Demand for Preoperative Bathing Solution in Japan Forecast and Outlook (2025–2035)

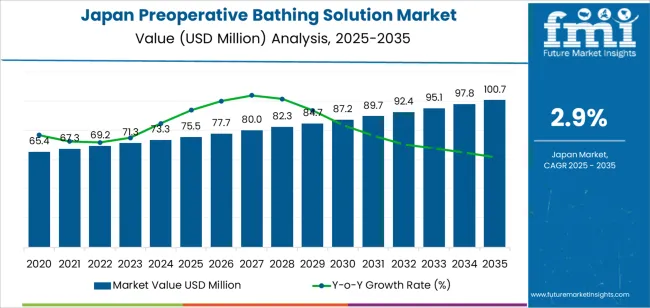

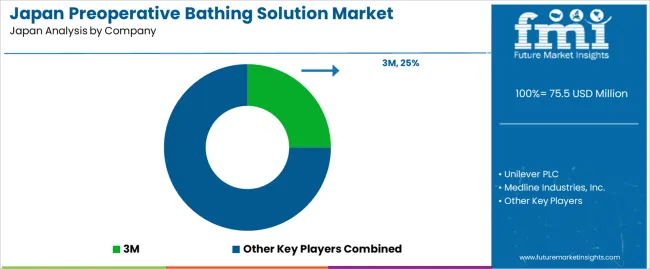

The demand for preoperative bathing solutions in Japan is valued at USD 75.5 million in 2025 and is projected to reach USD 100.7 million by 2035, reflecting a compound annual growth rate (CAGR) of 2.9%. This steady growth is driven by the increasing focus on infection control and improving patient outcomes in surgical settings. Preoperative bathing solutions, including antiseptic and antimicrobial products, help reduce surgical site infections and are becoming an integral part of pre-surgical protocols across hospitals and surgical centers. As the healthcare system places more emphasis on patient safety and hygiene, the demand for these solutions is expected to rise gradually.

The market shows stable, incremental growth over the forecast period, with year-on-year increases from USD 65.4 million in earlier years to USD 75.5 million by 2025, continuing to USD 100.7 million by 2035. The growth pattern exhibits minor fluctuations, with slight changes in growth rates between years. For example, the growth rate fluctuates between 2.8% and 3.0%, indicating slight acceleration and deceleration throughout the period. These fluctuations suggest that while the overall market trend remains positive, there are mild variations in growth momentum due to changes in healthcare protocols and seasonal factors influencing adoption rates across different periods.

Quick Stats of the Demand for Preoperative Bathing Solutions in Japan:

Demand for Preoperative Bathing Solutions in Japan Value (2025): USD 75.5 million

Demand for Preoperative Bathing Solutions in Japan Forecast Value (2035): USD 100.7 million

Demand for Preoperative Bathing Solutions in Japan Forecast CAGR (2025 to 2035): 2.9%

Leading Product Demand Segment: Bath Solutions/Liquid Soaps (59%)

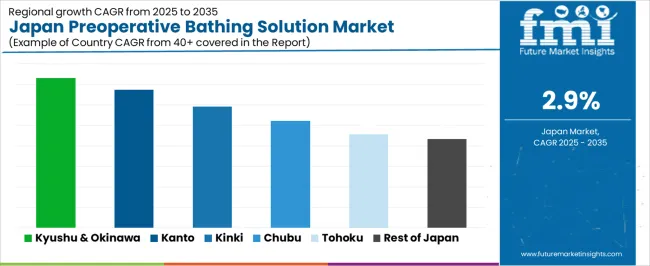

Key Growth Regions: Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan

Top Players in the Preoperative Bathing Solutions Industry in Japan: 3M, Unilever PLC, Medline Industries, Inc., Becton, Dickinson and Company (BD), Stryker

What is the Growth Forecast for Demand for Preoperative Bathing Solution in Japan through 2035?

Demand in Japan for preoperative bathing solutions is projected to increase from USD 75.5 million in 2025 to USD 100.7 million by 2035, reflecting a compound annual growth rate (CAGR) of approximately 2.9%. From USD 65.4 million in 2020, demand rises steadily each year, reaching USD 75.5 million in 2025. Between 2025 and 2030, demand will grow from USD 75.5 million to USD 84.7 million, driven by increasing surgical volumes, higher adoption of hygiene standards, and the integration of antiseptic bathing solutions in preoperative procedures. By 2035, demand is expected to reach USD 100.7 million, supported by stronger hospital protocols, rising healthcare awareness, and improvements in antiseptic formulations that enhance pre-surgical care.

The absolute dollar opportunity in this industry is projected to be USD 25.2 million, representing the difference between USD 75.5 million in 2025 and USD 100.7 million in 2035. During the first half of this decade (2025–2030), the demand will increase by USD 9.2 million, accounting for 36% of the total forecasted growth. The remaining USD 16.0 million opportunity is expected to occur between 2030 and 2035. As the market matures, the bulk of the growth will come from incremental improvements in preoperative protocols, resulting in greater adoption of specialized antiseptic bathing solutions. This steady increase over the forecast period presents clear growth opportunities for stakeholders in the healthcare sector.

Preoperative Bathing Solution Industry in Japan Key Takeaways

Metric

Value

Industry Value (2025)

USD 75.5 million

Forecast Value (2035)

USD 100.7 million

Forecast CAGR (2025 to 2035)

2.9%

What Is Driving the Demand for Preoperative Bathing Solution in Japan?

The demand for preoperative bathing solution in Japan is shaped by a growing emphasis on infectioncontrol practices within surgical care. As the number of surgical procedures increases in Japan, healthcare providers seek reliable methods to reduce microbial load on the skin before incision. Preoperative bathing solutions are used in surgical wards and intensive care units to support hygiene protocols and patientpreparation routines. Hospitals in Japan are increasingly adopting such solutions as part of standard presurgery workflows in order to minimise the risk of postoperative complications and align with clinical guidelines. The prevalence of aging patients and a busy surgical schedule contribute to the need for preoperative skinpreparation solutions across care settings.

Another factor supporting demand is the push toward more outpatient and sameday surgical services in Japan’s healthcare system. In settings where patients may prepare at home or arrive shortly before surgery, readytouse bathing solutions allow for convenient preoperative skin cleansing, reducing prep time in the hospital. Hospitals and clinics also replace older methods with products designed for ease of use and standardized application, thereby strengthening the uptake of preoperative bathing solutions. Cost management remains a consideration, but the integration of these products into hospital procurement and surgicalpreparation protocols supports sustained growth of demand in Japan.

What Factors Are Affecting the Demand for Preoperative Bathing Solution in Japan in Terms of Product Type and End User?

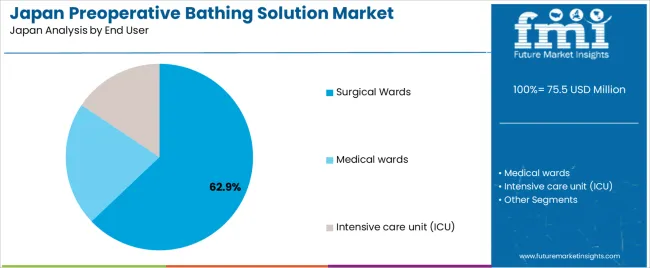

The demand for preoperative bathing solutions in Japan is influenced by both the product type and the end-user segments. Product types include bath solutions/liquid soaps, towels and wipes, shampoo caps, and scrub brushes, each serving different needs in the preoperative preparation process. End-users of these solutions include surgical wards, medical wards, intensive care units (ICUs), and other hospital departments that require hygienic protocols to prevent infections before surgery. These segments reflect the emphasis on infection control, patient preparation, and maintaining high hygiene standards in healthcare settings.

What Drives the Leading Demand for Bath Solutions/Liquid Soaps in Preoperative Bathing Solution in Japan?

Bath solutions/liquid soaps account for 59% of the total demand for preoperative bathing solutions in Japan. This product type is in high demand due to its effectiveness in cleansing the skin and reducing the risk of postoperative infections. Liquid soaps are commonly used in preoperative settings to ensure that patients are thoroughly sanitized before surgery. The demand for bath solutions is also driven by their convenience, ease of use, and widespread application across various surgical and medical procedures.

The preference for liquid soaps is further supported by Japan’s strict infection control standards and the healthcare system’s focus on patient safety. Bath solutions are an integral part of preoperative care protocols, helping to eliminate bacteria and other pathogens on the skin to reduce the risk of surgical site infections. As hospitals continue to prioritize hygiene and infection prevention, the demand for bath solutions and liquid soaps will remain strong in Japan’s healthcare environment.

What Drives the Demand for Surgical Wards in Preoperative Bathing Solution in Japan?

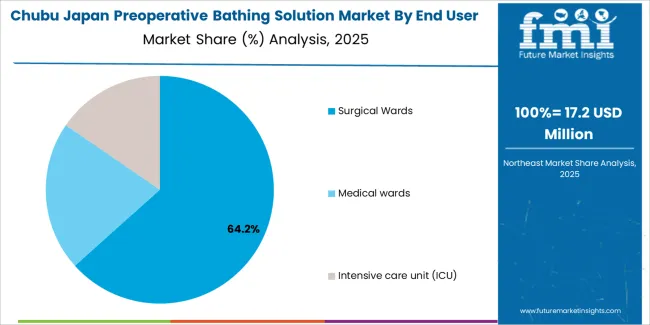

Surgical wards account for 62.9% of the total demand for preoperative bathing solutions in Japan. This high demand is primarily driven by the critical role surgical wards play in patient preparation before procedures. Preoperative bathing is an essential step in ensuring that patients are clean and free of pathogens, reducing the risk of infection during surgery. Surgical wards in Japan adhere to stringent infection control practices, which include the use of effective preoperative bathing solutions to ensure patient safety and optimal surgical outcomes.

The demand for preoperative bathing solutions in surgical wards is also influenced by the increasing number of surgeries being performed in Japan, particularly as the aging population requires more surgical interventions. As surgical wards remain central to the preoperative process, the need for efficient, reliable bathing solutions continues to grow, ensuring that patients are properly prepared for surgery. This demand is expected to increase as the focus on infection prevention and patient care in surgical settings intensifies.

What Are the Key Trends, Drivers, and Barriers in the Demand for Preoperative Bathing Solutions in Japan?

The demand for preoperative bathing solutions in Japan is increasing due to heightened focus on infection prevention and surgical site infection (SSI) reduction. With the country’s healthcare system prioritizing patient safety and infection control, more hospitals are adopting antiseptic preoperative bathing protocols. The growing number of elective surgeries, especially in outpatient and smaller medical settings, is further driving demand. However, challenges like cost, the need for proper reimbursement policies, and varying adoption rates across institutions pose barriers to widespread usage.

How is the growing focus on infection prevention influencing the demand for preoperative bathing solutions in Japan?

In Japan, the heightened emphasis on infection prevention, particularly surgical site infections (SSIs), is a major factor driving the demand for preoperative bathing solutions. Medical guidelines increasingly recommend pre-surgical antiseptic bathing to reduce microbial load on patients’ skin, which has led to more hospitals and clinics adopting these solutions. This growing awareness around infection control, combined with rising surgical volumes, particularly in outpatient care, is creating a favourable environment for preoperative bathing solution providers.

What Opportunities Exist for Preoperative Bathing Solutions in Japan’s Smaller Healthcare Facilities?

A key opportunity for preoperative bathing solutions in Japan lies in expanding use in smaller hospitals and outpatient surgical centers. These facilities often lack comprehensive infection control systems, making them prime candidates for preoperative bathing products. Additionally, as Japan’s healthcare system faces increasing demand for outpatient surgeries, there is growing potential for these solutions to be incorporated into standard practices for elective procedures. Cost-effective, easy-to-use bathing solutions that align with existing workflows could see significant adoption in these settings.

What Barriers are Limiting the Widespread Adoption of Preoperative Bathing Solutions in Japan?

Several barriers are slowing the adoption of preoperative bathing solutions in Japan. One significant challenge is the cost of specialized bathing products, which can be prohibitive for smaller institutions or those with tight budgets. Additionally, the varying implementation of infection control guidelines across medical facilities and inconsistent reimbursement policies hinder broader adoption. Some healthcare providers are also skeptical about the actual benefits of preoperative bathing solutions, especially in relation to standard bathing methods, which can further delay implementation.

What is the Demand for Preoperative Bathing Solution in Japan by Region?

Region

CAGR (%)

Kyushu & Okinawa

3.7%

Kanto

3.4%

Kinki

3.0%

Chubu

2.6%

Tohoku

2.3%

Rest of Japan

2.2%

The demand for preoperative bathing solutions in Japan is experiencing steady growth across regions. Kyushu and Okinawa lead with a 3.7% CAGR, driven by increasing awareness of infection prevention and a growing emphasis on hygiene in healthcare settings. Kanto follows at 3.4%, supported by advanced medical facilities and high adoption of infection control protocols. Kinki records 3.0%, influenced by established healthcare systems and rising demand for effective surgical preparation solutions. Chubu grows at 2.6%, with moderate demand in regional hospitals. Tohoku experiences a 2.3% growth, while the rest of Japan shows a 2.2% increase, reflecting gradual adoption of preoperative hygiene practices across smaller healthcare facilities.

How Is Kyushu & Okinawa Driving Demand for Preoperative Bathing Solution in Japan?

Kyushu & Okinawa is projected to grow at a CAGR of 3.7% through 2035 in demand for preoperative bathing solutions. The region’s healthcare system, particularly in urban areas like Fukuoka, is increasingly adopting preoperative care protocols to enhance patient safety and reduce surgical site infections. With the rise in elective surgeries and increased focus on infection prevention, healthcare providers in Kyushu & Okinawa are emphasizing the importance of antimicrobial bathing solutions. The region’s growing healthcare infrastructure further drives the adoption of these solutions for pre-surgical hygiene.

Urban areas like Fukuoka lead in adopting preoperative bathing protocols.

Rise in elective surgeries increases the demand for antimicrobial bathing solutions.

Infection prevention efforts boost the adoption of preoperative care solutions.

Growing healthcare infrastructure supports increased use of bathing solutions.

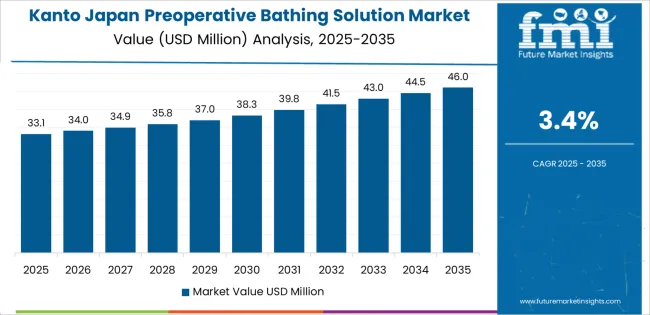

How Is Kanto Supporting Demand for Preoperative Bathing Solution in Japan?

Kanto is projected to grow at a CAGR of 3.4% through 2035 in demand for preoperative bathing solutions. As Japan’s economic and healthcare hub, Kanto, particularly Tokyo, leads in adopting preoperative hygiene protocols to reduce the risk of surgical site infections. With the increasing number of surgeries, both elective and emergency, healthcare facilities in the region are incorporating preoperative bathing solutions as part of their infection control measures. The rising awareness among healthcare providers and patients about the importance of pre-surgical hygiene further contributes to this demand.

Tokyo’s healthcare system leads in adopting preoperative hygiene protocols.

Increased number of surgeries in Kanto drives demand for bathing solutions.

Infection control measures in hospitals boost the adoption of bathing solutions.

Growing awareness of surgical hygiene increases use of preoperative products.

How Is Kinki Contributing to Demand for Preoperative Bathing Solution in Japan?

Kinki is projected to grow at a CAGR of 3.0% through 2035 in demand for preoperative bathing solutions. The region’s medical facilities, particularly in Osaka, are increasingly adopting preoperative bathing protocols as part of infection prevention strategies. With a significant volume of surgeries, particularly in specialized medical centers, the demand for antimicrobial solutions to maintain preoperative hygiene is rising. The increasing focus on patient safety and reducing healthcare-associated infections further drives the need for preoperative bathing solutions in the region’s hospitals and outpatient surgery centers.

Osaka’s medical facilities lead the adoption of preoperative bathing solutions.

Significant surgery volume increases the need for infection prevention measures.

Focus on patient safety drives demand for antimicrobial bathing products.

Reducing healthcare-associated infections accelerates the use of preoperative solutions.

How Is Chubu Contributing to Demand for Preoperative Bathing Solution in Japan?

Chubu is projected to grow at a CAGR of 2.6% through 2035 in demand for preoperative bathing solutions. The region’s hospitals and surgical centers are increasingly integrating preoperative hygiene measures, particularly antimicrobial bathing solutions, into their infection control practices. As the healthcare sector in cities like Nagoya continues to grow, so does the need for standardized preoperative care protocols to ensure patient safety. The rising awareness of surgical site infections and the importance of pre-surgical hygiene is driving the adoption of preoperative bathing solutions in Chubu’s healthcare facilities.

Nagoya’s healthcare facilities drive adoption of preoperative hygiene measures.

Growing awareness of surgical site infections increases demand for bathing solutions.

Focus on infection prevention accelerates the use of preoperative products.

Healthcare growth in Chubu supports the demand for antimicrobial bathing solutions.

How Is Tohoku Contributing to Demand for Preoperative Bathing Solution in Japan?

Tohoku is projected to grow at a CAGR of 2.3% through 2035 in demand for preoperative bathing solutions. With a focus on improving healthcare in rural areas and addressing regional disparities, Tohoku is increasingly adopting preoperative bathing protocols to enhance patient outcomes and reduce infection rates. Healthcare providers in the region are emphasizing the role of pre-surgical hygiene in infection prevention, particularly as the region’s aging population requires more surgical interventions. The growing healthcare infrastructure and awareness of infection control practices are contributing to increased demand for these solutions.

Rural areas in Tohoku adopt preoperative bathing protocols to improve care.

Aging population in Tohoku increases the need for infection prevention.

Growing awareness of infection control drives demand for bathing solutions.

Expanding healthcare infrastructure boosts adoption of preoperative hygiene practices.

How Is Rest of Japan Supporting Demand for Preoperative Bathing Solution?

The Rest of Japan is projected to grow at a CAGR of 2.2% through 2035 in demand for preoperative bathing solutions. While the region is less urbanized than others, the adoption of preoperative hygiene protocols is steadily increasing due to rising healthcare standards. Smaller cities and rural areas are adopting antimicrobial bathing solutions to prevent surgical site infections, especially as the number of elective surgeries rises. The increasing focus on patient safety, along with government and healthcare provider support for infection control, drives the demand for preoperative bathing solutions.

Adoption of preoperative hygiene protocols increases in rural areas.

Rising elective surgeries boost demand for infection prevention solutions.

Government and healthcare support for infection control drives growth.

Focus on patient safety accelerates use of preoperative bathing solutions.

What Is the Demand for Preoperative Bathing Solution in Japan and Who Are the Key Players Shaping the Industry?

The demand for preoperative bathing solution in Japan is driven by rising surgical volumes and increasing emphasis on infectioncontrol protocols. Japan’s ageing population and growing incidence of chronic disease contribute to greater utilization of surgical services, thus elevating the need for effective skinpreparation products. Clinical guidelines recommend antiseptic showers or baths before operations to reduce skin flora and potential surgicalsite infections. Healthcare providers in Japan are adopting standardized preoperative bathing protocols and selecting solutions with proven antimicrobial efficacy. The shift towards readytouse and singlepatient formulations supports clinical workflow efficiency and regulatory compliance, which further stimulates uptake within Japanese hospitals and surgical centres.

Major global companies active in Japan’s preoperative bathing solution segment include 3M, Unilever PLC, Medline Industries, Inc., Becton, Dickinson and Company (BD) and Stryker. These companies offer a range of antiseptic solutions, liquid soaps, wipes and skinpreparation kits designed for surgical wards and outpatient surgical settings. They collaborate with Japanese distributors and hospital procurement teams to align with local regulatory requirements and healthcare standards. Their leadership in product innovation, supplychain reliability and clinical support enables them to influence adoption of preoperative bathing solutions across Japan’s healthcare infrastructure.

Key Players in Preoperative Bathing Solution Industry in Japan

3M

Unilever PLC

Medline Industries, Inc.

BD (Becton, Dickinson and Company)

Stryker

Report Scope for Preoperative Bathing Solution Industry in Japan

Items

Values

Quantitative Units (2025)

USD million

End Use

Surgical Wards, Medical Wards, Intensive Care Units (ICU)

Product Type

Bath Solutions/Liquid Soaps, Towels and Wipes, Shampoo Caps, Scrub Brushes

Regions Covered

Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan

Countries Covered

Japan

Key Companies Profiled

3M, Unilever PLC, Medline Industries, Inc., Becton, Dickinson and Company (BD), Stryker

Additional Attributes

Dollar by sales across product types, user engagement trends, adoption rates by region, market dynamics, regulatory compliance, growth factors influencing surgical protocols

Preoperative Bathing Solution Industry in Japan Segmentation Product Type:

Bath Solutions/Liquid Soaps

Towels and Wipes

Shampoo Caps

Scrub Brushes

End User:

Surgical Wards

Medical Wards

Intensive Care Unit (ICU)

Region

Kyushu & Okinawa

Kanto

Kinki

Chubu

Tohoku

Rest of Japan

Frequently Asked Questions

How big is the demand for preoperative bathing solution in Japan in 2025?

The demand for preoperative bathing solution in Japan is estimated to be valued at USD 75.5 million in 2025.

What will be the size of preoperative bathing solution in Japan in 2035?

The market size for the preoperative bathing solution in Japan is projected to reach USD 100.7 million by 2035.

How much will be the demand for preoperative bathing solution in Japan growth between 2025 and 2035?

The demand for preoperative bathing solution in Japan is expected to grow at a 2.9% CAGR between 2025 and 2035.

What are the key product types in the preoperative bathing solution in japan?

The key product types in preoperative bathing solution in Japan are bath solutions/liquid soaps, towels and wipes, shampoo caps and scrub brushes.

Which end user segment is expected to contribute significant share in the preoperative bathing solution in Japan in 2025?

In terms of end user, surgical wards segment is expected to command 62.9% share in the preoperative bathing solution in Japan in 2025.

AloJapan.com