Demand for Battery Management System in Japan Forecast and Outlook 2025 to 2035

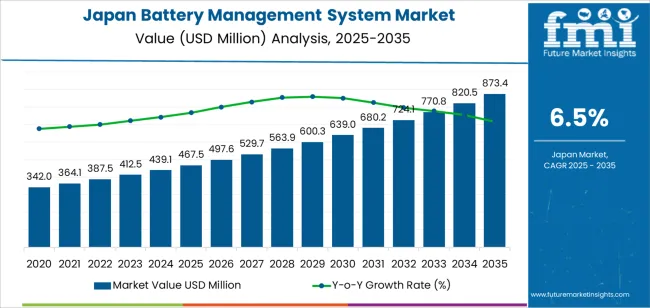

The demand for battery management systems (BMS) in Japan is expected to grow from USD 467.5 million in 2025 to USD 873.4 million by 2035, reflecting a compound annual growth rate (CAGR) of 6.5%. As the adoption of electric vehicles (EVs), renewable energy solutions, and energy storage systems continues to increase, the need for advanced BMS technology is becoming more critical. These systems ensure the efficient management of battery performance, safety, and longevity, all of which are essential as demand for high-capacity energy storage solutions grows across various sectors, including automotive, industrial, and residential.

The growing trend toward electrification in Japan, driven by both environmental regulations and the shift toward cleaner energy, will significantly contribute to the rise in demand for BMS technology. Battery management systems are essential in electric vehicle batteries, enabling optimal performance and safety. Moreover, with Japan’s emphasis on expanding its renewable energy infrastructure, the BMS industry is also benefiting from increased investments in energy storage systems to balance the intermittent nature of renewable power generation.

Quick Stats of the Demand for Battery Management System in Japan

Demand for Battery Management System in Japan Value (2025): USD 467.5 million

Demand for Battery Management System in Japan Forecast Value (2035): USD 873.4 million

Demand for Battery Management System in Japan Forecast CAGR (2025-2035): 6.5%

Demand for Battery Management System in Japan Leading Application: Automotive

Demand for Battery Management System in Japan Key Growth Regions: Kanto, Kinki, Chubu, Rest of Japan

Demand for Battery Management System in Japan Top Players: Texas Instruments, Toshiba Corporation, Infineon Technologies, STMicroelectronics, NXP Semiconductors

Innovation in BMS technology, such as improvements in battery life, charging speed, and efficiency, will continue to drive the growth of this sector. As battery technologies advance, there will be a growing need for more sophisticated systems to manage these increasingly complex and higher-performing batteries. Japan’s commitment to reducing carbon emissions and increasing its reliance on clean energy solutions will further fuel the demand for BMS as an integral component of EVs and energy storage systems.

What is the Growth Forecast for the Demand for Battery Management System in Japan through 2035?

Between 2025 and 2030, the demand for battery management systems in Japan will increase from USD 467.5 million to USD 600.3 million, adding USD 132.8 million. This growth is driven by the rising adoption of electric vehicles and energy storage systems as Japan accelerates its efforts toward achieving carbon neutrality. As more automakers in Japan focus on electric vehicle production and as energy storage solutions become more mainstream, the demand for BMS will experience rapid growth during this phase.

From 2030 to 2035, the demand is expected to continue accelerating, growing from USD 600.3 million to USD 873.4 million, adding USD 273.1 million. The latter phase will see the widespread adoption of electric vehicles, coupled with further advancements in battery technology, resulting in stronger growth for BMS systems. As energy storage systems and smart grid applications expand, the demand for battery management systems will grow in parallel, playing a pivotal role in the efficient and safe operation of these high-capacity storage solutions.

Demand for Battery Management System in Japan Key Takeaways

Metric

Value

Demand for Battery Management System in Japan Value (2025)

USD 467.5 million

Demand for Battery Management System in Japan Forecast Value (2035)

USD 873.4 million

Demand for Battery Management System in Japan Forecast CAGR (2025-2035)

6.5%

Why is the Demand for Battery Management System in Japan Growing?

The demand for battery management systems (BMS) in Japan is growing due to the increasing adoption of electric vehicles (EVs) and the expansion of renewable energy storage solutions. As Japan transitions toward a more sustainable energy landscape, the need for advanced battery management systems to optimize the performance, safety, and longevity of batteries becomes critical. BMS plays a key role in ensuring the safe operation of battery packs by monitoring temperature, voltage, and state of charge, thus preventing potential failures and extending battery life.

Japan’s strong automotive industry, with major manufacturers actively investing in EV technology, is one of the primary drivers of BMS demand. As the government pushes for stricter emissions regulations and more sustainable transportation solutions, EVs and hybrid vehicles are becoming increasingly popular, creating a significant demand for reliable and efficient battery systems. The growing demand for energy storage systems, driven by renewable energy adoption, is also a key factor. BMS solutions are crucial in managing large-scale battery storage systems that help stabilize energy grids and store solar or wind energy for later use.

Technological advancements in BMS, such as improvements in software, sensor technologies, and real-time monitoring, are contributing to greater efficiency and safety in battery operations. As Japan continues to lead in both automotive innovation and clean energy solutions, the demand for advanced battery management systems is expected to rise steadily through 2035.

What is the Segment-Wise Analysis of Demand for Battery Management System in Japan?

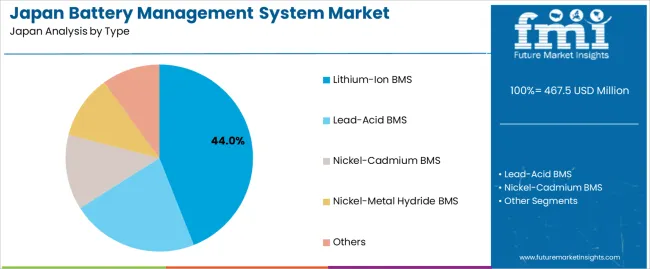

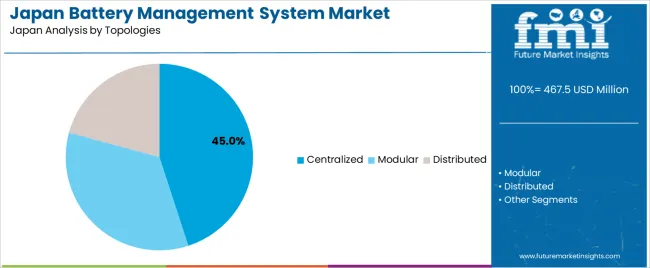

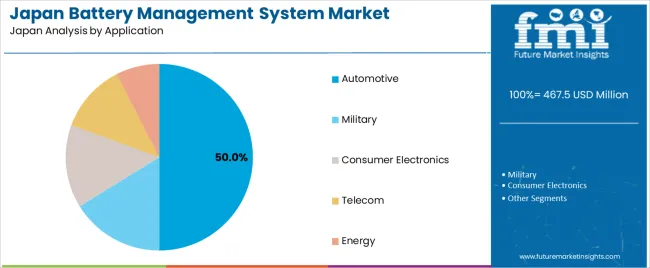

Demand for battery management systems (BMS) in Japan is segmented by type, topology, and application. By type, demand is divided into lithium-ion BMS, lead-acid BMS, nickel-cadmium BMS, nickel-metal hydride BMS, and others. The demand is also segmented by topology, including centralized, modular, and distributed. In terms of application, demand is divided into automotive, military, consumer electronics, telecom, and energy. Regionally, demand is divided into Kanto, Kinki, Chubu, Kyushu & Okinawa, Tohoku, and the Rest of Japan.

Why Does Lithium-Ion BMS Lead the Demand in Japan?

Lithium-ion battery management systems (BMS) account for 44% of the demand for BMS in Japan. Lithium-ion batteries are widely used across various industries due to their high energy density, long lifespan, and lighter weight compared to other battery types. These batteries are increasingly being adopted in applications like electric vehicles (EVs), consumer electronics, and renewable energy storage. The rising demand for EVs and portable electronics, combined with the need for efficient energy management and safety, has driven the growth of lithium-ion BMS. As the shift towards sustainable energy solutions continues, lithium-ion BMS will maintain its dominant share, supporting industries focused on energy efficiency, environmental impact reduction, and technological advancements.

Why Does Centralized Topology Dominate the Demand for Battery Management Systems?

Centralized topology accounts for 45% of the demand for battery management systems in Japan. This configuration is highly favored in large-scale applications such as electric vehicles, energy storage systems, and industrial machinery, where centralized control of the battery pack provides better system efficiency and cost-effectiveness. Centralized BMS allows for easier monitoring and management of the entire battery system from a single point, reducing the complexity of wiring and ensuring optimal performance and safety. It also enables more accurate battery monitoring, which is critical in high-capacity applications. As the demand for large-scale battery systems in sectors like automotive and energy grows, centralized BMS will remain the dominant topology choice due to its ability to effectively manage and optimize battery performance.

Why Does Automotive Lead the Application Demand for Battery Management Systems?

Automotive applications account for 50% of the demand for battery management systems in Japan. The growing adoption of electric vehicles (EVs) and hybrid electric vehicles (HEVs) has driven significant demand for advanced BMS, which are essential for monitoring the health and performance of the vehicle’s battery pack. Automotive BMS help ensure safety, optimize battery life, and manage power distribution effectively in EVs, making them critical components in the automotive industry’s transition towards electrification. The increasing focus on reducing carbon emissions and the adoption of stricter fuel efficiency regulations has accelerated the shift to electric vehicles, driving the demand for BMS in the automotive sector. As Japan continues to invest in sustainable transportation solutions, automotive applications will continue to dominate the demand for battery management systems in the country.

What Are the Key Trends, Drivers and Restraints in the Demand for Battery Management System in Japan?

Key drivers include strong uptake of EVs, increasing deployment of grid‑scale battery energy‑storage systems (BESS), regulatory and environmental pressures to improve battery lifecycle and reuse (second‑life applications), and technological advances in battery chemistry and IoT/analytics for real‑time battery health monitoring. Restraints include high cost of advanced BMS development, the rapid pace of change in battery technologies (which requires frequent BMS upgrades), stringent safety and certification regulations, and the challenge of retrofitting or replacing legacy battery systems in existing installations.

Why is Demand for Battery Management Systems Growing in Japan?

In Japan, demand for BMS is growing because major automakers and energy companies are responding to domestic and global goals for decarbonisation, electrification and renewable‑energy integration. As more EVs enter the industry and governments and utilities deploy battery‑based storage systems to stabilise grids and integrate intermittent wind/solar generation, BMS solutions become indispensable for managing battery health, safety, thermal stability and charging/ discharging cycles. Japan’s emphasis on second‑life batteries re‑using EV batteries for stationary storage creates further demand for BMS that can handle varied battery states and applications. The transition to cleaner transportation, modern grids and battery recycling/reuse is thus driving uptake of more sophisticated BMS across automotive and energy‑storage sectors.

How Are Technological Innovations Driving Growth of Battery Management Systems in Japan?

Technological innovations are expanding the potential and adoption of BMS in Japan by improving system accuracy, intelligence and flexibility. Advances include integration of IoT and AI for predictive maintenance, remote diagnostics, real‑time battery health analytics and adaptive thermal management. New battery chemistries (such as solid‑state batteries) and higher‑capacity battery packs demand more advanced BMS architectures that can manage different voltage profiles, safety conditions and second‑life applications. Modular and distributed BMS topologies are increasingly used to scale across large pack sizes and make maintenance easier. Packaging for grid‑scale BESS, enhanced cell‑balancing capabilities, fault‑tolerant designs and software updates over‑the‑air all contribute to growth and differentiation of BMS solutions in the Japanese industry.

What Are the Key Challenges Limiting Adoption of Battery Management Systems in Japan?

Despite strong growth, adoption of BMS in Japan faces several key challenges. One is cost pressures: advanced BMS with sophisticated sensors, software and control capabilities add to battery system cost, which can slow adoption in cost‑sensitive applications or smaller systems. Another is technological uncertainty: as battery chemistries rapidly evolve (e.g., solid‑state, alternative materials) and system architectures change (modular packs, second‑life reuse), BMS providers must continually upgrade and adapt, which can be resource‑intensive. Regulatory and certification complexity in Japan is also significant safety standards, environmental/ recycling requirements and grid‑integration rules can increase time‑to‑industry. Finally, for legacy installations or smaller scale systems, simpler battery management may suffice and advanced BMS may be seen as over‑engineering, which limits uptake.

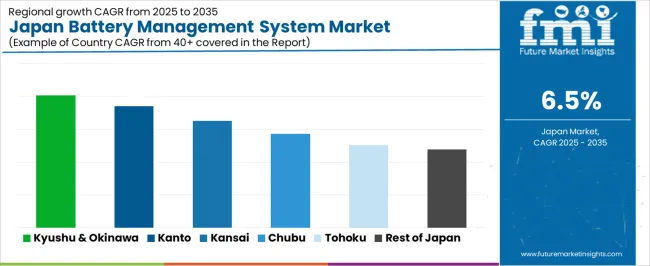

What is the Regional Demand Outlook for Battery Management Systems in Japan?

Region

CAGR (%)

Kyushu & Okinawa

8.1%

Kanto

7.4%

Kinki

6.5%

Chubu

5.7%

Tohoku

5.0%

Rest of Japan

4.8%

The demand for battery management systems (BMS) in Japan is growing across all regions, with Kyushu & Okinawa leading at an 8.1% CAGR. This growth is primarily driven by the increase in electric vehicle (EV) adoption and the push toward renewable energy solutions. Kanto follows with a 7.4% CAGR, fueled by the strong presence of EV manufacturers and battery companies in Tokyo. Kinki shows a 6.5% CAGR, driven by its well-established manufacturing and automotive sectors. Chubu experiences a 5.7% CAGR, supported by its focus on automotive and electronics. Tohoku and the Rest of Japan show more moderate growth at 5.0% and 4.8%, respectively, driven by expanding adoption in industrial and residential sectors for energy storage systems.

Why is Growth Strongest in Kyushu & Okinawa for Battery Management Systems?

Kyushu & Okinawa is experiencing the highest demand for battery management systems in Japan, with an 8.1% CAGR. This growth is largely driven by the region’s increasing focus on renewable energy and electric vehicles (EVs). Kyushu has become a hub for solar energy installations and energy storage systems, driving the need for effective battery management solutions to optimize energy usage and storage.

Okinawa, with its emphasis on sustainability and clean energy, is also contributing to this growth, as local policies encourage the adoption of EVs and energy-efficient technologies. The region’s strong commitment to reducing carbon emissions and integrating renewable energy sources into its grid is driving demand for battery management systems. As the region continues to invest in green technologies and infrastructure, the demand for BMS solutions to manage energy storage, EV batteries, and power grids will remain strong.

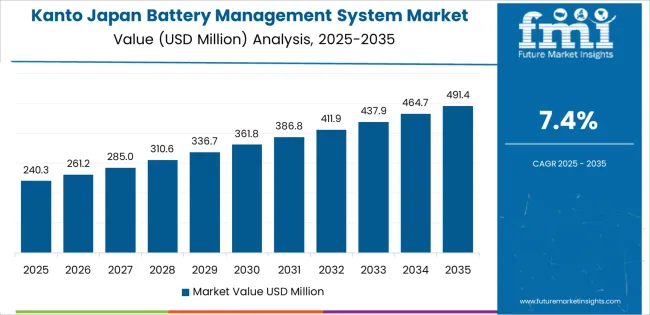

How is Growth in Kanto Influenced for Battery Management Systems?

Kanto is experiencing strong demand for battery management systems, with a 7.4% CAGR. This growth is largely attributed to the region’s concentration of electric vehicle manufacturers, battery companies, and technology innovators. Tokyo, as a major hub for automotive and electronics industries, has seen a rapid rise in the adoption of electric vehicles (EVs) and energy storage systems, both of which require efficient BMS solutions to ensure the optimal performance of batteries.

The Kanto region’s emphasis on sustainability and the promotion of EV infrastructure, including charging stations and green energy solutions, is driving the need for advanced battery management systems. With the growing adoption of EVs and renewable energy storage technologies, Kanto is expected to continue leading the way in battery management systems demand, as these technologies become essential for energy efficiency, battery longevity, and overall system reliability.

What is Driving Growth in Kinki for Battery Management Systems?

Kinki is seeing steady growth in demand for battery management systems, with a 6.5% CAGR. The region’s automotive and manufacturing sectors, particularly in cities like Osaka, are significant contributors to this growth. As electric vehicle (EV) adoption continues to rise, Kinki’s established automotive industry is increasingly incorporating advanced battery management systems to ensure the performance and longevity of EV batteries.

In addition, the region’s focus on energy-efficient technologies and industrial applications is supporting the demand for BMS solutions. Kinki’s manufacturers, especially those involved in electronics and industrial automation, are adopting battery management systems for applications such as energy storage and backup power systems. As the region continues to modernize its manufacturing processes and increase its use of renewable energy sources, the demand for battery management systems is expected to grow steadily, supporting the broader trend of energy efficiency and sustainability.

How is Growth in Chubu Being Influenced for Battery Management Systems?

Chubu is experiencing moderate growth in demand for battery management systems, with a 5.7% CAGR. The region’s industrial base, particularly in cities like Nagoya, is contributing to this demand, driven by the growing adoption of electric vehicles (EVs) and energy storage systems. As the automotive industry in Chubu, known for its major manufacturers, increasingly shifts toward electric and hybrid vehicles, the need for efficient and reliable battery management solutions is becoming more apparent.

Chubu’s focus on advanced manufacturing technologies and its growing interest in renewable energy projects, such as solar and wind energy, are driving the adoption of energy storage solutions that rely on BMS. As the region embraces green technologies and cleaner energy sources, the demand for battery management systems is expected to continue to grow at a moderate pace, supporting both the automotive and energy sectors in Chubu.

What is Driving Growth in Tohoku for Battery Management Systems?

Tohoku is seeing moderate growth in demand for battery management systems, with a 5.0% CAGR. The region’s push for renewable energy sources, particularly solar power, is contributing to the rising adoption of battery storage systems that require effective BMS solutions to manage energy storage and distribution. As Tohoku continues to invest in green technologies and renewable energy infrastructure, the demand for reliable battery management systems to optimize energy usage and ensure system reliability is growing.

While the region’s automotive and industrial sectors are less concentrated compared to other areas like Kanto and Kinki, Tohoku is seeing increased interest in energy-efficient solutions, including EV charging infrastructure and energy storage systems. This growing focus on sustainability and energy independence is driving demand for advanced battery management systems in Tohoku, supporting steady growth in the sector.

How is Growth in the Rest of Japan Being Supported for Battery Management Systems?

The Rest of Japan is experiencing steady growth in demand for battery management systems, with a 4.8% CAGR. While the growth is more moderate compared to other regions, the increasing adoption of renewable energy and electric vehicles in rural and less urbanized areas is contributing to this trend. As local governments and businesses in these areas invest in clean energy technologies, the need for efficient energy storage and battery management solutions is rising.

The Rest of Japan’s growing awareness of environmental issues and the need for sustainable energy solutions is driving the adoption of BMS in various sectors, including residential, commercial, and industrial applications. With continued government support for renewable energy projects and the expansion of EV infrastructure, the demand for battery management systems is expected to grow steadily across the Rest of Japan. The gradual shift toward green technologies and energy-efficient systems will help sustain this growth over the long term.

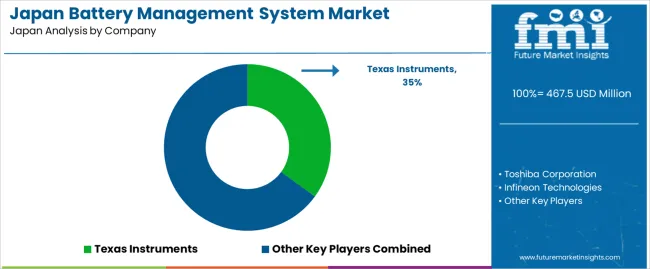

What is the Competitive Landscape of Japan Battery Management System Demand?

Demand for battery management systems (BMS) in Japan is witnessing strong growth, underpinned by the country’s strategic focus on electrification, renewable energy storage, and advanced mobility. As Japanese automakers accelerate electric‑vehicle development and energy‑storage systems for grid and industrial applications gain prominence, the need for robust BMS capable of monitoring battery health, managing charge/discharge cycles, and ensuring safety has become increasingly critical.

In Japan’s demand landscape, Texas Instruments holds an approximate 35.0% share, highlighting its prominent role in supplying BMS controllers and support systems to Japanese OEMs and energy‑storage integrators. Other key suppliers contributing to Japanese demand include Toshiba Corporation, Infineon Technologies, STMicroelectronics, and NXP Semiconductors, all providing semiconductor solutions, system integration, and BMS platforms tailored for Japan’s high‑reliability manufacturing and energy‑infrastructure industries.

Key growth drivers in Japan include the drive for higher EV penetration and stricter vehicle‑emissions targets, expansion of grid‑scale battery‑storage deployments to support renewable integration, and increasing demand for next‑generation battery chemistries (such as solid‑state batteries) that require advanced BMS capabilities. While challenges such as high development costs, the need for rigorous safety certification, and competition from domestic system‑builders exist, the outlook for BMS demand in Japan remains very positive as the country moves toward a more electrified and sustainable energy future.

Key Players in Japan Battery Management System Demand

Texas Instruments

Toshiba Corporation

Infineon Technologies

STMicroelectronics

NXP Semiconductors

Scope of Report

Items

Values

Quantitative Unit

USD million

Type

Lithium-Ion BMS, Lead-Acid BMS, Nickel-Cadmium BMS, Nickel-Metal Hydride BMS, Others

Topologies

Centralized, Modular, Distributed

Application

Automotive, Military, Consumer Electronics, Telecom, Energy

Key Players Profiled

Texas Instruments, Toshiba Corporation, Infineon Technologies, STMicroelectronics, NXP Semiconductors

Regions Covered

Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan

Additional Attributes

Dollar sales by battery type, topology, application, and regional distribution with a focus on automotive, military, and energy sectors

Japan Battery Management System Demand by Key Segments Type

Lithium-Ion BMS

Lead-Acid BMS

Nickel-Cadmium BMS

Nickel-Metal Hydride BMS

Others

Topologies

Centralized

Modular

Distributed

Application

Automotive

Military

Consumer Electronics

Telecom

Energy

Region

Kyushu & Okinawa

Kanto

Kinki

Chubu

Tohoku

Rest of Japan

Frequently Asked Questions

How big is the demand for battery management system in japan in 2025?

The global demand for battery management system in japan is estimated to be valued at USD 467.5 million in 2025.

What will be the size of demand for battery management system in japan in 2035?

The market size for the demand for battery management system in japan is projected to reach USD 873.4 million by 2035.

How much will be the demand for battery management system in japan growth between 2025 and 2035?

The demand for battery management system in japan is expected to grow at a 6.5% CAGR between 2025 and 2035.

What are the key product types in the demand for battery management system in japan?

The key product types in demand for battery management system in japan are lithium-ion bms, lead-acid bms, nickel-cadmium bms, nickel-metal hydride bms and others.

Which topologies segment to contribute significant share in the demand for battery management system in japan in 2025?

In terms of topologies, centralized segment to command 45.0% share in the demand for battery management system in japan in 2025.

AloJapan.com