympic legacy continues reshaping destination marketing strategies across Japanese prefectures. Major sporting venues now function as year-round tourism magnets attracting both domestic and international visitors. Additionally, regional sporting events generate substantial economic multiplier effects benefiting local hospitality and transportation sectors. Enhanced digital booking platforms streamline travel planning processes enabling seamless sports event attendance coordination.

Marathon tourism emerges as a particularly lucrative segment with events across Osaka, Tokyo, and Hokkaido attracting thousands. Winter sports destinations in Nagano and Hokkaido capitalize on premium snow quality drawing global ski enthusiasts. Moreover, niche segments including fishing expeditions and surfing retreats diversify the overall market portfolio. Corporate wellness programs increasingly incorporate sports tourism components supporting business travel integration.

Infrastructure modernization across stadiums and sports complexes enhances visitor experiences through technology-enabled services. Transportation connectivity improvements facilitate easier access to remote sports destinations throughout the archipelago. Government investment in multilingual support systems gradually addresses communication barriers affecting international sports travelers. Strategic partnerships between tourism boards and sports federations create comprehensive promotional campaigns targeting key source markets.

According to Web in Travel, Japan had the highest proportion of solo sports tourists at 20%, significantly higher than the global average of 11%. This distinctive traveler profile indicates strong domestic participation rates and independent travel preferences among Japanese consumers. Professional sports leagues including J-League football and B-League basketball develop fan engagement programs incorporating travel experiences. E-sports venues emerge as unconventional tourism attractions reflecting Japan’s leadership in digital gaming culture and competitive gaming tourism.

Key Takeaways

Japan Sports Tourism Market projected to reach US$ 10.7 Billion by 2034 with 8.9% CAGR

Football/Soccer dominates Sports Type segment with 36.1% market share

Men represent 58.2% of consumer orientation reflecting gender participation patterns

Online Booking channels command 62.8% share indicating digital transformation adoption

Domestic tourists account for 82.3% highlighting strong local market foundation

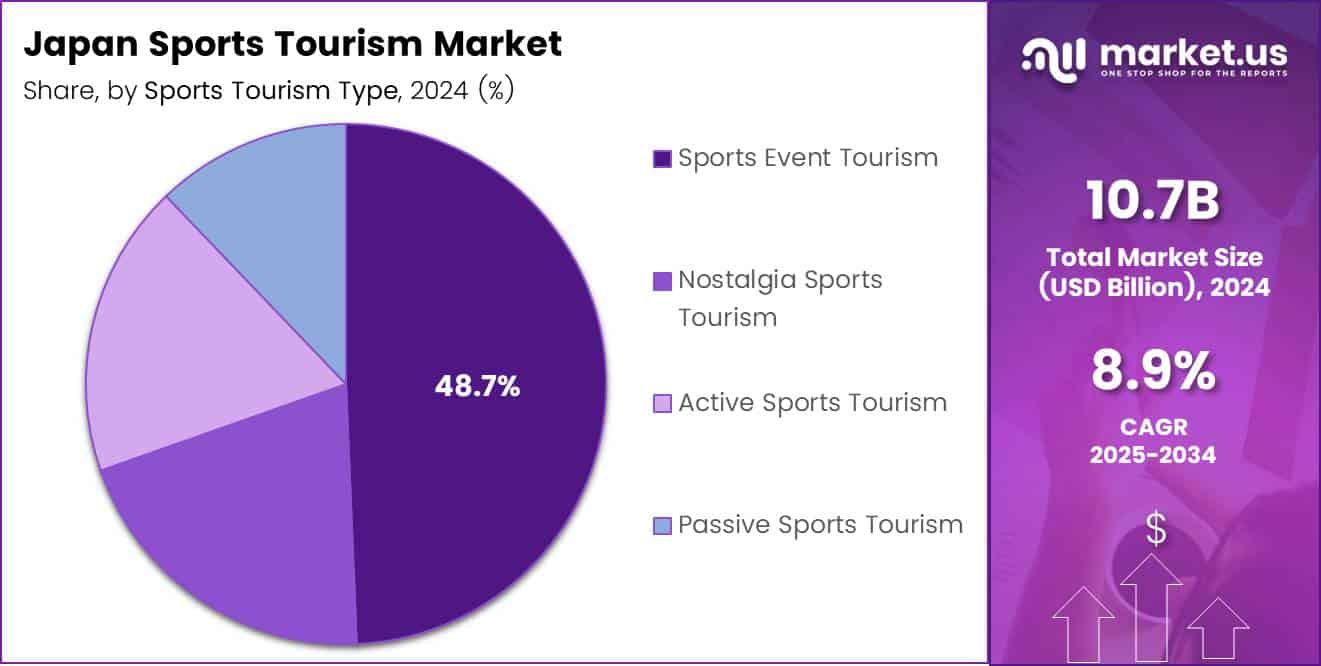

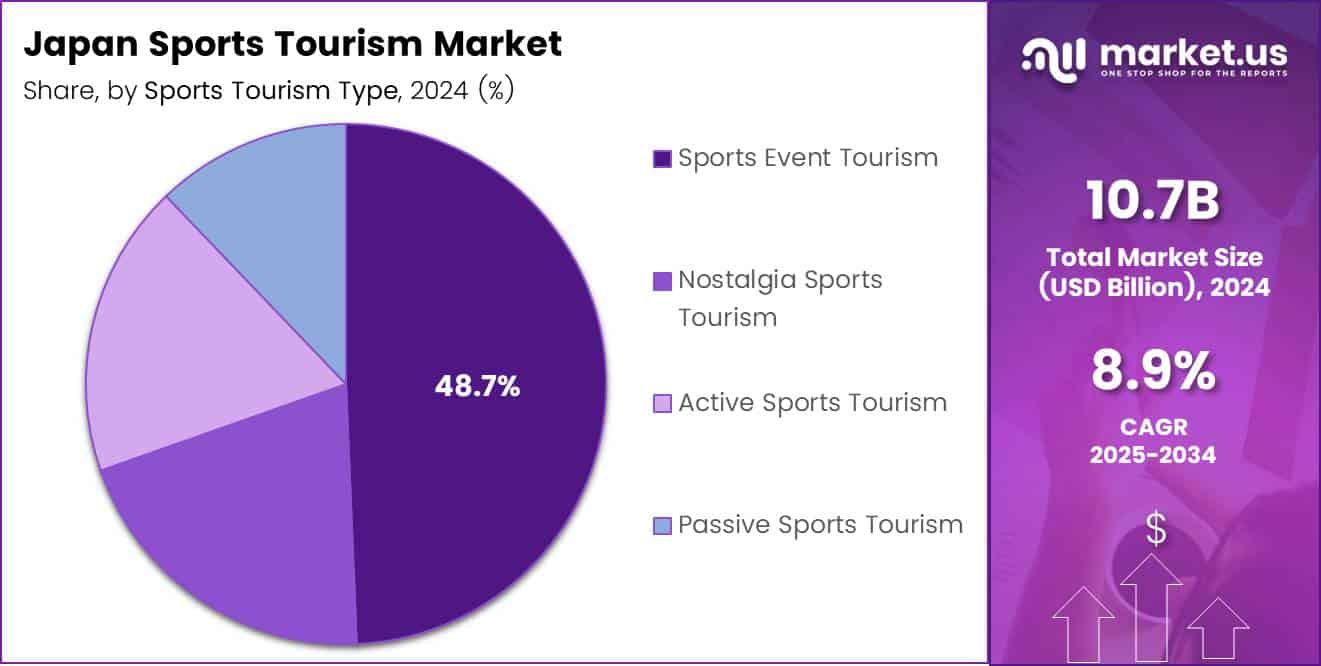

Sports Event Tourism leads with 48.7% share driven by major international competitions

Sports Type Analysis

Football/Soccer dominates with 36.1% due to J-League’s nationwide popularity and international tournament hosting capabilities.

Cricket represents an emerging segment capitalizing on growing South Asian expatriate communities and international cricket friendlies. Japan Cricket Association develops grassroots programs enhancing local participation rates and spectator interest levels. Cricket tourism packages targeting Indian and Pakistani diaspora communities create specialized niche market opportunities.

Motorsports tourism leverages legendary circuits including Suzuka and Fuji Speedway attracting Formula One and Super GT enthusiasts. These premium facilities offer immersive racing experiences combining track days with hospitality services and technical tours. Additionally, motorcycle touring routes through scenic Japanese countryside attract riding enthusiasts seeking adventure tourism experiences.

Consumer Orientation Analysis

Men dominate with 58.2% reflecting traditional gender participation patterns in competitive sports consumption and travel.

Men constitute the primary consumer demographic driven by higher engagement rates in competitive sports viewing and participation. Corporate hospitality packages and business-related sports travel disproportionately attract male professionals seeking networking opportunities. Furthermore, extreme sports and adventure tourism segments demonstrate pronounced male preference patterns influencing marketing strategies.

Women represent a rapidly expanding segment with increasing participation in marathon events and fitness-oriented travel experiences. Female sports tourists demonstrate preferences for wellness integration combining athletic activities with spa and cultural experiences. Moreover, women-only sports travel groups emerge addressing safety concerns and creating comfortable social environments.

Kids segment grows through family-oriented sports tourism packages incorporating youth sports camps and junior athlete development programs. Educational sports tours combining skill development with cultural immersion attract international families seeking enriching travel experiences. Additionally, school sports exchange programs facilitate youth sports tourism supporting long-term market development.

Booking Channel Analysis

Online Booking dominates with 62.8% reflecting digital transformation and mobile-first consumer booking behaviors.

Online booking platforms revolutionize sports tourism accessibility through integrated ticket purchasing and accommodation bundling services. Mobile applications provide real-time availability updates and personalized recommendations enhancing user experience and conversion rates. Furthermore, social media integration enables seamless sharing and collaborative trip planning among sports enthusiast communities.

Phone booking maintains relevance among older demographics and for complex itinerary customization requiring personal consultation services. Corporate travel managers utilize phone channels for group booking coordination and negotiating volume discounts. Additionally, last-minute availability inquiries often necessitate direct telephone communication with travel service providers.

In-person booking persists through traditional travel agencies serving customers preferring face-to-face consultation and tangible documentation. Regional travel centers at transportation hubs capture walk-in traffic from spontaneous travelers seeking immediate arrangements. Moreover, specialized sports travel agencies maintain physical offices building trusted relationships with repeat clientele.

Tourist Type Analysis

Domestic tourists dominate with 82.3% highlighting strong local market foundation and regional sports event accessibility.

Domestic tourists form the market backbone through weekend sports event attendance and short-duration regional travel patterns. Professional sports leagues cultivate loyal fan bases traveling regularly to support home and away matches. Furthermore, government promotional campaigns encouraging regional exploration stimulate domestic sports tourism participation across prefectures.

International tourists contribute premium revenue segments attracted by unique sporting events unavailable in home markets. Major tournaments including Rugby World Cup and potential Olympic events generate substantial inbound tourism surges. Additionally, niche sports experiences such as sumo wrestling tournaments and traditional martial arts training attract culturally curious international visitors.

Sports Tourism Type Analysis

Sports Event Tourism dominates with 48.7% driven by major international competitions and professional league match attendance.

Sports Event Tourism capitalizes on scheduled competitions ranging from local tournaments to international championships attracting spectators. Mega-events generate concentrated tourism impacts with accommodation and hospitality sectors experiencing peak demand periods. Moreover, recurring annual events create predictable tourism patterns enabling advanced planning and infrastructure optimization.

Nostalgia Sports Tourism targets fans visiting historic sports venues and halls of fame celebrating athletic heritage. Museums dedicated to baseball legends and Olympic history attract older demographics reminiscing about golden sporting eras. Additionally, stadium tours of legendary venues create emotional connections transcending contemporary competition schedules.

Active Sports Tourism engages participants traveling specifically to undertake sporting activities including skiing, surfing, and marathon running. Premium ski resorts in Hokkaido and Nagano attract international winter sports enthusiasts seeking powder snow experiences. Moreover, marathon events across major cities enable amateur athletes combining competition participation with destination exploration.

Passive Sports Tourism encompasses spectators attending events primarily for entertainment without active participation in athletic activities. Corporate hospitality boxes and VIP experiences cater to passive tourists seeking premium viewing environments. Additionally, festival atmospheres surrounding major sporting events attract casual tourists enjoying associated entertainment and cultural programming.

Key Market Segments

By Sports Type

Football/Soccer

Cricket

Motorsports

Basketball

Others

By Consumer Orientation

By Booking Channel

Online Booking

Phone Booking

In-Person Booking

By Tourist Type

By Sports Tourism Type

Sports Event Tourism

Nostalgia Sports Tourism

Active Sports Tourism

Passive Sports Tourism

Passive Sports Tourism

Drivers

Surging Global Demand for Marathon & Road Race Travel Experiences Drives Market Growth

Marathon tourism establishes Japan as a premier destination for endurance athletes seeking iconic urban racing experiences. Tokyo Marathon attracts over forty thousand participants annually with international runners comprising significant proportions of the field. Moreover, scenic courses through Kyoto, Osaka, and Hokkaido combine athletic challenge with cultural immersion opportunities. Registration demand consistently exceeds capacity necessitating lottery systems and premium entry packages.

Major international sporting events including Rugby World Cup and potential future Olympics generate substantial inbound tourism momentum. These mega-events showcase Japanese hospitality infrastructure and organizational excellence to global audiences stimulating repeat visitation. Furthermore, Olympic legacy venues continue attracting sports tourists seeking experiences at iconic facilities. Government investment in sports infrastructure modernization enhances Japan’s competitiveness as a major event host destination.

Premium ski infrastructure in Hokkaido and Nagano drives winter sports tourism growth attracting affluent international skiers. World-class powder snow conditions position Japan competitively against European and North American ski destinations. Moreover, luxury resort developments combining onsen relaxation with slope access create differentiated positioning appealing to premium travelers.

Restraints

Limited Multilingual Support in Local Sports Booking Platforms Restrains International Market Expansion

Language barriers significantly impede international sports tourists navigating local booking systems and event information platforms. Many regional sports venues and smaller tournament organizers lack English-language websites restricting accessibility for non-Japanese speakers. Furthermore, customer service channels predominantly operate in Japanese creating frustration when international travelers require assistance. Translation quality varies considerably across digital platforms resulting in confusion regarding booking procedures and event details.

Regional transportation signage and stadium wayfinding systems often lack comprehensive multilingual guidance challenging international visitor navigation. Ticketing procedures at physical box offices require Japanese language proficiency creating entry barriers for spontaneous attendance. Moreover, limited staff foreign language capabilities at sports venues impact service quality perceptions among international tourists. Mobile application interfaces rarely support multiple languages comprehensively restricting digital engagement opportunities.

Seasonal over-concentration creates infrastructure strain during peak sports tourism periods particularly surrounding major events and winter sports season. Accommodation capacity shortages drive price volatility deterring budget-conscious travelers and creating unpredictable cost structures. Transportation systems experience overcrowding affecting visitor experiences and operational efficiency during concentrated arrival periods. Moreover, hospitality service quality may decline under peak demand pressure impacting visitor satisfaction and repeat visitation likelihood.

Growth Factors

Development of E-Sports Tournament Tourism Ecosystems with Live-Arena Travel Bundles Creates New Growth Avenues

E-sports tournament tourism represents untapped potential leveraging Japan’s gaming culture leadership and competitive gaming infrastructure. Purpose-built e-sports arenas in Tokyo and Osaka attract international teams and spectators seeking immersive competitive gaming experiences. Moreover, championship events generate concentrated tourism impacts similar to traditional sporting competitions with accommodation and hospitality demand. Travel packages bundling arena tickets with gaming-themed cultural experiences appeal to younger demographic segments.

University sports tourism monetization through events like Hakone Ekiden relay race and inter-collegiate tournaments taps passionate collegiate fan bases. Campus tours highlighting athletic facilities and sports history attract prospective student-athletes and sports education enthusiasts. Moreover, alumni networks create built-in tourist segments returning for homecoming events and championship competitions. Broadcasting partnerships amplify event visibility attracting spectators beyond immediate university communities.

Adaptive and para-sports tourism products address accessibility requirements for athlete-travelers with disabilities seeking inclusive sporting experiences. Tokyo Paralympic legacy drives infrastructure improvements benefiting travelers requiring accessible facilities and specialized services. Furthermore, para-sports events showcase Japan’s commitment to inclusive tourism creating positive destination image perceptions. Specialized training facilities and coaching programs attract international adaptive athletes preparing for competitive events.

Emerging Trends

Augmented Reality Sports Trails & Gamified Athlete-Fan City Exploration Transform Digital Engagement

Augmented reality applications create interactive sports trails enabling tourists to engage with athletic heritage through smartphone-guided experiences. Digital overlays at historic sports venues provide immersive storytelling connecting visitors with legendary athletic moments and personalities. Moreover, gamification elements including achievement badges and competitive leaderboards enhance engagement particularly among younger tourist demographics. Location-based AR experiences drive foot traffic to multiple venues creating distributed economic benefits across destination areas.

Athlete-influencer led micro-community sports tours leverage social media followings creating intimate fan experiences with sports personalities. Professional and retired athletes host specialized training camps combining skill development with destination exploration opportunities. Furthermore, behind-the-scenes access and personal interaction opportunities justify premium pricing supporting high-value tourism segments. Social media documentation by participants generates organic marketing amplifying destination visibility to niche sports communities.

Carbon-neutral sports travel initiatives address environmental consciousness among sustainability-focused tourist segments seeking responsible travel options. Public transportation integration for sports event access reduces carbon footprints while managing venue-area traffic congestion. Moreover, renewable energy powered sports facilities and carbon offset programs align with global sustainability trends. Green certification programs for sports tourism operators create competitive differentiation attracting environmentally aware travelers.

Onsen recovery tourism positioned as integral to sports travel experiences creates unique wellness-sports convergence products. Hot spring resorts near ski areas and marathon routes market muscle recovery benefits attracting performance-conscious athletes. Furthermore, traditional Japanese wellness practices combined with modern sports science create authentic cultural experiences. Recovery-focused itineraries appeal to serious amateur athletes seeking performance optimization alongside recreational travel enjoyment.

Key Japan Sports Tourism Company Insights

Leading travel management companies and specialized sports tourism operators drive market innovation through integrated service offerings and technology-enabled platforms. These industry players develop comprehensive solutions addressing evolving consumer preferences and operational efficiency requirements.

Expedia Group leverages its extensive digital platform infrastructure enabling seamless sports event ticket and accommodation bundling for Japanese destinations. Their data analytics capabilities personalize recommendations enhancing conversion rates among sports tourism segments seeking convenience.

Carlson Wagonlit Travel specializes in corporate sports hospitality management coordinating executive travel for major sporting events across Japan. Their global network and local expertise facilitate complex group bookings and VIP experience coordination for business clients.

BCD Travel develops sustainable sports travel solutions integrating carbon tracking and offsetting features appealing to environmentally conscious corporate travelers. Their technology platforms optimize sports event logistics while supporting organizational sustainability commitments and reporting requirements.

Sports & Tourism Premier focuses exclusively on sports tourism creating specialized itineraries combining event attendance with cultural immersion experiences. Their niche positioning enables deep expertise in athlete travel requirements and fan engagement programming differentiating their service offerings.

Top Key Players in the Market

Expedia Group

Carlson Wagonlit Travel

BCD Travel

Sports & Tourisum Premier

Travel Leaders Group

Fareportal/Travelong

AAA Travel

Corporate Travel Management

Altour

Direct Travel

Omega World Travel

Recent Developments

In October 2025, Northstar Travel Group announced completion of acquisition by JTB Corp, strengthening integrated sports tourism service capabilities across Japanese and international markets through combined operational resources and distribution networks.

In October 2025, MUFG announced acquisition of Tokyo’s National Stadium naming rights from 2026, enhancing venue commercial viability and creating premium corporate hospitality opportunities for sports tourism packages at Japan’s flagship sporting facility.

In February 2025, Fortress announced completion of sale of PJC Investments Co., Ltd. for JPY 510 billion, signaling significant investment activity and market consolidation within Japan’s sports infrastructure and tourism development sectors.

Report Scope

AloJapan.com